Global Textile Chemicals Market Size, Share, Growth, and Industry Analysis, By Type (Coating and Sizing Chemicals, Colorants and Auxiliaries, Finishing Agents, Desizing Agents), By Fiber Type (Natural, Synthetic), By Application (Apparel, Home Furnishing, Automotive Textile, Industrial Textile), and Regional Textile Chemicals and Forecast to 2033

Industry: Chemicals & MaterialsGlobal Textile Chemicals Market Insights Forecasts to 2033

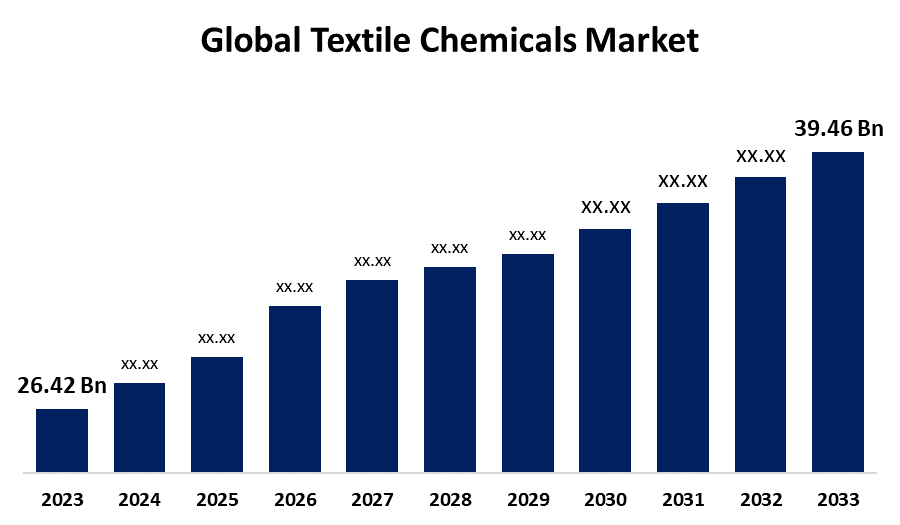

- The Global Textile Chemicals Market Size Was Valued at USD 26.42 Billion in 2023

- The Market Size is Growing at a CAGR of 4.09 % from 2023 to 2033

- The Worldwide Textile Chemicals Market Size is Expected to Reach USD 39.46 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Textile Chemicals Market Size is Anticipated to Exceed USD 39.46 Billion by 2033, Growing at a CAGR of 4.09 % from 2023 to 2033.

TEXTILE CHEMICALS MARKET REPORT OVERVIEW

Textile chemicals are compounds utilized in textiles to boost productivity. Textile chemicals are composed of different chemical compounds that are utilized at different stages of the production and assembly of textiles. These chemicals are important as they improve the look, feel, and performance of clothing. They are used in pre-treatment, dyeing, printing, and finishing processes to attain desired properties like color fastness, resilience, repellent to water, and flame resistance. Materials such as wool, flax, silk, cotton, bamboo, and hemp can be considered natural textiles, while materials like acrylic, nylon, rayon, spandex, and polyester are instances of synthetic textiles. Textiles with chemical finishes can be made much more wearable, attractive, and functional. For dyeing textiles, both knit and woven, chemicals are the most crucial ingredients. The application of chemicals to textiles has grown into a highly specialized business that uses a broad range of organic and inorganic chemicals to provide textiles with decorative and functional qualities. The development of chemistry formulations for customized applications in textile production has advanced significantly over the forecast period and it is expected that this trend will continue. In the textile business, detergents are frequently employed as cleaning and wetting agents. All textiles can be soaped and sized, as well as oil and sizing ingredients can be removed using textile detergent. This results in excellent soaping fastness. In the textile business, caustic soda is frequently used for dyeing and scouring procedures. The fabric's molecules are activated by soda, which raises pH and level and improves color absorption as a result colors get more vibrant and durable.

Report Coverage

This research report categorizes the market for the global textile chemicals market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global textile chemicals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global textile chemicals market.

Global Textile Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 26.42 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.09 % |

| 023 – 2033 Value Projection: | USD 39.46 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Fiber Type, By Application |

| Companies covered:: | Govi N.V., Huntsman International LLC, Kemira Oyj, Kiri Industries Ltd., LANXESS, OMNOVA Solutions Inc., Omya United Chemicals, Organic Dyes and Pigments, Resil Chemicals Pvt. Ltd., Solvay S.A, The Lubrizol Corporation, Evonik Industries AG., Fibro Chem, LLC, German Chemicals Lt, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

DRIVING FACTORS:

The growing consumer demand for premium, versatile clothing could boost industry expansion.

The development of technical textiles utilized in the building, automotive, and healthcare sectors is largely dependent on innovative products that offer certain performance qualities necessary for these sectors. As a result, these products are essential to advancing society and satisfying the changing demands of the world textile market. They make it possible for clothes production advances to occur, like eco-friendly finishes and dyes that promote sustainability objectives. To stimulate market growth, the government is putting in place several policy initiatives and programs, such as the Scheme for Integrated Textile Parks (SITP) and the Scheme for Additional Grants for Apparel Manufacturing Units under SITP (SAGAM).

RESTRAINING FACTORS

The disposal of textile effluent is governed by stringent environmental regulations and poses health risks.

The production process releases hazardous chemicals into the environment, which has a detrimental effect on human health and limits market expansion. Additionally, several regulatory regulations about the use of textile chemicals are anticipated to impede the market's expansion. These hazardous chemicals can lead to skin and respiratory disorders if the right safety measures are not followed during textile processing. Due to this, they are governed by stringent laws, which is a major barrier to the market's growth.

Market Segmentation

The textile chemicals market share is classified into type, fiber type, and application.

The coating and sizing chemicals segment has the highest share of the market during the forecast period.

Based on type, the textile chemicals are classified into coating and sizing chemicals, colorants and auxiliaries, finishing agents, and desizing agents. With the largest revenue share, coating and sizing chemicals dominated the market. This large portion is brought on by the growing markets for geotextiles, automotive, outdoor apparel, and aerospace. There will be a rise in the demand for sizing chemicals worldwide to ensure proper fabric size during the finishing process throughout the projection period. The most well-known natural pastes are made of gelatin, wheat, corn, and dextrin. Water-soluble polymers, which are also called textile-sizing chemicals or agents, are used to shield strands from mechanical stress during the weaving process. Coatings and sizing agents assist producers in fulfilling these demands. Furthermore, coatings and sizing compounds enhance the physical characteristics of textiles, including their resilience to abrasion, strength, and water repellency. As a result, the materials are better suited for a wider range of uses, including industrial and fashion.

The synthetic fiber segment is expected to boost the market growth over the forecast period.

Based on fiber type, the textile chemicals are classified into natural and synthetic. Synthetic fibers make up almost half of total fiber utilization. Synthetic fibers are easily dyed and more resilient than the majority of natural fibers. Additionally, a lot of synthetic textiles have user-friendly qualities including stain resistance, flexibility, and waterproofing. The most common synthetic fiber, polyester, is used to make various kinds of clothes as well as to reinforce belts, hoses, and tires. Synthetic fibers derived from nylon are widely used in the automobile and home furnishings industries. The rapidly growing population is expected to drive up consumer interest in home furnishings including carpets, upholstery, blankets, and bed linens, among other items. This will certainly contribute to the positive expansion of synthetic fiber. the Market Development Assistance (MDA) scheme, exporters can get financial support from the Indian Synthetic and Rayon Textile Export Promotion Council. exporters can get funding for project development, research, marketing, and capacity building under the market access initiative (MAI).

The apparel segment has the biggest market share throughout the forecast period.

Based on application, the textile chemicals are classified into apparel, home furnishing, automotive textile, industrial textile. The textile industry is largely composed of the apparel manufacturing sector, both in terms of volume and value. A range of chemicals are needed for this massive production to carry out tasks including dyeing, finishing, and sizing. Furthermore, particular chemical treatments are needed for the various fabric types (natural, synthetic, and blended) used in the manufacturing of clothing to obtain desirable qualities like color fastness, softness, water resistance, and durability. Several reasons need for textile chemicals in the manufacturing of technological textiles is rising quickly. Technical textiles are made for specialized uses outside of clothing, like industrial, automotive, construction, and healthcare applications.

Regional Segment Analysis of the Global Textile Chemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

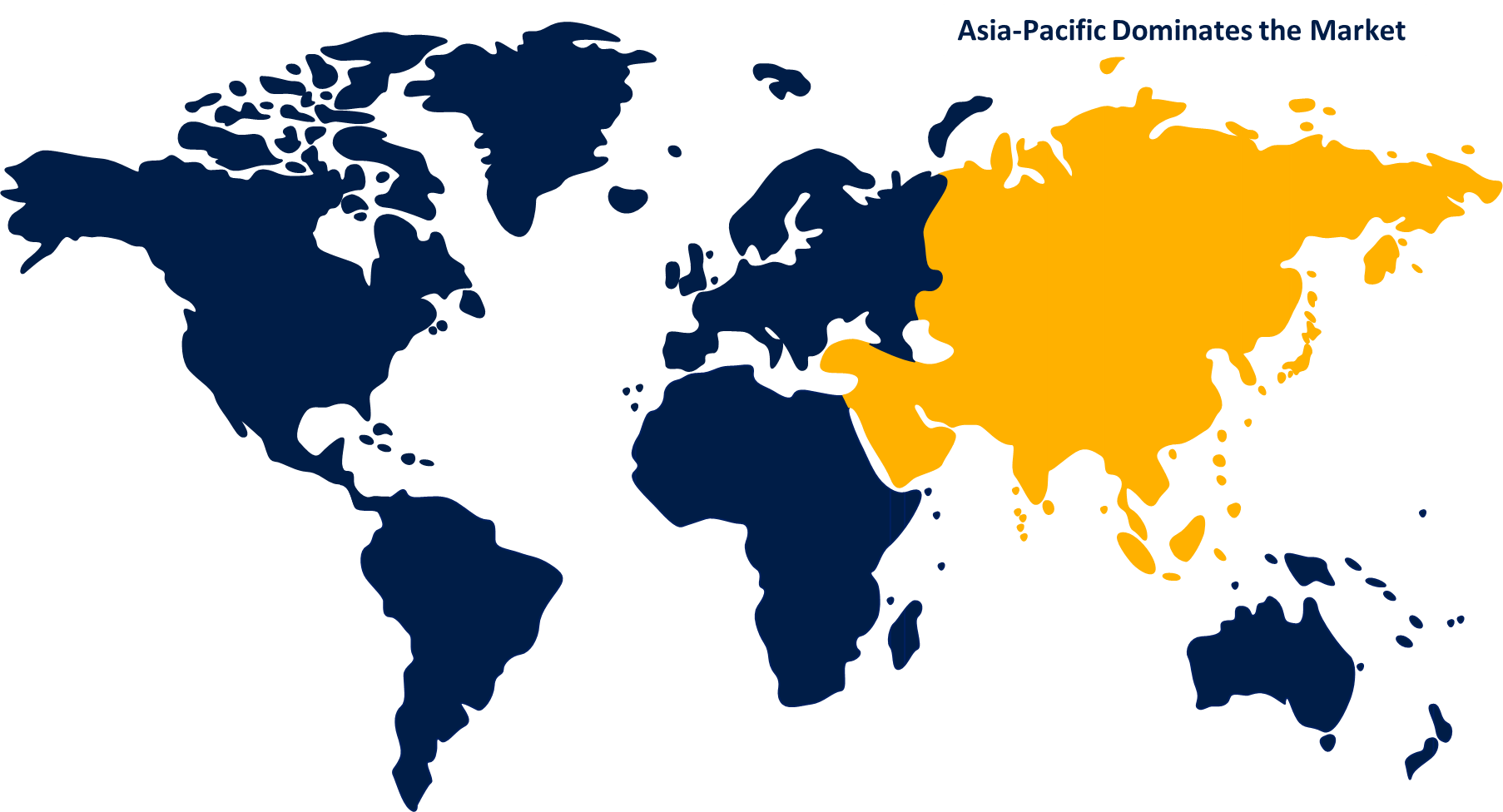

Asia-Pacific is having the biggest share of the textile chemicals market throughout the forecast period.

Get more details on this report -

Asia Pacific is expected to be the most profitable region for textile chemicals. The region's growth can be attributed to the broad demand for textiles from growing nations like China and India, which are known for their clothing and home furnishings industries. The chemical sector is also expanding as a result of supportive government activities in the area. The "Make in India" campaign in India is expected to have a significant impact on the nation's transformation into a center for the manufacturing of chemicals, especially specialized chemicals. The market is also being driven by government incentives to small-sized enterprises and the establishment of several manufacturing routes in Asia Pacific that are comparatively low-cost, like Vietnam, Bangladesh, and Indonesia.

The Europe is fastest growing region over the projected timeframe.

European textile industry and chemical innovation have an extensive record of influencing the textile chemicals market. Research and development are prioritized to provide novel textile chemicals that improve the functionality, durability, and performance of products. The market is expanding as a result of advancements in fields including sustainable chemistry, nanotechnology applications, and dyeing technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global textile chemicals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Govi N.V.

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd.

- LANXESS

- OMNOVA Solutions Inc.

- Omya United Chemicals

- Organic Dyes and Pigments

- Resil Chemicals Pvt. Ltd.

- Solvay S.A

- The Lubrizol Corporation

- Evonik Industries AG.

- Fibro Chem, LLC

- German Chemicals Lt

- Others

Key Market Developments

- In January 2024, the well-known innovator in sustainable textile finishes, Devan Chemicals, is thrilled to announce that be attending Heimtextil 2024. Devan cordially welcomes guests to visit booth A21 in Hall 11.0 to see firsthand the newest sustainable textile finishes that the company has created.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global textile chemicals market based on the below-mentioned segments:

Global Textile Chemicals Market, By Type

- Coating and Sizing Chemicals

- Colorants and Auxiliaries

- Finishing Agents

- Desizing Agents

Global Textile Chemicals Market, By Fiber Type

- Natural

- Synthetic

Global Textile Chemicals Market, By Application

- Apparel

- Home Furnishing

- Automotive Textile

- Industrial Textile

Global Textile chemicals Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global textile chemicals market over the forecast period?The global textile chemicals market size is expected to grow from USD 26.42 Billion in 2023 to USD 39.46 Billion by 2033, at a CAGR of 4.09 % during the forecast period 2023-2033.

-

1.What is the CAGR of the global textile chemicals market over the forecast period?Asia-Pacific is projected to hold the largest share of the global textile chemicals market over the forecast period.

-

3.Who are the top key players in the textile chemicals market?Govi N.V, Huntsman International LLC, Kemira Oyj, Kiri Industries Ltd.LANXESS, OMNOVA Solutions Inc, Omya United Chemicals, Organic Dyes and Pigments, Resil Chemicals Pvt. Ltd, Solvay S.A, The Lubrizol Corporation, Evonik Industries AG, Fibro Chem, LLC, German Chemicals Lt, and Others.

Need help to buy this report?