Global Sterile Injectable Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, Molecule Type (Small Molecule and Large Molecule), By Route Of Administration (Subcutaneous (SC), Intravenous (IV), Intramuscular (IM), and Others), By Therapeutic Application (Cancer, Diabetes, Cardiovascular Diseases, Central Nervous System Diseases, Infectious Disorders, Musculoskeletal, Anti-Viral, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Sterile Injectable Contract Manufacturing Market Insights Forecasts to 2033

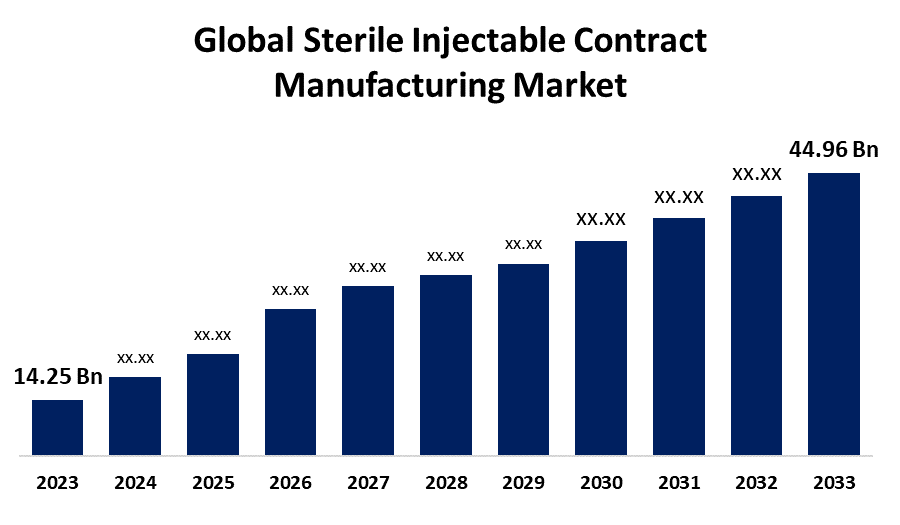

- The Global Sterile Injectable Contract Manufacturing Market Size was Valued at USD 14.25 Billion in 2023

- The Market Size is Growing at a CAGR of 12.18% from 2023 to 2033

- The Worldwide Sterile Injectable Contract Manufacturing Market Size is Expected to Reach USD 44.96 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Sterile Injectable Contract Manufacturing Market Size is Anticipated to Exceed USD 44.96 Billion by 2033, Growing at a CAGR of 12.18% from 2023 to 2033.

Market Overview

Medication and therapeutic medications that are injected directly into the bloodstream or body tissue are known as sterile injectables contract manufacturing. Injectable sterile supplies are a vital component of the medical infrastructure. They are used to treat a broad variety of illnesses, including chronic diseases like diabetes and multiple sclerosis, as well as serious diseases like cancer and HIV/AIDS. Sterile raw materials, sterile surroundings, and stringent guidelines to avoid contamination are all part of the extremely exact and tightly regulated production process for sterile injectables. For Instance, in September 2024, The Bloomington, Indiana, sterile injectable manufacturing facility of Simtra BioPharma Solutions announced an expansion worth more than $250 million. CDMO, or contract development and manufacturing organization, is what Simtra BioPharma Solutions does for injectables. The need for injectable formulations is also driven by the increased incidence of chronic diseases and the shorter approval periods for sterile injectables for other drug classes. The pharmaceutical industry's growing trend of outsourcing is another factor driving the growth in the sterile injectable manufacturing market.

Report Coverage

This research report categorizes the sterile injectable contract manufacturing market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the sterile injectable contract manufacturing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the sterile injectable contract manufacturing market.

Global Sterile Injectable Contract Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.25 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.18% |

| 2033 Value Projection: | USD 14.25 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 271 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Route Of Administration, By Therapeutic Application, By Region |

| Companies covered:: | Simtra BioPharma Solutions, Grand River Aseptic Manufacturing ( |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The primary drivers of the market growth are the growing need for biologics and biosimilars as well as the trend of outsourcing among pharmaceutical companies looking to boost productivity and cut expenses. The integration of cutting-edge technology within contract manufacturing services will continue to be a main factor driving the growth of the sterile injectable contract manufacturing market, as companies strive to improve their manufacturing operations and differentiate their products. Increased funding, partnerships, and strategic alliances amongst major players are expected to drive the growth sterile injectable contract manufacturing market.

Restraining Factors

High capital investment, strict regulations, regulatory delays, and technological complexity are major limitations that can restrict growth in the sterile injectable contract manufacturing market.

Market Segmentation

The sterile injectable contract manufacturing market share is classified into molecule type, route of administration, and therapeutic application.

- The large molecule segment is estimated to hold the largest market revenue share through the projected period.

Based on the molecule type, the sterile injectable contract manufacturing market is classified into small molecules and large molecules. Among these, the large molecule segment is estimated to hold the largest market revenue share through the projected period. The increasing demand for large molecules, which are frequently supplied as sterile injectables for the advancement of gene and cell therapies.

- The intravenous (IV) segment is anticipated to hold the largest market share through the forecast period.

Based on the route of administration, the sterile injectable contract manufacturing market is divided into subcutaneous (SC), intravenous (IV), intramuscular (IM), and others. Among these, the intravenous (IV) segment is anticipated to hold the largest market share through the forecast period. The growing movement toward personalized treatment in many healthcare systems is increasing demand for customized intravenous (IV) medications.

- The cancer segment is anticipated to hold the largest market share through the forecast period.

Based on the therapeutic application, the sterile injectable contract manufacturing market is divided into cancer, diabetes, cardiovascular diseases, central nervous system diseases, infectious disorders, musculoskeletal, anti-viral, and others. Among these, the cancer segment is anticipated to hold the largest market share through the forecast period. The need for more effective treatment alternatives, such as sterile injectables that provide medications directly to patients, is being driven by the increased incidence of cancer.

Regional Segment Analysis of the Sterile Injectable Contract Manufacturing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the sterile injectable contract manufacturing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the sterile injectable contract manufacturing market over the predicted timeframe. The North America region is credited with various aspects, including its sophisticated healthcare infrastructure, growing investments in research and development, advancements in technology, and the presence of significant businesses. Moreover, it is anticipated that the need for sterile injectable formulations will increase in this region due to the rising incidence of chronic illnesses and the rising need for biologics and biosimilars.

Europe is expected to grow at the fastest CAGR growth of the sterile injectable contract manufacturing market during the forecast period. Europe boasts a thriving pharmaceutical industry with many companies involved in medication discovery, research, and manufacture it is anticipated that the growing trend of outsourcing services to Europe nations supports the rise in demand for the sterile injectables contract manufacturing market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the sterile injectable contract manufacturing market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Simtra BioPharma Solutions

- Grand River Aseptic Manufacturing ("GRAM")

- WuXi STA

- Baxter

- Cipla Inc.

- NextPharma Technologies

- Catalent, Inc.

- Vetter Pharma

- FAMAR Health Care Services

- Recipharm AB

- Aenova Group

- Unither Pharmaceuticals

- Fresenius Kabi AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Grand River Aseptic Manufacturing ("GRAM"), a preeminent contract manufacturer of sterile injectable biologics, small molecules, and vaccines, opened its third state-of-the-art plant. The industry's expanding biologics pipeline and the rise of sophisticated drug delivery devices for patient self-administration benefit from the syringe and cartridge filling center's 150,000-square-foot footprint.

- In July 2023, WuXi STA, a worldwide Contract Research, Development, and Manufacturing Organization (CRDMO), launched its first fully automated sterile injectable manufacturing line with high potency (HP) at the pharma product site.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the sterile injectable contract manufacturing market based on the below-mentioned segments:

Global Sterile Injectable Contract Manufacturing Market, By Molecule Type

- Small Molecule

- Large Molecule

Global Sterile Injectable Contract Manufacturing Market, By Route of Administration

- Subcutaneous (SC)

- Intravenous (IV)

- Intramuscular (IM)

- Others

Global Sterile Injectable Contract Manufacturing Market, By Therapeutic Application

- Cancer

- Diabetes

- Cardiovascular Diseases

- Central Nervous System Diseases

- Infectious Disorders

- Musculoskeletal

- Anti-viral

- Others

Global Sterile Injectable Contract Manufacturing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the sterile injectable contract manufacturing market over the forecast period?The sterile injectable contract manufacturing market is projected to expand at a CAGR of 12.18% during the forecast period.

-

2. What is the market size of the sterile injectable contract manufacturing market?The Global Sterile Injectable Contract Manufacturing Market Size is Expected to Grow from USD 14.25 Billion in 2023 to USD 44.96 Billion by 2033, at a CAGR of 12.18% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the sterile injectable contract manufacturing market?North America is anticipated to hold the largest share of the sterile injectable contract manufacturing market over the predicted timeframe.

Need help to buy this report?