Global Spandex Fiber Market Size, Share, and COVID-19 Impact Analysis, By Fabric Type (Two-Way and Four-Way), By Application (Apparel, Automotive, Medical, and Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Spandex Fiber Market Insights Forecasts to 2033

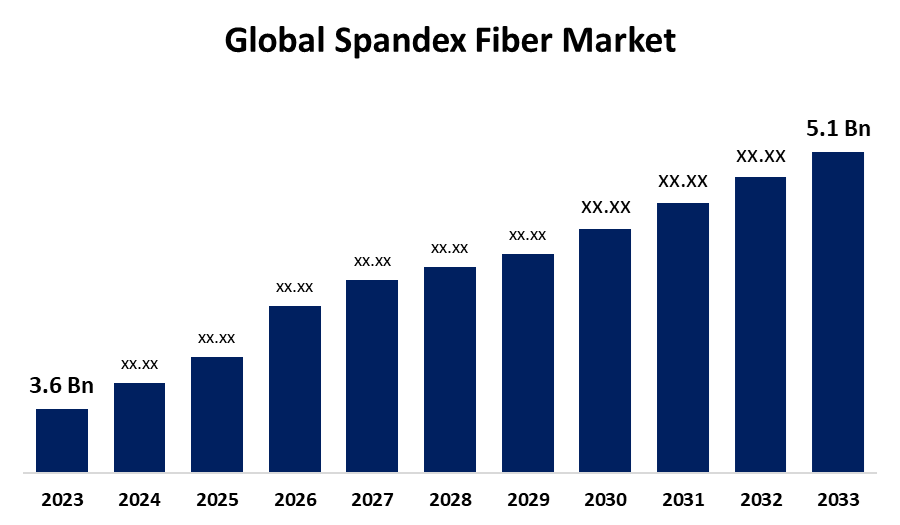

- The Spandex Fiber Market Size was valued at USD 3.6 Billion in 2023.

- The market is growing at a CAGR of 3.54% from 2023 to 2033.

- The Worldwide Spandex Fiber Market is expected to reach USD 5.1 Billion by 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global Spandex Fiber Market is expected to reach USD 5.1 billion by 2033, at a CAGR of 3.54% during the forecast period 2023 to 2033.

The spandex fiber market has seen steady growth, driven by its widespread use in activewear, sports apparel, and performance fabrics. Known for its exceptional elasticity, spandex, also referred to as elastane or Lycra, offers superior stretch, durability, and comfort, making it a preferred choice in various industries. The increasing demand for comfortable, form-fitting clothing in fashion, fitness, and medical sectors has fueled market expansion. Moreover, innovations in spandex production, including environmentally friendly alternatives and blending techniques, are helping meet the rising consumer preference for sustainable materials. The market is also benefitting from strong growth in the global athleisure trend. Key players in the market include manufacturers of fibers, textiles, and finished products, with North America and Europe being prominent regions for spandex consumption.

Spandex Fiber Market Value Chain Analysis

The spandex fiber market value chain begins with raw material production, where key inputs like polyurethane or polyester are sourced from chemical suppliers. These materials are then processed by spandex fiber manufacturers who use technologies such as melt spinning to produce elastane fibers. The fibers are sold to textile producers who weave or knit them into fabrics for use in various applications, including apparel, sportswear, and medical textiles. Finished textile products are distributed to wholesalers, retailers, or directly to consumers. The final stage involves consumer use, where spandex fibers provide comfort, flexibility, and durability in garments. Throughout the value chain, players are focusing on innovation, sustainability, and improving manufacturing processes to meet growing demand for eco-friendly alternatives and high-performance textiles.

Global Spandex Fiber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.6 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.54% |

| 2033 Value Projection: | USD 5.1 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Fabric Type, By Application, By Region |

| Companies covered:: | INVISTA, Asahi Kasei Corporation, Hyosung Corporation, Zhejiang Huafon Spandex Co. Ltd., Yantai Tayho Advanced Materials Co. Ltd., Indorama Industries Ltd, TK Chemical Corp., Taekwang Industrial Co. Ltd, Jiangsu Shaungliang Spandex Co. Ltd., Xiamen Lilong Spandex Co. Ltd., Tayho Advanced Materials Co., Ltd, DuPont, BASF, Mitsubishi Chemical, Dongil Industries, Nippon Shokubai, Guilin Songquan, And Other Key Vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Spandex Fiber Market Opportunity Analysis

The spandex fiber market presents significant growth opportunities, driven by rising demand for versatile, high-performance fabrics across several industries. The increasing popularity of activewear, athleisure, and fitness apparel presents a prime opportunity for spandex manufacturers, as its elasticity, durability, and comfort are crucial for these sectors. Additionally, advancements in eco-friendly and sustainable spandex production are tapping into the growing consumer demand for environmentally conscious products. The medical sector also offers opportunities, with spandex being used in compression garments and prosthetics. Expanding markets in emerging economies, where disposable income and lifestyle changes are on the rise, provide further avenues for growth. Innovations in blending spandex with other fibers for enhanced performance and new applications, such as in automotive and aerospace industries, present untapped potential.

Market Dynamics

Spandex Fiber Market Dynamics

New applications in the shapewear and intimate apparel industry

The spandex fiber market is seeing new applications in the shapewear and intimate apparel industry, driven by the growing demand for comfort, support, and functionality in everyday clothing. Spandex's superior elasticity makes it an ideal material for creating form-fitting shapewear that enhances body contouring and provides shaping without compromising comfort. In intimate apparel, spandex is used to produce seamless designs, ensuring smooth fits and flexibility, while also allowing for breathability and moisture-wicking properties. The rise in popularity of body-positive fashion and the increasing focus on comfort-driven, performance-oriented garments have created opportunities for innovation. Manufacturers are exploring the blending of spandex with other materials like cotton and lace to enhance fabric softness, durability, and overall aesthetics, further expanding its role in these industries.

Restraints & Challenges

Traditional spandex production involves chemical processes that contribute to pollution and high energy consumption, leading to growing pressure from consumers and regulatory bodies for eco-friendly alternatives. Another challenge is the fluctuating prices of raw materials, such as polyurethane, which can affect production costs and pricing stability. Additionally, the increasing competition from alternative stretch fabrics and innovations in non-synthetic fibers presents a threat to spandex’s dominance. The market also struggles with the complexity of recycling spandex, as it is difficult to separate from other fibers in blended fabrics, complicating waste management efforts. Lastly, global supply chain disruptions and geopolitical tensions can impact raw material sourcing and manufacturing efficiency, further adding to market uncertainties.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Spandex Fiber Market from 2023 to 2033. The North American spandex fiber market is one of the largest and most established, driven by strong demand across the apparel, sportswear, and medical sectors. The region’s growing fitness and wellness culture has fueled the need for high-performance, comfortable activewear, boosting spandex consumption. In addition, the popularity of athleisure, which combines functionality with fashion, continues to rise, further expanding the market. North America is also a hub for innovation, with companies focusing on sustainable production practices and eco-friendly spandex alternatives. The medical industry contributes significantly, using spandex in compression garments and prosthetics. The U.S. and Canada are key players in the market, with a well-developed manufacturing infrastructure and a high level of consumer awareness regarding product quality and performance. Regulatory support for environmental initiatives is also driving growth in the region.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growing middle-class population in emerging economies is further fueling demand for high-quality, affordable apparel. Additionally, advancements in manufacturing technologies and the availability of low-cost labor have made Asia Pacific a key production hub for spandex fibers. The region is also witnessing increased adoption of eco-friendly spandex production processes, responding to global sustainability trends. Furthermore, the growth of e-commerce and a shift towards more fashion-conscious, comfort-driven apparel are contributing to market expansion in Asia Pacific.

Segmentation Analysis

Insights by Fabric Type

The two way segment accounted for the largest market share over the forecast period 2023 to 2033. In the performance apparel segment, increasing demand for activewear, athleisure, and sportswear is driving the market, as consumers prioritize comfort, flexibility, and durability. Spandex’s superior stretchability and shape retention properties make it ideal for these applications. The other growth segment is the shift towards sustainable production, spurred by consumer and regulatory pressures for eco-friendly alternatives. Manufacturers are exploring biodegradable spandex, recycling technologies, and eco-conscious production methods to reduce environmental impact. This dual trend of performance-driven innovation and sustainability is creating new opportunities for spandex in various industries, including fashion, fitness, and medical textiles, while encouraging the development of more environmentally responsible solutions within the market.

Insights by Application

The apparel segment accounted for the largest market share over the forecast period 2023 to 2033. Spandex’s stretchability, durability, and comfort make it ideal for creating form-fitting, flexible garments that cater to both functionality and fashion. The growing fitness and wellness culture, along with the trend toward more comfortable and versatile clothing, is fueling demand for spandex in sportswear, gym wear, and casual everyday clothing. Additionally, spandex is increasingly used in intimate apparel, shapewear, and swimwear for its ability to enhance body shape and provide seamless fits. As consumers prioritize comfort and performance, especially in the post-pandemic era, the apparel segment continues to expand. Manufacturers are also innovating with eco-friendly spandex to cater to sustainability-conscious consumers, further supporting growth in this sector.

Recent Market Developments

- In May 2024, Hyosung TNC, a leading global manufacturer of textile and industrial materials, has revealed its plans to increase production of spandex tailored for the diaper industry.

Competitive Landscape

Major players in the market

- INVISTA

- Asahi Kasei Corporation

- Hyosung Corporation

- Zhejiang Huafon Spandex Co. Ltd.

- Yantai Tayho Advanced Materials Co. Ltd.

- Indorama Industries Ltd

- TK Chemical Corp.

- Taekwang Industrial Co. Ltd

- Jiangsu Shaungliang Spandex Co. Ltd.

- Xiamen Lilong Spandex Co. Ltd.

- Tayho Advanced Materials Co., Ltd

- DuPont

- BASF

- Mitsubishi Chemical

- Dongil Industries

- Nippon Shokubai

- Guilin Songquan

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Spandex Fiber Market, Fabric Type Analysis

- Two-Way

- Four-Way

Spandex Fiber Market, Application Analysis

- Apparel

- Automotive

- Medical

- Other Applications

Spandex Fiber Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Spandex Fiber Market?The global Spandex Fiber Market is expected to grow from USD 3.6 billion in 2023 to USD 5.1 billion by 2033, at a CAGR of 3.54% during the forecast period 2023-2033

-

Who are the key market players of the Spandex Fiber Market?Some of the key market players of the market are INVISTA, Asahi Kasei Corporation, Hyosung Corporation, Zhejiang Huafon Spandex Co. Ltd., Yantai Tayho Advanced Materials Co. Ltd., Indorama Industries Ltd, TK Chemical Corp., Taekwang Industrial Co. Ltd, Jiangsu Shaungliang Spandex Co. Ltd., Xiamen Lilong Spandex Co. Ltd., Tayho Advanced Materials Co., Ltd, DuPont, BASF, Mitsubishi Chemical, Dongil Industries, Nippon Shokubai, and Guilin Songquan.

-

Which segment holds the largest market share?The two way segment holds the largest market share and is going to continue its dominance.

-

Which region dominates the Spandex Fiber Market?North America dominates the Spandex Fiber Market and has the highest market share

Need help to buy this report?