Global Terminal Tractor Market Size, Share, and COVID-19 Impact Analysis, By Type (Manual, Automated), By Propulsion (Diesel, Electric, Hybrid, CNG), By Tonnage (Less than 50 Ton, 50-100 Ton, and More than 50 Ton), By Application (Airport, Marine Port, Oil & Gas, Warehouse & Logistics, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Automotive & TransportationGlobal Terminal Tractor Market Insights Forecasts to 2032

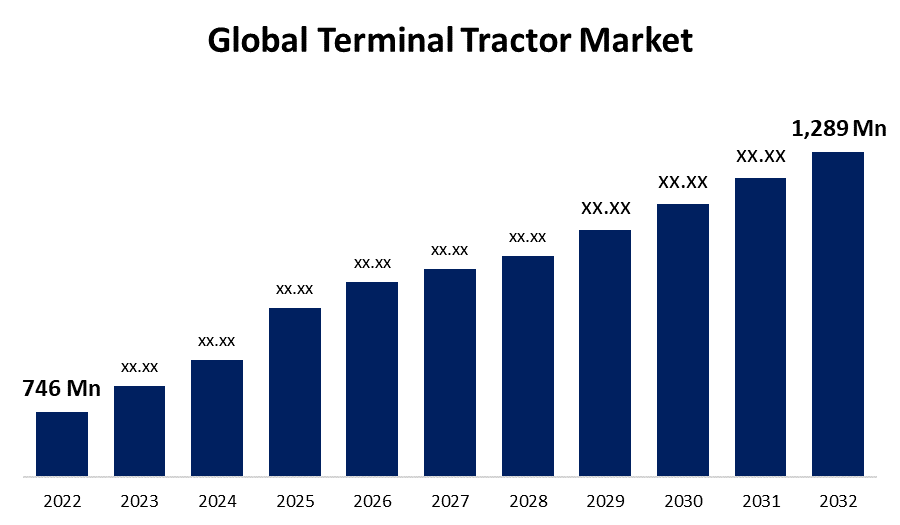

- The Global Terminal Tractor Market Size was valued at USD 746 Million in 2022.

- The Market is Growing at a CAGR of 5.6% from 2022 to 2032

- The Worldwide Terminal Tractor Market Size is expected to reach USD 1,289 Million by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Terminal Tractor Market Size is expected to reach USD 1,289 Million by 2032, at a CAGR of 5.6% during the forecast period 2022 to 2032.

A terminal tractor is a type of vehicle developed specially to transport semi-trailers around the grounds of a manufacturing plant, warehouse, receiving facility, or container station. Terminal tractors are sometimes referred to as yard hostlers, yard jockeys, spotter trucks, and shunt trucks. Terminal tractors provide an important function in a variety of industries. They resemble enormous freight vans seen on the road. Terminal tractors, on the other hand, are only intended for usage near a cargo plot or hayloft. Although certain versions are the Department of Transport certified, they are rarely seen on public roadways. These tractors offer exceptional motility, short turnaround times, unparalleled dependability, and the capacity to move large products easily. Terminal tractors are three to ten times more productive than truck transportation at hauling trailers and/or containers because of increased motility, particularly in small places. The highly expanding e-commerce market, major expenditures in the manufacturing sector, particularly in developing nations, and a steady increase in automotive production in Asian countries are among the primary drivers expected to contribute to market demand as well as expansion over the forecast period.

Global Terminal Tractor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 746 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.6% |

| 2032 Value Projection: | 1,289 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Propulsion, By Tonnage, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Konecranes, Capacity Trucks, Terberg Special Vehicles, Kalmar, TICO Tractors, Hyster-Yale Group, Hoist Liftruck, Sany Group, CVS Ferrari, Toyota Material Handling, Jungheinrich, Crown, Equipment Corporation, Orange EV and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased demand for efficient transportation of cargo operations at ports, terminals, and logistics facilities has boosted the worldwide terminal tractor market. Because of the increasing volume of cargo transit globally, terminal tractors are critical in optimizing processes, reducing delays, and maximizing the transfer of goods. In addition, the ability to transport cargo trailers or containers quickly and safely increases the demand for terminal tractors, boosting output and reliability in distribution centers. Also, rising automation in the warehouse and transportation sector is a major driver driving the growth of the terminal tractor market. Moreover, the expansion of new avenues for sales for instance e-Commerce is likely to generate several prospects for the terminal tractor market to flourish, because these innovations enable better productivity and operational engagement.

Additionally, regulatory framework and requirements have a considerable impact on the terminal tractor industry. To decrease fatalities and increase operating safety, terminal tractors have anti-collision systems, radar, cameras, sensors, and advanced driver assistance systems (ADAS). Globally, the inclusion of safety-enhancing solutions and compliance with safety criteria are major considerations affecting vehicle operators' and facility operators' purchase decisions. Furthermore, major end-user groups and terminal tractor manufacturers place a high priority on the research and development, and adoption of low-emission, higher-efficiency terminal tractors.

Market Segmentation

By Type Insights

The manual segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global terminal tractor market is segmented into the manual and automated. Among these, the manual segment is dominating the market with the largest revenue share of 83.6% over the forecast period. Human operators work through the inadequacies of every component of equipment or manage anomalies in operational processes, allowing manual terminal tractors to operate even when machines cannot operate in ideal conditions. On the other hand, automated equipment must run flawlessly to avoid becoming a bottleneck in the terminal's efficiency. In a manual terminal tractor, changing or repairing a single component or machine has a modest impact on terminal performance.

By Propulsion Insights

The hybrid segment is witnessing significant CAGR growth over the forecast period.

On the basis of propulsion, the global terminal tractor market is segmented into diesel, electric, hybrid, and CNG. Among these, the hybrid is witnessing significant CAGR growth over the forecast period. These terminal tractors have a diesel engine as well as renewable energy storage technology, which helps to boost fuel consumption and minimize emissions. The popularity of hybrid terminal tractors is growing because they provide the appropriate degree of performance while reducing fuel usage and carbon emissions. Hybrid technology is expected to enhance vehicle fuel efficiency. Several firms are developing or have built hybrid terminal trucks.

By Tonnage Insights

The more than 50 Ton segment is expected to hold the largest share of the Global Terminal Tractor Market during the forecast period.

Based on the tonnage, the global terminal tractor market is classified into less than 50 Tons, 50-100 Tons, and more than 50 Tons. Among these, the more than 50 Ton segment is expected to hold the largest share of the terminal tractor market during the forecast period. Terminal tractors of varying tonnages are available from a variety of companies. The empty containers are organized at port terminals and in the logistics company operations utilizing terminal tractors with a payload capacity of 50 tonnes. Because more big containers (those weighing more than 20 tons) are being moved at port terminals, the demand for terminal tractors with a tonnage capacity of fewer than 50 tonnes have driven up.

By Application Insights

The warehouse & logistics segment accounted for the largest revenue share of more than 41.7% over the forecast period.

On the basis of application, the global terminal tractor market is segmented into airports, marine ports, oil & gas, warehouse & logistics, and others. Among these, the warehouse & logistics segment is dominating the market with the largest revenue share of 41.7% over the forecast period. Terminal tractors are purpose-built to give the capabilities required in warehouse and logistics applications. Terminal tractors are vehicles that are specifically built for transporting and shifting huge trailers and containers in commercial settings such as airports, seaports, warehouses, and logistics facilities. These machines include modern technologies and imaginative designs to assist the user.

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. E-commerce is the most rapidly expanding business and a major driver of North America's enormous market for these automobiles. Manufacturers in the United States are making investments in new equipment, particularly labor-saving automation solutions, to assist reduce the reliance on and expense of material handling labor. As a result, the region's terminal tractor market is being driven by rising demand from the transportation and e-commerce industries. Furthermore, the advancement of sophisticated technologies and automation in the terminal tractor market, as well as increased labor productivity and less human error, are expected to drive the terminal tractor market in the United States forward.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. The growth of the market is attributed to an increase in demand for terminal tractors in the storage and transportation industry. Terminal tractors transport trailers and containers within and around warehouses, ports, and distribution facilities. In addition, due to the increased demand from e-commerce, the marketplace for terminal tractors is developing rapidly in the region. As e-commerce companies grow their operations, there is a greater need for terminal tractors to transfer manufactured products from warehouses to distribution centers.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period, because of the strong economics of European nations such as Germany, the United Kingdom, and Spain, as well as the availability of key terminal tractor manufacturers. Furthermore, automation technologies are widely used in this region. Automation-enhanced equipment boosts production. The overall number of unmanned terminals in this region is predicted to rise, fueling the expansion of the terminal tractors market over the forecast period.

List of Key Market Players

- Konecranes

- Capacity Trucks

- Terberg Special Vehicles

- Kalmar

- TICO Tractors

- Hyster-Yale Group

- Hoist Liftruck

- Sany Group

- CVS Ferrari

- Toyota Material Handling

- Jungheinrich

- Crown

- Equipment Corporation

- Orange EV

Key Market Developments

- On March 2023, TICO has collaborated with Volvo Penta to connect the Pro-Spotter Electric (EV unit) with their proven driveline, batteries, and e-accessories found throughout the Volvo Group. The EV truck, the most recent TICO innovation, combines the power and durability of the TICO Pro-Spotter truck with the Volvo Group's proven electric design, reliability, and components.

- On January 2023, Kalmar, a Cargotec subsidiary, is partnering with Toyota Tsusho America and Ricardo on the development of fuel-cell-powered terminal tractors. Ricardo plc, based in the United Kingdom, is in charge of designing, integrating, and assembling the fuel cells for the Kalmar Ottawa platform. Fuel-cell-powered terminal tractors will provide Kalmar clients with extended operating uptime and eliminate the requirement for new investments in electrical grid infrastructure when compared to battery-powered options.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Terminal Tractor Market based on the below-mentioned segments:

Terminal Tractor Market, Type Analysis

- Manual

- Automated

Terminal Tractor Market, Propulsion Analysis

- Diesel

- Electric

- Hybrid

- CNG

Terminal Tractor Market, Tonnage Analysis

- Less than 50 Ton

- 50-100 Ton

- More than 50 Ton

Terminal Tractor Market, Application Analysis

- Airport

- Marine Port

- Oil & Gas

- Warehouse & Logistics

- Others

Terminal Tractor Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Terminal Tractor market?The Global Terminal Tractor Market is expected to grow from USD 746 million in 2022 to USD 1,289 million by 2032, at a CAGR of 5.6% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Konecranes, Capacity Trucks, Terberg Special Vehicles, Kalmar, TICO Tractors, Hyster-Yale Group, Hoist Liftruck, Sany Group, CVS Ferrari, Toyota Material Handling, Jungheinrich, Crown, Equipment Corporation, Orange EV.

-

3. Which segment dominated the Terminal Tractor market share?The warehouse & logistics segment in application type dominated the Terminal Tractor market in 2022 and accounted for a revenue share of over 41.7%.

-

4. Which region is dominating the Terminal Tractor market?North America is dominating the Terminal Tractor market with more than 38.7% market share.

-

5. Which segment holds the largest market share of the Terminal Tractor market?The manual segment based on type holds the maximum market share of the Terminal Tractor market.

Need help to buy this report?