Global Thermal Energy Storage Market Size, Share, and COVID-19 Impact Analysis, By Technology (Sensible Heat Storage, Latent Heat Storage, and Thermochemical Storage), Storage Material (Water, Molten Salts, Phase Change Materials, and Others), By End User (Utilities, Commercial, and Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Thermal Energy Storage Market Insights Forecasts to 2033

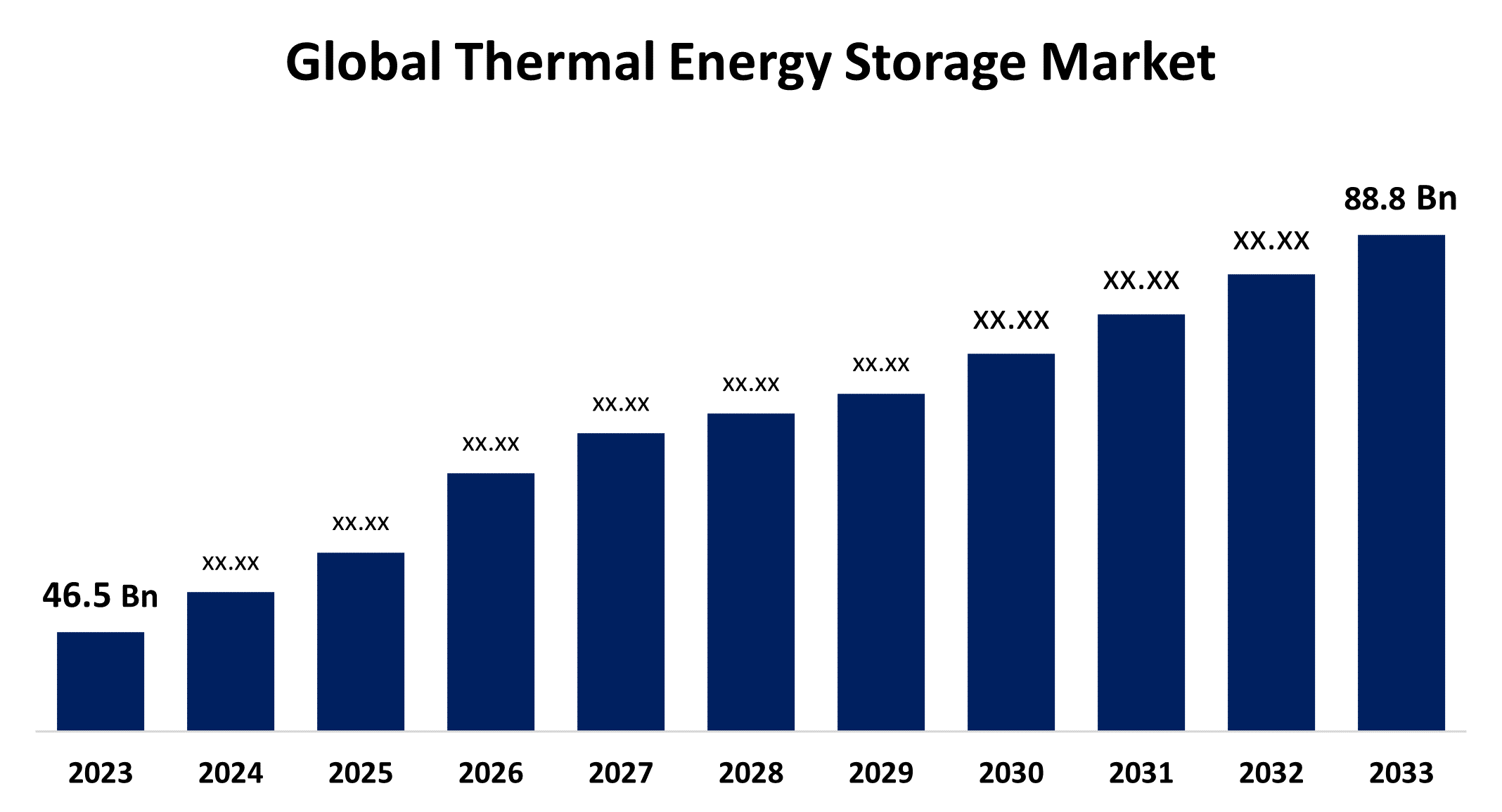

- The Global Thermal Energy Storage Market Size was Valued at USD 46.5 Billion in 2023

- The Market Size is Growing at a CAGR of 6.68% from 2023 to 2033

- The Worldwide Thermal Energy Storage Market Size is Expected to Reach USD 88.8 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Thermal Energy Storage Market Size is Anticipated to Exceed USD 88.8 Billion by 2033, Growing at a CAGR of 6.68% from 2023 to 2033.

Market Overview

Thermal energy storage (TES) is a technology that stores energy as heat or cold in a material, rather than as electricity, and uses it later when needed. This can help balance energy supply and demand, improve energy system efficiency, and integrate renewable energy sources. TES can also help buildings be more flexible, adaptable, and sustainable, and can reduce costs.

According to U.S. Department of Energy, The U.S. government has undertaken the ambitious goal of creating a carbon-pollution-free power sector by 2035 and a net-zero-emissions economy by 2050. Energy storage will undoubtedly play a key role in helping to achieve these objectives and will take on an increasingly important role in the U.S. energy ecosystem. In addition to the U.S. government’s climate goals, the growth of electric vehicle usage, increased deployment of variable renewable generation, and declining costs of storage technologies are among other drivers of expected future growth of the energy storage market. By 2030 global energy storage markets are estimated to grow by 2.5–4 terawatt-hours annually.

On September 21, 2023, the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) announced the FY23 Solar-thermal Fuels and Thermal Energy Storage Via Concentrated Solar-thermal Energy funding opportunity (FOA). This FOA will award up to USD 30 million for research, development, and demonstration projects in thermochemical storage via solar fuel production and local thermal energy storage (TES) for dispatchable energy. This opportunity will help advance the goals of achieving carbon pollution-free electricity by 2035 and to deliver an equitable, clean energy future to put the United States on a path to achieve net-zero emissions, economy-wide, by no later than 2050.

Report Coverage

This research report categorizes the market for thermal energy storage based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the thermal energy storage market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the thermal energy storage market.

Global Thermal Energy Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 46.5 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.68% |

| 2033 Value Projection: | USD 88.8 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By End User, By Region |

| Companies covered:: | Abengoa S.A., Baltimore Aircoil Company, Burns & McDonnell, Caldwell Energy Company, CALMAC, Deepchill Solutions Inc., DN Tanks, Dunham-Bush Limited, EVAPCO, Inc., FAFCO, Inc., Goss Engineering, Inc., McDermott, New BrightSource, Ltd., Siemens Gamesa Renewable Energy, S.A., Steffes, LLC, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need for electricity, district heating and cooling, and intelligent infrastructure heating and cooling is on the rise. There is a growing demand for renewable energy sources, and thermal energy storage can serve as an alternative to fossil fuels. Governments, associations, and universities worldwide are actively investing in research and development to create innovative storage solutions with minimal or zero environmental impact. Ongoing research and development are also focused on integrating thermal energy storage techniques into building structures by utilizing phase change materials in air vents and plasters. Technological advancements, such as ice-based technology, investments in smart city development, and the commercialization of concentrated solar power (CSP) plants, are significantly driving the market.

Restraining Factors

Infrastructure and equipment like control systems, heat exchangers, insulation, and storage tanks are necessary for storing thermal energy, adding to the complexity. High upfront costs, especially in regions with limited access to financial incentives or government support, could deter potential investors and project developers from pursuing thermal energy storage projects. The large amount of stored thermal energy poses potential risks and hazards to human safety. These significant barriers may impede the market's growth.

Market Segmentation

The thermal energy storage market share is classified intotechnology, storage material, and end user.

- The sensible heat storage segment is estimated to hold the highest market revenue share through the projected period.

Based on the technology, the thermal energy storage market is classified into sensible heat storage, latent heat storage, and thermochemical storage. Among these, the sensible heat storage segment is estimated to hold the highest market revenue share through the projected period. This is because sensible heat storage is the simplest and most economical way of storing thermal energy, which stores the heat energy in its sensible heat capacity under the change in temperature. For e.g., water can store heat energy either by raising its temperature or changing its phase, but it is known as sensible heat when it stores energy due to rising temperature. Sensible heat storage is one of the most common applications due to its feasibility and simplicity. The mechanism is based on heat that is charged into the system to modify the temperature of a storage medium without changing its phase. The absorption and release occur via radiation, conduction, and convection. Sensible heat storage often has a low energy density and prone to thermal energy runaway

- The molten salts segment is anticipated to hold the largest market share through the forecast period.

Based on the storage material, the thermal energy storage market is divided into water, molten salts, phase change materials, and others. Among these, the molten salts segment is anticipated to hold the largest market share through the forecast period. A phase-changing substance that is commonly used for thermal energy storage is called molten salt. Molten salt thermal energy storage systems are ideal for these kinds of uses because molten salt thermal energy storage systems enable continuous power generation. Because molten salt thermal energy storage technology provides a clean and sustainable energy storage solution, there has been a larger adoption of this technology as the energy sector works to reduce its carbon footprint and greenhouse gas emissions. Furthermore, there is a demand for more economical and effective energy storage solutions, which molten salt thermal energy storage, can offer due to the growing costs of conventional energy sources like fossil fuels. Lastly, the industry has grown as a result of developments in molten salt thermal energy storage technology, which includes better materials, system designs, and interaction with other energy systems. These developments have also made the technology more appealing and viable for a variety of applications

- The utilities segment dominates the market with the largest market share through the forecast period.

Based on the end user, the thermal energy storage market is divided into utilities, commercial, and industrial. Among these, the utilities segment dominates the market with the largest market share through the forecast period. This dominance is driven by several factors, including the increasing demand for efficient energy management solutions, the growing integration of renewable energy sources, and the need to balance supply and demand on the grid. Utilities leverage thermal energy storage systems to store excess energy during off-peak hours and release it during peak demand, enhancing grid stability and reducing energy costs. Additionally, the adoption of advanced technologies and supportive government policies further strengthens the position of the utilities segment in the thermal energy storage market.

Regional Segment Analysis of the Thermal Energy Storage Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

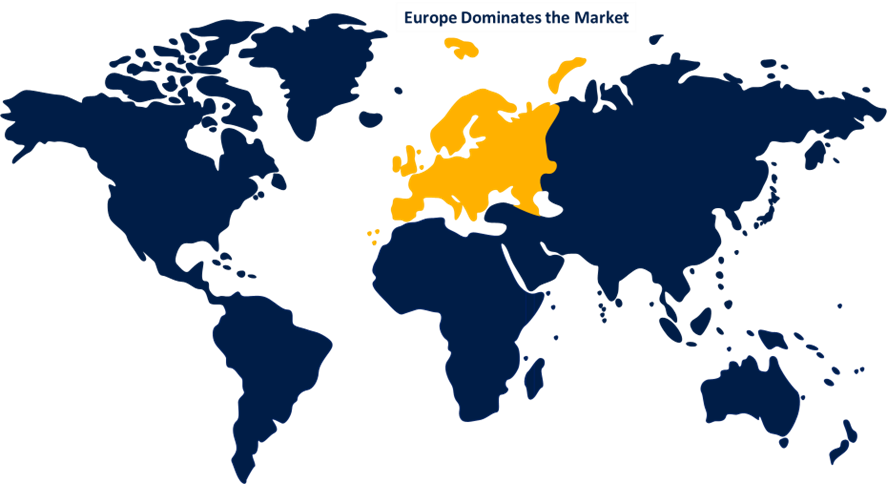

Europe is anticipated to hold the largest share of the thermal energy storage market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the thermal energy storage market over the predicted timeframe. The deployment of renewable energy technologies, such as concentrated solar power (CSP) plants, which frequently thermal energy storage systems, has received significant investment and policy support from the European Union due to its ambitious climate and renewable energy targets. One such target is to achieve net-zero emissions by 2050. Thermal energy storage is in high demand to facilitate the grid integration of solar electricity because countries like Germany, Spain, and Italy have been at the forefront of CSP development in Europe. The region's dominance in this sector has also been aided by Europe's well-established ecosystem for research and development, which includes a large number of technical institutes and pilot projects aimed at developing solutions for thermal energy storage. According to European Association for Storage of Energy, with renewable energy projected to constitute 69% of the EU's electricity mix by 2030, TES emerges as a crucial solution to address energy demand, grid stability, and decarbonization challenges. As Europe steers towards a carbon-neutral future, TES is positioned to bridge the gap between the current energy landscape and the renewable energy targets set for 2030 and 2050. TES technologies are set to play an integral role in Europe's transition to renewable energy dominance, offering longer-duration storage solutions and reducing reliance on fossil fuels.

Asia Pacific is expected to grow at the fastest CAGR growth of the thermal energy storage market during the forecast period. Rapid industrialization and urbanization across countries like China, India, and Japan are driving energy demand, leading to increased investments in energy storage solutions to ensure grid stability and efficiency. Additionally, government initiatives promoting renewable energy integration, coupled with rising awareness about energy conservation, are propelling the adoption of thermal energy storage systems in the region. The growing emphasis on reducing carbon emissions and enhancing energy security further supports the market's robust growth prospects in Asia-Pacific. Countries with high solar irradiance, such as China and India, are leading in CSP developments. The rising energy demand in Asia-Pacific countries is driving the adoption of TES systems to enhance grid stability, manage peak loads, and improve overall energy efficiency. Rapid urbanization and industrialization contribute significantly to this increased demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the thermal energy storage market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abengoa S.A.

- Baltimore Aircoil Company

- Burns & McDonnell

- Caldwell Energy Company

- CALMAC

- Deepchill Solutions Inc.

- DN Tanks

- Dunham-Bush Limited

- EVAPCO, Inc.

- FAFCO, Inc.

- Goss Engineering, Inc.

- McDermott

- New BrightSource, Ltd.

- Siemens Gamesa Renewable Energy, S.A.

- Steffes, LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2024, Saudi Arabian oil firm Aramco entered into a memorandum of understanding (MOU) with Rondo Energy, a thermal energy storage company, following an equity investment.

- In May 2024, EPRI, in collaboration with Southern Company and Storworks, recently completed testing of a pilot concrete thermal energy storage (CTES) system at Alabama Power’s Ernest C. Gaston Electric Generating plant (Gaston) marking the largest such pilot in the world. The technology was developed by Storworks.

- In April 2024, Vantaa Energy plans to construct a 90 GWh thermal energy storage facility in underground caverns in Vantaa, near Helsinki. It said it would be the world’s largest seasonal energy storage site by all standards upon completion in 2028.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the thermal energy storage market based on the below-mentioned segments:

Global Thermal Energy Storage Market, By Technology

- Sensible Heat Storage

- Latent Heat Storage

- Thermochemical Storage

Global Thermal Energy Storage Market, By Storage Material

- Water

- Molten Salts

- Phase Change Materials

- Others

Global Thermal Energy Storage Market, By End User

- Utilities

- Commercial

- Industrial

Global Thermal Energy Storage Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the thermal energy storage market over the forecast period?The thermal energy storage market is projected to expand at a CAGR of 6.68% during the forecast period.

-

2.What is the market size of the thermal energy storage market?The Global Thermal Energy Storage Market Size is Expected to Grow from USD 46.5 Billion in 2023 to USD 88.8 Billion by 2033, at a CAGR of 6.68% during the forecast period 2023-2033.

-

3.Which region holds the largest share of the thermal energy storage market?Europe is anticipated to hold the largest share of the thermal energy storage market over the predicted timeframe.

Need help to buy this report?