Global Spinal Implants and Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Spinal Biologics, Spinal Fusion Devices, Non-Fusion Devices, Vertebral Compression Fracture Treatment Devices, Spinal Bone Growth Stimulators), By Technology (Spinal Fusion & Fixation Technologies, Vertebral Compression Fracture Treatment, Motion Preservation Technologies), By Surgery (Open Surgery and Minimally Invasive Surgery [MIS]), By Procedure Type (Discectomy, Laminotomy, Foraminotomy, Corpectomy, Facetectomy), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Spinal Implants and Devices Market Insights Forecasts to 2032

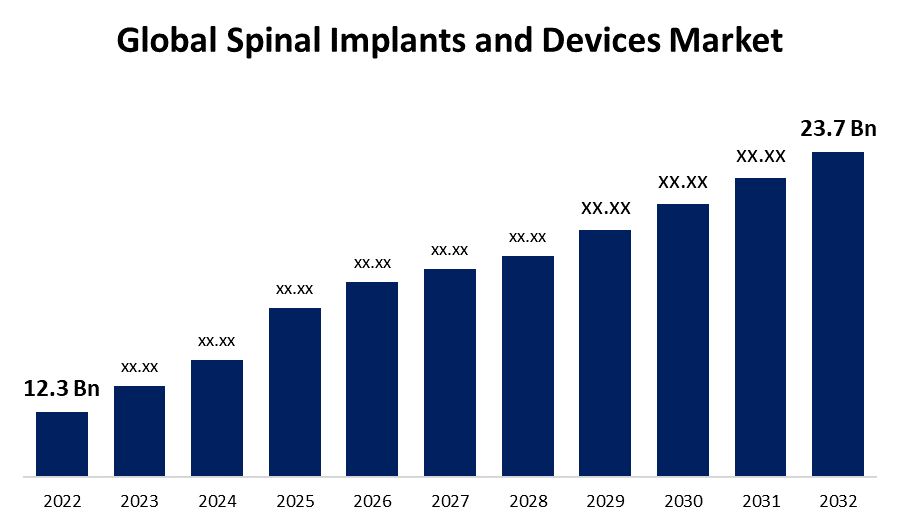

- The Global Spinal Implants and Devices Market Size was valued at USD 12.3 Billion in 2022.

- The Market is growing at a CAGR of 6.7% from 2022 to 2032.

- The Worldwide Spinal Implants and Devices Market size is expected to reach USD 23.7 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Spinal Implants and Devices Market Size is expected to reach USD 23.7 billion by 2032, at a CAGR of 6.7% during the forecast period 2022 to 2032.

Market Overview

Spinal implants are devices used to strengthen the spine, permit fusion, and correct spinal-level abnormalities. Scoliosis, spondylolisthesis, kyphosis, and fracture are just a few of the conditions that are treated by spinal implants. Its main purpose is to take the place of native disc material and assist in the fusion of two vertebrae. The primary causes of this compression include disc herniation, bone fractures, and degenerative changes to the spine. By immobilizing the vertebrae, this treatment eliminates or considerably reduces the discomfort that is brought on by the aberrant movement of the vertebrae. With the development of modern spine implants and technology, therapy possibilities at the spinal level are constantly improving. Additionally, using these implants and gadgets is one of the efficient and advised ways to cure spinal misalignments or degenerative alterations. The increasing incidence of spinal illnesses, increased desire for less invasive procedures, and technical developments in bone grafting products are the main market drivers for spinal implants and surgical equipment. For example, according to an article that appeared in NCBI in October 2021, there are an estimated 768,473 new occurrences of spinal injury worldwide each year, with the frequency of traumatic spine fractures at 10.5 per 100,000 people. Additionally, a November 2022 NCBI article noted that falls and motor vehicle incidents accounted for 25% and 50%, respectively, of spine fractures in younger patients.

Report Coverage

This research report categorizes the global spinal implants and devices market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global spinal implants and devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global spinal implants and devices market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Spinal Implants and Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.3 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 6.7% |

| 022 – 2032 Value Projection: | USD 23.7 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Type, By Technology, By Surgery, By Procedure Type, By Region. |

| Companies covered:: | Medtronic, Johnson & Johnson, Stryker, NuVasive, Zimmer Biomet, Globus Medical, Inc., Alphatec Spine, Inc., Orthofix Holdings, Inc., RTI Surgical Holdings, Ulrich GmbH & Co. KG, B. Braun Melsungen AG, Seaspine Holdings Corporation |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Throughout the forecast period, the market is expected to increase as a result of growing spinal diseases, fractures, and injuries, as well as rising demand for improved medical technologies and implants. For instance, according to figures provided by the WHO, between 250,000 and 500,000 SCI cases are recorded each year globally. In addition, obesity typically increases lower back problems already present and raises the possibility of recurrence, leading to a rise in the usage of spinal devices during therapy. Degenerative disc disorders, vertebral compression fractures, spondylolisthesis, and spinal stenosis are among the most prevalent spine-related illnesses affecting older adults. Furthermore, a rising older population and an increase in the number of obese individuals frequently show symptoms of abnormalities of the vertebral column, such as spinal stenosis, which heightens the demand for spinal surgery and propels the market's expansion. Also, the techniques used by emerging leading players, such as mergers and acquisitions to create cutting-edge items, will help in the market's expansion.

Restraining Factors

Market expansion is probably going to be hampered by expensive procedures and strict regulatory approval processes. Also, the spinal implant industry is subject to stringent regulatory requirements and standards. Obtaining regulatory approvals and clearances for new devices can be a time-consuming and costly process. Moreover, spinal implant procedures are typically complex surgeries that require highly skilled surgeons and specialized healthcare facilities. In addition, the availability and efficacy of alternative treatments can influence the demand for spinal implants and devices.

Market Segmentation

- In 2022, the spinal fusion devices segment is dominating the market with the largest market share over the forecast period.

On the basis of product type, the global spinal implants and devices market is divided into different segments such as spinal biologics, spinal fusion devices, non-fusion devices, vertebral compression fracture treatment devices, and spinal bone growth stimulators. Among these segments, spinal fusion devices hold the largest market share at 58% due to a rise in spinal fusion surgeries. Technology breakthroughs in spine fusion surgery, whether with or without internal fixation, have resulted in high growth, and the rising demand has also been driven by the expansion of the indications for spine fusions.

Vertebral compression fracture treatment devices are expected to drive the fastest growth during the forecast period, due to a rise in spinal conditions and patients' preference for minimally invasive procedures. Additionally, several significant players apply for permission from various regulatory agencies to increase their regional presence.

- In 2022, the spinal fusion and fixation technologies segment is influencing the largest market growth during the forecast period.

Based on the surgery, the global spinal implants and devices market is segmented into different segments such as spinal fusion & fixation technologies, vertebral compression fracture treatment, and motion preservation technologies. Throughout these segments, spinal fusion and fixation technologies accounted for the largest market share of 68% during the forecast period, due to their inclusion of both posterior and anterior surgical techniques, covering a wide spectrum of techniques. Segment expansion was also facilitated by the FDA's increasing approval of spinal fusion and fixation devices. For instance, the FDA approved Surgalign's Cortera Spinal Fixation System's 510(k) approval in August 2022. One of the business's new main posterior fixation systems, the Cortera Spinal Fixation System, is meant to drive further advancement.

- In 2022, the laminotomy segment is leading the market with the largest market share of 38.1% during the forecast period.

Based on the procedure type, the global spinal implants and devices market is bifurcated into segments such as discectomy, laminotomy, foraminotomy, corpectomy, and facetectomy. Among these, laminotomy held the largest market share growth of 38.1% over the projection period, owing to this is among the most often carried out spine operations. Combinations of discectomy and laminectomy are routinely carried out. These decompressive procedures are the ones that are performed most commonly in the United States. A spinal decompression treatment normally costs approximately $23,500 in the United States.

Regional Segment Analysis of the spinal implants and devices market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

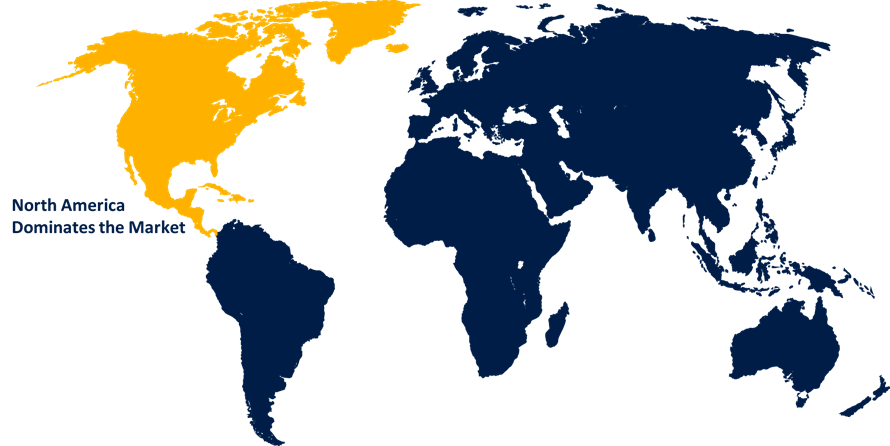

North America dominates the spinal implants and devices market over the forecast period

Get more details on this report -

The North America market is projected the fastest-growing region with a 48.8% revenue share during the forecast period, owing to an increase in spinal cord implant (SCIs) in the US. Furthermore, prominent competitors have seen a significant gain in market revenue in the U.S. due to technical advancements and an increase in FDA approvals.

Due to an increase in SCI instances in China and India, Asia Pacific is anticipated to expand the quickest throughout the projection period. Additionally, Japan has aided in the quick advancement of its extremely complex spinal operations. Regional expansion is also considerably fueled by an aging population and a rise in traffic accidents.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global spinal implants and devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Johnson & Johnson

- Stryker

- NuVasive

- Zimmer Biomet

- Globus Medical, Inc.

- Alphatec Spine, Inc.

- Orthofix Holdings, Inc.

- RTI Surgical Holdings

- Ulrich GmbH & Co. KG

- B. Braun Melsungen AG

- Seaspine Holdings Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Excavation Micro, a brand-new minimally invasive surgery (MIS) innovation from NuVasive Inc., provides all-inclusive TLIF and decompression solutions. The increasing innovations and new releases are therefore expected to lead to a growth in demand for spinal implants and devices throughout the course of the projected timeframe.

- In August 2022, Press ON posterior lumbar fixations was commercially released by Nexus Spine. To prevent set screw loosening, Press ON has rods that press into pedicle screws rather than attaching with set screws.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Spinal Implants and Devices Market based on the below-mentioned segments:

Global Spinal Implants and Devices Market, By Product Type

- Spinal Biologics

- Spinal Fusion Devices

- Non-Fusion Devices

- Vertebral Compression Fracture Treatment Devices

- Spinal Bone Growth Stimulators

Global Spinal Implants and Devices Market, By Technology

- Spinal Fusion & Fixation Technologies

- Vertebral Compression Fracture Treatment

- Motion Preservation Technologies

Global Spinal Implants and Devices Market, By Surgery

- Open Surgery

- Minimally Invasive Surgery

Global Spinal Implants and Devices Market, By Procedure Type

- Discectomy

- Laminotomy

- Foraminotomy

- Corpectomy

- Facetectomy

Spinal Implants and Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?