Global Taxi Sharing Software Market Size, Share, and COVID-19 Impact Analysis, By Type (Standalone Platform and Integrated), By Application (For Business, For Individuals, and For Schools), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Information & TechnologyGlobal Taxi Sharing Software Market Insights Forecasts to 2033

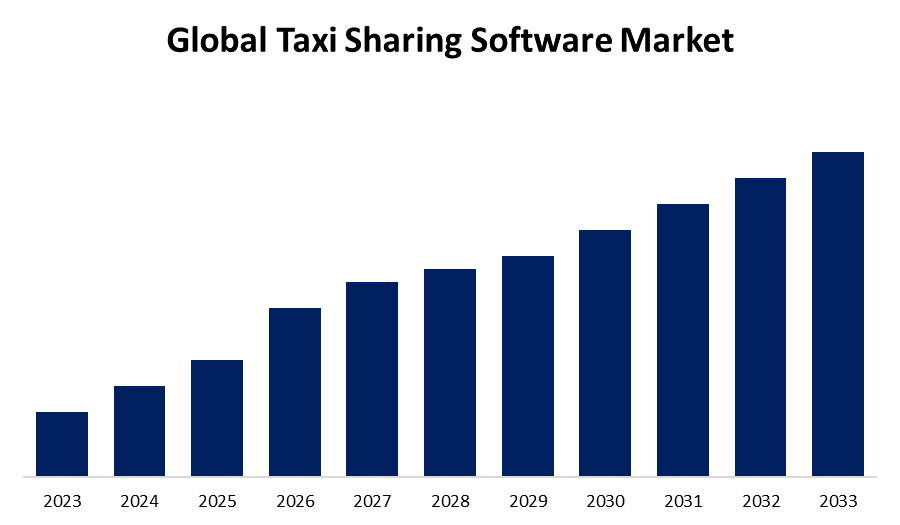

- The Global Taxi Sharing Software Market Size is expected to hold a significant share by 2023

- The Market Size is Growing at a CAGR of 9.97% from 2023 to 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Taxi Sharing Software Market Size is expected to Hold a Significant Share by 2033, at a CAGR of 9.97% during the forecast period 2023 to 2033. Taxi-sharing software has opportunities to significantly optimize route planning and lower operating costs with the development of autonomous vehicles.

Market Overview

A taxi-sharing software is made between a car owner and a user who enters the pickup and destination locations via an app or website. In simple mobile applications, taxi-sharing software links drivers and passengers in the area, improving route planning and cutting down on transportation expenses. Advanced features like GPS navigation, fare estimates, in-app purchases, real-time car tracking, and user rating systems are frequently included in the software. It makes it easier to identify and reserve rides, making the experience smooth for both drivers and passengers. For Instance, in August 2023, Uber, a taxi aggregator, launched "Group Rides," a new ride-sharing service for India that enables users to split fares with up to three other passengers traveling to the same location. The market for taxi-sharing software, which is driving the growth includes the sector that offers platforms and software solutions that enable ride-sharing services to customers going on similar routes or to comparable destinations.

Challenges

The regulatory challenges that the taxi sector must contend with in different authorities include safety regulations, licensing requirements, and resistance from established taxi services. Taxi-sharing websites manage private user information, and any privacy violations or problems could result in legal challenges as well as damage to the company's brand.

Report Coverage

This research report categorizes the taxi sharing software market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the taxi sharing software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the taxi sharing software market.

Global Taxi Sharing Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.97% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 227 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, and By Region |

| Companies covered:: | Carma Technology Corporation, Ola Share, Lyft Inc., Uber Technologies, Karos, Via Transportation Inc., BlaBlaCar, Waze Mobile, sRide., Wunder mobility, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for affordable transportation, increased environmental concerns, and improvements in mobile technology are the main factors driving the growth in taxi sharing software market. The market for taxi-sharing software is expanding quickly due to the growing need for shared mobility solutions. The market for taxi sharing software is anticipated to expand as a result of rising car ownership costs, growing demand from online taxi booking channels, and rising demand for ride-hailing and ride-sharing services. The market for taxi sharing software is also being propelled by low taxi fares and growing traffic congestion when compared to other forms of transportation.

Restraining Factors

The taxi sharing software market growth is restricted by several challenges, including as stringent government regulations, supply chain interruptions, and shifting consumer preferences.

Market Segmentation

The taxi sharing software market share is classified into type and application.

- The integrated segment is estimated to hold the largest market revenue share through the projected period.

Based on the type, the taxi sharing software market is classified into standalone platforms and integrated. Among these, the integrated segment is estimated to hold the largest market revenue share through the projected period. The software such as integrated into already-existing ride-hailing or transportation platforms, providing taxi-sharing as an extra function in addition to standard ride-hailing services.

- The for-business segment is anticipated to hold a significant market share through the forecast period.

Based on the application, the taxi sharing software market is divided into for business, for individuals, and for schools. Among these, the for-business segment is anticipated to hold a significant market share through the forecast period. Software solutions for taxi sharing are made to satisfy the transportation requirements of company clients and staff, providing economical and effective travel choices for business related tasks.

Regional Segment Analysis of the Taxi Sharing Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the taxi sharing software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the taxi sharing software market over the predicted timeframe. The demand for taxi-sharing services is driven by the North America market high smartphone adoption and established sharing economy. The market for taxi-sharing software in the US has a lot of room to grow due to new developments in technology, rising customer demand, and changing legal requirements.

Asia Pacific is expected to grow at the fastest CAGR growth of the taxi sharing software market during the forecast period. Asia Pacific is expanding quickly as a result of rising smartphone usage, urbanization, and government backing for shared mobility solutions. The industry within the Indian transportation sector includes many services offerings point-to-point transportation via taxi sharing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the taxi sharing software market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Carma Technology Corporation

- Ola Share

- Lyft Inc.

- Uber Technologies

- Karos

- Via Transportation Inc.

- BlaBlaCar

- Waze Mobile

- sRide.

- Wunder mobility

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, after a four-year hiatus, Ola Consumer relaunched ride-sharing on the Ola app to gain traction despite fierce competition from rivals Uber and Rapido. During Ola's annual product launch event, co-founder Bhavish Aggarwal announced the growth of the Taxi-sharing service.

- In June 2023, Uber Technologies launched trips in electric vehicles at the airport in Mumbai. The Mumbai airport is accessible to travelers via the Uber Green Taxi. The organization hopes to help lower carbon emissions and encourage environmentally friendly transportation throughout the city.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the taxi sharing software market based on the below-mentioned segments:

Global Taxi Sharing Software Market, By Type

- Standalone Platform

- Integrated

Global Taxi Sharing Software Market, By Application

- For Business

- For Individuals

- For Schools

Global Taxi Sharing Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the taxi sharing software market over the forecast period?The taxi sharing software market is projected to expand at a CAGR of 25.76% during the forecast period.

-

2. What is the market size of the taxi sharing software market?The Global Taxi Sharing Software Market Size is Expected to Grow from USD 99.96 Billion in 2023 to USD 988.75 Billion by 2033, at a CAGR of 25.76% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the taxi sharing software market?North America is anticipated to hold the largest share of the taxi sharing software market over the predicted timeframe.

Need help to buy this report?