Global Specialty Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Marine, Aviation & Transport (MAT), Marine Insurance, and Inland Marine Insurance), By Distribution Channel (Brokers and Non-Brokers), By End User (Business and Individuals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Specialty Insurance Market Insights Forecasts to 2033

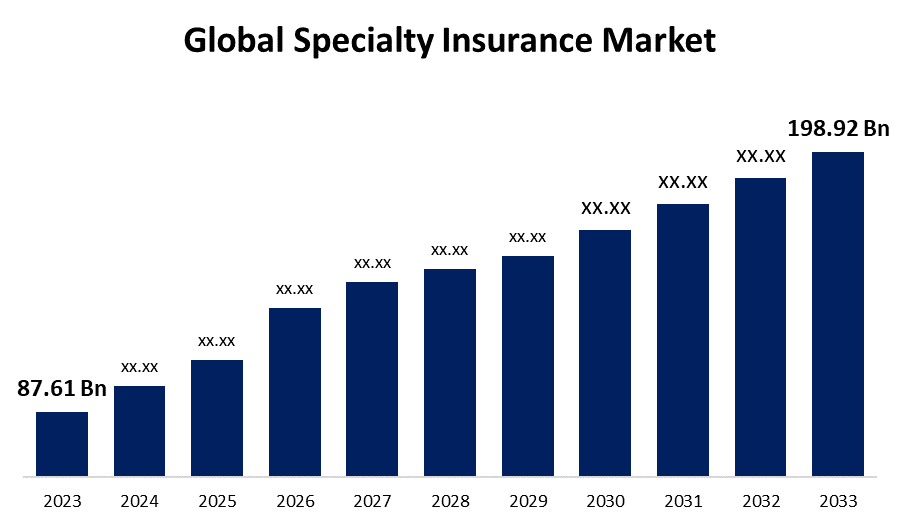

- The Global Specialty Insurance Market Size was Valued at USD 87.61 Billion in 2023

- The Market Size is Growing at a CAGR of 8.55% from 2023 to 2033

- The Worldwide Specialty Insurance Market Size is Expected to Reach USD 198.92 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Specialty Insurance Market Size is Anticipated to Exceed USD 198.92 Billion by 2033, Growing at a CAGR of 8.55% from 2023 to 2033.

Market Overview

Serving distinct and unconventional risks that frequently lie beyond the purview of regular insurance policies, the global specialty insurance market is a vibrant and specialized subset of the larger insurance sector. As companies and individuals look for customized coverage options for risks that are getting more complicated and specialized, this sector has grown in popularity. Specialty insurance covers certain, frequently high-risk, and unusual scenarios; regular insurance, on the other hand, mostly concentrates on ordinary hazards like property damage or liability. These could involve terrorism, fine art, aviation, maritime, cyber liability, and other unusual risks. By utilizing their knowledge, specialty insurers close the gaps left by traditional insurance offers by underwriting and creating policies that offer complete protection for these unique risks. Strategic alliances, joint ventures, and mergers and acquisitions (M&A) bolster advanced product lines and international expansion. Furthermore, the need for specialty insurance policies is rising as a result of developments in wellness, personalized medicine, new technology, specialized therapies, and pharmaceutical improvements.

Report Coverage

This research report categorizes the market for the global specialty insurance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global specialty insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global specialty insurance market.

Global Specialty Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 87.61 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 8.55% |

| 2033 Value Projection: | USD 198.92 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Distribution Channel, By End User and By Region. |

| Companies covered:: | AXA, AIG, Allianz, ASSICURAZIONI GENERALI S.P.A., Berkshire Hathaway Inc., Chubb, Munich Reinsurance Company,, PICC, Tokio Marine HCC, Zurich, Hiscox Ltd., Manulife Financial Corporation, MAPFRE S.A., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Accurate evaluation of current and future risks in the global specialty insurance market is made feasible by the application of technologies such as blockchain and the Internet of Things (IoT). Furthermore, a major factor driving the expansion of the global specialty insurance market is the broad range of coverage options that specialty insurance provides, together with a high degree of flexibility with regard to the policy term, policy duration, and coverages. Conversely, during the projected period, the market expansion is anticipated to be driven by the rise in demand for specialty insurance among Program Administrators (PAs), who are among the primary distributors of specialty insurance products. Industries are subject to increasingly stringent laws and compliance requirements from governments across the globe. Specialty insurance guarantees compliance while assisting companies in navigating these intricate legal environments. The number of trade agreements is also increasing, which is increasing the demand for new insurance plans for cross-border activities.

Restraining Factors

Significant weather disasters are resulting in catastrophic physical damage, but there have also been an increase in claims and poor financial underwriting performance in the professional indemnity and liability sector. Insurance firms will therefore raise their rates to offset this. In more dire circumstances, insurers can decide not to continue providing coverage for underperforming companies or professions. Therefore, it is expected that the unsteady insurance market will impede the uptake of specialty insurance and thereby limit the expansion of the market.

Market Segmentation

The global specialty insurance market share is segmented into type, distribution channel, and end-user.

- The marine, aviation & transport (MAT) segment dominates the market with the largest market share through the forecast period.

Based on the type, the global Specialty Insurance market is segmented into marine, aviation & transport (MAT), marine insurance, and inland marine insurance. Among these, the marine, aviation & transport (MAT) segment dominates the market with the largest market share through the forecast period. The need for strong MAT services is being driven by the increase in cross-border trade between different nations, which is necessary for the effective shipping of commodities, the transportation of passengers, and the ongoing interchange of ideas. In addition, MAT's adoption of advanced technologies is improving environmental compliance, safety, and efficiency. The increased accessibility and appeal of transportation due to technological advancements is driving up demand for these services. In addition, the demand for air and maritime transportation is rising as a result of the expansion in tourism worldwide. Additionally, a positive market perspective is being provided by governments and international organizations highlighting the significance of environmentally friendly and sustainable transportation technologies.

- The brokers segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the distribution channel, the global specialty insurance market is segmented into brokers and non-brokers. Among these, the brokers segment is anticipated to grow at the fastest CAGR growth through the forecast period. Brokers can customise solutions to meet specific demands since they possess specialized knowledge in assessing complicated and unique risks in addition to their skills in risk management. They can also locate the best specialist insurance policies because they have access to a wide network of insurers. In addition, fostering close, one-on-one connections with clients helps brokers comprehend their unique specialty insurance needs. Additionally, they frequently help clients with compliance issues, streamlining the procedure and ensuring adherence to all legal standards. They can also react fast to changes in the market and new hazards. They maintain their lead in the specialized insurance sector due to their flexibility in responding to changing conditions and developing pertinent products.

- The business segment accounted for the largest revenue share through the forecast period.

Based on the end-user, the global specialty insurance market is segmented into business, and individuals. Among these, the business segment accounted for the largest revenue share through the forecast period. Businesses can use specialty insurance to address a variety of risks and particular difficulties that are unique to their industry and might not be covered by ordinary insurance policies. These specialized insurance plans might include a range of industries, including manufacturing, construction, healthcare, and technology. Businesses can reduce risks associated with product liability, cybersecurity, intellectual property, and environmental issues by purchasing specialty insurance. Specialty insurance companies can assist businesses in protecting themselves against unanticipated events and unstable market conditions by providing customized policies that take into account the unique risks and intricacies of certain sectors. In a highly competitive market, this focused strategy fosters corporate trust and facilitates growth and continuity.

Regional Segment Analysis of the Global Specialty Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

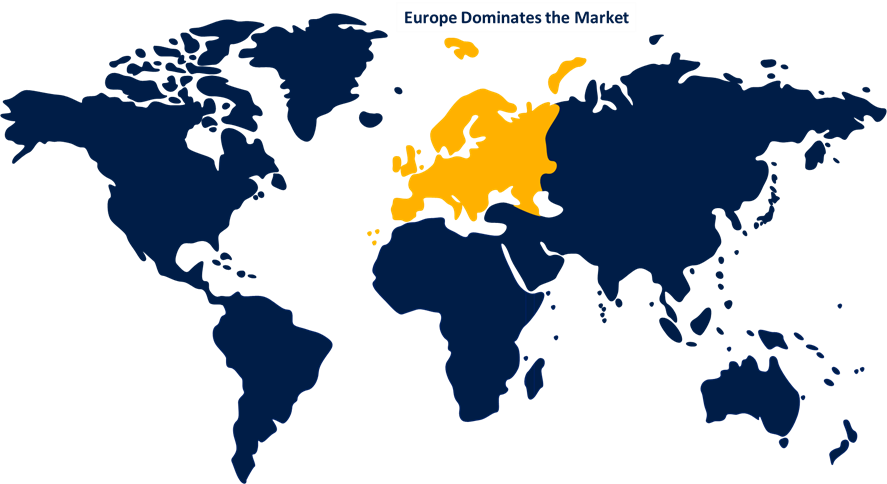

Europe is anticipated to hold the largest share of the global specialty insurance market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the global specialty insurance market over the predicted timeframe. Due in large part to its strong regulatory environment, especially in the financial services sector, which facilitates transparent and trustworthy specialized insurance operations, Europe accounted for the largest share of the market. Major international financial centers like London also provide an environment that is favorable for the growth of specialty insurance businesses. These centers draw talent and experience from around the world, which promotes innovation and growth in the market for specialty insurance products. Moreover, businesses and people can invest in specialty insurance products owing to the economic stability and prosperity of European nations. In addition, the area's emphasis on environmental responsibility and sustainability fits in nicely with the rising market for eco-friendly insurance solutions.

Asia Pacific is expected to grow at the fastest CAGR growth of the global specialty insurance market during the forecast period. The demand for specialty insurance solutions in this area is being driven by the region's rapid economic expansion, rising middle-class population, and growing knowledge of risk management. The Asia Pacific specialty insurance industry is growing at a rapid rate as more companies and people look to protect themselves against specific risks like cyber threats and environmental liabilities. Specialty insurance is growing rapidly in this region due to insurers' increased customization of their products to suit the varied needs of this dynamic and changing market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global specialty insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AXA

- AIG

- Allianz

- ASSICURAZIONI GENERALI S.P.A.

- Berkshire Hathaway Inc.

- Chubb

- Munich Reinsurance Company,

- PICC

- Tokio Marine HCC

- Zurich

- Hiscox Ltd.

- Manulife Financial Corporation

- MAPFRE S.A.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, AXA XL introduced a new endorsement to help public companies address SEC cyber incident reporting requirement costs.

- In June 2023, The Hanover Added SimpliSafe® to Its Suite of Risk Management Providers for Personal Lines Customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global specialty insurance market based on the below-mentioned segments:

Global Specialty Insurance Market, By Type

- Marine, Aviation & Transport (MAT)

- Marine Insurance

- Inland Marine Insurance

Global Specialty Insurance Market, By Distribution Channel

- Brokers

- Non-Brokers

Global Specialty Insurance Market, By End User

- Business

- Individuals

Global Specialty Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?AXA, AIG, Allianz, ASSICURAZIONI GENERALI S.P.A., Berkshire Hathaway Inc., Chubb, Munich Reinsurance Company, PICC, Tokio Marine HCC, Zurich, Hiscox Ltd., Manulife Financial Corporation, MAPFRE S.A., and Others.

-

2. What is the size of the global specialty insurance market?The Global Specialty Insurance Market Size is Expected to Grow from USD 87.61 Billion in 2023 to USD 198.92 Billion by 2033, at a CAGR of 8.55% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Europe is anticipated to hold the largest share of the global specialty insurance market over the predicted timeframe.

Need help to buy this report?