Global Sporting Goods Market Size, Share, and COVID-19 Impact Analysis, By Product (Adventures Sports, Ball Games, Fitness/Strength Equipment, and Athletic Training Equipment), By Distribution Channel (Hypermarket/Supermarket, Convenience/Departmental Store, Specialty Store, and Online Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Consumer GoodsGlobal Sporting Goods Market Insights Forecasts to 2033

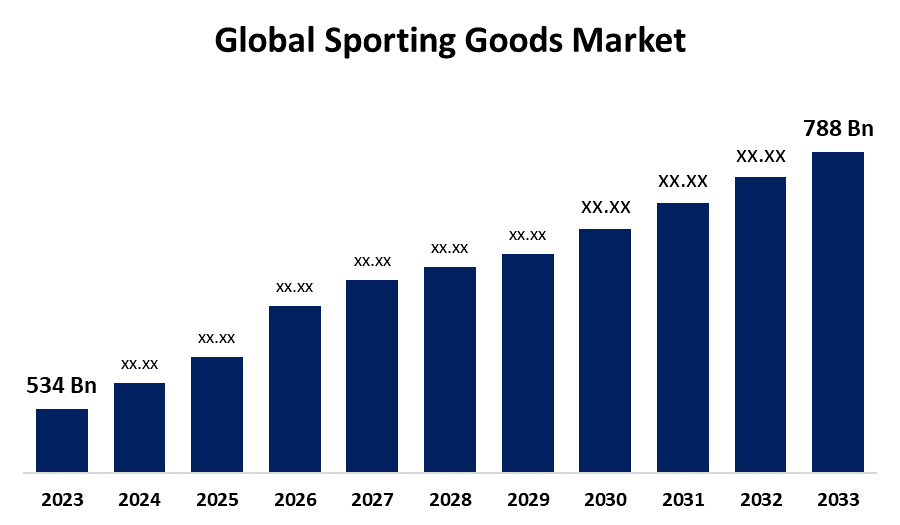

- The Global Sporting Goods Market Size was Valued at USD 534 Billion in 2023

- The Market Size is Growing at a CAGR of 3.97% from 2023 to 2033

- The Worldwide Sporting Goods Market Size is Expected to Reach USD 788 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Sporting Goods Market Size is Anticipated to Exceed USD 788 Billion by 2033, Growing at a CAGR of 3.97% from 2023 to 2033.

Market Overview

Sporting goods involve a broad range of specially developed gear, accessories, and equipment. These goods help athletes and those participating in sports and fitness activities perform better and have a more enjoyable time. Sporting goods are needed by people who engage in outdoor enjoyment, competitive athletics, fitness training, and recreational sports. To minimize the risk of harm, these products are designed to satisfy certain performance requirements, safety laws, and ergonomic considerations. As a result, users can continue to enjoy their favorite sports and activities.

Several factors drive the industry, including the need to boost performance, increase safety, and adjust to the shifting requirements of different sports. Furthermore, key market players include Adidas AG, Nike, Inc., Under Armour, Inc., PUMA SE, AMER Sports, Admiral Sportswear Limited, Diadora S.p.A., Ellesse, and ODLO International AG. It appears that the market for sporting goods is developing because of the increasing innovations in this industry.

For instance, in March 2023, The PUMA Brilliance Pack, which came in brand-new colorways, included specific sizes for the FUTURE, ULTRA, and KING models. A fantastic fit for fantastic ballers, PUMA honored the skill of women's basketball while anticipating the next wave of young female athletes.

Report Coverage

This research report categorizes the global sporting goods market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global sporting goods market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global sporting goods market.

Global Sporting Goods Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 534 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.97% |

| 2033 Value Projection: | USD 788 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 213 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Distribution, By Region |

| Companies covered:: | Adidas AG, Nike, Inc., Under Armour, Inc., PUMA SE, AMER Sports, Admiral Sportswear Limited, Diadora S.p.A., Ellesse, Whitetail Headquarters, ODLO International AG, Hummel International Sport & Leisure A/S, Betr Holdings, Inc., Hammer Sports, Polar Electro, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Sport can improve children's health and provide young people with an exciting opportunity to learn new skills, take risks, and achieve their goals. Because the younger generation's sedentary habits have led to several lifestyle problems, sports have become more and more significant as a means of sustaining health. Customers are increasingly more interested in new trends like athletic and casual wear, and the sector is seeing an increase in the awareness of sports. Due to growing disposable income and urbanization, more people are turning to sports as a healthy lifestyle, which presents tremendous opportunities for growth in the sporting goods market.

Restraining Factors

The pandemic caused difficulties for the sports business, reducing operations and equipment manufacturing and restricting growth in the market. Sports equipment can be viewed as pricey by certain people, which might restrict the market's expected growth.

Market Segmentation

The global sporting goods market share is classified into product and distribution channels.

- The ball games segment is expected to hold the largest share of the global sporting goods market during the forecast period.

Based on the product, the global sporting goods market is divided into adventure sports, ball games, fitness/strength equipment, and athletic training equipment. Among these, the ball games segment is expected to hold the largest share of the global sporting goods market during the forecast period. Ball games are an essential part of human culture and recreation, drawing people of all ages from all over nations. As they unite people and give them a sense of belonging, these games naturally promote social interaction and community involvement. Playing ball games improves reflexes, balance, and motor skills, lowers the risk of chronic diseases like obesity, diabetes, and cardiovascular problems, and helps people maintain a healthy body weight. Playing sports also helps people stay physically active and healthy.

- The specialty store segment is expected to hold the largest share of the global sporting goods market during the forecast period.

Based on the distribution channel, the global sporting goods market is divided into hypermarkets/supermarkets, convenience/departmental stores, specialty stores, and online stores. Among these, the specialty store segment is expected to hold the largest share of the global sporting goods market during the forecast period. Sports goods stores are an example of specialty stores. They retain a limited product selection but provide a large range of clothing and equipment for both athletes and outdoor lovers. These shops stock a large variety of goods, like basketballs and tents for camping, and their knowledgeable staff is always happy to help customers locate the perfect equipment for their needs.

Regional Segment Analysis of the Global Sporting Goods Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global sporting goods market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global sporting goods market over the predicted timeframe. The United States sporting goods market shows potential for continuous growth because of changing consumer preferences, material advancements, and a focus on sustainability. The area is home to a few of the most well-liked sports globally, like basketball, football, and baseball, leading to a high need for sports gear, particularly basketball equipment. The United States, with its strong disposable incomes and busy lifestyles, is a lucrative market for manufacturers of sports goods.

Asia Pacific is expected to grow at the fastest pace in the global sporting goods market during the forecast period. The APAC region is expected to experience significant expansion in the sporting goods market and will rank second due to increasing interest in fitness and high-quality sports equipment in the forecast period. Additionally, an increase in spending on fantasy sports has been driven by the growing disposable income in the region, causing a greater need for sporting goods due to the multiplier effect on discretionary purchases. In 2024, India is projected to reach a per capita household disposable income of approximately USD 2534.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global sporting goods market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Adidas AG

- Nike, Inc.

- Under Armour, Inc.

- PUMA SE

- AMER Sports

- Admiral Sportswear Limited

- Diadora S.p.A.

- Ellesse

- Whitetail Headquarters

- ODLO International AG

- Hummel International Sport & Leisure A/S

- Betr Holdings, Inc.

- Hammer Sports

- Polar Electro

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, the sports gaming and media company Betr Holdings, Inc., established in Miami, launched new market access agreements for online sportsbooks and casinos in Pennsylvania, as well as online sportsbooks in Colorado and Kentucky.

- In April 2023, Nike and Liga BBVA MX Femenil announced a three-year partnership that will see Nike serve as the league's sole sports partner.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global sporting goods market based on the below-mentioned segments:

Global Sporting Goods Market, By Product

- Adventures Sports

- Ball games

- Fitness/Strength equipment

- Athletic training equipment

Global Sporting Goods Market, By Distribution Channel

- Hypermarket/Supermarket

- Convenience/Departmental Store

- Specialty Store

- Online Stores

Global Sporting Goods Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Adidas AG, Nike, Inc., Under Armour, Inc., PUMA SE, AMER Sports, Admiral Sportswear Limited, Diadora S.p.A., Ellesse, Whitetail Headquarters, ODLO International AG, Hummel International Sport & Leisure A/S, Betr Holdings, Inc., Hammer Sports, Polar Electro, and Others.

-

2. What is the size of the global sporting goods market?The global sporting goods market is expected to grow from USD 534 Billion in 2023 to USD 788 Billion by 2033, at a CAGR of 3.97% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global sporting goods market over the predicted timeframe.

Need help to buy this report?