Spain Polyolefin Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyethylene (PE), Polypropylene (PP), Ethylene-Vinyl Acetate (EVA), Thermoplastic Polyolefins (TPO), Polyoxymethylene (POM), Polycarbonate (PC), Polymethyl Methacrylate (PMMA), and Others), By Application (Film & Sheet, Injection Molding, Blow Molding, Profile Extrusion, and Others), and Spain Polyolefin Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsSpain Polyolefin Market Insights Forecasts to 2033

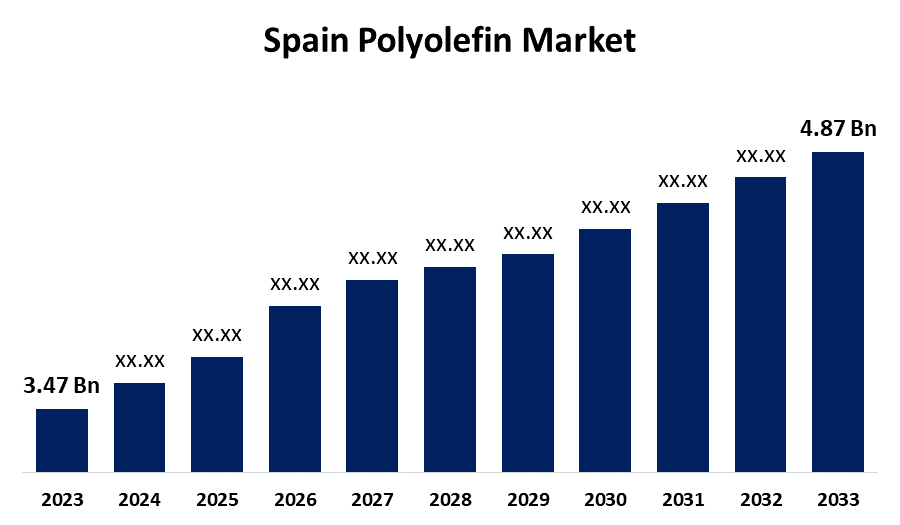

- The Spain Polyolefin Market Size was valued at USD 3.47 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.45% from 2023 to 2033

- The Spain Polyolefin Market Size is Expected to Reach USD 4.87 Billion by 2033

Get more details on this report -

The Spain Polyolefin Market Size is Anticipated to Reach USD 4.87 Billion by 2033, growing at a CAGR of 3.45% from 2023 to 2033.

Market Overview

Polyolefin is a polymer derived from olefins, which are hydrocarbons characterized by a carbon-to-carbon double bond. The most common polyolefins are polyethylene (PE) and polypropylene (PP). In Spain, polyolefins are utilized in various applications, including PolyAl, a non-fiber component used in carton packaging that combines layers of polyolefins and aluminum to protect food from oxygen and moisture. Polypropylene resins are widely used to manufacture household items, building materials, and packaging products. Advanced polyolefin products are employed in automotive parts, electrical appliances, as well as pipe and sheet applications. The Spanish polyolefins market is primarily driven by processes such as injection molding, which is fast, efficient, and offers low labor costs. Profile extrusion is another economical method, featuring low tooling costs and readily available equipment.

Report Coverage

This research report categorizes the market for the Spain polyolefin based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain polyolefin market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain polyolefin market.

Spain Polyolefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.47 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.45% |

| 2033 Value Projection: | USD 4.87 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Repsol SA, China Petroleum & Chemical Corp Class H, PetroChina Co Ltd Class H, TotalEnergies SE, Chevron Corp, Exxon Mobil Corp, OMV AG, LyondellBasell Industries NV Class A, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Spain polyolefin market is influenced by several key factors. Polyolefin are utilized across various industries, including packaging, construction, automotive, and consumer goods. Increased demand is driven by population growth, urbanization, and changing lifestyles. The packaging industry is moving towards sustainable and lightweight materials, making polyolefin an excellent choice due to its cost-effectiveness, moisture resistance, and strength. Furthermore, as environmental awareness grows, there is also a rising interest in bio-based polyolefin. These alternatives are renewable, sustainable, and biodegradable, distinguishing them from traditional plastics. Additionally, stringent government policies aimed at reducing carbon emissions are contributing to revenue growth in this sector, as polyolefin has a relatively low carbon dioxide footprint.

Restraining Factors

Factors restraining the Spain polyolefin market include an increase in plant capacity that has not been matched by a corresponding rise in demand. Additionally, there are concerns regarding plastic disposal and stricter government regulations promoting the use of paper products. The cost of polyolefin is directly related to the price of the raw materials used in their production, which in turn is influenced by the prices of oil and natural gas.

Market Segmentation

The Spain polyolefin market share is classified into product and application.

- The polyethylene (PE) segment is expected to hold the largest market share through the forecast period.

The Spain polyolefin market is segmented by product into polyethylene (PE), polypropylene (PP), ethylene-vinyl acetate (EVA), thermoplastic polyolefins (TPO), polyoxymethylene (POM), polycarbonate (PC), polymethyl methacrylate (PMMA), and others. Among these, the polyethylene (PE) segment is expected to hold the largest market share through the forecast period. This is largely due to its increased use in prototype development with 3D printers and CNC machines. Additionally, the expansion of the construction and furniture sectors, along with the presence of major automotive industries and rising demand for advanced infrastructure, have become key factors driving the polyethylene industry in Spain.

- The film & sheet segment is expected to dominate the Spain polyolefin market during the forecast period.

Based on the application, the Spain polyolefin market is divided film & sheet, injection molding, blow molding, profile extrusion, and others. Among these, the film & sheet segment is expected to dominate the Spain polyolefin market during the forecast period. Polyolefin offers high-quality shrink films with enhanced clarity and appearance for the consumer goods industry. They are stronger, puncture-resistant, FDA-approved, contain no chlorine, and are more durable; however, they tend to be relatively more expensive. Spain's market has significant potential due to the high demand for polyolefin in the furniture and interior industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain polyolefin market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Repsol SA

- China Petroleum & Chemical Corp Class H

- PetroChina Co Ltd Class H

- TotalEnergies SE

- Chevron Corp

- Exxon Mobil Corp

- OMV AG

- LyondellBasell Industries NV Class A

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, CCL Label, a global leader in labels and packaging, opened a new production facility for shrink sleeve labels in Tibi, Spain, near Alicante. The facility offers a variety of shrink sleeve materials, with a special focus on the EcoFloat shrink sleeves made from polyolefin. These sleeves are approved for use with PET, HDPE, and PP bottles and containers and have been widely adopted by well-known brands.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Polyolefin Market based on the below-mentioned segments:

Spain Polyolefin Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Thermoplastic Polyolefins (TPO)

- Polyoxymethylene (POM)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Others

Spain Polyolefin Market, By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

- Others

Need help to buy this report?