Global Styrenic Block Copolymer Market Size, Share, and COVID-19 Impact Analysis, By Product (Styrene-Butadiene-Styrene (SBS), Styrene-Isoprene-Styrene (SIS), Styrene-Isoprene Butadiene Block Copolymer (SIBS), and Hydrogenated Styrenic Block Copolymers (HSBC)), By Application (Paving & Roofing, Footwear, Advanced Materials, Adhesives, Sealants & Coatings, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Styrenic Block Copolymer Market Insights Forecasts to 2033

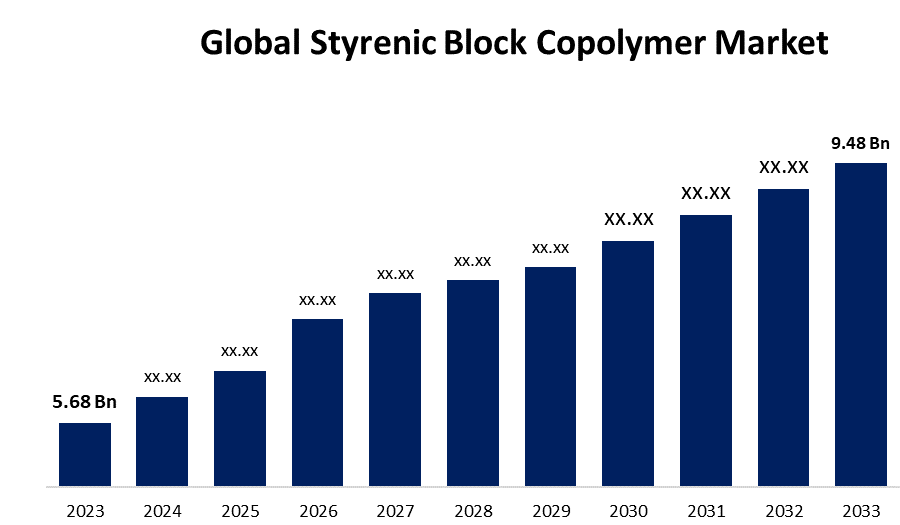

- The Global Styrenic Block Copolymer Market Size was Valued at USD 5.68 Billion in 2023

- The Market Size is Growing at a CAGR of 5.26% from 2023 to 2033

- The Worldwide Styrenic Block Copolymer Market Size is Expected to Reach USD 9.48 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Styrenic Block Copolymer Market Size is Anticipated to Exceed USD 9.48 Billion by 2033, Growing at a CAGR of 5.26% from 2023 to 2033.

Market Overview

Thermoplastic elastomers (TPEs) include the frequently utilized polymers known as styrene block copolymers or SBCs. TPEs are thermoplastic polymers that have great processability and elasticity similar to rubber. In newborn diapers, the styrene block copolymer is frequently utilized in the production of waistbands, buttons, ear and side panels, leg elastics, and landing fields. Manufacturers of baby diapers introduced compounds including SBS, SIS, SEEPS, SEPS, and SEEPS due to the elastomeric fabrics, which increased comfort and fit. These compounds have the potential to stimulate the need for styrenic block copolymers in the industry. These factors come together to reduce the cost of manufacturing final products made from these components as compared to vulcanized rubber. This considerably increases the global demand for styrenic block copolymers and synthetic leather. The efforts of expanding enterprises to improve their production capacity and the local environment are positively impacting the worldwide styrenic block copolymer market. The resultant polymer structure, which consists of alternating blocks of diene and styrene units, is called a block copolymer. Depending on how these blocks are stacked, styrene block copolymers can take on many forms, including styrene-butadiene-styrene (SBS), styrene-isoprene-styrene (SIS), and styrene-ethylene/butylene-styrene (SEBS).

Report Coverage

This research report categorizes the market for the global styrenic block copolymer market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global styrenic block copolymer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global styrenic block copolymer market.

Global Styrenic Block Copolymer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 5.68 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.26% |

| 2033 Value Projection: | USD 9.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | LCY Group, KRATON CORPORATION, ZEON CORPORATION, Asahi Kasei Corporation, SIBUR, Zhejiang Zhongli Synthetic Material Technology Co., Ltd., Fujian Gulei Petrochemical Co., Ltd., China Petroleum & Chemical Corporation (Sinopec), INEOS Styrolution Group GmbH, JSR Corporation, LG Chem, CHIMEI, Versalis S.p.A., En Chuan Chemical Industries Co., Ltd., Denka Company Limited, Kuraray Co., Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Styrenic block copolymers are widely used in the construction industry, especially for products like adhesives, sealants, coatings, and insulation. In order to stimulate economic growth, governments, and private investors are concentrating on developing infrastructure, which is driving increased demand for SBC-based products in the construction sector. In many regions of the world, aging infrastructure has to be maintained and renovated in order to guarantee efficiency and safety. In order to repair roads, bridges, pipelines, and other infrastructure, SBCs are frequently used due to their exceptional qualities, which include flexibility, durability, and weather resistance. These products are the most widely utilized elastomeric polymers in asphalt modification. They are utilized to offer important attributes such as long-term performance, resistance to thermal deterioration, durability over a wide temperature range, superior waterproofing capabilities, simplicity of application, and better aesthetics in modified bituminous roofing materials. In SBS applications, polymer-modified bitumens (PMBs) are mostly utilized for roofing membranes and pavement.

Restraining Factors

The volatility of oil prices has increased significantly. The cost of thermoplastic elastomers has been impacted. The primary raw material used in the production of the product, butadiene, has fluctuated in price due to the volatility of the oil price. That would thus cause the price of SBC to fluctuate greatly. On the other hand, the price of SBC is directly impacted by changes in the price of crude oil. Since main raw ingredients like ethylene, propylene, and benzene are usually derived from derivatives of crude oil, variations in the price of crude oil have a significant impact on the final product's cost.

Market Segmentation

The global styrenic block copolymer market share is classified into product, and application.

- The styrene-butadiene-styrene (SBS) segment is expected to hold the largest share of the global styrenic block copolymer market during the forecast period.

Based on the product, the global styrenic block copolymer market is divided into styrene-butadiene-styrene (SBS), styrene-isoprene-styrene (SIS), styrene-isoprene butadiene block copolymer (SIBS), and hydrogenated styrenic block copolymers (HSBC). Among these, the styrene-butadiene-styrene (SBS) segment is expected to hold the largest share of the global styrenic block copolymer market during the forecast period. This increase might be the result of expanding demand from the polymer footwear, adhesives & sealants, and construction sectors. styrene-butadiene-styrene (SBS) finds application in the building sector for roofing and pavement. styrene-butadiene-styrene (SBS) is utilized in modified bituminous roofing materials to provide a variety of benefits, such as exceptional waterproofing capabilities, stability in thermal degradation tolerance throughout a broad temperature range, long-term performance, and enhanced aesthetics.

- The paving & roofing segment is expected to hold the largest share of the global styrenic block copolymer market during the forecast period.

Based on the application, the global styrenic block copolymer market is divided into paving & roofing, footwear, advanced materials, adhesives, sealants & coatings, and others. Among these, the paving & roofing segment is expected to hold the largest share of the global styrenic block copolymer market during the forecast period. The category is anticipated to be driven by the global construction industry's growth. The rapid growth of the manufacturing and infrastructure sectors in the world's fast-paced economies has resulted in significant expenditures on transportation and road maintenance projects, which has increased the demand for asphalt pavers globally. The substance is frequently added to asphalt that is put on routes as a petroleum modification.

Regional Segment Analysis of the Global Styrenic Block Copolymer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global styrenic block copolymer market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global styrenic block copolymer market over the predicted timeframe. This is mostly due to the food packaging industry's growing use of styrenic block copolymers, particularly for wrapping films. Higher-income individuals are more prevalent in regions, especially in the US, which is driving up demand for food, consumer clothing, and footwear. Due to the existence of well-established sectors including consumer products, construction, automotive, and packaging, North America is an important market for styrenic block copolymers. The two main contributors to the regional market are the United States and Canada. The growing focus on sophisticated packaging solutions and the necessity for sustainable and lightweight materials are driving the market for styrenic block copolymers in North America.

Asia Pacific is expected to grow at the fastest pace in the global styrenic block copolymer market during the forecast period. Strong demand for reasonably priced homes and government programs that provide basic necessities like food and shelter are two important elements that are anticipated to propel the region's building sector. Stricter regulations and growing public awareness of carbon emissions would promote the development of green buildings, a major end-use for lightweight, renewable materials like SBCs. The increased number of working individuals, particularly women, is driving up demand for fake data leather shoes and handbags. To stimulate market expansion, the region's well-established payers mainly in China are increasing their output to meet global demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global styrenic block copolymer market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LCY Group

- KRATON CORPORATION

- ZEON CORPORATION

- Asahi Kasei Corporation

- SIBUR

- Zhejiang Zhongli Synthetic Material Technology Co., Ltd.

- Fujian Gulei Petrochemical Co., Ltd.

- China Petroleum & Chemical Corporation (Sinopec)

- INEOS Styrolution Group GmbH

- JSR Corporation

- LG Chem

- CHIMEI

- Versalis S.p.A.

- En Chuan Chemical Industries Co., Ltd.

- Denka Company Limited

- Kuraray Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, the US company Kraton Corporation, which produces specialty polymers and high-value biobased products, announced a USD 35 million investment to modernize the crude tall oil biorefinery towers at its Panama City, Florida, manufacturing site.

- In July 2023, KKR & CO. INC. declared that it has added Chase Corporation to its portfolio of chemicals, for a USD 1.3 billion investment. With this transaction, KKR & CO. INC. should be able to increase its exposure to the specialty chemicals market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global styrenic block copolymer market based on the below-mentioned segments:

Global Styrenic Block Copolymer Market, By Product

- Styrene-Butadiene-Styrene (SBS)

- Styrene-Isoprene-Styrene (SIS)

- Styrene-Isoprene Butadiene Block Copolymer (SIBS)

- Hydrogenated Styrenic Block Copolymers (HSBC)

Global Styrenic Block Copolymer Market, By Application

- Paving & Roofing

- Footwear

- Advanced Materials

- Adhesives

- Sealants & Coatings

- Others

Global Styrenic Block Copolymer Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?LCY Group, KRATON CORPORATION, ZEON CORPORATION, Asahi Kasei Corporation, SIBUR, Zhejiang Zhongli Synthetic Material Technology Co., Ltd., Fujian Gulei Petrochemical Co., Ltd., China Petroleum & Chemical Corporation (Sinopec), INEOS Styrolution Group GmbH, JSR Corporation, LG Chem, CHIMEI, Versalis S.p.A., En Chuan Chemical Industries Co., Ltd., Denka Company Limited, Kuraray Co., Ltd., Others.

-

2. What is the size of the global styrenic block copolymer market?The global styrenic block copolymer market is expected to grow from USD 5.68 Billion in 2023 to USD 9.48 Billion by 2033, at a CAGR of 5.26% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global styrenic block copolymer market over the predicted timeframe.

Need help to buy this report?