Global Special Mission Aircraft Market Size, Share, and COVID-19 Impact Analysis, By Platform (Military Aviation, Commercial Aviation, and Unmanned Aerial Vehicle); By Application (Command and Control, Combat Support, Intelligence, Surveillance, and Reconnaissance, Air-Rocket Launch, Transportation, Others); By Point of Sale (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Special Mission Aircraft Market Insights Forecasts to 2033

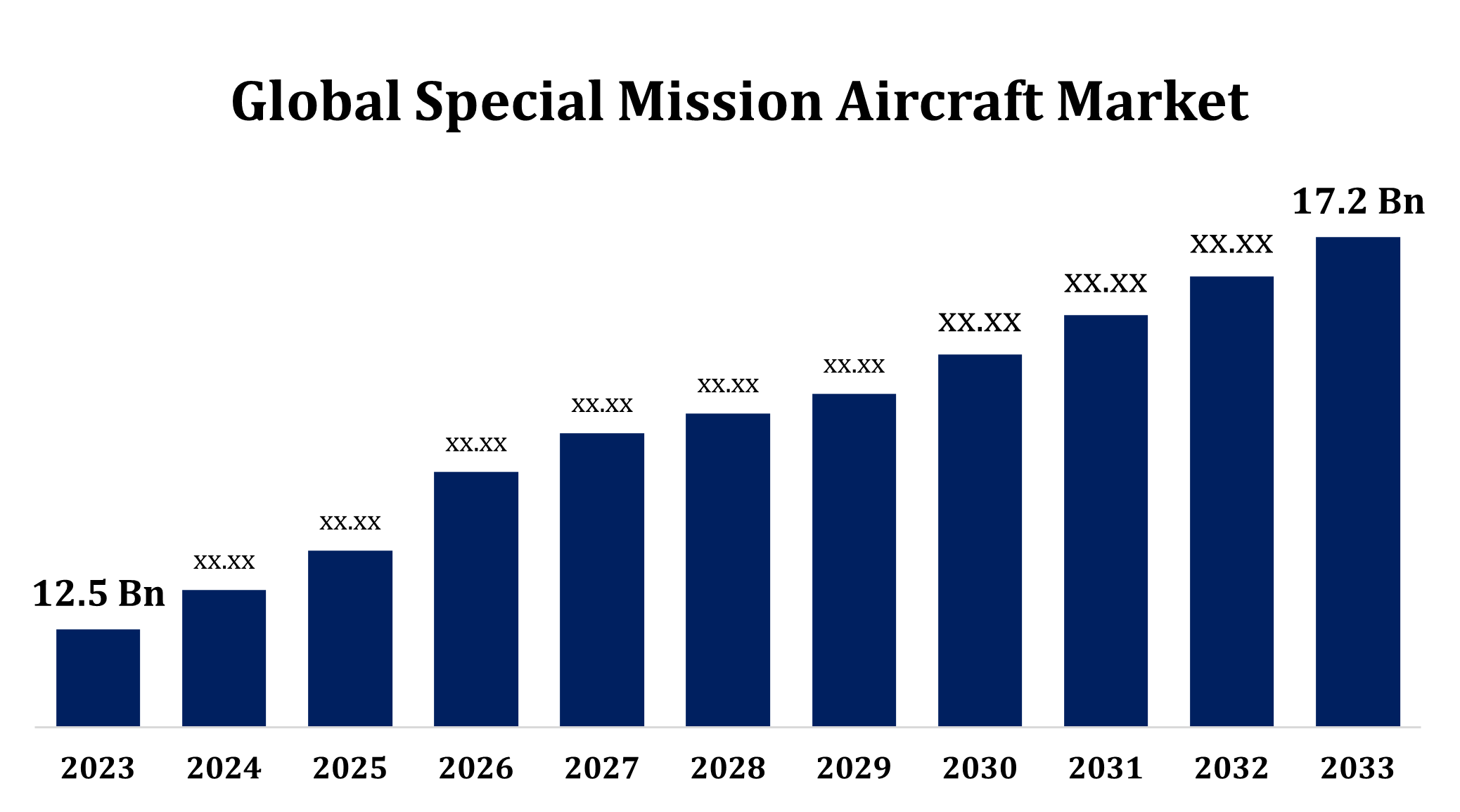

- The Global Special Mission Aircraft Market Size was valued at USD 12.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.24% from 2023 to 2033.

- The Worldwide Special Mission Aircraft Market Size is expected to reach USD 17.2 Billion by 2033.

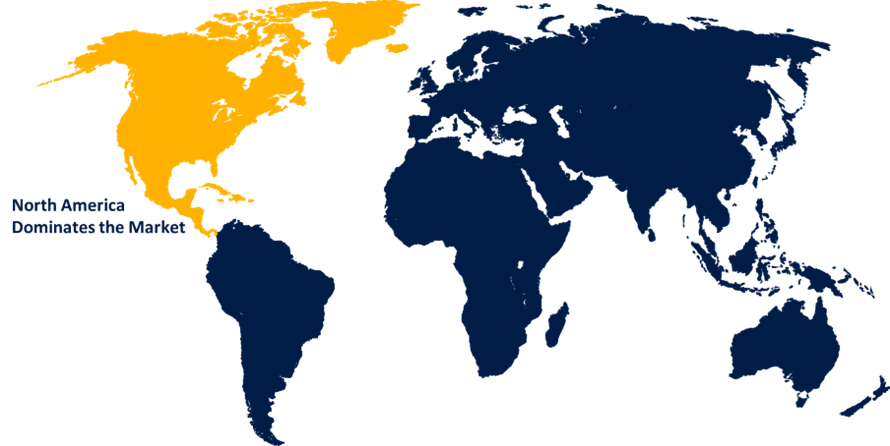

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Special Mission Aircraft Market Size is expected to reach USD 17.2 Billion by 2033, at a CAGR of 3.24% during the forecast period 2023 to 2033.

The special mission aircraft market is experiencing steady growth due to increasing defense, security, and surveillance needs worldwide. These aircraft are designed for specific operations such as intelligence gathering, reconnaissance, maritime patrol, search and rescue, and electronic warfare. Military and law enforcement agencies are the primary users, but demand is also rising in commercial sectors like environmental monitoring and disaster response. Advancements in avionics, sensors, and artificial intelligence are enhancing their capabilities, making them more effective and versatile. The market is driven by geopolitical tensions, technological innovations, and government investments in defense modernization. North America and Europe dominate, while Asia-Pacific shows significant growth potential. Key players include Boeing, Lockheed Martin, Saab, and Northrop Grumman. Challenges include high development costs and regulatory constraints.

Special Mission Aircraft Market Value Chain Analysis

The special mission aircraft market value chain involves multiple stages, from raw material procurement to end-user deployment. It begins with suppliers providing essential components like avionics, sensors, engines, and airframes. Aircraft manufacturers such as Boeing, Lockheed Martin, and Saab integrate these into specialized platforms. System integrators enhance aircraft capabilities by adding mission-specific equipment, including radar, communication systems, and surveillance tools. Research and development play a crucial role in innovation, driven by defense contractors and technology firms. Regulatory bodies ensure compliance with safety and operational standards. The final stage involves sales and aftermarket services, including maintenance, upgrades, and training for military and commercial operators. Key challenges include high costs, complex supply chains, and stringent regulations, while technological advancements drive market growth.

Special Mission Aircraft Market Opportunity Analysis

The special mission aircraft market presents significant growth opportunities driven by rising defense budgets, border security concerns, and advancements in surveillance technology. Increased geopolitical tensions are prompting nations to invest in intelligence, reconnaissance, and electronic warfare aircraft. The growing need for maritime patrol, disaster response, and environmental monitoring is expanding demand beyond military applications. Emerging economies in Asia-Pacific and the Middle East are investing in fleet modernization, creating new market opportunities. Technological innovations in artificial intelligence, autonomous systems, and sensor integration are enhancing aircraft capabilities, attracting both defense and commercial buyers. Additionally, retrofitting existing aircraft with advanced mission systems offers a cost-effective alternative to new acquisitions. However, manufacturers must navigate regulatory challenges and high R&D costs to fully capitalize on market potential.

Global Special Mission Aircraft Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 12.5 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 3.24% |

| 023 – 2033 Value Projection: | USD 17.2 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 129 |

| Segments covered: | By Platform, By Application, By Point of Sale and By Regional Analysis |

| Companies covered:: | The Boeing Company, Lockheed Martin, Dassault Aviation SA, Textron Aviation Inc., Northrop Grumman Corporation, General Dynamics Corporation, Butler National Corporation, General Atomics Aeronautical Systems Inc., Israel Aerospace Industries Ltd., L Harris Technologies Inc., Ruag International Holding AG, Gulfstream Aerospace Corporation, Elbit Systems Ltd., Bombardier Inc., BAE Systems, Pilatus Aircraft Ltd, and other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Special Mission Aircraft Market Dynamics

Rising investments in military and defense sectors

Rising investments in military and defense sectors are driving the growth of the special mission aircraft market. Governments worldwide are increasing defense budgets to enhance intelligence, surveillance, and reconnaissance (ISR) capabilities, fueling demand for advanced aircraft equipped with cutting-edge technologies. Nations facing geopolitical tensions are prioritizing fleet modernization and acquiring specialized aircraft for border security, maritime patrol, and electronic warfare. Additionally, the integration of AI, autonomous systems, and next-generation avionics is improving operational efficiency and mission effectiveness. Emerging economies, particularly in Asia-Pacific and the Middle East, are expanding their defense fleets, creating lucrative opportunities for manufacturers. However, high development costs and stringent regulatory requirements remain key challenges. Despite these hurdles, ongoing defense spending ensures sustained market expansion and technological advancements.

Restraints & Challenges

Stringent regulatory and compliance requirements add complexity to manufacturing and operations, delaying aircraft deployment. Integration of advanced technologies such as AI, sensors, and electronic warfare systems requires significant R&D investments, increasing financial risks for manufacturers. Additionally, supply chain disruptions and geopolitical uncertainties impact the availability of critical components, leading to production delays. The market also faces challenges in retrofitting aging aircraft with modern capabilities due to compatibility issues. Furthermore, pilot and crew training for specialized missions demand extensive resources. Despite these obstacles, ongoing defense investments and technological advancements continue to drive market growth, requiring companies to navigate these challenges strategically.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Special Mission Aircraft Market from 2023 to 2033. North America dominates the special mission aircraft market, driven by high defense budgets, advanced aerospace capabilities, and strong government investments in intelligence, surveillance, and reconnaissance (ISR) operations. The United States leads the region, with key players like Boeing, Lockheed Martin, and Northrop Grumman developing cutting-edge special mission aircraft for military, homeland security, and law enforcement applications. Growing demand for electronic warfare, border surveillance, and maritime patrol aircraft further boosts market expansion. Additionally, advancements in AI, sensor technology, and unmanned systems enhance mission effectiveness. Canada also contributes to the market through defense modernization programs and partnerships with U.S. aerospace firms. However, challenges such as high procurement costs and strict regulatory frameworks persist. Overall, North America remains a key driver of market growth and innovation.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The Asia-Pacific special mission aircraft market is experiencing rapid growth due to increasing defense expenditures, geopolitical tensions, and the need for advanced surveillance capabilities. Countries like China, India, Japan, and South Korea are heavily investing in intelligence, surveillance, and reconnaissance (ISR) aircraft, maritime patrol aircraft, and electronic warfare systems to strengthen national security. Rising border conflicts and territorial disputes in the South China Sea further drive demand. Additionally, emerging economies are modernizing their defense fleets and developing indigenous aerospace capabilities. Governments are also expanding investments in disaster response and environmental monitoring applications. However, challenges such as high acquisition costs, complex regulatory requirements, and technology transfer restrictions persist. Despite these hurdles, advancements in AI, sensor integration, and UAV technology continue to fuel regional market expansion.

Segmentation Analysis

Insights by Platform

The military segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is fueled by increasing defense budgets and the rising need for advanced intelligence, surveillance, and reconnaissance (ISR) capabilities. Nations worldwide are investing in electronic warfare, maritime patrol, and border security aircraft to counter evolving threats. Geopolitical tensions and asymmetric warfare further accelerate demand for multi-role aircraft equipped with cutting-edge sensors, radar, and AI-driven analytics. Fleet modernization programs in countries like the U.S., China, and India are boosting new aircraft acquisitions and upgrades of existing platforms. Additionally, the integration of unmanned aerial systems (UAS) with manned aircraft is enhancing mission efficiency. Despite challenges like high procurement costs and stringent regulations, continuous technological advancements ensure sustained growth in the military segment.

Insights by Application

The Intelligent, Surveillance and Reconnaissance segment accounted for the largest market share over the forecast period 2023 to 2033. Governments and defense organizations are investing heavily in ISR aircraft equipped with advanced sensors, radar, and AI-driven data analytics to enhance real-time situational awareness. Increased demand for airborne early warning, electronic warfare, and maritime surveillance is further fueling market expansion. The integration of unmanned aerial systems (UAS) with ISR operations is also improving operational efficiency and mission effectiveness. Countries in North America, Europe, and Asia-Pacific are leading in ISR fleet upgrades, focusing on next-generation surveillance technologies. However, high development costs and stringent regulatory requirements remain challenges. Despite this, technological advancements continue to drive strong growth in the ISR segment.

Insights by Point of Sale

The OEM segment accounted for the largest market share over the forecast period 2023 to 2033. OEMs such as Boeing, Lockheed Martin, and Northrop Grumman are investing in research and development to integrate cutting-edge avionics, AI-driven surveillance systems, and enhanced communication technologies. Rising defense budgets and military modernization programs worldwide are driving new aircraft acquisitions, boosting OEM production. Additionally, the expansion of multi-mission capabilities in ISR, maritime patrol, and electronic warfare aircraft is increasing demand for customized solutions. Emerging economies in Asia-Pacific and the Middle East are also investing in indigenous aircraft development, further fueling market growth. However, challenges such as high production costs, supply chain disruptions, and stringent regulations persist, requiring OEMs to adopt agile strategies for sustained growth.

Recent Market Developments

- In October 2024, Bombardier Defense reinforced its role as a leading provider of advanced airborne mission capabilities, addressing the growing complexity of global military operations.

Competitive Landscape

Major players in the market

- The Boeing Company

- Lockheed Martin

- Dassault Aviation SA

- Textron Aviation Inc.

- Northrop Grumman Corporation

- General Dynamics Corporation

- Butler National Corporation

- General Atomics Aeronautical Systems Inc.

- Israel Aerospace Industries Ltd.

- L Harris Technologies Inc.

- Ruag International Holding AG

- Gulfstream Aerospace Corporation

- Elbit Systems Ltd.

- Bombardier Inc.

- BAE Systems

- Pilatus Aircraft Ltd

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Special Mission Aircraft Market, Platform Analysis

- Military Aviation

- Commercial Aviation

- Unmanned Aerial Vehicle

Special Mission Aircraft Market, Application Analysis

- Command and Control

- Combat Support

- Intelligence, Surveillance, and Reconnaissance

- Air-Rocket Launch

- Transportation

- Others

Special Mission Aircraft Market, Point of Sale Analysis

- OEM

- Aftermarket

Special Mission Aircraft Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Special Mission Aircraft Market?The global Special Mission Aircraft Market is expected to grow from USD 12.5 billion in 2023 to USD 17.2 billion by 2033, at a CAGR of 3.24% during the forecast period 2023-2033.

-

2. Who are the key market players of the Special Mission Aircraft Market?Some of the key market players of the market are the Boeing Company, Lockheed Martin, Dassault Aviation SA, Textron Aviation Inc., Northrop Grumman Corporation, General Dynamics Corporation, Butler National Corporation, General Atomics Aeronautical Systems Inc., Israel Aerospace Industries Ltd., L Harris Technologies Inc., Ruag International Holding AG, Gulfstream Aerospace Corporation, Elbit Systems Ltd., Bombardier Inc., BAE Systems, and Pilatus Aircraft Ltd

-

3. Which segment holds the largest market share?The OEM segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?