Global Stem Cell Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Product (Consumables, Instruments, and Stem Cell Lines), Application (Research, Clinical, and Cell Tissue & Banking), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Stem Cell Manufacturing Market Insights Forecasts to 2033

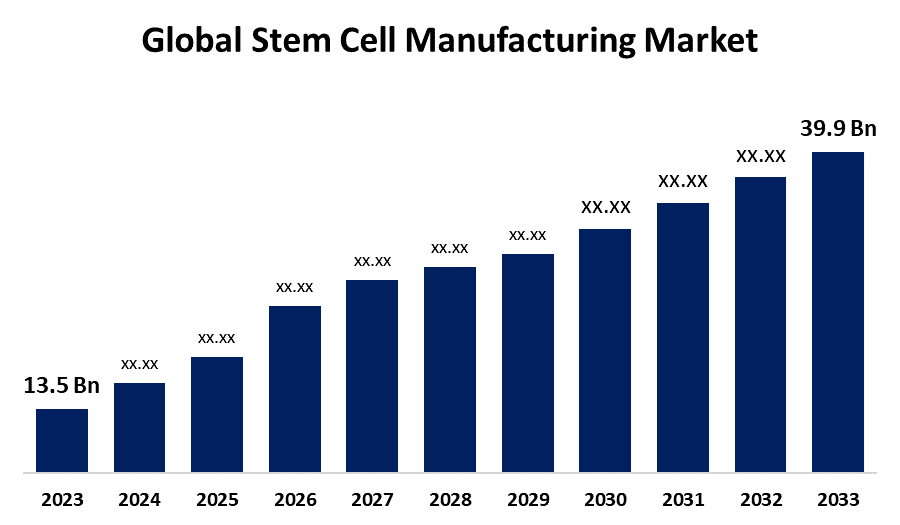

- The Global Stem Cell Manufacturing Market Size was Valued at USD 13.5 Billion in 2023

- The Market Size is Growing at a CAGR of 11.45% from 2023 to 2033

- The Worldwide Stem Cell Manufacturing Market Size is Expected to Reach USD 39.9 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Stem Cell Manufacturing Market Size is Anticipated to Exceed USD 39.9 Billion by 2033, Growing at a CAGR of 11.45% from 2023 to 2033.

Market Overview

Stem cells are a special type of cells that have two significant properties. They are able to make more cells similar to themselves. That is, they self-renew. And they can become other cells that do different things in a process known as differentiation. Stem cells are found in approximately all tissues of the body. They are needed for the protection of tissue as well as for repair after injury. Depending on where the stem cells are, they can develop into different tissues. For example, hematopoietic stem cells reside in the bone marrow and can make all the cells that function in the blood. Stem cells also can become brain cells, heart muscle cells, bone cells, or other cell types.

The US Food and Drug Administration (FDA) has the authority to regulate regenerative medicine products, including stem cell products and exosome products. There is a lot of disingenuous information on the internet about these products, including statements about the conditions they can be used to treat. FDA is worried that many patients seeking cures and remedies may be misled by information about products that are illegally marketed, have not been shown to be safe or effective, and, in some cases, may have important safety issues that put patients at risk. FDA wants to help consumers be informed about how these products are regulated, and what to look for when allowing for treatment with one of these products.

For instance, In September 2024, Cellino Biotech received $25 million in funding from the Advanced Research Projects Agency for Health (ARPA-H), an agency of the U.S. Department of Health and Human Services. The funding will support Cellino’s Next-Generation Biomanufacturing Ultra-Scalable Approach (NEBULA) project, an initiative to develop cassette-based biomanufacturing technology for developing personalized regenerative medicines.

Report Coverage

This research report categorizes the market for stem cell manufacturing based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the stem cell manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the stem cell manufacturing market.

Global Stem Cell Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.45% |

| 2033 Value Projection: | USD 39.9 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 232 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Thermo Fisher Scientific, Merck Millipore, Lonza Group AG, Danaher Corporation, Sartorius AG, Bio-Rad Laboratories, Becton, Dickinson and Company, Stemcell Technologies, Fujifilm Holdings Corporation, Miltenyi Biotech, Terumo Corporation, Corning Inc., Bio-Techno Corporation, Takara Bio Group, Eppendorf AG7, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The progress of the stem cell manufacturing market largely depends on advancements in regenerative medicine and increased investments in research and development. The rising awareness of stem cells' therapeutic potential for chronic diseases, along with the increasing incidences of conditions such as cancer and neurological disorders, drives demand. Furthermore, government initiatives supporting stem cell research and favorable regulatory frameworks contribute to market growth. Collaborations between academic institutions and Biotechnology company’s further drive innovation, making stem cell therapies more accessible and effective, thus expanding the market.

Restraining Factors

The stem cell manufacturing market faces several restraints such as high manufacturing costs and complex regulatory requirements. Ethical concerns regarding stem cell sourcing, particularly embryonic stem cells may hinder research and public acceptance. Additionally, the lack of standardized protocols and quality control measures complicates the commercialization of stem cell therapies, contributing to hesitance among investors and slowing down the market's overall growth.

Market Segmentation

The stem cell manufacturing market share is classified into product and application.

- The consumables segment is estimated to hold the highest market revenue share through the projected period.

Based on the product, the stem cell manufacturing market is classified into consumables, instruments, and stem cell lines. Among these, the consumables segment is estimated to hold the highest market revenue share through the projected period. This is due to the essential role these products play in a range of applications. Consumables, including culture media, reagents, and other materials essential for stem cell research and therapy, continue to experience rising demand as research expands. Moreover, the increasing number of clinical trials and the growing prevalence of cell-based therapies further boost the consumption of these products, making this segment a cornerstone of the industry and significantly contributing to overall market growth.

- The research segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the stem cell manufacturing market is divided into research, clinical, cell tissue & banking. Among these, the research segment is anticipated to hold the largest market share through the forecast period. This is due to its crucial role in scientific advancements. Increasingly, researchers are utilizing stem cells for studying disease mechanisms, drug discovery, and regenerative medicine, most important to a growing demand for essential tools and technologies in this area. Increased funding for stem cell research from governments and private organizations Governments, private institutions, and non-profit organizations identify the transformative potential of stem cell research and provide financial support to drive innovation. Additionally, technological advancements in stem cell culture techniques, genetic editing, and cell characterization tools improve the efficiency and accuracy of research applications. These advancements enable researchers to work with a broader range of stem cell types and manipulate them with precision, further propels this segment's expansion, solidifying its position as a leading contributor to market growth.

Regional Segment Analysis of the Stem Cell Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the stem cell manufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the stem cell manufacturing market over the predicted timeframe. This is because its advanced healthcare infrastructure, substantial investments in biotechnology, and a strong presence of leading research institutions. Increased funding from both the public and private sectors enhances innovation and development in this field. Favorable regulatory frameworks in North America provide a conducive environment for stem cell research and clinical trials, fostering growth and innovation. Collaborative efforts between academic institutions and industry players, along with emergent public awareness of the probability of stem cell-based treatments, are additional drivers, and a growing focus on personalized medicine further drives demand for stem cell therapies, consolidating North America's leading position in the global stem cell manufacturing landscape.

Asia Pacific is expected to grow at the fastest CAGR growth of the stem cell manufacturing market during the forecast period. This is driven by increasing government initiatives to promote biotechnology and stem cell research, coupled with rising investments from both local and international companies. The region's growing population and the rising prevalence of chronic diseases necessitate advanced medical treatments, paving the way for stem cell therapies. The rapid market expansion in Asia Pacific is also contributed to by improving healthcare infrastructure and increasing awareness of regenerative medicine, positioning the region as a key player in the global stem cell manufacturing arena.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the stem cell manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific

- Merck Millipore

- Lonza Group AG

- Danaher Corporation

- Sartorius AG

- Bio-Rad Laboratories

- Becton, Dickinson and Company

- Stemcell Technologies

- Fujifilm Holdings Corporation

- Miltenyi Biotech

- Terumo Corporation

- Corning Inc.

- Bio-Techno Corporation

- Takara Bio Group

- Eppendorf AG7

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, BlueRock Therapeutics, a clinical-stage cell therapy company and wholly owned, independently operated subsidiary of Bayer, announced the clearance of its Investigational New Drug (IND) application by the U.S. Food and Drug Administration (FDA) for OpCT-001, an investigational induced pluripotent stem cell (iPSC)-derived cell therapy for the treatment of primary photoreceptor diseases.

- In April 2024, Vertex Pharmaceuticals will pay TreeFrog Therapeutics $25 million to license TreeFrog's cell manufacturing technology, C-Stem, to increase the manufacture of Vertex's cell therapies for type 1 diabetes (T1D).

- In March 2024, Brazil’s Ministry of Health and nonprofit Caring Cross announced a collaboration aimed at local manufacturing of CAR-T cell and stem cell gene therapies at a much lower cost than Europe and the U.S.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the stem cell manufacturing market based on the below-mentioned segments:

Global Stem Cell Manufacturing Market, By Product

- Consumables

- Instruments

- Stem Cell Lines

Global Stem Cell Manufacturing Market, By Application

- Research

- Clinical

- Cell Tissue & Banking

Global Stem Cell Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the stem cell manufacturing market over the forecast period?The stem cell manufacturing market is projected to expand at a CAGR of 11.45% during the forecast period.

-

2. What is the market size of the stem cell manufacturing market?The Global Stem Cell Manufacturing Market Size is Expected to Grow from USD 13.5 Billion in 2023 to USD 39.9 Billion by 2033, at a CAGR of 11.45% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the stem cell manufacturing market?North America is anticipated to hold the largest share of the stem cell manufacturing market over the predicted timeframe.

Need help to buy this report?