Global Telecom Power Systems Market Size, Share, and COVID-19 Impact Analysis, By Component (Rectifiers, Inverters, Convertors, Controllers, Heat management systems, Generators, and Others), By Grid Type (On-grid, Off-grid, and Bad grid), By Power Rating (Below 10 kW, 10-20 kW, and Above 20 kW), By Power Source (Diesel-Battery Power Source, Diesel-Solar Power Source, Diesel-Wind Power Source, and Multiple Power Sources), By Technology (AC power systems and DC power systems), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: Electronics, ICT & MediaGlobal Telecom Power Systems Market Insights Forecasts to 2032

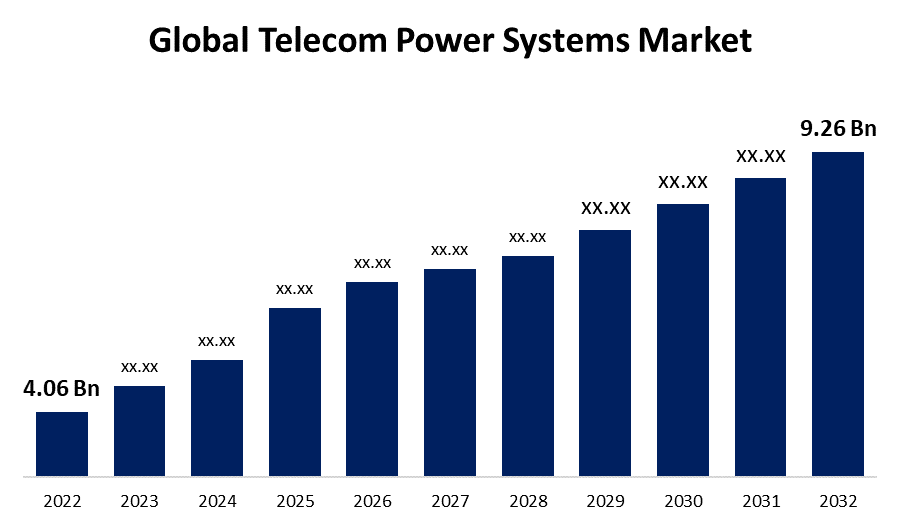

- The Global Telecom Power Systems Market Size was valued at USD 4.06 Billion in 2022.

- The Market is Growing at a CAGR of 8.6% from 2022 to 2032.

- The Worldwide Telecom Power Systems Market is expected to reach USD 9.26 Billion by 2032.

- Asia-Pacific is expected to Grow the fastest during Size the forecast period.

Get more details on this report -

The Global Telecom Power Systems Market Size is expected to reach USD 9.26 billion by 2032, at a CAGR of 8.6% during the forecast period 2022 to 2032.

Market Overview

Telecom power systems are critical infrastructures that provide reliable and uninterrupted power supply to telecommunication networks. These systems ensure the smooth operation of telecom equipment, including base stations, data centers, and switching centers, which are vital for communication services. They comprise components like rectifiers, batteries, power distribution units, and monitoring systems. Telecom power systems are designed to handle various power sources, such as grid power, solar panels, and generators, and offer backup power during outages. With their emphasis on efficiency, scalability, and remote management, these systems play a crucial role in maintaining the connectivity and functionality of modern telecommunications networks.

Report Coverage

This research report categorizes the market for telecom power systems market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the telecom power systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the telecom power systems market.

Global Telecom Power Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.06 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.6% |

| 2032 Value Projection: | USD 9.26 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Component, By Grid Type, By Power Rating, By Power Source, By Technology, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Eaton Corporation Inc., Huawei Technologies, Cummins Inc., ZTE Corporation, General Electric, Schneider Electric, Efore Group, Eltek AS, Delta Group, Alpha Technologies, ABB Group, Ascot Industrial S.R.L., Corning Incorporated, Unipower, Dynamic Power Group, Staticon, VoltServer, Vertiv Group |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers of telecom power systems include reliability, efficiency, scalability, and remote management. Reliability is crucial to ensure continuous and uninterrupted power supply to telecom equipment, even in adverse conditions. Efficiency is essential to reduce power consumption and operating costs, as well as minimize environmental impact. Scalability allows the systems to adapt to changing power requirements and accommodate network expansion. Remote management enables the real-time monitoring and control of power systems from a central location, improving uptime and reducing maintenance costs. These drivers are critical for meeting the demanding requirements of modern telecommunications networks, where connectivity and uptime are essential for delivering high-quality services.

Restraining Factors

The restraints of telecom power systems include cost considerations, limited infrastructure in remote areas, and environmental challenges. High costs associated with implementing and maintaining power systems pose a challenge for telecom operators. In remote areas, the lack of existing infrastructure and access to reliable power sources can hinder the deployment of power systems. Additionally, environmental challenges such as extreme weather conditions and regulatory requirements related to emissions and energy efficiency can impose constraints on the design and operation of telecom power systems.

Market Segmentation

- In 2022, the generator segment accounted for around 35.2% market share

On the basis of components, the global telecom power systems market is segmented into rectifiers, inverters, converters, controllers, heat management systems, generators, and others. The generator segment is dominating with the largest market share in 2022, due to the high demand for reliable backup power solutions in the telecommunications industry. Generators provide a dependable source of electricity during power outages or in regions with unreliable grid power. They offer immediate power supply to critical telecom equipment, ensuring uninterrupted communication services. The robustness, scalability, and quick response of generators make them a preferred choice for telecom operators, contributing to their dominance in the market.

- In 2022, the on-grid segment dominated with more than 42.5% market share

Based on grid type, the global telecom power systems market is segmented into the on-grid, off-grid, and bad grid. Out of this, the on-grid is dominating the market with the largest market share in 2022, due to the widespread availability and reliability of grid power in developed regions. On-grid power systems utilize grid power as the primary source of electricity, with backup power options like generators and batteries. The convenience and cost-effectiveness of on-grid solutions make them a preferred choice for telecom operators in areas with stable grid power supply. Additionally, the increasing adoption of renewable energy sources like solar panels and wind turbines in on-grid systems is expected to further drive their growth in the coming years.

Regional Segment Analysis of the Telecom Power Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific dominated the market with more than 34.7% revenue share in 2022.

Get more details on this report -

Based on region, Asia-Pacific is expected to witness substantial growth in the forecast period in the telecom power systems market. The region's increasing population, rapid urbanization, and growing demand for mobile communication services are key drivers of this growth. With emerging economies like China and India experiencing significant telecom infrastructure development, there is a rising need for reliable power systems to support expanding networks. Moreover, the deployment of 5G technology and the increasing penetration of smartphones are fueling the demand for robust and efficient power solutions. The growing focus on renewable energy integration and the presence of key market players in the region further contribute to the projected growth of the Asia-Pacific telecom power systems market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global telecom power systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Eaton Corporation Inc.

- Huawei Technologies

- Cummins Inc.

- ZTE Corporation

- General Electric

- Schneider Electric

- Efore Group

- Eltek AS

- Delta Group

- Alpha Technologies

- ABB Group

- Ascot Industrial S.R.L.

- Corning Incorporated

- Unipower

- Dynamic Power Group

- Staticon, VoltServer

- Vertiv Group

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2022, Huawei introduced a new addition to its network solution by launching a 50 Gbps E band solution designed to fulfill ultra-high bandwidth requirements in urban areas. This solution can offer a transmission range up to 50% greater than other available industry solutions, thereby saving network energy across all bands and facilitating the expansion of 5G networks.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global telecom power systems market based on the below-mentioned segments:

Telecom Power Systems Market, By Component

- Rectifiers

- Inverters

- Convertors

- Controllers

- Heat management systems

- Generators

- Others

Telecom Power Systems Market, By Grid Type

- On-grid

- Off-grid

- Bad grid

Telecom Power Systems Market, By Power Rating

- Below 10 kW

- 10-20 kW

- Above 20 kW

Telecom Power Systems Market, By Power Source

- Diesel-Battery Power Source

- Diesel-Solar Power Source

- Diesel-Wind Power Source

- Multiple Power Sources

Telecom Power Systems Market, By Technology

- AC power systems

- DC power systems

Telecom Power Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?