Global Stain-Resistant Fabric Market Size, Share, and COVID-19 Impact Analysis, By Type (Cotton, Silk, Denim, Polyester, Nylon, Others), By Application (Household, Commercial, Hospitality, Educational Institutes, Others), By Distribution Channel (Shopping Mall & Supermarket, Franchised Store, Online Store, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Advanced MaterialsGlobal Stain-Resistant Fabric Market Size Insights Forecasts to 2032

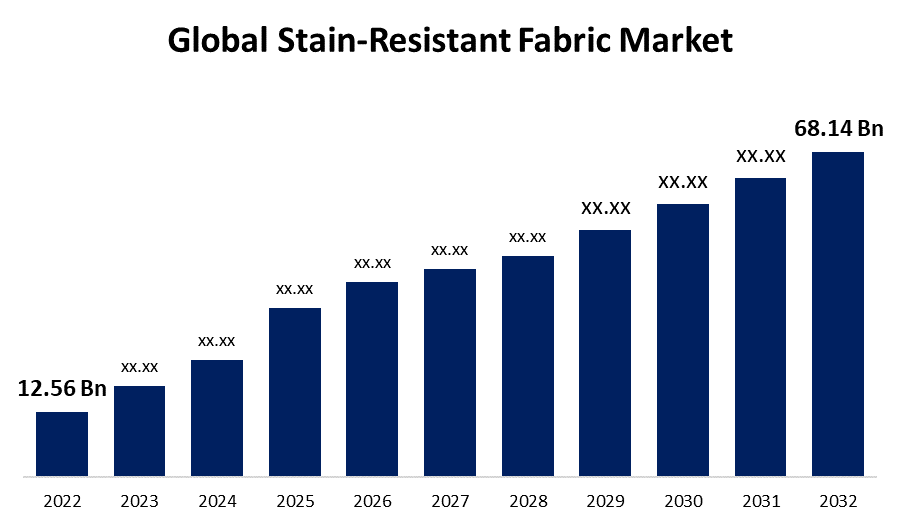

- The Global Stain-Resistant Fabric Market Size was valued at USD 12.56 Billion in 2022.

- The Market Size is Growing at a CAGR of 18.42% from 2022 to 2032.

- The Worldwide Stain-Resistant Fabric Market Size is expected to reach USD 68.14 Billion by 2032.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Stain-Resistant Fabric Market Size is expected to reach USD 68.14 Billion by 2032, at a CAGR of 18.42% during the forecast period 2022 to 2032.

Stain resistance is defined as the ability to resist contamination from atmospheric dust and is an important performance of exterior coatings. The need for stain-resistant fabric is rapidly expanding, owing in large part to increased awareness of the numerous benefits that fabric protection offers. Consumer are becoming more aware of the benefits of protecting their clothing, furniture, and textiles, which is driving up demand for fabric protection products and services. Customers are also drawn in by the time-saving feature of the fabric protection. Fabrics that have been treated require less time and effort to clean and maintain, saving both time and money. This convenience feature is especially important in homes with children or dogs, where spills and mishaps are more common. The ease of washing protected materials precisely meets consumers' demands for effective and hassle-free solutions. In addition, these industries strictly adhere to GMPs, which require a clean and well-organized working environment. As a consequence, there is always a demand in these industries for garments made of stain-resistant fabrics. Furthermore, as a result of the fabric product's continuous improvement, the target market or consumer is looking for high-quality fabric materials that are odour, moisture, and stain-resistant. Some of the largest fabric companies are currently planning to develop such multifunctional fabric products while taking consumer wants and preferences into account.

Global Stain-Resistant Fabric Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 12.56 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 18.42% |

| 2032 Value Projection: | USD 68.14 Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application, By Distribution, By Region |

| Companies covered:: | Crypton LLC., Revolution Performance Fabrics, Bru Textiles n.v, Nanotex LLC, Dropel Fabrics, SuperFabric, The Chemours Company, Abercrombie Textiles, LLC, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

Working on the production line in different manufacturing facilities for different sectors, like the car industry, and chemical industry personnel often get dirt on their clothes. Furthermore, the global market for stain-resistant fabrics sees opportunities in key industries such as automotive and chemical. In sports industries, players tend to sweat, pick up dirt, or become stained. Furthermore, the products are widely used for stain protection and waterproofing in furnishings such as sofas, rugs, and carpets. These products are compatible with a wide range of fabric materials, including polypropylene, acrylic, rayon, and cotton. Growing consumer spending on upholstery products by the middle and upper classes, as well as commercial segments such as hotels and cafes, is expected to boost growth. Furthermore, to meet the needs and demands of their intended consumers, manufacturers are now developing stain-resistant textiles. The use of stain-resistant fabric materials has several significant benefits, including long-term durability, ease of handling, and resistance to waterborne stains, sunlight, insects, abrasion, and mildew. These factors will boost the market growth during the forecast period.

Restraining Factors

Many end users worldwide cannot afford the product's high manufacturing costs, which has resulted in its low market penetration. As a result, businesses must work to make their equipment more affordable, and government support will also help to improve the market's prospects in developing countries.

Market Segmentation

By Type Insights

The nylon segment dominates the market with the largest revenue share over the forecast period.

Based on type, the global stain-resistant fabric market is segmented into cotton, silk, denim, polyester, nylon, and others. Among these, the nylon segment is dominating the market with the largest revenue share over the forecast period. Nylon is one of the toughest covering textiles. When combined with other fibres, this fibre is more resistant to pilling, crushing, and fading. Polymers are used to create nylon, a resilient and robust synthetic carpet fibre. The durability of nylon carpet is well known, it is resistant to crushing, matting, and stains. It is also easy to maintain as well as clean.

By Application Insights

The commercial segment is witnessing significant CAGR growth over the forecast period.

On the basis of application, the global stain-resistant fabric market is segmented into household, commercial, hospitality, educational institutes, and others. Among these, the commercial segment is witnessing significant growth over the forecast period. These industries require a clean and organized environment, so the textiles used in these institutions are thoroughly examined for cleanliness. Franchised stores benefit from stain-resistant fabrics as well, as they contribute to a clean and appealing shopping environment.

By Distribution Channel Insights

The franchised store segment is expected to hold the largest share of the global stain-resistant fabric market during the forecast period.

Based on the distribution channel, the global stain-resistant fabric market is classified into shopping malls & supermarkets, franchised stores, online stores, and others. Among these, the franchised store segment is expected to hold the largest share of the stain-resistant fabric market during the forecast period. Contracting with external suppliers is much simpler. As part of the mall, the consumer is more likely to see lower costs and better terms for the products and services in franchised stores.

Regional Insights

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with the largest market share over the forecast period. The local real estate market has been driven by increasing residential development projects as a result of population growth. This has contributed to the growth of the market for floor-cleaning equipment. Furthermore, rising consumer disposable income and rapid urbanization in emerging markets are expected to benefit market expansion. The availability of large commercial spaces in countries and increased demand for the product.

North America is expected to grow the fastest during the forecast period. North American consumers are becoming increasingly concerned about environmental and health issues. As a result of this increased awareness, there is a growing demand for fabric protection products that are not only effective but also non-toxic and environmentally friendly. To meet this demand, regional manufacturers are developing and promoting environmentally friendly fabric protection options that complement consumers' environmental goals and health-conscious lifestyles.

List of Key Market Players

- Crypton LLC.

- Revolution Performance Fabrics

- Bru Textiles n.v

- Nanotex LLC

- Dropel Fabrics

- SuperFabric

- The Chemours Company

- Abercrombie Textiles, LLC

Key Market Developments

- In October 2023, Blue island, a brand known for its unique and cost-effective approach to fashion, has officially announced exciting new additions to wardrobes around the world. Fashion meets functionality in this exclusive line of Stain-proof and Breathable Clothing. The new portfolio enables wearers to up their style quotient while effectively combating common stains.

- In October 2022, PANGAIA introduced its first product that incorporates DROPELTM technology, which is an invisible coating that protects the garment from water-based stains. This technology is compatible with natural fibers and produces a biobased polymer that is used as a stain-repellent finish in part. Bluesign certification has been obtained for the coating's manufacturing process.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the global stain-resistant fabric market based on the below-mentioned segments:

Stain-Resistant Fabric Market, Type Analysis

- Cotton

- Silk

- Denim

- Polyester

- Nylon

- Others

Stain-Resistant Fabric Market, Application Analysis

- Household

- Commercial

- Hospitality

- Educational Institutes

- Others

Stain-Resistant Fabric Market, Distribution Channel Analysis

- Shopping Mall & Supermarket

- Franchised Store

- Online Store

- Others

Stain-Resistant Fabric Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?