Global Tax Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Services), By Tax Type (Indirect Tax, Direct Tax), By Deployment Mode (On-premise, Cloud), By Organization Size (Large Enterprise, Small & Medium Size Enterprise), By Industry Vertical (Manufacturing, BFSI, Healthcare, Retail & E-Commerce, Telecom & IT, Energy & Utility, Media & Entertainment, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Banking & FinancialGlobal Tax Management Market Insights Forecasts to 2032

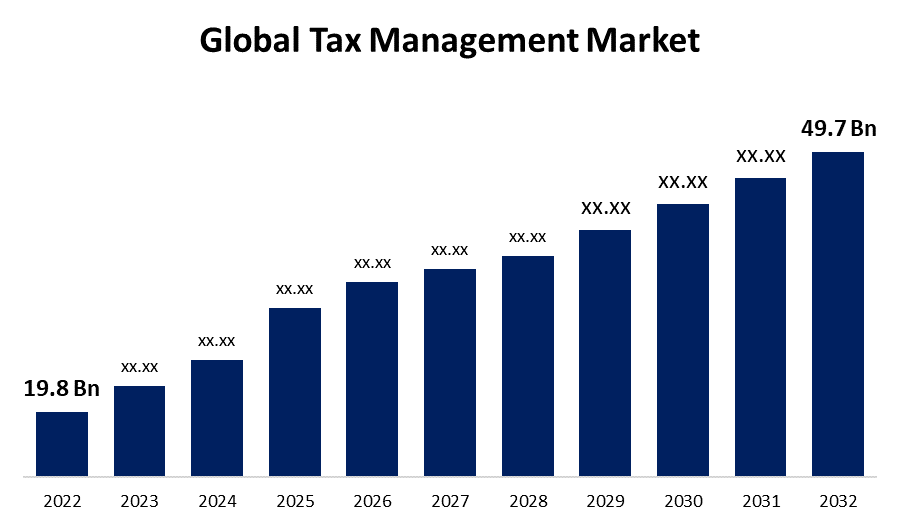

- The Global Tax Management Market Size was valued at USD 19.8 Billion in 2022.

- The Market is growing at a CAGR of 9.6% from 2022 to 2032

- The Worldwide Tax Management Market is expected to reach USD 49.7 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Tax Management Market Size is expected to reach USD 49.7 Billion by 2032, at a CAGR of 9.6% during the forecast period 2022 to 2032.

The growing use of cloud-based tax management software by businesses has resulted in the delivery of security applications scalability, and data backup policies, as well as increased productivity and decreased human error in tax filing. During the pandemic, a rise in e-commerce sales boosted online buying, allowing for real-time transactions around the world. This expanded the use of digital financial services, which is likely to promote tax management software use during the forecast period. Tax management software, which integrates a variety of applications such as sales and billing software, purchasing software, accounting, employee payroll systems, and other financial applications, can be customized for specific business needs and deployed across corporate networks on a variety of platforms, is becoming more prevalent by organizations.

Global Tax Management Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 23.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 9.6% |

| 2032 Value Projection: | USD 49.7 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Tax Type, By Deployment Mode, By Organization Size, By Industry Vertical, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Avalara, Inc., TaxSlayer LLC., SAP SE, Thomson Reuters Corporation, Wolters Kluwer N.V., Sovos Compliance, LLC, Sailotech Pvt Ltd., HRB Digital LLC., Intuit, Inc., Vertex, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing volume of financial interactions across business sectors as a result of the rise of digitalization, developments in the global tax statutory environment, compliance maintenance with immediate visibility into the status, minimized threats, and high-quality tax data within the system of the record itself, and the corresponding decrease of regulatory expenses through automation adoption are all factors driving the ongoing expansion of the tax management market. Moreover, as businesses grow, they require business-oriented tax management that encodes corporate policies, rules, and processes while following to specific business requirements. These solutions can help accountants perform better as the number of employees in the office grows and the business expands. Additionally, rising demand for more cost-effective tax filing solutions is expected to boost revenue growth in the global tax management market in the coming years. Furthermore, the use of web-based e-commerce and banking solutions is increasing the number of online transactions globally. This increase in online digital transactions is expected to drive demand for various tax management solutions for sales tax, GST, and service tax, which will drive market growth globally.

Restraining Factors

Limitation in VAT design and administrative reforms as a setback for the tax management market. Although most developing countries have implemented VAT, it frequently suffers from being insufficient in one or more aspects. Over the supply chain, the cost of doing business has risen. This is because VAT is figured at each stage of the sales process; accounting simply is an immense burden for a company, which subsequently passes on the additional cost to the final consumer.

Market Segmentation

By Component Insights

The services segment dominates the market with the largest revenue share over the forecast period.

Based on components, the global tax management market is segmented into software and services. Among these, the services segment is dominating the market with the largest revenue share more than 36.8% over the forecast period. The demand for supporting services among firms is rising as tax management software usage spreads across key industries. Services are essential for businesses in all sectors to use tax management software to its full potential. Consulting, integration, deployment, as well as training, maintenance, and support, are all included in the tax management services. These services are being adopted by businesses to improve their tax management procedures. Consulting services assist a company in selecting the best tax management software to meet the latter's unique needs. These services give end users advice; and assist them in integrating and deploying software that is customized for their needs. They aid in determining the kind of integration needed by organizations to meet tax demands. Additionally, they support businesses at every stage of software usage.

By Tax Type Insights

The direct tax segment is witnessing significant CAGR growth over the forecast period.

Based on tax type, the global tax management market is segmented into direct tax and indirect tax. Among these, the direct tax segment is witnessing significant CAGR growth over the forecast period. Without using any intermediaries, taxpayers pay direct taxes to the government. They are imposed on businesses and taken into account by the study. Corporate tax, wealth tax, estate duty, gift tax, fringe benefit tax, and professional tax are a few of the direct taxes taken into account. For shifting market demands, vendors are providing clear and comprehensive direct tax solutions. Multiple return types can be filed with direct tax software, which also offers centralized user management to streamline tax compliance procedures. Of the various jurisdictions, filing taxes can be difficult for multi-state and multinational firms. However, direct tax management software makes it easier, faster, and more secure to file federal, state, and local taxes.

By Deployment Mode Insights

The cloud segment is expected to hold the largest share of the Global Tax Management Market during the forecast period.

Based on the deployment, the global tax management market is classified into on-premise and cloud. Among these, the cloud segment is expected to hold the largest share of the tax management market during the forecast period. More organizations are choosing cloud-based tax management software. Users who choose a cloud-based deployment model can use any computer, laptop, or mobile device to access the solution from any location. Cloud solutions relieve the load of system administration and maintenance, allowing the management of a firm to concentrate on tasks that provide value. The always-online cloud deployment mode is intended to prevent data loss because indirect taxes must be determined, stored, and collected on a transaction-by-transaction basis, and at a higher frequency, the cloud is well suited for this. If the platform used for indirect tax is always active and can move parallel at the speed those transactions occur, a company can conduct business effectively.

By Organisation Size Insights

The large enterprise segment accounted for the largest revenue share of more than 57.2% over the forecast period.

Based on organization size, the global tax management market is segmented into large enterprises and small & medium size enterprises. Among these, the large enterprise segment dominates the market with the largest revenue share of 57.2% over the forecast period. To manage taxes and control compliance obligations, an increasing number of major businesses are turning to tax management solutions. It can be difficult for any small business owner to manage taxes, but it is a necessary component of operating a small business. Small and medium-sized businesses, which support job creation and economic growth, pay relatively low taxes. Because they are receiving loans with lower interest rates than typical, SMEs require tax software to manage their tax filings and financial operations. As a result, during the projection period, SMEs are likely to have an increased requirement for tax software.

By Industry Vertical Insights

Rising implementation of tax management software to boost BFSI segment growth.

Based on industry vertical, the global tax management market is segmented into manufacturing, BFSI, healthcare, retail & e-commerce, telecom & IT, energy & utility, media & entertainment, and others. During the forecast period, the BFSI segment is expected to lead in terms of revenue contribution to the global tax management market. In the BFSI industry, increasing digital transformation and a growing number of customers using banking services are expected to drive growth in this segment. As a result, data volumes in the BFSI industry are rapidly increasing. This industry's government regulations are complicated and sensitive. Another important factor driving the adoption of tax management software in the BFSI industry is the growing number of financial transactions globally.

Regional Insights

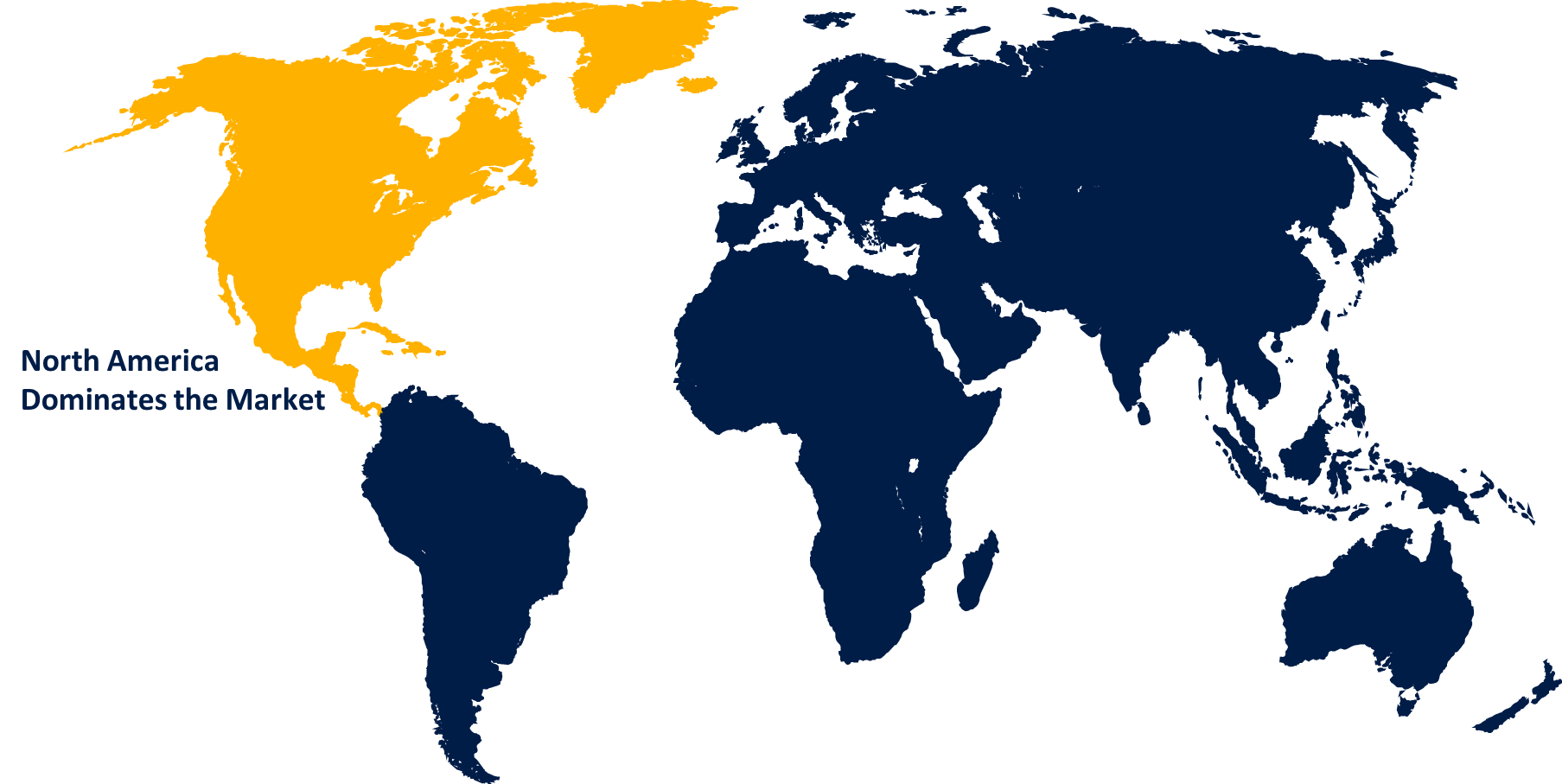

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. The region has seen remarkable development in the adoption of tax software as a result of ongoing changes and laws in the local taxation system, and North America currently holds the largest market share for tax management software. Software developers and significant vendors have a great chance to invest in the market because of the complexity of the tax system and the variations in tax and labor laws in the area. To improve the efficiency of the taxing system, software vendors in the area have begun merging with outside developers. Businesses in North America use cutting-edge technologies and channels as a result to stay competitive and develop at an exponential rate. The taxation climate and product uptake in North America are both being significantly impacted.

Asia-Pacific market is expected to grow the fastest during the forecast period. In the upcoming years, the Asia Pacific market is expected to grow at a moderate development rate. Tax changes and the frequency of tax audits will be under focus as governments in this region remain driven to defend their tax bases. This will make it easier to use reliable solutions to manage tax reports. As a result, it is anticipated that demand for tax management software will increase in the area. It is also crucial for tax authorities and payers in Asia Pacific to stay educated on variables affecting the company's tax obligations due to the region's constantly changing tax environment.

The Middle East, Africa, and Latin America are expected to experience steady growth during the span of the research period. This increase is mostly due to the increased use of tax software by SMEs and large firms to manage financial transactions and tax filings.

List of Key Market Players

- Avalara, Inc.

- TaxSlayer LLC.

- SAP SE

- Thomson Reuters Corporation

- Wolters Kluwer N.V.

- Sovos Compliance, LLC

- Sailotech Pvt Ltd.

- HRB Digital LLC.

- Intuit, Inc.

- Vertex, Inc.

Key Market Developments

- On February 2023: Asure Software Inc., a provider of HR and payroll solutions for small businesses, and Intuit Turbotax teamed. The cooperation would accelerate tax refunds, reduce the number of errors, and speed up the employee's tax filing process.

- On February 2023: Avalara, Inc., A leader in cloud-based tax management software has just released "Avalara Property Tax," an automated property tax compliance solution for businesses and accountants that manages property tax compliance by minimizing errors through automation.

- On January 2023: Thomson Reuters paid USD 500 million for Sureprep LLC, an American tax software business. The acquisition aimed to deliver connected, automated, end-to-end tax workflow solutions to both firms' clients.

- Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2032. Spherical Insights has segmented the Global Tax Management Market based on the below-mentioned segments:

Tax Management Market, Component Analysis

- Software

- Services

Tax Management Market, Tax Type Analysis

- Indirect Tax

- Direct Tax

Tax Management Market, Deployment Mode Analysis

- On-premise

- Cloud

Tax Management Market, Organization Size Analysis

- Large Enterprise

- Small & Medium Size Enterprise

Tax Management Market, Industry Vertical Analysis

- Manufacturing

- BFSI

- Healthcare

- Retail & E-Commerce

- Telecom & IT

- Energy & Utility

- Media & Entertainment

- Others

Tax Management Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?