United States Home Improvement Market Size, Share, and COVID-19 Impact Analysis, By Product (Building and Remodelling, Home Decor, Outdoor Living, and Tools and Hardware), By Sales Channel (Homeware Stores, Franchised Stores, Specialty Stores, Online, and Others), and United States Home Improvement Market Insights, Industry Trend, Forecasts to 2033.

Industry: Consumer GoodsUnited States Home Improvement Market Insights Forecasts to 2033

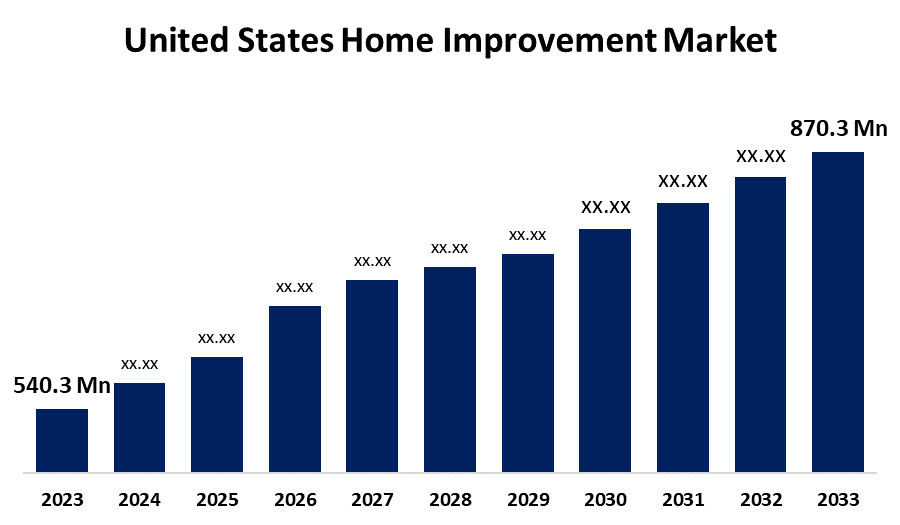

- The United States Home Improvement Market Size was valued at USD 540.3 Million in 2023.

- The Market is growing at a CAGR of 4.88% from 2023 to 2033

- The United States Home Improvement Market Size is expected to reach USD 870.3 Million by 2033

Get more details on this report -

The United States Home Improvement Market is anticipated to exceed USD 870.3 Million by 2033, growing at a CAGR of 4.88% from 2023 to 2033.

Market Overview

Home improvement is a part of the broader building and construction industry. It undertakes projects aimed at improving or enhancing the functional features of an existing home. Home improvement projects include aspects of home improvement that can range from improving the exterior of the home to improving plumbing systems and lighting. The United States home improvement market has grown significantly in recent years, emerging as a major sector in the broader economy. This growth trajectory is underpinned by a confluence of factors, including rising homeownership preferences, an aging housing stock, and a strong real estate market that encourages renovations and improvements. With a market value of several hundred billion dollars, estimates indicate sustained growth. This expansion is fueled by both discretionary and necessary improvements, from kitchen and bathroom remodels to energy-efficient upgrades and home automation systems. Driven by the desire to expand living space and increase property values, the market dynamics are reflected in increased spending by homeowners on home improvement projects. The United States home improvement sector is a robust and diverse industry that includes a wide spectrum of products and services aimed at enhancing residential properties. Homeowners invest in renovations, repairs, and upgrades to create more comfortable, functional, and visually appealing living spaces. Factors such as economic conditions, trends in the housing market, and aging housing stock affect the vitality of the industry. Sustainability, energy efficiency, and technological advancements are key drivers shaping this sector.

Report Coverage

This research report categorizes the market for the United States home improvement market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States home improvement market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States home improvement market.

United States Home Improvement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 540.3 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.88% |

| 2033 Value Projection: | 870.3 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Sales Channel |

| Companies covered:: | The Home Depot U.S.A., Inc., Lowe’s Companies Inc., Menard Inc., Floor & Decor Holdings Inc., Kohler Company, and other key companies |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

A key driver of market growth is changing demographics, with millennials and the Gen Z population entering their peak homeownership years, fueling demand for home renovations and upgrades. Financially, the market is buoyed by rising home prices, which encourages homeowners to invest in their properties to increase their value. Lifestyle changes are deeply affecting home improvement trends. Home entertainment, remote work, and sustainability concerns are pushing homeowners to renovate. Innovations in building materials and construction techniques offer homeowners enhanced durability, functionality, and design possibilities, leading to market growth. Government policies, including tax credits for energy-efficient renovations and infrastructure spending, are driving market growth by making certain home improvements more economically attractive. The first major driver of the US home improvement market is the dynamics of the US real estate market. In many regions, the lack of affordable housing options has made renovating more attractive than buying a new home.

Restraining Factors

The home improvement sector is driving significant increases in the cost of building materials, equipment, and skilled labor. A critical shortage of skilled workers in the construction industry poses significant challenges, affecting project timelines and increasing labor costs. Home improvement projects often face complex and lengthy permitting processes that can delay or disrupt project timelines.

Market Segmentation

The United States home improvement market share is classified into product and sales channels.

- The home decor segment is expected to grow at the fastest CAGR in the United States home improvement market during the forecast period.

The United States home improvement market is segmented by product into building and remodeling, home decor, outdoor living, and tools and hardware. Among these, the home decor segment is expected to grow at the fastest CAGR in the United States home improvement market during the forecast period. This trend is driven by changes in consumer preferences and lifestyles. As homeowners seek to personalize and enhance their living spaces, they are increasingly investing in interior design, furniture, wall art, lighting, and other decor elements. Several factors contribute to the rapid growth of the home decor segment. First, the rise of online shopping and the availability of e-commerce platforms have made it easier for consumers to find and purchase decorative items. Second, the influence of social media, design-focused television shows, and home decor has created more interest in interior design and inspired individuals to refresh their living spaces.

- The online segment is expected to grow at the fastest CAGR in the United States home improvement market during the forecast period.

The United States home improvement market is segmented by sales channel into homeware stores, franchised stores, specialty stores, online, and others. Among these, the online segment is expected to grow at the fastest CAGR in the United States home improvement market during the forecast period. This trend is driven by digital transformation and changing consumer behavior. As more and more homeowners turn to the Internet for convenience and a wider selection of products, the online market for home improvement products has grown significantly. First, the convenience of shopping for home improvement products from the comfort of their home has attracted consumers, allowing them to browse, compare prices, and buy at their own pace. Second, the wide product selection available on the e-commerce platform, along with user reviews and recommendations, makes it easy for customers to find the right solution for their projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States home improvement market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Home Depot U.S.A., Inc.

- Lowe’s Companies Inc.

- Menard Inc.

- Floor & Decor Holdings Inc.

- Kohler Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2023, Home Depot, the largest global home improvement retailer, finalized a definitive agreement to acquire International Designs Group (IDG). IDG operates Construction Resources and other design-focused subsidiaries. Construction Resources is a leading distributor of surfaces, equipment, and architectural specialty products that supply commercial contractors engaged in renovation, remodeling, residential housing, and multi-family projects.

- In October 2023, Great Day Improvements again expanded organically, adding more than 40 locations to its existing brand portfolio. The recent strategic acquisition of K-Designers is a significant step for Great Day Improvements to enter the California remodeling market.

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United States Home Improvement Market based on the below-mentioned segments:

United States Home Improvement Market, by Product and

- Building and Remodelling

- Home Decor

- Outdoor Living

- Tools and Hardware

United States Home Improvement Market, By Sales Channel

- Homeware Stores

- Franchised Stores

- Specialty Stores

- Online

- Others

Need help to buy this report?