Global System Integration Market Size, Share, and COVID-19 Impact Analysis, By Type (Vertical Integration, Horizontal Integration, Point-to-Point Integration, Others) By Service (Infrastructure Integration, Application Integration, Data Integration, Business Consulting, Others), By Industry Verticals (Oil & Gas, IT & Telecom, Defense & Security, BFSI, Media and Entertainment, Manufacturing, Healthcare, Transportation & Logistics, Retail & E-Commerce, Education, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Information & TechnologyGlobal System Integration Market Insights Forecasts to 2032

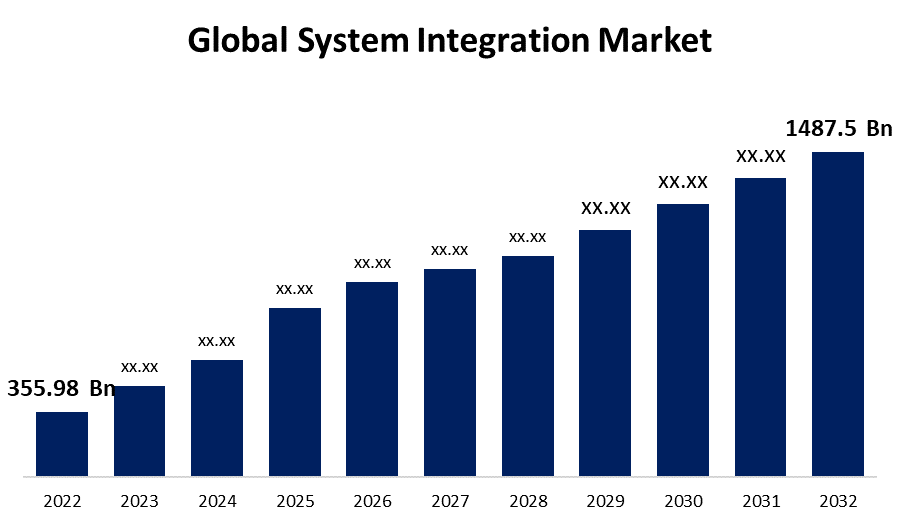

- The Global System Integration Market Size was valued at 355.98 Billion in 2022.

- The market is growing at a CAGR of 15.4% from 2022 to 2032

- The Worldwide System Integration Market is expected to reach USD 1487.5 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global System Integration Market Size is expected to reach USD 1487.5 Billion by 2032, at a CAGR of 15.4% during the forecast period 2022 to 2032.

System integration is the process of merging all of an organization's virtual as well as physical components. The physical components include diverse machine systems, computer equipment, inventory, and so forth. Data stored in databases, software, and apps comprise the virtual components. The primary goal of system integration is the procedure of merging all of these components so that they function as one integrated system. The main objective for firms to employ system integration is to increase the efficiency and quality of operations. System integration is required for both business-to-business communication and internal enterprise cooperation. The integration of systems is critical for establishing efficient workflows. With rising data volumes and increased cloud computing adoption, system integration is expected to keep increasing over the projection period.

Global System Integration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 355.98 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 15.4% |

| 2032 Value Projection: | USD 1487.5 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Type, By Servic, By Industry Verticals, and By Region |

| Companies covered:: | Capgemini, INTECH, Infosys, Fujitsu, SAP, Oracle, General Dynamics, Accenture, Deloitte, Capgemini, Fortinet, Inc., TCS, Cisco Systems, Inc., Tech Mahindra, Cognizant, HCL Technologies, and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The system integration market includes organizations that provide services and solutions designed to guarantee that various technical components, both software, and hardware, are capable of functioning together cohesively. As organizations and governments implement more technology-based solutions, the demand for these systems to be connected becomes increasingly important for cost-effectiveness, increased functionality, and flexibility. Integration is required for uninterrupted service due to the wide range of solutions spanning cloud platforms, on-premises systems, and third-party apps. The growing usage of cloud computing and the burgeoning number of small and medium-sized organizations (SMEs) are propelling the global system integration market forward. Furthermore, AI-assisted automated integration solutions are expected to become a major part of the future, accelerating and simplifying integration operations.

Furthermore, rapid digital transformation and an increase in both privately and publicly funded infrastructure development investments have increased the demand for project execution and system integration solutions. Additionally, the growing requirement to eliminate diversity, and disparity, and raise the uniqueness of essential applications and infrastructures is expected to result in opening up new market prospects for cutting-edge system integration solutions. While technologically advanced countries in North America and Europe used to be key system integration markets mainly because of their early adoption of technologies, regions such as Asia-Pacific are experiencing tremendous growth as a result of increased digitization and the development of the information technology (IT) industry.

Market Segmentation

By Type Insights

The horizontal integration segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global system integration market is segmented into the vertical integration, horizontal integration, point-to-point integration, and others. Among these, the horizontal integration segment is dominating the market with the largest revenue share of 36.2% over the forecast period. This is primarily attributed to its adaptability and versatility, which enable enterprises to efficiently connect a wide range of technologies across various operating systems and vendors. Horizontal integration, also known as "Enterprise Service Bus (ESB)," integrates dissimilar systems at a specific level of operation, enabling them to interact and collaborate without affecting their underlying structures. Horizontal integration is also consistent with the growing trend toward cloud-based solutions and the demand for entire IT ecosystems in large enterprises. Many enterprises today choose this method to address their expanding IT infrastructures and the necessity for diverse systems to work in tandem.

By Service Insights

The application integration segment is expected to hold the largest share of the Global System Integration Market during the forecast period.

Based on the service, the global system integration market is classified into infrastructure integration, application integration, data integration, business consulting, and others. Among these, the application integration segment is expected to hold the largest share of the System Integration market during the forecast period. With industries becoming increasingly dependent on a variety of software solutions and platforms to run and support their customers, ensuring that these programs work together has become critical. Application integration is concerned with ensuring that various software applications, platforms, and systems can interact with one another successfully. The growing need for cohesive user experiences, process automation, and the necessity to integrate several software applications inside an organization all contribute to this segment's statistical significance. The growing demand for application integration services has been spurred by the requirement for smooth interoperability between systems.

By Industry Verticals Insights

The IT & telecom segment accounted for the largest revenue share of more than 38.2% over the forecast period.

On the basis of industry verticals, the global system integration market is segmented into oil & gas, IT & telecom, defense & security, BFSI, media and entertainment, manufacturing, healthcare, transportation & logistics, retail & e-commerce, education, and others. Among these, the IT & telecom segment is dominating the market with the largest revenue share of 38.2% over the forecast period, owing to the constant evolution of technology in this sector and the need for seamless integration of various IT systems and telecom services. This industry incorporates the integration of diverse information technology systems, networks, and telecommunications devices. The increased spending on system integration solutions by key companies has improved IT infrastructure management and significantly reduced redundancy. In addition, system integration facilitates the merging of hardware and software solutions obtained from a diverse set of IT providers. The growing need for telecommunications systems to expand network coverage is prompting numerous telecom companies to diversify their operations.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. This dominance is due to the existence of major global firms, technical developments, and significant expenditure on IT infrastructure as well as services. North America, especially the United States, has long been on the vanguard of technological progress. Some of the primary industries generating demand for system integration services in North America are finance, healthcare, telecommunications, and manufacturing. With the advent of cloud computing, IoT, and big data analytics, organizations in North America are actively searching for system integrators to help them administer and integrate these technologies more efficiently. Global IT massive companies established in the United States, such as IBM, Microsoft, and Oracle, play a major part in the region's system integration market.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The Asia Pacific region is experiencing tremendous digitalization and technical innovation, led by economic powerhouses such as China, Japan, India, and South Korea. Manufacturing, banking, healthcare, and e-commerce are increasing regional demand for system integration services. Rising middle-class populations in general, growing urbanization, and the growing popularity of digital services constitute key trends influencing the Asia Pacific system integration market. The region is home to notable technology firms such as Samsung (South Korea), Alibaba (China), and Sony (Japan), all of which contribute considerably to the region's technological ecosystem.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. Europe has a thriving system integration industry, as a result of its broad corporate landscape and focus on digital transformation. The region is concerned with ensuring that improvements in technology are consistent across countries and businesses. Global firms like SAP (Germany), Capgemini (France), and Atos (France) offer major contributions to Europe's system integration market.

List of Key Market Players

- Capgemini

- INTECH

- Infosys

- Fujitsu

- SAP

- Oracle

- General Dynamics

- Accenture

- Deloitte

- Capgemini

- Fortinet, Inc.

- TCS

- Cisco Systems, Inc.

- Tech Mahindra

- Cognizant

- HCL Technologies

Key Market Developments

- On July 2023, Olympus Corporation has announced the release of their latest procedure room visualization and integration solution, the EASYSUITETM ES-IP system. The ES-IP system, the next generation of EASYSUITE, is a modular, scalable, workflow-based solution. The new Olympus digital hub is at its heart, providing the ability to run current software programs as well as potential future Olympus multi-specialty applications (apps).

- On June 2023, Cleo, the pioneer and global leader in the Ecosystem Integration software category and provider of the Cleo Integration Cloud (CIC) platform, has announced a collaboration with Globus Systems, Inc., an IT services company that provides a wide range of system integration solutions for modern organizations. The partnership's goal is to help organizations that need to automate core business processes (like Order-to-Cash, Procure-to-Pay, and Load Tender-to-Invoice) by providing a single-platform solution for API and EDI with end-to-end visibility and closed-loop analytics to enable rapid decision-making and organizational agility for improved revenue capture. As a result, the collaboration will assist joint clients in accelerating corporate value creation in today's quickly changing digital economy.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global System Integration Market based on the below-mentioned segments:

System Integration Market, Type Analysis

- Vertical Integration

- Horizontal Integration

- Point-to-Point Integration

- Others

System Integration Market, Service Analysis

- Infrastructure Integration

- Application Integration

- Data Integration

- Business Consulting

- Others

System Integration Market, Industry Verticals Analysis

- Oil & Gas

- IT & Telecom

- Defense & Security

- BFSI

- Media and Entertainment

- Manufacturing

- Healthcare

- Transportation & Logistics

- Retail & E-Commerce

- Education

- Others

System Integration Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the System Integration market?The Global System Integration Market is expected to grow from USD 355.98 billion in 2022 to USD 1487.5 billion by 2032, at a CAGR of 15.4% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Capgemini, INTECH, Infosys, Fujitsu, SAP, Oracle, General Dynamics, Accenture, Deloitte, Capgemini, Fortinet, Inc., TCS, Cisco Systems, Inc., Tech Mahindra, Cognizant, HCL Technologies.

-

3. Which segment dominated the System Integration market share?The IT & telecom segment in industrial vertical type dominated the System Integration market in 2022 and accounted for a revenue share of over 38.2%.

-

4. What are the elements driving the growth of the System Integration market?Rising cloud-based technology improvements, growing adoption of the Internet of Things (IoT), and increasing spending in distributed information technology systems (telecommunication networks and real-time process control) are among some of the variables that are driving the growth of the system integration market.

-

5. Which region is dominating the System Integration market?North America is dominating the System Integration market with more than 38.7% market share.

-

6. Which segment holds the largest market share of the System Integration market?The horizontal integration segment based on type holds the maximum market share of the System Integration market.

Need help to buy this report?