Global Stationary Energy Storage Market Size, Share, and COVID-19 Impact Analysis, By Battery (Lithium Ion, Sodium Sulphur, Lead Acid, and Flow Battery), By Application (Grid Services, and Behind the Meter), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Stationary Energy Storage Market Insights Forecasts to 2033

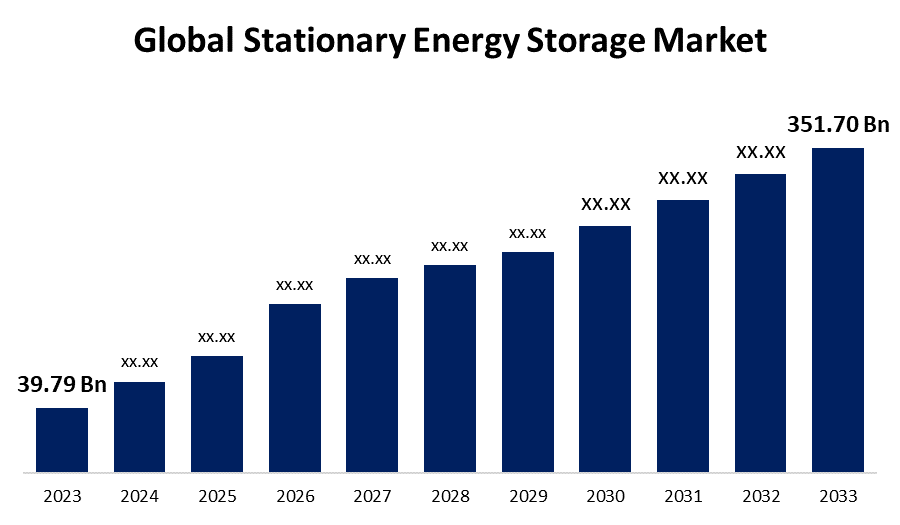

- The Global Stationary Energy Storage Market Size was Valued at USD 39.79 Billion in 2023

- The Market Size is Growing at a CAGR of 24.35% from 2023 to 2033

- The Worldwide Stationary Energy Storage Market Size is Expected to Reach USD 351.70 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Stationary Energy Storage Market Size is Anticipated to Exceed USD 351.70 Billion by 2033, Growing at a CAGR of 24.35% from 2023 to 2033.

Market Overview

Stationary energy storage is a system that stores excess energy, such as solar energy, and provides a reliable power supply. This system can be used to deliver power for consumption or back to the grid. A fundamental factor for successful transition of energy and for guaranteeing an independent energy supply is storage technologies. A major challenge for storage and capacitors is ensuring high-performance storage systems that can be produced cost-effectively and can be used in large scales for local storage of renewable energy. Energy needs to be available when required. For this reason, the high volatility of the power grids needs to be balanced with the increasing number of renewable energy. As the use and demand of renewable energies increase, the importance of energy storage systems increases as well.

For Instance, In October 2023, India’s cabinet approved a 13GW renewable energy project, with a 7.5GW solar park, in the most northern state of Ladakh, a remote area that has amongst the most suitable solar conditions in the world. Prime Minister Narendra Modi also announced plans for 12GWh of Battery Energy Storage Systems (BESS) in Pang at the southern tip of the state, which has an extreme climate, with very strong irradiation and high altitude offering low temperatures.

Report Coverage

This research report categorizes the market for stationary energy storage based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the stationary energy storage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the stationary energy storage market.

Global Stationary Energy Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 39.79 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 24.35% |

| 2033 Value Projection: | USD 351.70 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Battery, By Application, By Region |

| Companies covered:: | Tesla, LG Chem, BYD Company, Samsung SDI, Siemens, Fluence Energy, General Electric, ABB, Panasonic, Sonnen Batterie GmbH, Saft Groupe, Johnson Controls, Enel X, AES Corporation, Sonnen eco GmbH, Fortive Corporation, Younicos, Engie S.A., Eaton Corporation, Mitsubishi Heavy Industries, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing reliance on renewable energy sources poses challenges for grid stability due to their variable power generation. To address this issue, stationary energy storage systems play a crucial role in stabilizing the grid. Innovations in battery technology, such as improved energy density, longer lifecycle, and faster charging capabilities, are continuously developed. Improvement in grid stability and support for the integration of renewable energy sources is likely achieved by the integration of these advanced battery systems into the energy grid. Excess energy generated during periods of low demand can be stored and released during peak demand by enhanced battery storage systems, thus balancing supply and demand more effectively. Many governments worldwide are implementing supportive policies and incentives. These initiatives include tax incentives, feed-in tariffs, and grants specifically designed to encourage the deployment of energy storage systems.

Restraining Factors

The main restraining factors for the stationary energy storage market are some of the hazards associated with the usage of batteries such as fire, toxicity, and high voltage risk. The most common problem with the use of lithium-ion batteries is a fire hazard and as energy storage uses more battery cells per string, it can elevate the voltage levels and put employees at risk. The disadvantages of stationary energy storage include their high capital cost, risks of energy loss, and short service life. In addition, they are difficult to standardize and require complex maintenance.

Market Segmentation

The stationary energy storage market share is classified into battery and application.

- The lithium ion segment is anticipated to hold the largest market share through the forecast period.

Based on the battery, the stationary energy storage market is divided into lithium ion, sodium sulphur, lead acid, and flow battery. Among these, the lithium ion segment is anticipated to hold the largest market share through the forecast period. This is due to the lithium-ion (Li-ion) batteries being renowned for their superior attributes in energy storage technology, making them highly favored across various applications. The exceptional energy density allows for storing more energy in a smaller physical space compared to alternative technologies. This compactness is crucial for optimizing space utilization in both small and large-scale energy storage systems. Scalability is another significant benefit of Li-ion batteries, as they can be easily expanded or downsized to meet specific energy storage requirements. This versatility enables their deployment across diverse applications, ranging from grid-scale installations to behind-the-meter systems for commercial and residential use. This adaptability is particularly advantageous in dynamic energy environments where flexibility and scalability are critical. Furthermore, Li-ion technology continues to advance through ongoing research and development efforts aimed at enhancing lifespan, reducing costs, and improving safety features. These continuous improvements bolster the reliability and longevity of Li-ion batteries, making them increasingly competitive and attractive for a wide range of energy storage applications.

- The grid services segment is estimated to hold the highest market revenue share through the projected period.

Based on the application, the stationary energy storage market is classified into grid services and behind the meter. Among these, the grid services segment is estimated to hold the highest market revenue share through the projected period. Energy storage systems are pivotal in facilitating the seamless integration of renewable energy sources such as solar and wind into the power grid. Given the intermittent nature of renewables, energy storage plays a critical role in balancing grid fluctuations, ensuring a stable and reliable electricity supply. By storing excess electricity generated during periods of high renewable energy output, these systems can release it during peak demand hours. This capability not only reduces the need for expensive peak power generation but also contributes to lowering overall electricity costs and enhancing grid efficiency. Furthermore, governments worldwide are actively supporting the deployment of grid-scale energy storage through various incentives and subsidies. These governmental initiatives aim to accelerate renewable energy integration, enhance grid flexibility, and modernize energy infrastructure. Incentives such as tax credits, grants, and favorable regulatory frameworks incentivize investments in energy storage projects, driving market growth and innovation in the energy storage sector.

Regional Segment Analysis of the Stationary Energy Storage Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the stationary energy storage market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the stationary energy storage market over the predicted timeframe. The growing focus on energy resilience and reliability has the potential to enhance the market potential for stationary energy storage in North America. With an increasing frequency of extreme weather events and natural disasters, there is a heightened awareness of the vulnerabilities in the existing energy infrastructure. Stationary energy storage systems offer a solution by providing backup power during outages, thereby improving energy resilience. Their ability to store excess energy and release it when needed enhances the reliability of the electrical grid, ensuring a steady supply of electricity even in challenging conditions. Additionally, the integration of stationary energy storage systems into the energy grid enhances its overall resilience and stability.

Asia Pacific is expected to grow at the fastest CAGR growth of the stationary energy storage market during the forecast period. The development of the stationary energy storage market in Asia Pacific could be driven by rapid urbanization and industrialization. As urban populations increase and industrial activities increase across the region, there is a rising demand for reliable and sustainable energy solutions. Stationary energy storage systems offer a practical solution to meet this demand by providing backup power during outages and supporting grid stability. Their ability to store excess energy generated from renewable sources also aligns with the region’s efforts to transition towards cleaner energy alternatives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the stationary energy storage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tesla

- LG Chem

- BYD Company

- Samsung SDI

- Siemens

- Fluence Energy

- General Electric

- ABB

- Panasonic

- Sonnen Batterie GmbH

- Saft Groupe

- Johnson Controls

- Enel X

- AES Corporation

- Sonnen eco GmbH

- Fortive Corporation

- Younicos

- Engie S.A.

- Eaton Corporation

- Mitsubishi Heavy Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, Nuvation Energy, a leading provider of battery management systems (BMS), announced their latest product line expansion with the introduction of a 36-channel cell interface (CI-36) module. Compatible with Nuvation's existing G5 Battery Management system, the CI-36 allows for denser system designs, leading to more cost-effective energy storage solutions in line with the trend towards 52s and 104s module configurations.

- In August 2024, Dymax, a manufacturer of light-curable materials and associated equipment, introduced an assortment of light-curable adhesives and coatings designed for stationary energy storage systems like industrial gas turbines (IGTs) as well as fuel cells and electrolyzers, including solid oxide (SOFC) and proton exchange membrane (PEMFC).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the stationary energy storage market based on the below-mentioned segments:

Global Stationary Energy Storage Market, By Battery

- Lithium Ion

- Sodium Sulphur

- Lead Acid

- Flow Battery

Global Stationary Energy Storage Market, By Application

- Grid Services

- Behind The Meter

Global Stationary Energy Storage Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the stationary energy storage market over the forecast period?The stationary energy storage market is projected to expand at a CAGR of 24.35% during the forecast period.

-

2. What is the market size of the stationary energy storage market?The Global Stationary Energy Storage Market Size is Expected to Grow from USD 39.79 Billion in 2023 to USD 351.70 Billion by 2033, at a CAGR of 24.35% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the stationary energy storage market?North America is anticipated to hold the largest share of the stationary energy storage market over the predicted timeframe.

Need help to buy this report?