Global System Integrators Market Size, Share, and COVID-19 Impact Analysis, By Type (Hardware, Software, and services), By Enterprise Size (SMEs and Large Enterprise), By Vertical (IT & Telecommunication, Defense & security, BFSI, Oil & gas, Healthcare, Transportation, Retail, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal System Integrators Market Insights Forecasts to 2033

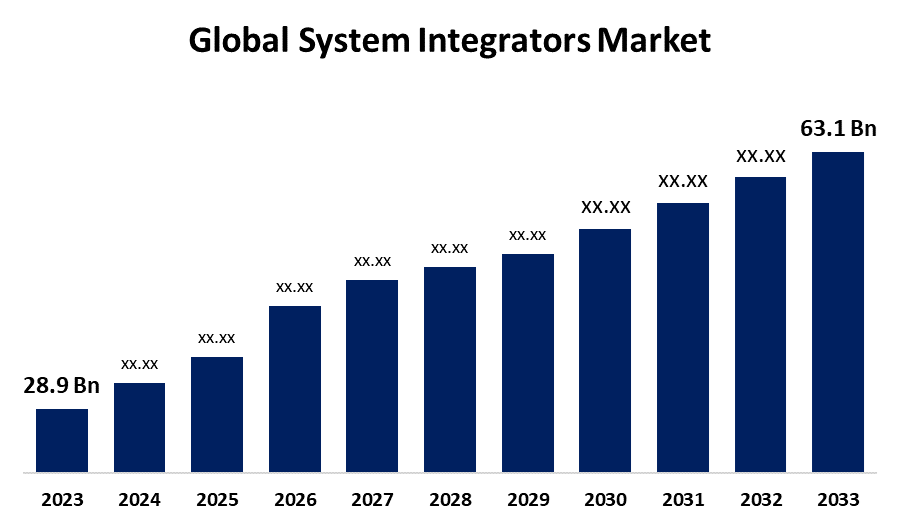

- The Global System Integrators Market Size Was Estimated at USD 28.9 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.12% from 2023 to 2033

- The Worldwide System Integrators Market Size is Expected to Reach USD 63.1 Billion By 2033

- Asia Pacific is Expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global System Integrators Market Size is anticipated to exceed USD 63.1 billion by 2033, growing at a CAGR of 8.12% from 2023 to 2033. The market growth is due to the rapid expansion of IoT and the growing emphasis on security are driving demand for system integration services. System integrators are transforming into strategic partners, providing ongoing innovation and support to satisfy these expanding demands.

Market Overview

The system integrators market refers to the sector that offers all-inclusive solutions that combine different hardware, software, and technology systems into a unified and useful whole. System integrators assist companies in creating, putting into practice, and maintaining specialized IT infrastructure solutions that satisfy certain organizational requirements.

The landscape of information and communications technology (ICT) solutions for governments has shifted considerably in recent years, with increased citizen expectations and long-term operational changes post-pandemic. To address these complicated expectations, System Integrators must prioritize delivering more secure, adaptable, and scalable systems that connect government needs to cloud-based applications.

As government agencies use new technology to improve efficiency, careful planning is required to prevent establishing further information silos. The success of technology integration is determined not just by the tools used, but also by how well they are integrated into the agency's existing systems. A well-thought-out strategy may streamline operations, boost productivity, and help organizations achieve their objectives.

The system integrators are used the help businesses connect and optimize their IT systems, software, and infrastructure. By integrating various technologies, system integrators streamline processes, enhance operational efficiency, and improve overall performance, and the increasing government innovation towards the system integrators and the rising use of the expansion of the market.

Report Coverage

This research report categorizes the system integrators market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the system integrators market. Recent market developments and competitive strategies such as expansion, Type of Software launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the system integrators market.

Global System Integrators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 28.9 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.12% |

| 2033 Value Projection: | USD 63.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Enterprise Size, By Vertical, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Avanceon, Jitterbit Inc., ATS Automation Tooling Systems Inc., BW Design Group, John Wood Group PLC, MAVERICK Technologies LLC, Tesco Controls, Inc., JR Automation and others eky players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The system integrators market is experiencing rapid growth driven by the increasing proliferation of IoT devices, and system integrators are essential to making effective data gathering, processing, and analysis possible. They assist firms in utilizing insights to improve operational efficiency and decision-making by combining analytics and visualization technologies. As system integrators put strong safeguards in place to guard against cyberattacks, security continues to be a top concern. The need for system integration services is being greatly increased by this increased reliance on IoT. Growing worries about cybersecurity, data privacy, and compliance are driving up demand for integration services. System integrators are becoming strategic partners as industries change, providing ongoing innovation and long-term support.

Restraining Factors

Market expansion is hampered by the lack of standards in system integration, necessitating unique solutions for every project, which adds time and expense. Additionally, it impedes the creation of reusable parts, which restricts future scalability and efficiency. Standardizing interfaces and protocols would save resources and increase integration consistency.

Market Segmentation

The global system integrators market is classified intotype, enterprise size, and vertical.

- The hardware segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the type, the system integrators market is categorized into hardware, software, and services. Among these, the hardware segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the rising need for sophisticated infrastructure in sectors such as healthcare, BFSI, and telecommunications. The demand for specialized hardware solutions is further fueled by investments in IoT, AI, and smart city efforts. Consequently, there is a rise in the demand for reliable networking, server, and data storage solutions.

- The large enterprises segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the enterprise size, the system integrators market is categorized into SMEs and large enterprises. Among these, the large enterprises segment held the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the big businesses that negotiate complicated IT systems, there is an increasing need for specialized integration solutions. Enhancing agility, scalability, and decision-making is made possible in large part by cloud integration and AI-driven technology. Large-scale digital transformation projects using emerging technologies are becoming more and more dependent on expert system integrators.

- The IT & telecommunication segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the vertical, the system integrators market is categorized into IT & telecommunication, defense & security, BFSI, oil & gas, healthcare, transportation, retail, and others. Among these, the segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the rapid digital transformation and cloud adoption are increasing the need for system integrators to handle complicated IT infrastructures. The proliferation of 5G networks, as well as the need for improved cybersecurity, are driving cooperation with system integrators. These trends underline the need for system integrators in creating and maintaining contemporary, secure networks.

Regional Segment Analysis of the System Integrators Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the System Integrators market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the System Integrators market over the predicted timeframe. The region's growth can be boosted by the growing need for digital transformation in sectors including manufacturing, financial services, and healthcare. The need for system integrators to link these intricate systems and guarantee smooth operation is fueled by the region's emphasis on implementing cutting-edge technologies like AI, machine learning, and IoT. Opportunities for integrators are further increased by the pervasive adoption of cloud computing and edge technologies, particularly as businesses want to update outdated systems and boost operational effectiveness.

Asia Pacific is expected to grow at the fastest CAGR of the System Integrators market during the forecast period. The regional growth can expand due to the increase in urbanization and industrial expansion, and the rise in digital technologies. System integrators are in high demand to oversee complex infrastructure projects as a result of significant investments made by countries such as China, Japan, and India in automation, cloud computing, and smart city programs. System integrators now have more chances to propel digital transformation as a result of the growing demand for IoT, AI, and data analytics integration in manufacturing and transportation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the system integrators market, along with a comparative evaluation primarily based on their Type of Software offerings, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes Type of Software development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Avanceon

- Jitterbit Inc.

- ATS Automation Tooling Systems Inc.

- BW Design Group

- John Wood Group PLC

- MAVERICK Technologies LLC

- Tesco Controls, Inc.

- JR Automation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In October 2024, FUJIFILM Business Innovation Philippines Corp. (FUJIFILM BI PH) formed a strategic relationship with Microdata Systems and Management Inc. to improve its business software solutions via system integration. The agreement, which was officially announced, seeks to provide integrated and efficient solutions to help Filipino firms optimize operations and increase production.

- In December 2023, MDS System Integration, a subsidiary of Midis Group, acquired a majority stake in Smplid, a digital transformation and IT solutions provider. This acquisition is intended to strengthen MDS's digital solutions capabilities, extend its service offerings, and increase its customer base. The agreement is consistent with MDS's vision of leading in the digital transformation market by providing innovative and comprehensive IT solutions across several sectors.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the system integrators market based on the below-mentioned segments:

Global System Integrators Market, By Type

- Hardware

- Software

- Services

Global System Integrators Market, By Enterprise Size

- SMEs

- Large Enterprises

Global System Integrators Market, By Vertical

- IT & Telecommunication

- Defense & security

- BFSI

- Oil & gas

- Healthcare

- Transportation

- Retail

- Others

Global System Integrators Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the system integrators market over the forecast period?The system integrators market is projected to expand at a CAGR of 8.12% during the forecast period.

-

2. What is the market size of the system integrators market?The Global System Integrators Market Size is expected to grow from USD 28.9 billion in 2023 to USD 63.1 billion by 2033, at a CAGR of 8.12% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the system integrators market?North America is anticipated to hold the largest share of the system integrators market over the predicted timeframe.

Need help to buy this report?