Global Supplementary Cementitious Materials Market Size, Share, and COVID-19 Impact Analysis, By Type (Ferrous Slag, Fly Ash, Silica Fume, Slag Cement, Calcinated Clay, Gypsum, and Limestone), By End-User (Agriculture, Residential, Commercial, Industrial, Infrastructure, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Supplementary Cementitious Materials Market Insights Forecasts to 2033

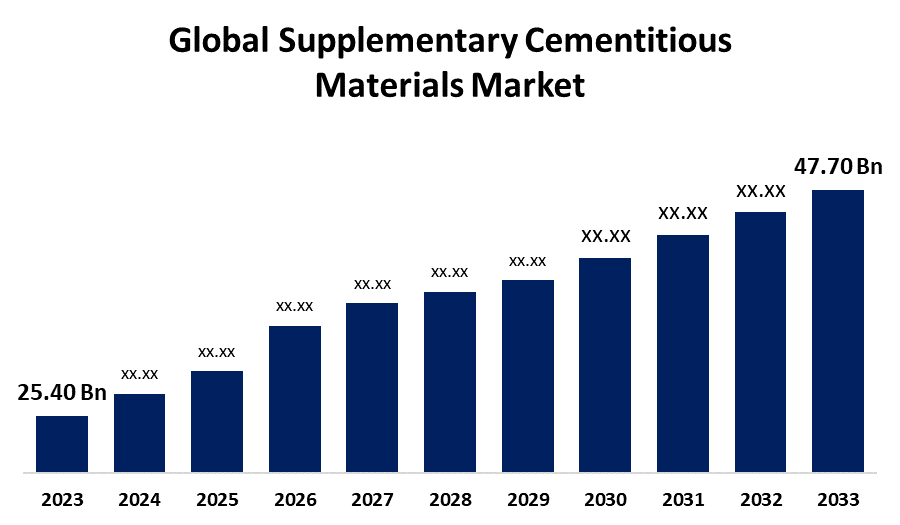

- The Global Supplementary Cementitious Materials Market Size Was Valued at USD 25.40 Billion in 2023

- The Market Size is Growing at a CAGR of 6.50% from 2023 to 2033

- The Worldwide Supplementary Cementitious Materials Market Size is Expected to Reach USD 47.70 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Supplementary Cementitious Materials Market Size is Anticipated to Exceed USD 47.70 Billion by 2033, Growing at a CAGR of 6.50% from 2023 to 2033.

Market Overview

Supplementary cementitious materials (SCMs) are compounds used in concrete mixtures to improve their qualities or to replace a portion of the Portland cement. SCMs can enhance the strength, durability, and sustainability of concrete. Supplementary cementing materials, such as slag cement, fly ash, and silica fume, are frequently added to concrete mixtures to improve strength and permeability. The growing need for construction projects around the world is propelling the market for supplementary cementitious materials. Furthermore, the inexpensive cost of these materials, as well as the possibility to produce them using industrial waste products, are increasing their popularity. Furthermore, there are chances to use various types of industrial and dry waste materials in cement manufacturing, which can reduce pollution while also providing effective waste management solutions.

In December 2023, Terra CO2, the developer of a scalable low-carbon supplementary cementitious material, and Eagle Materials Inc. announced that they signed exclusive agreements for the potential deployment of multiple eco-friendly, low-carbon cementitious commercial-scale plants in three different geographic areas, including the Greater Denver market.

Report Coverage

This research report categorizes the market for supplementary cementitious materials based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the supplementary cementitious materials market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the supplementary cementitious materials market.

Global Supplementary Cementitious Materials Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 25.40 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.50% |

| 2033 Value Projection: | USD 47.70 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End-User, By Region |

| Companies covered:: | CEMEX S.A.B. de C.V., Ferroglobe, CR Minerals Company, LLC, HEIDELBERGCEMENT AG, Lafarge, • Charah Solutions, Inc., LAFARGE, ArcelorMittal, CemGreen ApS, SIKA AG, Bharathi Cement Corporation Private Limited, Boral, Tata Steel, BASF SE, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The supplementary cementitious materials (SCMs) market is driven by a combination of environmental, economic, and technological factors including increasing concerns about sustainability and reducing carbon footprints push the demand for SCMs, as they help lower greenhouse gas emissions by reducing the reliance on traditional Portland cement. Regulatory policies and standards promoting eco-friendly construction practices further accelerate this trend. Economically, SCMs offer cost benefits and performance enhancements, such as improved durability and strength of concrete, making them attractive for various applications. Advances in processing technology and the growing construction industry, particularly in emerging economies, also contribute to the market's growth. Additionally, SCMs support effective recycling and waste management by utilizing industrial by-products, aligning with broader environmental and economic goals.

Restraining Factors

The market for supplementary cementitious materials (SCMs) faces several constraints despite its potential for promoting sustainable construction including high initial costs and supply chain issues related to sourcing SCMs that can deter adoption. Additionally, variability in the quality and performance of SCMs, coupled with stringent regulatory and standards compliance, can create barriers. The lack of widespread awareness and expertise among construction professionals further inhibits their use. Compatibility issues with other concrete mix components, along with logistical challenges related to handling and storage, also contribute to the market's restraint.

Market Segmentation

The supplementary cementitious materials market share is classified into type and end-user.

- The ferrous slag segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the supplementary cementitious materials market is classified into ferrous slag, fly ash, silica fume, slag cement, calcinated clay, gypsum, and limestone. Among these, the ferrous slag segment is estimated to hold the highest market revenue share through the projected period. Ferrous slag, a byproduct of steel production, is highly valued for its performance in concrete applications due to its beneficial properties, such as improved durability and resistance to high temperatures. Its widespread use in various construction projects, including infrastructure, commercial, and industrial applications, contributes to its dominant market position. The increasing focus on sustainable construction practices and the need for durable materials further bolsters the demand for the ferrous slag segment.

- The infrastructure segment is anticipated to hold the largest market share through the forecast period.

Based on the end-user, the supplementary cementitious materials market is divided into agriculture, residential, commercial, industrial, infrastructure, and others. Among these, the infrastructure segment is anticipated to hold the largest market share through the forecast period. This dominance is due to the substantial demand for high-performance and durable materials in large-scale infrastructure projects such as roads, bridges, tunnels, and airports. SCMs are highly valued in these applications for their ability to enhance concrete strength, durability, and sustainability. The continuous investment in infrastructure development and maintenance globally supports the dominance of the infrastructure segment in the SCM market.

Regional Segment Analysis of the Supplementary Cementitious Materials Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

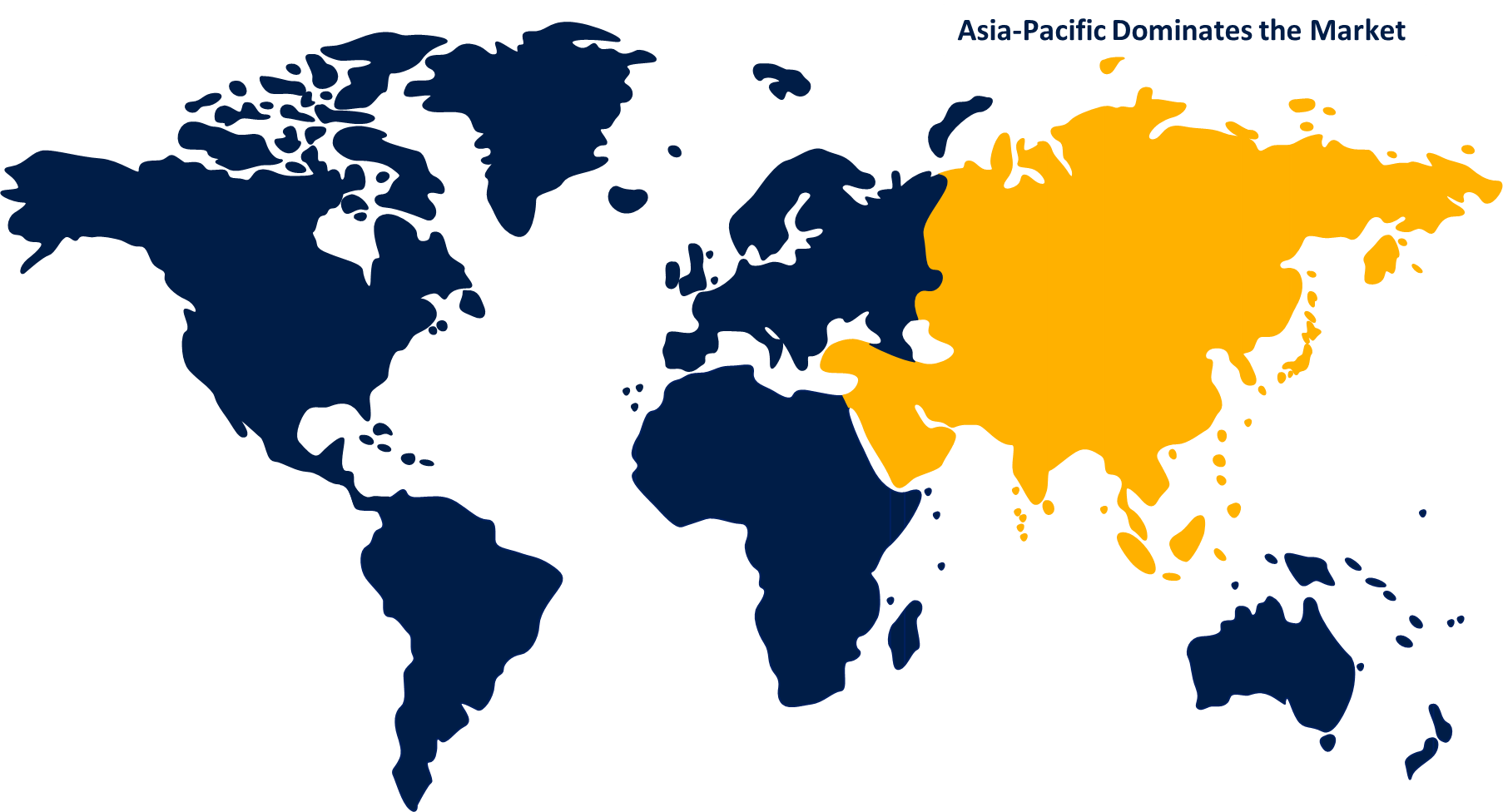

Asia Pacific is anticipated to hold the largest share of the supplementary cementitious materials market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the supplementary cementitious materials market over the predicted timeframe. Asia Pacific region is driven by rapid urbanization and extensive infrastructure development. The region's significant investment in infrastructure projects, such as roads and bridges, coupled with a booming construction industry, fuels the demand for SCMs. Government policies promoting sustainable construction practices and the region’s robust economic growth further support the market. Additionally, increasing awareness of the environmental and performance benefits of SCMs contributes to their rising adoption in construction applications

North America is expected to grow at the fastest CAGR growth of the supplementary cementitious materials market during the forecast period. This rapid expansion is fueled by significant infrastructure investments, a strong emphasis on sustainable construction practices, and technological advancements in SCM products. The region’s stringent regulations and growing market awareness of the environmental and performance benefits of SCMs further drive adoption.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the supplementary cementitious materials market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CEMEX S.A.B. de C.V.

- Ferroglobe

- CR Minerals Company, LLC

- HEIDELBERGCEMENT AG

- Lafarge

- Charah Solutions, Inc.

- LAFARGE

- ArcelorMittal

- CemGreen ApS

- SIKA AG

- Bharathi Cement Corporation Private Limited

- Boral

- Tata Steel

- BASF SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2023, Holcim announced the introduction of its ECOAsh beneficiated ash into its Lafarge facilities in western Canada, with ambitions to expand into the United States.

- In October 2023, Eco Material Technologies, a leading supplier of sustainable cementitious materials (SCMs) and near zero carbon cement replacement solutions, recently announced an agreement with Georgia Power to gather millions of tonnes of landfilled ash from Plant Branch.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the supplementary cementitious materials market based on the below-mentioned segments:

Global Supplementary Cementitious Materials Market, By Type

- Ferrous Slag

- Fly Ash

- Silica Fume

- Slag Cement

- Calcinated Clay

- Gypsum

- Limestone

Global Supplementary Cementitious Materials Market, By End-User

- Agriculture

- Residential

- Commercial

- Industrial

- Infrastructure

- Others

Global Supplementary Cementitious Materials Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the supplementary cementitious materials market over the forecast period?The supplementary cementitious materials market is projected to expand at a CAGR of 6.50% during the forecast period.

-

2.What is the market size of the supplementary cementitious materials market?The Global Supplementary Cementitious Materials Market Size is Expected to Grow from USD 25.40 Billion in 2023 to USD 47.70 Billion by 2033, at a CAGR of 6.50% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the supplementary cementitious materials market?Asia Pacific is anticipated to hold the largest share of the supplementary cementitious materials market over the predicted timeframe.

Need help to buy this report?