Spain Respiratory Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Ventilators, Oxygen Therapy Devices, Nebulizers, and CPAP/BiPAP Devices), By Application (Chronic Obstructive Pulmonary Disease (COPD), Sleep Apnea, Asthma, Infectious Diseases, and Others), By End-User (Hospitals & ASCs, Specialty Clinics, Home Care Settings, and Others), and Spain Respiratory Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Respiratory Devices Market Insights Forecasts to 2033

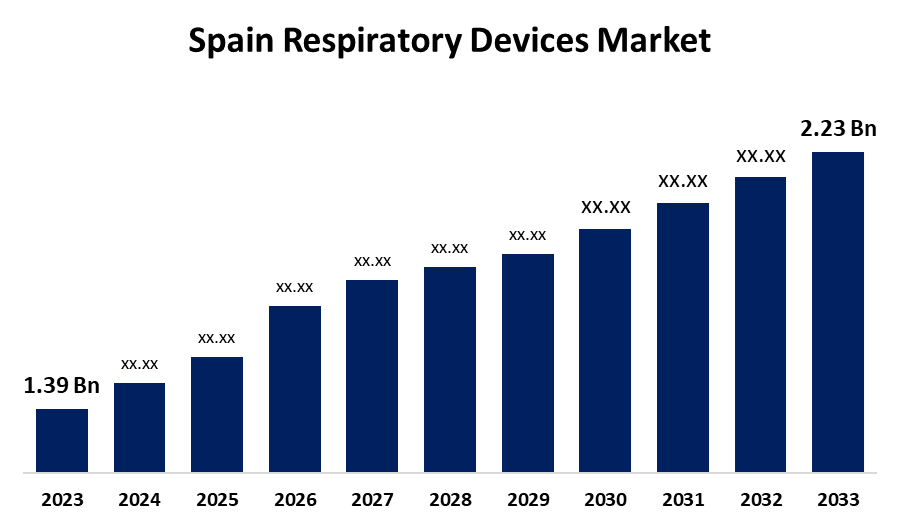

- The Spain Respiratory Devices Market Size was valued at USD 1.39 Billion in 2023.

- The Spain Respiratory Devices Market is growing at a CAGR of 4.84% from 2023 to 2033

- The Spain Respiratory Devices Market Size is expected to reach USD 2.23 Billion by 2033

Get more details on this report -

The Spain Respiratory Devices Market is anticipated to exceed USD 2.23 Billion by 2033, growing at a CAGR of 4.84% from 2023 to 2033. The rising prevalence of respiratory disorders, technological advancements, and rising application of the device in homecare settings are driving the growth of the respiratory devices market in the Spain.

Market Overview

The respiratory devices market refers to the industry making devices such as oxygen concentrates, ventilators, and inhalers that aid in breathing. Patients may use respiratory devices at home or in a clinical setting, such as a hospital. This medical device helps people breathe, remove carbon dioxide, or treat muscle atrophy. There is an increased prevalence of respiratory diseases like chronic obstructive pulmonary disease (COPD), tuberculosis (TB), asthma (Asthma), and sleep apnea (SAP). Further, the surging developments and expanding applications in home care settings, are propelling the market expansion of respiratory devices. The number of government initiatives undertaken in the country by spreading awareness about the symptoms in order to decrease the number of cases of respiratory diseases are providing market growth opportunities for respiratory devices.

Report Coverage

This research report categorizes the market for the Spain respiratory devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain respiratory devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain respiratory devices market.

Spain Respiratory Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.39 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.84% |

| 2033 Value Projection: | USD 2.23 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Dragerwerk AG, Fisher & Paykel Healthcare Ltd, Fosun Pharmaceutical (Breas Medical AB), GlaxoSmithKline PLC, General Electric Company (GE Healthcare), Invacare Corporation, Koninklijke Philips NV, Medtronic PLC, Smiths Medical Md, Inc., Resmed Inc., Rotech Healthcare Inc., Hamilton Medical AG, Apex Medical Corporation, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The high prevalence rate of respiratory disorders is propelling the market demand for respiratory devices. The prevalence of COPD in Spain is high and is estimated to affect more than 10% of the adult population. The integration of technological advancement such as 3D printing, smart devices, and remote monitoring in respiratory devices are significantly contributing to propel the market growth. The rising application of device such as oxygen therapy and airway management/tracheostomy care for homecare settings. Further, the increasing rate of respiratory therapy interventions including mechanical ventilation or continuous positive airway pressure therapy for treating obstructive sleep apnea are propelling the market.

Restraining Factors

The increased price of the devices and patient non-compliance owing to discomfort with devices like CPAP masks are challenging the respiratory devices market.

Market Segmentation

The Spain respiratory devices market share is classified into type, application, and end-user.

- The therapeutic devices segment dominated the respiratory devices market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain respiratory devices market is segmented by type into ventilators, oxygen therapy devices, nebulizers, and CPAP/BiPAP devices. Among these, the therapeutic devices segment dominated the respiratory devices market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Oxygen concentrators, nebulizers, mechanical ventilators, CPAP and BiPAP machines are some of the respiratory devices used for therapeutic purposes. The rising number of therapeutic respiratory device products is driving the market growth.

- The sleep apnea segment dominated the respiratory devices market with a significant market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period.

The Spain respiratory devices market is segmented by application into chronic obstructive pulmonary disease (COPD), sleep apnea, asthma, infectious diseases, and others. Among these, the sleep apnea segment dominated the respiratory devices market with a significant market share in 2023 and is anticipated to witness a significant CAGR growth during the forecast period. The most popular sleep apnea devices are CPAP machines. They come with a mask, filter, and tubing that attaches to a machine that inflates your lungs during sleeping.

- The hospitals & ASCs segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe.

The Spain respiratory devices market is segmented by end-user into hospitals & ASCs, specialty clinics, home care settings, and others. Among these, the hospitals & ASCs segment dominated the market with the largest market share in 2023 and is expected to grow at a significant CAGR growth during the projected timeframe. Respiratory devices such as ventilators, oxygen concentrators, nasal cannulas, bag-valve-masks, and CPAP machines are commonly used in hospitals & ASCs. The growing number of patient admissions in hospitals & ASCs setting is propelling the market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain respiratory devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dragerwerk AG

- Fisher & Paykel Healthcare Ltd

- Fosun Pharmaceutical (Breas Medical AB)

- GlaxoSmithKline PLC

- General Electric Company (GE Healthcare)

- Invacare Corporation

- Koninklijke Philips NV

- Medtronic PLC

- Smiths Medical Md, Inc.

- Resmed Inc.

- Rotech Healthcare Inc.

- Hamilton Medical AG

- Apex Medical Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, ABM Respiratory Care received a CE mark for their BiWaze Cough assist system in accordance with European Union’s Medical Device Regulation (MDR) 2017/745, according to the company.

- In February 2022, Aptar Pharma, a global leader in drug delivery systems, services and active material science solutions, announced the launch of HeroTracker Sense, a novel digital respiratory health solution that transforms a standard metered dose inhaler (pMDI) into a smart connected healthcare device.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain respiratory devices market based on the below-mentioned segments:

Spain Respiratory Devices Market, By Type

- Ventilators

- Oxygen Therapy Devices

- Nebulizers

- CPAP/BiPAP Devices

Spain Respiratory Devices Market, By Application

- Chronic Obstructive Pulmonary Disease (COPD)

- Sleep Apnea

- Asthma

- Infectious Diseases

- Others

Spain Respiratory Devices Market, By End-User

- Hospitals & ASCs

- Specialty Clinics

- Home Care Settings

- Others

Need help to buy this report?