Global Sulphonamides Market Size, Share, and COVID-19 Impact Analysis, By Medication Type (Generics and Branded), By Route of Administration (Topical, Oral, and Others), By Application (Respiratory Tract Infection (RTI), Gastrointestinal Infection (GIT), Urinary Tract Infection (UTI), Skin Infection, and Others), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies, and Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Sulphonamides Market Insights Forecasts to 2033

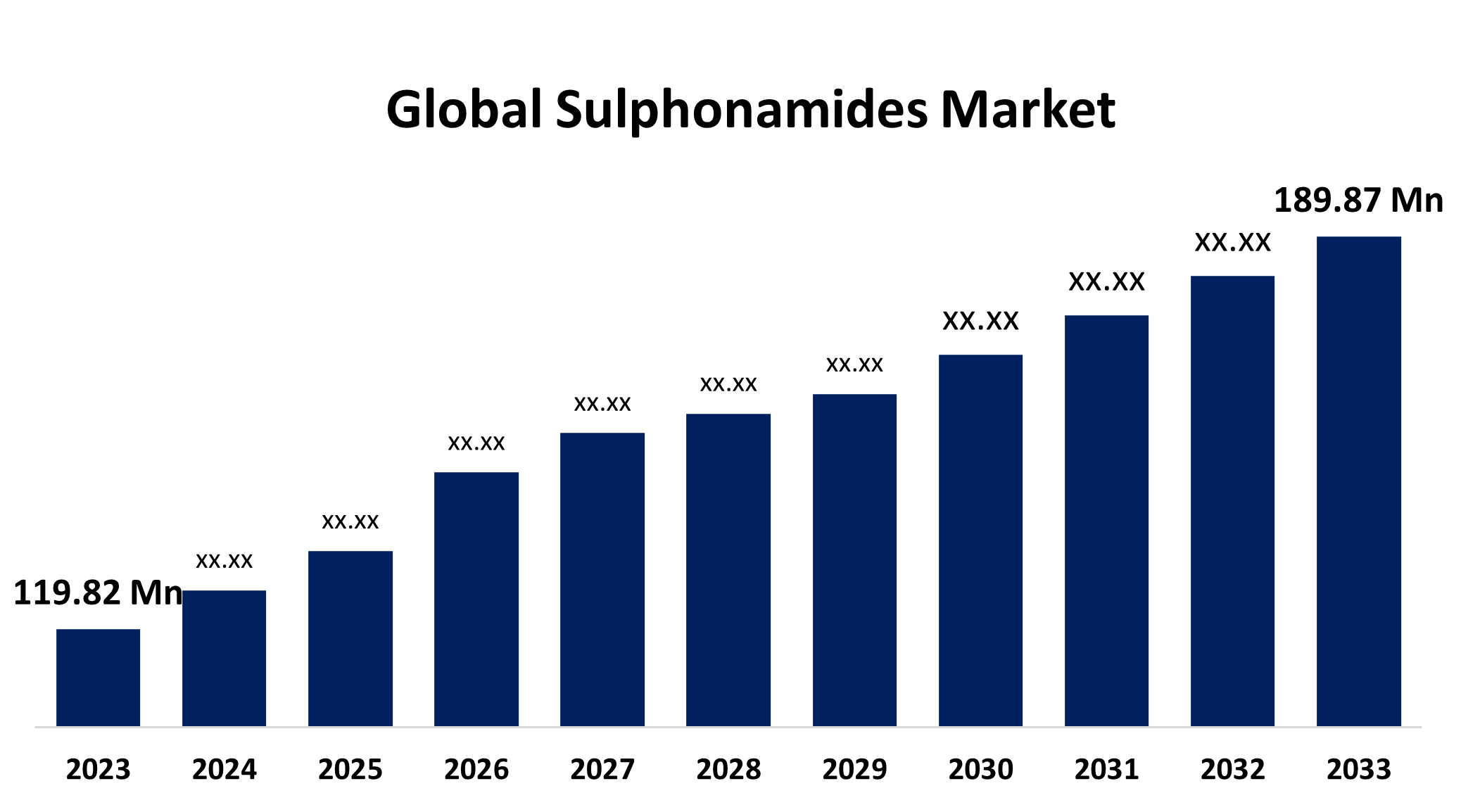

- The Global Sulphonamides Market Size was Estimated at USD 119.82 Million in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.71% from 2023 to 2033

- The Worldwide Sulphonamides Market Size is Expected to Reach USD 189.87 Million by 2033

- Asia Pacific is predicted to grow at the fastest CAGR throughout the projection period

Get more details on this report -

The Global Sulphonamides Market Size is anticipated to exceed USD 189.87 Million by 2033, Growing at a CAGR of 4.71% from 2023 to 2033. The market expansion is accelerated by the rising incidence of bacterial infections, increasing research and development (R&D) studies, and extensive utilization in hospital and veterinary clinics.

Market Overview

The sulphonamides market aims to develop, produce, and commercialize the sulphonamide class of drugs that are used to treat bacterial infections. Sulfonamides are referred to as sulfa drugs. Sulphonamides are the first effective antibacterial agents to be introduced in clinical medicine. Sulphonamides are bacteriostatic (prevent the growth of the bacteria) and have a wide range of antibacterial activity against gram-positive and gram-negative bacteria. It exerts its therapeutic action by inhibiting the production of folic acid in bacteria. The drugs that are classified under the sulphonamides category are sulfamethizole, sulfisoxazole, sulphacytine, sulfasalazine, sulfadiazine, sulfamethoxazole, etc. The marketed products of the sulphonamides include SalPHAZ, Septran, SS Sulfa, SILVOPAR, etc.

Several government initiatives drive the sulphonamides market growth. For instance, in 2020, the Government of India, the Ministry of Chemicals and Fertilizers, and the Department of Pharmaceuticals established and approved the “Production Linked Incentives (PLI) Scheme” for the promotion of the domestic manufacturing of the Key Starting Materials (KSM), Drug Intermediates (Dis), and Active Pharmaceutical Ingredients (APIs) in India which has been notified vide Gazette Notification no.31026/16/2020-Policy. This scheme aims to decrease India's reliance on imports of vital APIs by increasing domestic production of identified KSMs, drug intermediates, and APIs by appealing to large investments in the industry. Therefore, increasing the production and formulation of active pharmaceutical ingredients, including sulphonamide medications, promotes the growth of the sulphonamide market.

The growing occurrence of bacterial infections in society caused by the ingestion of bacteria from the unhygienic environment or contaminated food alters the immunity of the human body, leading to an increase in demand for sulphonamide medications, resulting in the expansion of the sulphonamides market.

Globally, urinary tract infection is the most common infectious disease, affecting 150 million people each year. For example, it has been estimated that the economic burden of recurrent UTIs in the United States (U.S.) is more than USD 5 billion each year. Thus, extensive usage of sulphonamide drugs in the management of urinary tract infections, as sulphonamides are the first choice of drug for UTI recommended by doctors, resulted in the growth of the market. The innovations in drug discovery techniques and the upsurge in the production of generic medications propels the market growth.

Report Coverage

This research report categorizes the global sulphonamides market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global sulphonamides market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global sulphonamides market.

Global Sulphonamides Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 119.82 Million |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.71% |

| 023 – 2033 Value Projection: | USD 189.87 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 257 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Medication Type, By Route of Administration, By Distribution Channel, By Regional Analysis |

| Companies covered:: | Cipla Limited., Monarch Pharmaceuticals, Lexine Tenochem Pvt. Ltd., Glenmarke Pharma Ltd., Teva Pharmaceuticals Ltd., Glaxo Smith Kline PLC, Cadila Pharmaceuticals Ltd., Allergan, Amneal Pharmaceuticals LLC, Dr. Reddy’s Laboratories, Pfizer, Aurobindo Pharma, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

The rising cases of global infectious diseases and antibiotic-resistant strains have increased the significance of sulfonamides in the pharmaceutical industry. The sulphonamides market expansion is driven by advancements in pharmaceutical formulations that enhance product efficacy and safety, resulting in the rising need for sulphonamide drugs.

The broad-spectrum activity of the sulphonamides against bacterial infections enables the minimized use of the other classes of drugs, limited adverse effects, cost-effectiveness, and a wide area of applications boosts the market size. Self-medication trends, increased over-the-counter use for minor infections, and online pharmacies are boosting demand for easily accessible antimicrobial agents like sulphonamides. Early disease diagnosis and treatment awareness encourage healthcare providers to prescribe these medications.Top of Form

The advancements in drug discovery and development methods, such as molecular docking, combinatorial chemistry, high-throughput screening, virtual screening, and PCR techniques, fuel the market growth.

Restraining Factors

The sulphonamides market growth can be hindered by the presence of alternatives to treat bacterial infections, the high cost of the drug development process, stringent government regulations, and patent expirations.

Market Segmentation

The global sulphonamides market share is classified into medication type, route of administration, application, and distribution channel.

- The branded segment dominated the global sulphonamides market in 2023 and is anticipated to grow at a CAGR of 4.56% throughout the forecast period.

Based on the medication type, the global sulphonamides market is categorized into generics and branded. Among these, the branded segment dominated the global sulphonamides market in 2023 and is anticipated to grow at a CAGR of 4.56% throughout the forecast period. This segment's growth is accompanied by patient convenience, reliability, higher quality standards, brand recognition, and credibility, widely recommended by healthcare professionals, undergoing extensive stages of clinical trials for better outcomes, and is mostly prescribed during chronic conditions.

- The oral segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the route of administration, the global sulphonamides market is categorized into topical, oral, and others. Among these, the oral segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The segment expansion is attributed to its efficacy, enhancement of patient compliance, presence of stringent regulation allowing the maintenance of quality and safety standards, simple formulation method, cost-effective prices, ease of administration, greater accessibility, benefits the middle and low-income countries, suitable to geriatric populations owing to greater stability sugar taste of tablets as tablet coating is done, non-invasiveness, available in targeted drug delivery formulations, and greater chemical and physical stability.

- The skin infection segment held the largest market share of 24.78% in 2023 and is predicted to grow at a substantial CAGR throughout the projected timeframe.

Based on the application, the global sulphonamides market is categorized into respiratory tract infection (RTI), gastrointestinal infection (GIT), urinary tract infection (UTI), skin infection, and others. Among these, the skin infection segment held the largest market share of 24.78% in 2023 and is predicted to grow at a substantial CAGR throughout the projected timeframe. The segment's growth is owing to rising cases of several skin infections such as dermatitis, acne, burns, and itching. For instance, the data provided by the British Journal of Dermatology represents the global prevalence of atopic dermatitis, and the population affected by atopic dermatitis was estimated to be 2.6% and 204.05 million people, respectively.

- The hospital pharmacies segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe.

Based on the distribution channel, the global sulphonamides market is categorized as retail pharmacies, hospital pharmacies, and online pharmacies. Among these, the hospital pharmacies segment accounted for the largest share in 2023 and is expected to grow at a significant CAGR throughout the projected timeframe. The segmental expansion is ascribed to the wide availability of the sulphonamides stock, collaborations with distributors and vendors, and healthcare associations that benefit the patients financially, availability of critical care drugs, personalized medications, and patient counseling facilities.

Regional Segment Analysis of the Global Sulphonamides Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global sulphonamides market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global sulphonamides market over the predicted timeframe. The accessibility of advanced technology, the increasing utilization of antibiotics, the rise in infection prevalence, and the expansion of research and development in the medical sciences are all contributing factors to development. The growth of the region is, therefore, expected to be fueled by the development and commercialization of new medications in the United States and Canada. As a result, the nation, which is known for having a foremost pharmaceutical industry and a thriving research and development sector that has produced novel sulphonamide formulations and combination treatments, has established itself and is expected to hold a sizable portion of the market in North America.

Asia Pacific is anticipated to grow at the fastest CAGR throughout the projected timeframe. The constantly expanding population and high prevalence of infectious diseases in the Asia Pacific area offer an enormous development prospect for the sulphonamides sector. In nations like China, India, and Japan, healthcare expenditure is rising, infrastructure is being improved, and healthcare services are being expanded. The region's sulphonamide market is anticipated to continue growing as a result of government initiatives and regulatory reforms. Based on their enormous patient bases, better healthcare infrastructure, and rising rates of infectious diseases, developing nations like South Korea, Brazil, India, and Mexico present possible growth prospects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global sulphonamides market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cipla Limited.

- Monarch Pharmaceuticals

- Lexine Tenochem Pvt. Ltd.

- Glenmarke Pharma Ltd.

- Teva Pharmaceuticals Ltd.

- Glaxo Smith Kline PLC

- Cadila Pharmaceuticals Ltd.

- Allergan

- Amneal Pharmaceuticals LLC

- Dr. Reddy’s Laboratories

- Pfizer

- Aurobindo Pharma

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2024, Atteeque Ahmed and et al. reported that in-vitro ins-silico screening of acryl pyrazole sulfonamides showed antidiabetic activity by inhibiting the alpha-glucosidase enzyme. This research study is published in the Journal, Frontiers in Chemistry.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global sulphonamides market based on the below-mentioned segments:

Global Sulphonamides Market, By Medication Type

- Generics

- Branded

Global Sulphonamides Market, By Route of Administration

- Topical

- Oral

- Others

Global Sulphonamides Market, By Application

- Respiratory Tract Infection (RIT)

- Gastrointestinal Infection (GIT)

- Urinary Tract Infection (UIT)

- Skin Infection

- Others

Global Sulphonamides Market, By Distribution Channel

- Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Global Sulphonamides Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global sulphonamides market?The global sulphonamides market is projected to expand at 4.71% during the forecast period.

-

2. Who are the top key players in the global sulphonamides market?The key players in the global sulphonamides market are Cipla Limited., Monarch Pharmaceuticals, Lexine Tenochem Pvt. Ltd., Glenmarke Pharma Ltd., Teva Pharmaceuticals Ltd., Glaxo Smith Kline PLC, Cadila Pharmaceuticals Ltd., Allergan, Amneal Pharmaceuticals LLC, Dr. Reddy’s Laboratories, Pfizer, Aurobindo Pharma, and others.

-

3. Which region holds the largest share of the market?North America is anticipated to hold the largest share of the global sulphonamides market over the predicted timeframe.

Need help to buy this report?