Spain Smoothies Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fruit-Based, Dairy-Based, and Others), By Distribution Channel (Supermarkets/Hypermarkets, Smoothie Bars, Convenience Stores, and Others), and Spain Smoothies Market Insights, Industry Trend, Forecasts to 2033.

Industry: Food & BeveragesSpain Smoothies Market Insights Forecasts to 2033

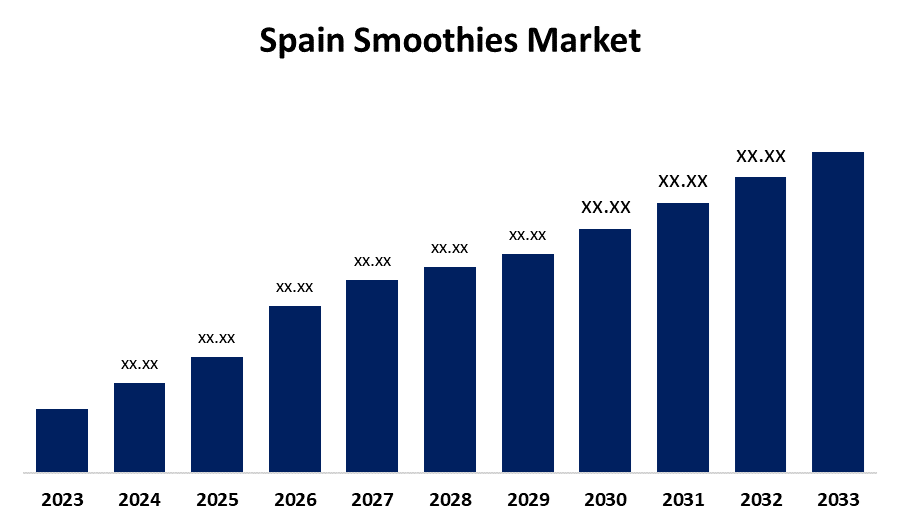

- The Spain Smoothies Market Size is Growing at a CAGR of 7.8% from 2023 to 2033

- The Spain Smoothies Market Size is Expected to Hold a Significant Share By 2033

Get more details on this report -

The Spain Smoothies Market Size is Anticipated to Hold a Significant Share by 2033, growing at a CAGR of 7.8% from 2023 to 2033.

Market Overview

Spain smoothie market indicates the manufacturing, consumption, and distribution of smoothie drinks, usually produced through blending fruits, vegetables, dairy, or plant-based fluids, often supplemented with other nutrients such as protein, vitamins, and minerals. Smoothies are increasingly becoming popular as a healthy, convenient choice among consumers looking for nutritious substitutes for conventional snacks and meals. The Spanish market is increasingly adopting health-oriented trends, and thus, smoothie consumption is on the rise among all segments of the population, from gym-goers to working professionals. The Spanish smoothie market is growing due to increasing consumer awareness of healthy diet benefits and the convenience of smoothies as a way to consume additional fruits and vegetables. With health issues like obesity and lifestyle diseases, consumers are shifting towards functional and nutritious foods. The demand for plant-based and organic products is also rising, as people seek cleaner, more natural beverages. Government initiatives promoting healthier eating practices and reducing sugar consumption in schools and public campaigns have contributed to the growth of the market. Additionally, initiatives promoting local agriculture and the use of fresh, locally grown fruits and vegetables further enhance the appeal of smoothies as a healthy, locally-based choice in the Spanish food and beverage industry.

Report Coverage

This research report categorizes the market for the Spain smoothies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain smoothies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain smoothies market.

Spain Smoothies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.8% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Juice & World SL (Juicy Avenue), Zumosol, Smoothie King, Frutolandia, Hero España and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Spain smoothies market is largely influenced by growing health awareness among consumers looking for healthy and convenient food. Growing awareness about the health benefits of eating fruits and vegetables, together with rising concern about obesity and lifestyle diseases, has prompted a shift toward healthier drinks such as smoothies. Moreover, the need for natural, plant-based, and organic products also favors the growth of the market since consumers opt for cleaner and more sustainable products. The fitness and wellness lifestyle trend, as well as the hectic lifestyles of urban dwellers, have also increased the demand for ready-to-drink smoothies.

Restraining Factors

The market for premium smoothies is hampered by high prices, competition from other healthy drink options, unpredictable raw material costs, and supply chain losses. Premium smoothies made with exotic or organic ingredients are too expensive, limiting affordability for the wider public. The availability of functional drinks and juices also generates competition.

Market Segmentation

The Spain smoothies market share is classified into product type and distribution channel.

- The fruit-based smoothies segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

The Spain smoothies market is segmented by product type into fruit-based, dairy-based, and others. Among these, the fruit-based smoothies segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The popularity of fruit smoothies in Spain is driven by the high demand for natural, healthy drinks, which offer a concentrated source of vitamins, minerals, and antioxidants. The high health awareness in Spain and the variety of fruits available, both domestic and imported, contribute to the popularity of these smoothies over dairy-based alternatives.

- The supermarkets/hypermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the Spain smoothies market is divided into supermarkets/hypermarkets, smoothie bars, convenience stores, and others. Among these, the supermarkets/hypermarkets segment accounted for the highest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Supermarkets and hypermarkets offer a wide range of smoothie products, making them accessible and convenient for consumers. They serve a wide customer base, offering affordable prices and regular promotions. Their market position is strengthened by the increasing trend of buying smoothies as part of routine grocery shopping, making them market leaders over other channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain smoothies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Juice & World SL (Juicy Avenue)

- Zumosol

- Smoothie King

- Frutolandia

- Hero España

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2025, Tropicool recently launched the Neymar Jr. Açaí and Banana Smoothie. This ready-to-drink beverage combines the creamy sweetness of bananas with the rich, authentic taste of açaí, reflecting the brand's commitment to nutritional excellence. It's inspired by Neymar's dynamic lifestyle and aims to offer a perfect balance of flavor and nutrition.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain smoothies market based on the below-mentioned segments:

Spain Smoothies Market, By Product Type

- Fruit-Based

- Dairy-Based

- Others

Spain Smoothies Market, By Distribution Channel

- Supermarkets/Hypermarkets

- Smoothie Bars

- Convenience Stores

Need help to buy this report?