Spain Ultrasound Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Diagnostic Ultrasound Devices and Therapeutic Ultrasound Devices), By Portability (Handheld, Compact, and Cart/Trolley), By Application (Cardiology, Obstetrics/Gynaecology, Radiology, Orthopaedic, Anesthesia, Emergency Medicine, Primary Care, and Critical Care), By End-use (Hospitals, Imaging Centres, and Research Centres), and Spain Ultrasound Devices Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareSpain Ultrasound Devices Market Insights Forecasts to 2033

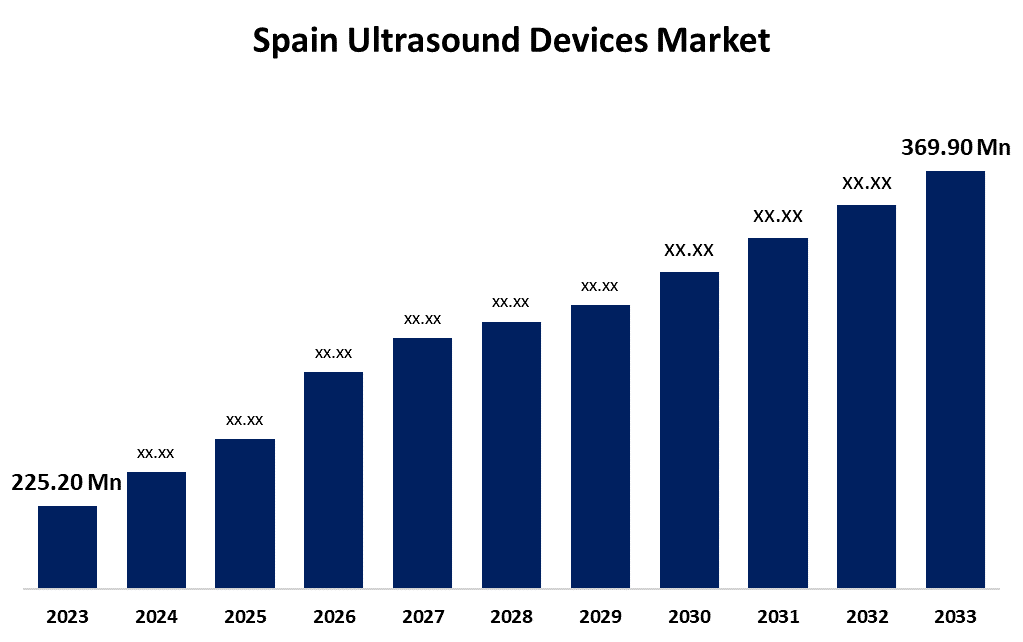

- The Spain Ultrasound Devices Market Size was valued at USD 225.20 Million in 2023.

- The Spain Ultrasound Devices Market Size is Growing at a CAGR of 5.09% from 2023 to 2033

- The Spain Ultrasound Devices Market Size is Expected to reach USD 369.90 Million by 2033

Get more details on this report -

The Spain Ultrasound Devices Market Size is anticipated to Exceed USD 369.90 Million by 2033, Growing at a CAGR of 5.09% from 2023 to 2033. The Growing burden of chronic diseases and increasing usage of ultrasound devices in disease diagnosis are driving the growth of the ultrasound devices market in the Spain.

Market Overview

The ultrasound devices market refers to the industry for medical imaging instruments used for high-frequency sound waves to visualize internal body structures. Ultrasound devices, also known as sonographs or echographs, are used to offer a non-invasive way to diagnose and monitor various medical conditions. The device is the most prevalently used diagnostic tool in medical imaging due to its low cost and faster results. There is growing development of wireless transducers, app-based ultrasound technology, fusion with CT/MR, and laparoscopic ultrasound, along with the expanding ultrasound device applications in 3D imaging and shear wave elastography. Increasing research activities and the presence of well-established companies as well as the rise in contract manufacturing organizations are all the factors bolstering the market growth opportunities.

Report Coverage

This research report categorizes the market for the Spain ultrasound devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Spain ultrasound devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Spain ultrasound devices market.

Spain Ultrasound Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 225.20 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.09% |

| 2033 Value Projection: | USD 369.90 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Portability, By Application, By End-use |

| Companies covered:: | Canon Medical Systems Corporation, Fujifilm Holdings Corporation, GE Healthcare, Hologic Inc., Koninklijke Philips NV, Mindray Medical International Limited, Samsung Electronics Co. Ltd, Esaote SpA, Siemens Healthineers AG, Carestream Health, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The growing burden of chronic diseases and increasing number of aging population responsible for driving the ultrasound devices market demand as this device is used to monitor a wide variety of physiological information such as anatomical localization, tissue structure, hemodynamics, and muscle activity. The increasing use of point-of-care testing with ultrasound devices for rapid diagnosis and treatment decisions by performing and interpreting scans directly at the patient’s bedside. The advancement in imaging technology and healthcare reforms for improved patient experiences and more accurate diagnosis are propelling the ultrasound devices market.

Restraining Factors

The strict regulation associated with the approval of ultrasound devices is challenging the market growth. Further, the increased cost of advanced equipment and shortage of skilled sonographers are hindering the market.

Market Segmentation

The Spain ultrasound devices market share is classified into product, portability, application, and end-use.

- The diagnostic ultrasound devices segment is dominating the Spain ultrasound devices market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the predicted timeframe.

The Spain ultrasound devices market is segmented by product into diagnostic ultrasound devices and therapeutic ultrasound devices. Among these, the diagnostic ultrasound devices segment is dominating the Spain ultrasound devices market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the predicted timeframe. Diagnostic ultrasound devices are non-invasive and used to image inside the body in order to visualize changes in function within a structure or organ. The technological advancements and prevalence of lifestyle related disorders contribute to propelling the market.

- The cart/trolley segment is dominating the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

The Spain ultrasound devices market is segmented by portability into handheld, compact, and cart/trolley. Among these, the cart/trolley segment is dominating the market with the largest revenue share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Cart/trolley provide mobility and stability to the ultrasound device, commonly used in healthcare facilities and medical offices where the device needs to be transported between patient rooms or examination areas. The rapid diagnosis provided by the segment for increased patient recover and satisfaction is driving the market.

- The radiology segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the predicted timeframe.

The Spain ultrasound devices market is segmented by application into cardiology, obstetrics/gynaecology, radiology, orthopaedic, anesthesia, emergency medicine, primary care, and critical care. Among these, the radiology segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the predicted timeframe. The radiology segment includes visualization of internal organs, guiding procedures like biopsies, assessing blood flow, and examining the fetus during pregnancy. The rising application of AI in radiology drives the market growth.

- The hospitals segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the predicted timeframe.

The Spain ultrasound devices market is segmented by end-use into hospitals, imaging centres and research centres. Among these, the hospitals segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the predicted timeframe. Ultrasound devices are extensively used in hospitals for diagnostic and therapeutic applications such as imaging internal organs, monitoring fetal development during pregnancy, guiding biopsies, and assessing blood flow. The increased number of patients visiting hospitals with various lifestyle disorders leads to the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Spain ultrasound devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- GE Healthcare

- Hologic Inc.

- Koninklijke Philips NV

- Mindray Medical International Limited

- Samsung Electronics Co. Ltd

- Esaote SpA

- Siemens Healthineers AG

- Carestream Health

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2022, Fujifilm Sonosite, Inc. – the world leader in point-of-care ultrasound (POCUS) solutions – has added to its next-generation POCUS portfolio with the launch of its new, premium Sonosite LX system in Europe, featuring the company’s largest clinical image and a monitor that extends, rotates and tilts to enable enhanced, real-time provider collaboration.

- In May 2022, Clarius Received CE Mark Certification for Seven New Ultra-Portable Wireless Ultrasound Scanners for Apple and Android Devices. Clarius Mobile Health is first to introduce a third-generation product line of high-performance wireless ultrasound scanners in the European Union and United Kingdom.

Market Segment

This study forecasts revenue at Spain, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Spain ultrasound devices market based on the below-mentioned segments:

Spain Ultrasound Devices Market, By Product

- Diagnostic Ultrasound Devices

- Therapeutic Ultrasound Devices

Spain Ultrasound Devices Market, By Portability

- Handheld

- Compact

- Cart/Trolley

Spain Ultrasound Devices Market, By Application

- Cardiology

- Obstetrics/Gynaecology

- Radiology

- Orthopaedic

- Anesthesia

- Emergency Medicine

- Primary Care

- Critical Care

Spain Ultrasound Devices Market, By End-use

- Hospitals

- Imaging Centres

- Research Centres

Need help to buy this report?