Spain Polystyrene Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS), and Expandable Polystyrene (EPS)), By Form Type (Foams, Films and Sheets, Injection Molding, and Other), and Spain Polystyrene Market Insights, Industry Trend, Forecasts to 2033.

Industry: Chemicals & MaterialsSpain Polystyrene Market Insights Forecasts to 2033

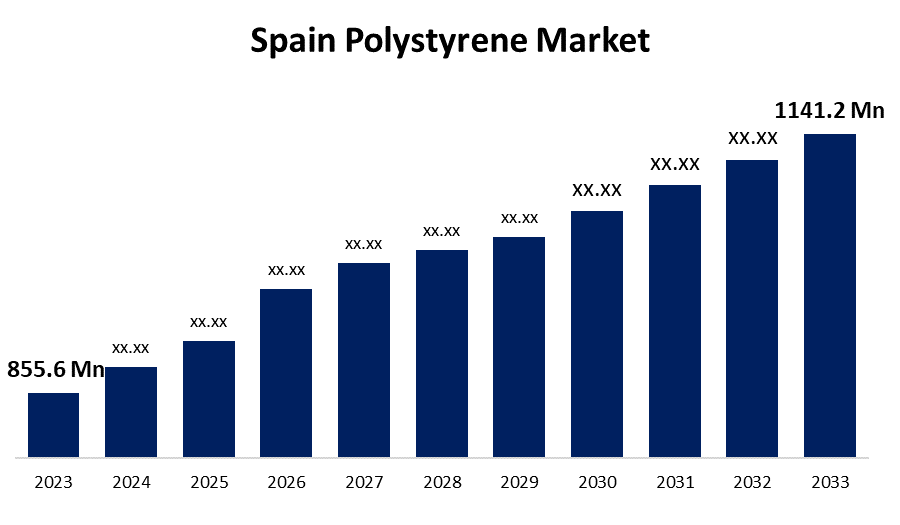

- The Spain Polystyrene Market Size was valued at USD 855.6 Million in 2023.

- The Market Size is Growing at a CAGR of 2.92% from 2023 to 2033

- The Spain Polystyrene Market Size is Expected to Reach c by 2033

Get more details on this report -

The Spain Polystyrene Market Size is Anticipated to Reach USD 1141.2 Million by 2033, growing at a CAGR of 2.92% from 2023 to 2033.

Market Overview

Polystyrene, also known as poly-phenylethene, is a synthetic thermoplastic polymer made from styrene monomers. It is a brittle, clear, and inexpensive resin that is resistant to chemicals and serves as an excellent electrical insulator. However, polystyrene has a low melting point and is a poor barrier to air and water vapor. In Spain, companies utilize polystyrene to create a variety of products, including food packaging containers, protective packaging materials, insulation panels, and certain components used in electronics. Additionally, Spain has manufacturing facilities that produce polystyrene resin, which can be processed into different products. Spain is a net importer of polystyrene (PS), it imports more of this material than it exports. The primary sources of polystyrene imports include Portugal, Morocco, Italy, France, and Turkey. Most of these imports are used in various manufacturing applications, such as packaging, construction materials, and plastic consumer goods. Moreover, Spain polystyrene market driven by several factors, such as increasing demand for energy-efficient buildings, growth in construction activities, and rising awareness of the environmental benefits of using polystyrene insulation materials.

Report Coverage

This research report categorizes the market for the Spain polystyrene based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain polystyrene market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain polystyrene market.

Spain Polystyrene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 855.6 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 2.92% |

| 2033 Value Projection: | USD 855.6 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Resin Type, By Form Type |

| Companies covered:: | ADAMA Agricultural Solutions, Stepan Co, Helena Laboratories, Nufarm Ltd, Croda International PLC, Clariant AG, Solvay SA, Ashland Inc, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the polystyrene (PS) market is driven by rising demand from consumer electronics manufacturers, influenced by technological advancements and decreasing prices. The expanding young demographic and digitization also boost electronic product consumption, contributing to PS market growth. Plastics valued for their lightweight nature and insulating properties, play a crucial role in packaging delicate items like electronics and food, enhancing protection during transport. Their versatility allows for custom packaging solutions, while affordability promotes widespread use. Additionally, advancements in production technologies have improved the durability and sustainability of polystyrene, addressing environmental concerns. Its moisture and chemical resistance further ensure the protection of goods in critical industries like pharmaceuticals and cosmetics. Overall, these benefits contribute to polystyrene's significant growth and dominance in the packaging sector.

Restraining Factors

The main factors restraining the polystyrene (PS) market in Spain are primarily related to environmental concerns. These include its non-biodegradability, difficulties in recycling, and negative public perception due to plastic pollution, which have resulted in increasing pressure for more sustainable alternatives. Polystyrene is not easily biodegradable and can persist in the environment for extended periods, contributing significantly to plastic pollution, particularly in marine environments. This is a major concern for both consumers and policymakers. Additionally, recycling polystyrene is complex and often not economically viable, which exacerbates waste management issues. These challenges are coupled with stringent regulations regarding plastic usage in the region.

Market Segmentation

The Spain polystyrene market share is classified into resin type and form type.

- The high impact polystyrene (HIPS) segment is expected to hold the largest market share through the forecast period.

The Spain polystyrene market is segmented by resin type into general purpose polystyrene (GPPS), high impact polystyrene (HIPS), and expandable polystyrene (EPS). Among these, the high impact polystyrene (HIPS) segment is expected to hold the largest market share through the forecast period. HIPS (High Impact Polystyrene) is highly versatile and offers excellent impact resistance and rigidity, making it a preferred choice in various industries. It is commonly used in the production of consumer goods, electronics, toys, and packaging materials. This wide range of applications has led to its extensive adoption across different sectors, significantly contributing to its market share. Moreover, the demand for HIPS has been bolstered by its cost-effectiveness. Compared to some other engineering plastics, HIPS is relatively affordable, making it an attractive option for manufacturers who want to maintain cost efficiency without compromising on product quality.

- The foams segment is expected to dominate the Spain polystyrene market during the forecast period.

Based on the form type, the Spain polystyrene market is divided into foams, films and sheets, injection molding, and other. Among these, the foams segment is expected to dominate the Spain polystyrene market during the forecast period. The widespread use of polystyrene (PS) foams in insulation and packaging applications aligns with the growing demand for energy efficiency and protective shipping solutions. PS foams are particularly favored for their exceptional insulating properties, making them a popular choice in the construction and building industry for applications such as insulation panels and roofing materials. As energy efficiency becomes an increasingly significant concern worldwide, the demand for effective insulation materials has surged, driving the growth of PS foam products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain polystyrene market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ADAMA Agricultural Solutions

- Stepan Co

- Helena Laboratories

- Nufarm Ltd

- Croda International PLC

- Clariant AG

- Solvay SA

- Ashland Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2023, TotalEnergies, a global petrochemical company headquartered in Paris, has acquired Iber Resinas, a plastics recycler located in Spain. Iber Resinas specializes in recycling polypropylene, polyethylene, and polystyrene sourced from household and industrial waste at its two plants near Valencia. The company boasts a large network of direct customers to whom it supplies products for the manufacture of automotive parts, packaging, and building materials.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain Polystyrene Market based on the below-mentioned segments

Spain Polystyrene Market, By Resin Type

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expandable Polystyrene (EPS)

Spain Polystyrene Market, By Form Type

- Foams

- Films and Sheets

- Injection Molding

- Other

Need help to buy this report?