Global Thermal Power Plant Market Size, Share, Growth, and Industry Analysis, By Fuel Type (Coal, Gas, Nuclear, and Others), By Capacity (Up to 400 MW, 400-800 MW, More Than 800 MW), By Turbine Type (Simple Cycle, and Combined Cycle), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Energy & PowerGlobal Thermal Power Plant Market Insights Forecasts to 2033

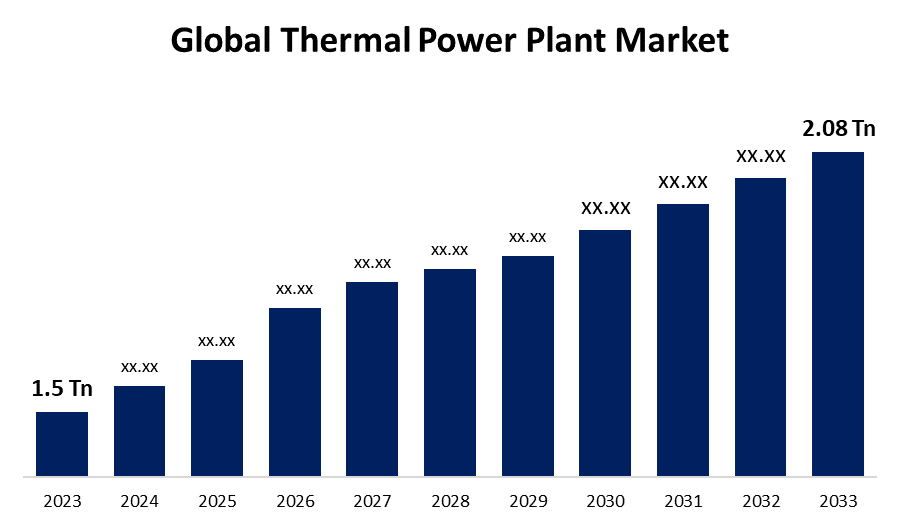

- The Global Thermal Power Plant Market Size was Valued at USD 1.5 Trillion in 2023

- The Market Size is Growing at a CAGR of 3.32% from 2023 to 2033

- The Worldwide Thermal Power Plant Market Size is Expected to Reach USD 2.08 Trillion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Thermal Power Plant Market Size is Anticipated to Exceed USD 2.08 Trillion by 2033, Growing at a CAGR of 3.32% from 2023 to 2033.

The increasing investments in rural development and urbanization have greatly increased worldwide demand for efficient and reliable electricity supply.

THERMAL POWER PLANT MARKET REPORT OVERVIEW

A thermal power plant converts heat energy into electrical power. A thermal power production point converts heat energy into electricity or power. Most stations use steam or heat to convert heat energy into mechanical energy, which is then used to generate electricity. The thermal power plant is where electricity is generated from heat, steam, or coal. It converts fossil fuels into electric current or power. Boilers are essential components of the energy generation process in a thermal power plant. These specialty vessels are designed to efficiently convert water into steam, which is then used to power turbines and generators. The heat generated by burning fossil fuels or other heat sources is transmitted to the water in the boiler, resulting in high-pressure steam. This steam, in turn, powers turbines, which generate energy. As a result, the incorporation of boilers is critical to the overall efficiency and performance of a thermal power plant, making them an essential component in the energy production ecosystem.

The growing number of industrial and home units is predicted to increase the need for efficient power supply, driving the worldwide thermal power plant market in the approaching years. The rapidly growing global population is predicted to increase energy demand during the projection period. The fast expansion of sectors in developing and underdeveloped economies presents a substantial potential opportunity for market players. Furthermore, the growing number of real estate housing projects drives up energy usage. Rising government initiatives to electrify rural areas are majorly boosting the global thermal power plants market.

The government of India made a decision to add 80 GW of thermal power capacity by 2031-32, and why it is critical to meeting the nation's power needs. "Due to the country's tremendous economic expansion, power demand has risen to an unprecedented level.

Report Coverage

This research report categorizes the market for the global thermal power plant market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global thermal power plant market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global thermal power plant market.

Global Thermal Power Plant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.5 Trillion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.32% |

| 2033 Value Projection: | USD 2.08 Trillion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Fuel Type, By Capacity, By Turbine Type, By Region |

| Companies covered:: | China Huaneng Group, Koradi Super Thermal Power supply, Akrimota Thermal Power Station, General Electric Company, Chubu Electric Power Co. Inc., National Thermal Power Corporation Limited, ENGIE, Tata Power, Duke Energy Corporation, SSE, EDF, American Electric Power Company, Inc., Siemens AG, Tiroda Thermal Power Station, Mundra Thermal Power Station, Sasan Ultra Mega Power Plant, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

DRIVING FACTORS:

The growing power generation demand across the world can boost market growth.

Considering the worldwide energy needs continuously expanding as a result of industrialization and urbanization around the world, particularly in emerging nations, the demand for dependable, abundant, and economical power production sources has increased dramatically. Thermal power plants, which mostly use coal, natural gas, or oil as fuel, currently account for the majority of worldwide electricity generation, and their role is expanding further to meet the world's increasing energy demand. According to predictions, worldwide energy consumption could expand by 25% to 50% in the future decades, and many emerging countries' economic growth paths would depend on reliable and continuous access to power. While renewable energy sources are an important long-term option, fossil fuel-based thermal plants provide the dispatchable base load capacity required to meet the continuous power demands of industrial and residential consumers.

RESTRAINING FACTORS

The stringent environmental regulation might impede market growth.

The thermal power plant market faces numerous hurdles. Stringent environmental restrictions around the world are causing these facilities to lower their carbon footprint. This necessitates large capital investments in carbon capture devices, putting pressure on margins.

Market Segmentation

The thermal power plant market share is classified into fuel type and capacity.

The coal segment is accounting the largest share of the market during the forecast period.

Based on fuel type, the thermal power plant market is classified into coal, gas, nuclear, and others. Coal power is cost-effective for base-load electricity generation due to its constant supply and cheap fuel prices. Many power firms favor coal because it provides greater energy independence than imported natural gas. Countries with large coal reserves, such as China, India, and the United States, can use their domestic coal mining industries to fuel coal-fired power plants and meet expanding electricity demands. Furthermore, coal plants require less infrastructure investment than natural gas plants because coal does not need to be delivered via pipelines and may utilize existing rail and port networks. While concerns over coal's carbon emissions are rising environmental laws, many power producers continue to regard coal as an affordable alternative for supplying base load needs. REC Ltd, a state-run company, plans to provide loans of up to rupees 1.75 trillion for coal-fired power plants by 2032. India aims to increase thermal power generation capacity by 80 GW in time.

The high need for more than 800 MW capacity of power plant can boost the market growth.

Based on capacity, the thermal power plant market is classified into up to 400 MW, 400-800 MW, and more than 800 MW. This rise could be attributed to increasing demand for almost 800 MW of electricity across a variety of industries. Over the previous decade, this market has grown in response to rapid industrialization and rapidly increasing worldwide electricity demand. Rising investments in developing nations' industrialization are expected to drive the growth of this category, as well as the thermal power plant market as a whole, in the near future.

The combined cycle segment has the highest market share throughout the forecast period.

Based on turbine type, the thermal power plant market is classified into simple cycle, and combined cycle. In comparison to simple cycle plants, the combined cycle has emerged as the dominant option, owing to continual design advances that boost performance and flexibility by 42.1%. Modern gas turbines for combined cycle duty can achieve extremely high fuel efficiency and dependability due to developments in materials, cooling, and combustion controls. This allows for increased power output over longer running cycles, maximizing asset usage. In addition to increased efficiency, combined cycle plants can ramp output levels faster than baseload coal units, which helps balance fluctuating renewable energy on the grid. Their adaptability enables greater use of solar and wind electricity while maintaining system stability. Power companies can dispatch combined cycle capacity based on spot price power markets, using less fuel, during less demand timeframe.

Regional Segment Analysis of the Global Thermal Power Plant Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific will have the biggest share of the global thermal power plant market throughout the forecast period.

Get more details on this report -

Asia Pacific is home to the world's leading coal corporations, including Coal India Limited. Coal India is a major supplier of coal around the world. The abundance of coal in the Asia-Pacific area has resulted in the availability of inexpensive coal. Furthermore, growing industrialization and urbanization in countries like as China, India, South Korea, and Indonesia have contributed significantly to the region's increased demand for thermal power. China and India are the world's manufacturing hubs, and the presence of several large companies in the region has greatly increased thermal electricity consumption. Rising government investments in urbanization and industrialization are predicted to greatly promote the market's growth.

North America is the fastest growing region during the forecast period.

The abundant supply of gas from countries such as the United States has greatly contributed to the expansion of the thermal power plant market. Natural gas is in significant demand in the United States and Europe for use in thermal power plants to generate energy. The thermal power plant market is primarily driven by the presence of a well-established and robust infrastructure. Expanding expenditures on thermal power capacity in the United States, in addition to rising demand for electricity, is expected to fuel the growth of the North American thermal power plant market during the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global thermal power plant market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China Huaneng Group

- Koradi Super Thermal Power supply

- Akrimota Thermal Power Station

- General Electric Company

- Chubu Electric Power Co. Inc.

- National Thermal Power Corporation Limited

- ENGIE

- Tata Power

- Duke Energy Corporation

- SSE

- EDF

- American Electric Power Company, Inc.

- Siemens AG

- Tiroda Thermal Power Station

- Mundra Thermal Power Station

- Sasan Ultra Mega Power Plant

- Others

Key Market Developments

- In July 2022, A natural gas-fired power plant went into service in Southwest Michigan. The project cost USD 1.1 billion and was built by Kiewit Corporation, with equipment from General Electric.

- In October 2021, American Electric Power agreed to sell its Kentucky operations, including Kentucky Power and AEP Kentucky Transco, to Liberty, a parent company of Algonquin Power & Utilities Corp's regulated utility division, for an enterprise value of US$ 2.84 billion.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global thermal power plant market based on the below-mentioned segments:

Global Thermal Power Plant Market, By Fuel Type

- Coal

- Gas

- Nuclear

- Others

Global Thermal Power Plant Market, By Capacity

- Up to 400 MW

- 400-800 MW

- More than 800 MW

Global Thermal Power Plant Market, By Turbine Type

- Simple Cycle

- Combined Cycle

Global Thermal Power Plant Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?