Global SUV Market Size, Share, and COVID-19 Impact Analysis, By Type (Compact, Full-Size, Mid-Size, MPV, and Sub-Compact), By Propulsion (Electric Vehicles, Hybrid (HEV, PHEV), Internal Combustion Engines), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal SUV Market Insights Forecasts to 2033

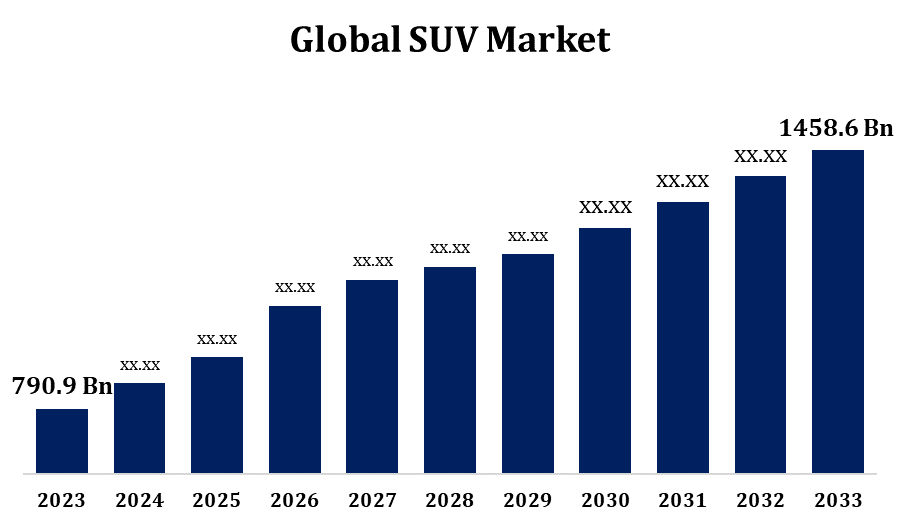

- The Global SUV Market Size was valued at USD 790.9 Billion in 2023.

- The Market Size is growing at a CAGR of 6.31% from 2023 to 2033.

- The Worldwide SUV Market Size is expected to reach USD 1458.6 Billion By 2033.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global SUV Market Size is expected to reach USD 1458.6 Billion By 2033, at a CAGR of 6.31% During the Forecast period 2023 to 2033.

The SUV market continues to thrive, driven by consumer demand for versatility, comfort, and advanced technology. Known for their spacious interiors, higher ground clearance, and off-road capabilities, SUVs appeal to families, outdoor enthusiasts, and urban dwellers alike. Innovations in hybrid and electric SUVs are reshaping the segment, addressing environmental concerns and enhancing fuel efficiency. Compact SUVs are particularly popular for their balance of functionality and urban-friendly dimensions, while luxury SUVs cater to premium buyers seeking high-end features. The market also benefits from increased safety standards and infotainment advancements. Asia-Pacific leads in growth, supported by rising disposable incomes and infrastructure development. With shifting consumer preferences and a focus on sustainability, the SUV segment remains a dominant force in the global automotive industry.

SUV Market Value Chain Analysis

The SUV market value chain integrates raw material sourcing, production, distribution, and after-sales services. It starts with acquiring materials like steel, aluminum, and electronics for manufacturing critical components such as engines, transmissions, and electric powertrains. Suppliers deliver advanced parts, including infotainment systems and safety technologies, enabling automakers to assemble innovative and high-quality vehicles. The production phase involves advanced manufacturing techniques and quality checks to meet evolving consumer demands. Distribution channels include dealerships, online platforms, and direct sales networks, ensuring market reach. After-sales services like maintenance, spare parts, and customer support enhance brand loyalty. With the shift toward electric SUVs, battery production and charging infrastructure development have become integral. Sustainability, cost efficiency, and innovation are pivotal in optimizing the SUV market value chain.

SUV Market Opportunity Analysis

The SUV market presents significant growth opportunities driven by evolving consumer preferences and technological advancements. Rising urbanization and increasing disposable incomes are fueling demand for compact and mid-size SUVs, especially in emerging markets. The shift toward electrification offers a lucrative avenue, with electric SUVs gaining popularity due to environmental awareness and government incentives. Advancements in autonomous driving and connected vehicle technologies further enhance market potential, catering to tech-savvy consumers. Luxury SUVs are also witnessing robust demand, propelled by premium features and a focus on comfort. Additionally, SUVs' adaptability for diverse terrains and family-friendly designs broaden their appeal. Manufacturers investing in lightweight materials, sustainability, and efficient powertrains can tap into these opportunities. The expanding global middle class and infrastructure development make the SUV segment a vital contributor to the automotive industry’s future growth.

Global SUV Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 790.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.31% |

| 2033 Value Projection: | USD 1458.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Propulsion, By Region |

| Companies covered:: | BMW AG, BYD, Ford Motor Company, Geely Auto, GMC, Honda Motor Co., Ltd., Hyundai Motor Company, Jaguar Land Rover Automotive PLC, Mahindra&Mahindra Ltd., Mercedes-Benz Group, Renault, Stellantis NV, Suzuki Motor Corporation, TATA Motors Limited, TOYOTA MOTOR CORPORATION, Volkswagen, Volvo Car Corporation, and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

SUV Market Dynamics

Manufacturers' Investments in Electric Vehicle (EV) Technology

Manufacturers are heavily investing in electric vehicle (EV) technology to revolutionize the SUV market. With growing consumer demand for sustainable and energy-efficient vehicles, automakers are prioritizing research and development in battery technology, electric powertrains, and lightweight materials. Key investments focus on enhancing range, charging speed, and performance to align with evolving expectations. Partnerships with battery suppliers and advancements in solid-state batteries are crucial strategies. Automakers are also expanding EV production facilities and developing dedicated platforms for electric SUVs to streamline manufacturing. Government incentives and stricter emissions regulations further drive these investments, pushing brands to innovate and differentiate in a competitive market. By integrating smart connectivity and autonomous driving capabilities, manufacturers are creating versatile electric SUVs that appeal to environmentally conscious and tech-savvy consumers, securing their position in the future automotive landscape.

Restraints & Challenges

Rising production costs, driven by advanced technology integration, raw material prices, and regulatory compliance, strain profitability. Stricter emission standards and the transition to electric vehicles require substantial investments in research, development, and infrastructure, posing financial and operational hurdles. The growing competition among automakers increases market saturation, making differentiation difficult. Consumer preferences for affordability and sustainability further pressure manufacturers to balance innovation with cost efficiency. Supply chain disruptions, including semiconductor shortages and global logistics challenges, continue to impact production timelines and availability. Additionally, concerns over SUVs' environmental impact, particularly for traditional internal combustion engine models, have led to shifting perceptions and regulatory scrutiny.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the SUV Market from 2023 to 2033. The SUV market in North America remains robust, driven by consumer preference for versatile, spacious, and technologically advanced vehicles. SUVs dominate vehicle sales in the region, with compact and mid-size models gaining traction due to their balance of functionality and fuel efficiency. The demand for luxury SUVs also continues to rise, supported by affluent buyers seeking premium features. Increasing interest in hybrid and electric SUVs reflects growing environmental consciousness and favorable government incentives. However, the market faces challenges such as high production costs and rising competition from crossover vehicles. Automakers are focusing on innovation, including advanced safety features, infotainment systems, and improved fuel efficiency, to attract buyers. With a strong emphasis on electrification and sustainability, the North American SUV market is poised for steady growth and transformation.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The SUV market in the Asia-Pacific region is experiencing rapid growth, fueled by rising disposable incomes, urbanization, and changing consumer lifestyles. Compact and mid-size SUVs dominate sales, offering an ideal blend of functionality and affordability for diverse markets. China and India lead the segment, driven by large populations and expanding middle-class buyers. The transition to electric and hybrid SUVs is accelerating, supported by government incentives and growing environmental awareness. Automakers are focusing on region-specific designs, prioritizing fuel efficiency, affordability, and adaptability to local road conditions. With infrastructure development and a shift toward sustainable mobility, the Asia-Pacific SUV market is poised for sustained expansion and innovation in the coming years.

Segmentation Analysis

Insights by Type

The mid-size segment accounted for the largest market share over the forecast period 2023 to 2033. The mid-size SUV segment is experiencing notable growth, driven by its balance of versatility, performance, and affordability. These vehicles appeal to a broad range of consumers, from families seeking spacious interiors to urban drivers valuing practicality without sacrificing comfort. Rising global disposable incomes and shifting preferences toward SUVs as daily drivers have contributed to this trend. Mid-size SUVs often offer advanced features, including modern infotainment systems, safety technologies, and efficient powertrains, making them highly desirable. Hybrid and electric options in this segment are also gaining traction, aligning with increasing environmental awareness and government incentives. Automakers are investing heavily in innovative designs and competitive pricing to capture market share. As a result, the mid-size SUV segment is emerging as a pivotal contributor to the overall growth of the global SUV market.

Insights by Propulsion

The electric vehicles segment accounted for the largest market share over the forecast period 2023 to 2033. The electric vehicle (EV) segment within the SUV market is witnessing rapid growth, driven by rising consumer demand for sustainable transportation and government incentives promoting zero-emission vehicles. As environmental concerns grow, consumers are increasingly opting for electric SUVs due to their eco-friendly credentials, lower operating costs, and advanced technology features. Automakers are responding with a broadening range of electric SUV models, focusing on improved battery range, fast-charging capabilities, and enhanced performance. The growth is also fueled by advancements in EV infrastructure, such as more charging stations and better battery technology. Consumers’ desire for SUVs with both ample space and energy efficiency has made electric SUVs highly appealing. As more automakers commit to electrification, the electric SUV segment is expected to continue its expansion, contributing significantly to the broader EV market's growth trajectory.

Recent Market Developments

- In August 2024, in Guiyang, China, Geely Auto unveiled the E5, an electric SUV. The E5 satisfies regulatory requirements in 89 countries and boasts sophisticated functionality and a simple design.

Competitive Landscape

Major players in the market

- BMW AG

- BYD

- Ford Motor Company

- Geely Auto

- GMC

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Jaguar Land Rover Automotive PLC

- Mahindra&Mahindra Ltd.

- Mercedes-Benz Group

- Renault

- Stellantis NV

- Suzuki Motor Corporation

- TATA Motors Limited

- TOYOTA MOTOR CORPORATION

- Volkswagen

- Volvo Car Corporation

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

SUV Market, Type Analysis

- Compact

- Full-Size

- Mid-Size

- MPV

- Sub-Compact

SUV Market, Propulsion Analysis

- Electric Vehicles

- Hybrid (HEV, PHEV)

- Internal Combustion Engines

SUV Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the SUV Market?The global SUV Market is expected to grow from USD 790.9 billion in 2023 to USD 1458.6 billion by 2033, at a CAGR of 6.31% during the forecast period 2023-2033.

-

2. Who are the key market players of the SUV Market?Some of the key market players of the market are BMW AG; BYD; Ford Motor Company; Geely Auto; GMC; Honda Motor Co., Ltd.; Hyundai Motor Company; Jaguar Land Rover Automotive PLC; Mahindra&Mahindra Ltd.; Mercedes-Benz Group; Renault; Stellantis NV; Suzuki Motor Corporation; TATA Motors Limited; TOYOTA MOTOR CORPORATION; Volkswagen; and Volvo Car Corporation.

-

3. Which segment holds the largest market share?The mid-size segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the SUV Market?North America dominates the SUV Market and has the highest market share.

Need help to buy this report?