Global Surgical Gloves Market Size, Share, and COVID-19 Impact Analysis, By Material (Latex Gloves, Nitrile Gloves, Vinyl Gloves, Neoprene Gloves), By Usage (Disposable Gloves, Reusable Gloves), By Form (Powder-free Gloves, Powdered Gloves), By End User (Hospital, Veterinary, Emergency medical service, Dental, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Surgical Gloves Market Insights Forecasts to 2033

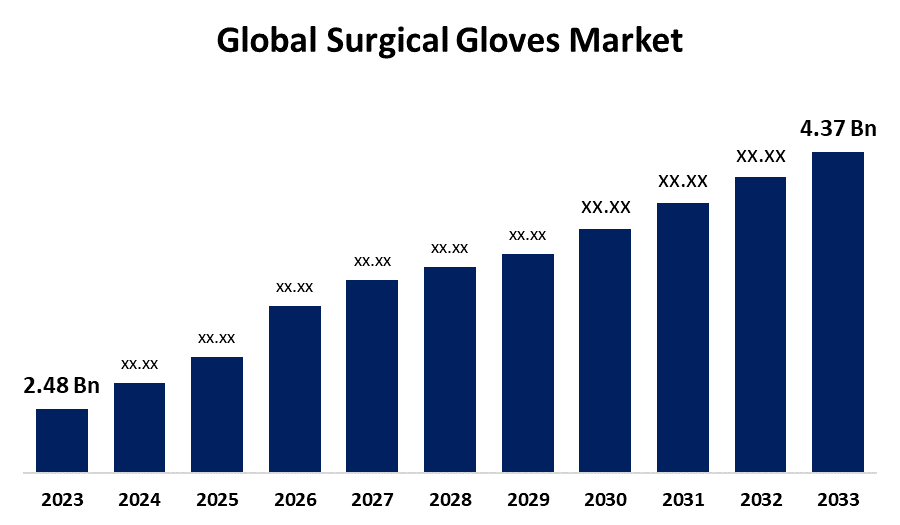

- The Global Surgical Gloves Market Size was Valued at USD 2.48 Billion in 2023

- The Market Size is Growing at a CAGR of 5.83% from 2023 to 2033

- The Worldwide Surgical Gloves Market Size is Expected to Reach USD 4.37 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Surgical Gloves Market Size is Anticipated to Exceed USD 4.37 Billion by 2033, Growing at a CAGR of 5.83% from 2023 to 2033.

Market Overview

Surgical gloves are primarily used as a protective barrier to prevent disease transmission between healthcare personnel and patients during surgical procedures. Surgical gloves are used during surgery and are often prepared to a higher quality, with improved precision, size, and sensitivity. Surgical gloves prevent clinicians and patients from cross-contamination during medical examinations. Surgical gloves are constructed of polymers such as polyisoprene, latex, neoprene, and nitrile. These products can function as sterile gloves. Surgical gloves are used in a variety of medical activities, including surgery and dentistry. Surgical gloves are used in crime scene evaluation because of their tight fit and thinness, making them easy to use. Manufacturers are putting more effort into making powder-free gloves by removing any remaining powder from powdered gloves. Furthermore, various legislative measures are contributing to the growth of powder-free nitrile gloves by imposing stricter restrictions and requirements for the use of powdered gloves, which raises safety concerns. As a result, the surgical glove industry is likely to see increased profitability.

Report Coverage

This research report categorizes the market for the global surgical gloves market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global surgical gloves market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global surgical gloves market.

Global Surgical Gloves Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.48 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.83% |

| 2033 Value Projection: | USD 4.37 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material, By Usage, By Form, By End User, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Kanam Latex Industries Pvt. Ltd., Narang Medical Limited, MRK Healthcare Pvt. Ltd., Cardinal Health Inc., Ansell Ltd., Top Glove Corporation, Hartalega Holdings, Sempermed, Globus Group., Sun Healthcare (M) Sdn. Bhd., Berner International GmbH, Dach, ERENLER MEDIKAL SAN. TIC. LTD. STI., Medline Industries, Inc., Leboo Healthcare Products Limited, and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Major market players are investing heavily in R and D to increase their product lines, allowing the market for weight loss products to develop. Furthermore, market players are launching a variety of strategic measures to expand their global footprint, including the introduction of new products, contracts, M and A transactions, increased investment, and collaboration with other businesses. To expand and thrive in an increasingly competitive and dynamic market, the surgical glove sector must offer fairly priced products. In addition, the growing number of surgical procedures performed, such as carotid endarterectomy, appendectomy, cesarean section, coronary artery bypass graft (CABG), and circumcision, is predicted to drive up demand for surgical gloves. For example, the Centers for Medicare and Medicaid Services claim that in response to the pandemic's consequences, hospitals quickly established new safety standards, resulting in a large fall in non-essential surgical rates. As a result, the increasing number of surgical procedures is expected to drive the surgical glove market.

Restraining Factors

The growing demand for more sustainable alternatives as people become more conscious of environmental issues may have an impact on the market for traditional disposable gloves. This is projected to have a negative impact on the surgical glove market throughout the forecast period.

Market Segmentation

The global surgical gloves market share is classified into material, usage, and end user.

- The latex gloves segment is expected to hold the largest share of the global surgical gloves market during the forecast period.

Based on the material, the global surgical gloves market is categorized into latex gloves, nitrile gloves, vinyl gloves, and neoprene gloves. Among these, the latex gloves segment is expected to hold the largest share of the global surgical gloves market during the forecast period. They are also extremely durable and tear-resistant because of their natural rubber properties, and they can act as an effective barrier against bacterial and viral illnesses. Latex gloves are still the most popular choice for surgical procedures due to their superior quality and performance, despite the emergence of new materials such as nitrile and vinyl, which have some advantages over latex, such as hypoallergenic and chemical resistance. In reality, latex gloves currently represent the largest market segment for surgical gloves, accounting for a sizable share of total sales.

- The disposable gloves segment is expected to grow at the fastest CAGR during the forecast period.

Based on the usage, the global surgical gloves market is categorized into disposable gloves and reusable gloves. Among these, the disposable gloves segment is expected to grow at the fastest CAGR during the forecast period. Several factors contribute to this, including favorable occupational safety rules, the growing emphasis on workplace safety and security, and rising healthcare costs. Furthermore, surgical gloves protect the body from potentially toxic chemicals such as abrasive items, alcohol, and chemicals, as well as biohazards such as viruses and bacteria, bodily fluids, and so on.

- The powdered gloves segment is predicted to dominate the global surgical gloves market during the forecast period.

Based on the form, the global surgical gloves market is categorized into powder-free gloves and powdered gloves. Among these, the powdered gloves segment is predicted to dominate the global surgical gloves market during the forecast period. Glove powder, which is made up of dry substances such as silicone and cornstarch, is found in powdered gloves, preventing them from adhering together and making them easier to wear.

- The hospital segment is expected to hold a significant share of the global surgical gloves market during the forecast period.

Based on the end user, the global surgical gloves market is categorized into hospital, veterinary, emergency medical service, dental, and others. Among these, the hospital segment is expected to hold a significant share of the global surgical gloves market during the forecast period. This importance is due to several variables, including a fast-growing geriatric population, particularly in affluent countries, and an increase in hospital-acquired illnesses such as hepatitis and AIDS. These factors are expected to considerably contribute to the growing demand for medical gloves. The increasing occurrence of hospital-acquired infections (HAIs) such as surgical site infections, ventilator-associated pneumonia, and bloodstream infections is expected to fuel the need for medical gloves in the hospital end-use segment.

Regional Segment Analysis of the Global Surgical Gloves Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is projected to hold the largest share of the global surgical gloves market over the forecast period.

Get more details on this report -

Asia Pacific is projected to hold the largest share of the global surgical gloves market over the forecast period. This is due to the region's increased manufacture of personal protective equipment (PPE), which has been affected by rising healthcare expenditures, rising healthcare penetration, and government measures to improve awareness. Furthermore, the growing senior population, which is predisposed to various chronic illnesses, the increased emphasis on attracting qualified healthcare personnel, and greater health insurance penetration have produced positive conditions for the business environment in APAC countries.

North America is expected to grow at the fastest CAGR of the global surgical gloves market during the forecast period. A growing number of hospital admissions, numerous surgical operations, and stringent regulatory requirements. Thus, when hospital admissions and surgical procedures increase, so does the demand for surgical gloves, resulting in regional market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global surgical gloves market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kanam Latex Industries Pvt. Ltd.

- Narang Medical Limited

- MRK Healthcare Pvt. Ltd.

- Cardinal Health Inc.

- Ansell Ltd.

- Top Glove Corporation

- Hartalega Holdings

- Sempermed

- Globus Group.

- Sun Healthcare (M) Sdn. Bhd.

- Berner International GmbH

- Dach

- ERENLER MEDIKAL SAN. TIC. LTD. STI.

- Medline Industries, Inc.

- Leboo Healthcare Products Limited

- Others

Key Market Developments

- In June 2023, Maxter Healthcare began construction on the first phase of a surgical glove manufacturing facility in Brazoria County, south of Houston. It would be Maxter Healthcare's first facility in the United States, with an investment of up to $550 million.

- In May 2023, Ansell, a global leader in personal protective equipment, commemorated the first phase of Go Live for Packing & Irradiation Operations at its new Kovai manufacturing site in India with a big launch event on March 24, 2023.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global surgical gloves market based on the below-mentioned segments:

Global Surgical Gloves Market, By Material

- Latex Gloves

- Nitrile Gloves

- Vinyl Gloves

- Neoprene Gloves

Global Surgical Gloves Market, By Usage

- Disposable Gloves

- Reusable Gloves

Global Surgical Gloves Market, By Form

- Powder-free Gloves

- Powdered Gloves

Global Surgical Gloves Market, By End User

- Hospital

- Veterinary

- Emergency Medical Service

- Dental

- Others

Global Surgical Gloves Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global surgical gloves market over the forecast period?The Global Surgical Gloves Market Size is expected to Grow from USD 2.48 Billion in 2023 to USD 4.37 Billion by 2033, at a CAGR of 5.83% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global surgical gloves market?Asia Pacific is projected to hold the largest share of the global surgical gloves market over the forecast period.

-

3. Who are the top key players in the surgical gloves market?Kanam Latex Industries Pvt. Ltd., Narang Medical Limited, MRK Healthcare Pvt. Ltd., Cardinal Health Inc., Ansell Ltd., Top Glove Corporation, Hartalega Holdings, Sempermed, Globus Group., Sun Healthcare (M) Sdn. Bhd., Berner International GmbH, Dach, Medline Industries, Inc., Leboo Healthcare Products Limited, and others.

Need help to buy this report?