Global Steel Waste Management Market Size, Share, and COVID-19 Impact Analysis, By Waste Type (Non-Ferrous Scrap, Ferrous Scrap, and Others), By Source (Industrial Scrap, End-of-Life Products, and Others), By End-Use Industry (Automotive, Manufacturing, Construction, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Steel Waste Management Market Insights Forecasts to 2033

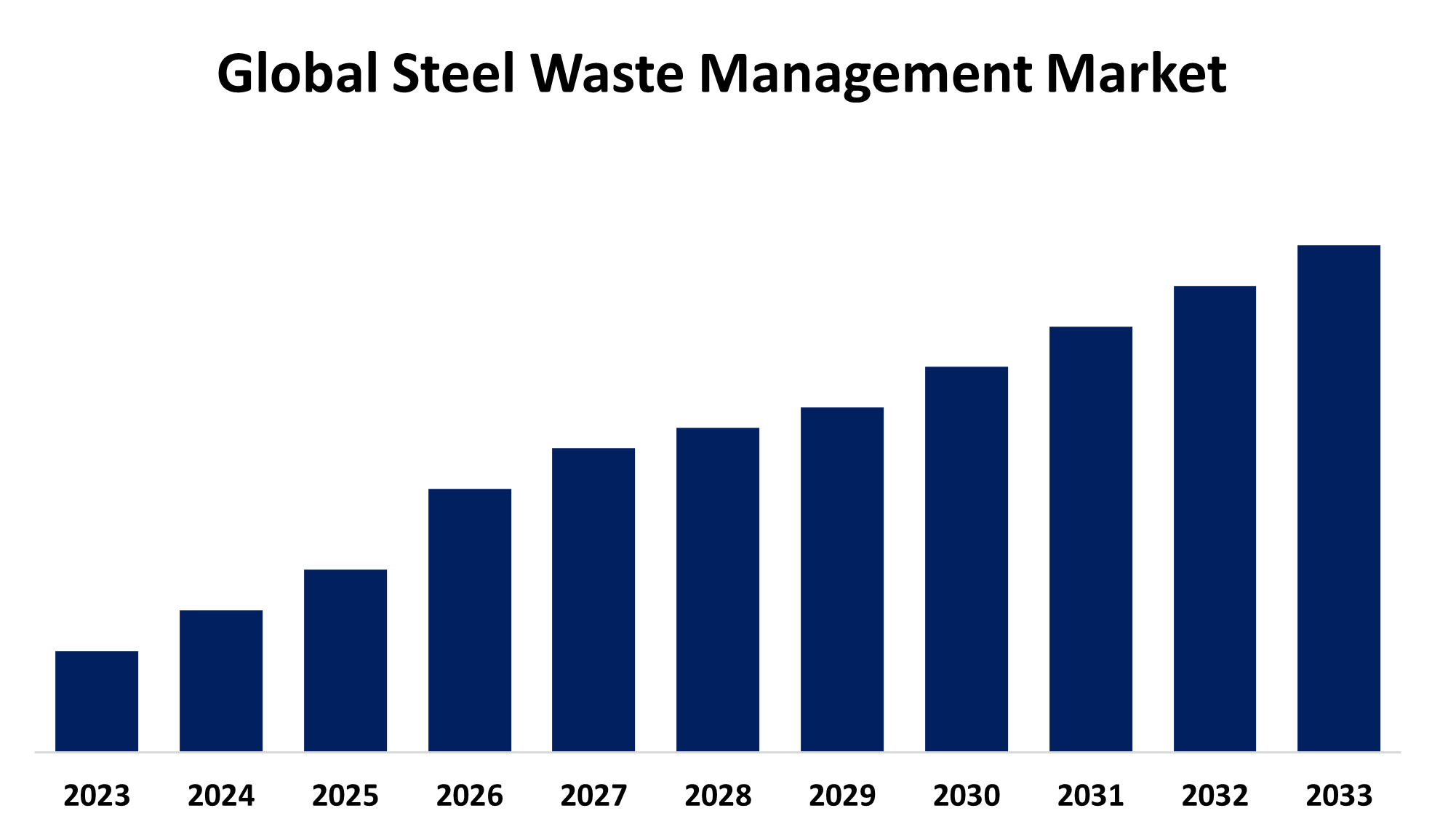

- The Global Steel Waste Management Market Size was estimated to exceed a significant share in 2023

- The Market Size will Grow at a Substantial CAGR from 2023 to 2033.

- The Worldwide Steel Waste Management Market Size is Expected to Reach a Significant Share by 2033.

- Middle East and Africa is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Steel Waste Management Market Size is anticipated to reach a significant share by 2033, at a substantial CAGR during the forecast period 2023-2033. The Global Steel Waste Management Market offers considerable opportunities for businesses and investors. These include technological advancements, such as AI-powered sorting systems and robotic automation, which increase efficiency and reduce labor costs. Another area of growth is the development of innovative recycling processes, such as hydrometallurgical techniques for recovering valuable metals from complex waste streams.

Market Overview

The global market for steel waste management refers to the overall process of managing scrap steel including collection, sorting, processing, and recycling. Demand factors such as the need for recycled steel, strict environmental legislation, and the ever-growing awareness of sustainability in steel are driving the steel waste management market. Furthermore, rising demand for recycled steel in the construction, automotive, and infrastructure industries provides an opportunity for scrap recycling. Technological advancements in processing waste, like automated sorting and recovery systems, allow for cost-efficient recovery of resources, thereby minimizing cost and environmental implications. In August 2020, Steel Recycling Business, a Tata Steel group company, introduced FerroHaat, the first-of-its-kind mobile application for sourcing steel scrap from traders. The application is an important step for the company towards organizing India's scrap market and also providing a reliable source of scrap metal to the steel industry. Furthermore, the increased environmental regulations around the world have also prompted various industries to follow eco-friendly practices related to waste management, thereby increasing opportunities for new solutions and services. Emerging markets offer unexplored potential for providers of steel waste management services through rapid industrialization and urbanization.

Report Coverage

This research report categorizes the steel waste management market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the steel waste management market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the steel waste management market.

Global Steel Waste Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 – 2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 246 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Waste Type, By Source, By End-Use Industry and By Regional Analysis |

| Companies covered:: | ArcelorMittal, Nucor Corporation, Schnitzer Steel Industries, Inc., Steel Dynamics, Inc., Tata Steel, ThyssenKrupp AG, Commercial Metals Company (CMC), Sims Metal Management, JSW Steel, POSCO, Metso Outotec, Novelis Inc., and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

There are various distinct drivers propelling the growth of the global steel waste management market. This is because rising steel production around the world leads to significant amounts of scrap and waste, thereby requiring effective solutions for management. Higher steel consumption and waste generation in emerging economies, especially with increasing urbanization and industrialization, create a demand for recycling infrastructure. Furthermore, in April 2024, Wall Recycling, LLC, a leading provider of waste and recycling solutions, announced the sale of its scrap metal recycling operations to Foss Recycling. The transaction enables Wall Recycling to strategically focus on its core integrated waste operations. Stringent environmental regulations are driving industries to adopt the principles of sustainable waste management. Processing technologies, including automated sorting and resource recovery systems, are improving efficiency and scalability. The integration of the digital platform for sourcing and managing scrap steel further accelerates market growth with increasing investments in waste management infrastructure. Efforts to reduce the emission of greenhouse gases and energy intake in steelmaking are also driving solutions for waste management globally.

Restraining Factors

Several constraints will confront the expansion of global steel waste management. High installation investments in recycling plants and advanced processing technologies for steel waste are financially unaffordable for smaller firms. The complexity arises from mixed steel waste contaminated with impurities. Fluctuating prices for steel scrap create volatility in the profits and the market.

Market Segmentation

The steel waste management market share is classified into waste type, source, and end-use industry.

- The ferrous scrap segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the waste type, the steel waste management market is divided into non-ferrous scrap, ferrous scrap, and others. Among these, the ferrous scrap segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Recycling ferrous scrap is economical consumes much less energy and emits far fewer greenhouse gases than the production of steel from raw materials. Moreover, the rising demand for sustainability and the acceptance of circular economy principles further consolidate the position of ferrous scrap in the steel waste management market.

- The industrial scrap segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe.

Based on the source, the steel waste management market is divided into industrial scrap, end-of-life products, and others. Among these, the industrial scrap segment accounted for the majority of the share in 2023 and is estimated to grow at the fastest CAGR during the projected timeframe. Steel waste management is critical for industrial scrap as it ensures efficient recycling, lowering environmental impact and manufacturing costs. Industrial scrap can be recycled multiple times without losing quality, making it a key raw material for new steel production. Effective management reduces reliance on virgin materials, saves energy, and cuts emissions. It also helps businesses meet regulations, improve efficiency, and support sustainability. These factors drive the growth of the industrial scrap segment in the steel waste management market.

- The automotive segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe.

Based on the end-use industry, the steel waste management market is divided into automotive, manufacturing, construction, and others. Among these, the automotive segment held the largest share in 2023 and is estimated to grow at the fastest CAGR during the predicted timeframe. The high volume of steel used in vehicle production, as well as the significant amount of scrap generated during manufacturing and at the end-of-life stages. Because vehicles are primarily made of steel, large amounts of scrap are recovered and recycled when they are withdrawn. The automotive industry's focus on sustainability increases demand for efficient steel recycling practices, reinforcing its market dominance.

Regional Segment Analysis of the Steel Waste Management Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific is anticipated to hold the largest share of the steel waste management market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the steel waste management market over the predicted timeframe. The region hosts some of the world's major steel-producing countries, including China, India, and Japan. The states in these counties produce a significant amount of steel waste through industries such as construction, automotive, and manufacturing. All these are assisted by a good recycling infrastructure, favorable government regulations for sustainable practices, and rapid industrialization in many emerging markets. Being the world's largest producer and consumer of steel, China has the most influential position in the region to drive demand for the management of its steel waste.

Middle East and Africa is expected to grow at the fastest CAGR growth of the steel waste management market during the forecast period. This growth is attributed to a combination of factors, with rapid industrialization and urbanization at the top coupled with investment in infrastructures and manufacturing plants in key countries such as Saudi Arabia, the UAE, and South Africa. The focus placed by these countries on sustainability and green technologies boosts demand for efficient steel recycling and waste management products. Increased government support towards recycling initiatives and strict implementation of environmental standards are also stimulating steel waste management market's further growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the steel waste management market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ArcelorMittal

- Nucor Corporation

- Schnitzer Steel Industries, Inc.

- Steel Dynamics, Inc.

- Tata Steel

- ThyssenKrupp AG

- Commercial Metals Company (CMC)

- Sims Metal Management

- JSW Steel

- POSCO

- Metso Outotec

- Novelis Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the Steel Waste Management market based on the below-mentioned segments:

Global Steel Waste Management Market, By Waste Type

- Non-Ferrous Scrap

- Ferrous Scrap

- Others

Global Steel Waste Management Market, By Source

- Industrial Scrap

- End-of-Life Products

- Others

Global Steel Waste Management Market, By End-Use Industry

- Automotive

- Manufacturing

- Construction

- Others

Global Steel Waste Management Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the steel waste management market over the forecast period?The Market Size will Grow at a Substantial CAGR from 2023 to 2033.

-

2. What is the market size of the steel waste management market?The Global Steel Waste Management Market Size is expected to reach a significant share by 2033, at a substantial CAGR during the forecast period 2023-2033.

-

3. Which region holds the largest share of the steel waste management market?Asia-Pacific is anticipated to hold the largest share of the steel waste management market over the predicted timeframe.

Need help to buy this report?