Global Thermo Compression Forming Market Size, Share, and COVID-19 Impact Analysis, By Foam Type (Thermoplastic Foams, Needle-Punch Nonwovens, and Lightweight Glass Mat Thermoplastic), End-Use Industry (Automotive, Aerospace, Medical, Construction, Electrical & Electronics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Advanced MaterialsGlobal Thermo Compression Forming Market Insights Forecasts to 2033

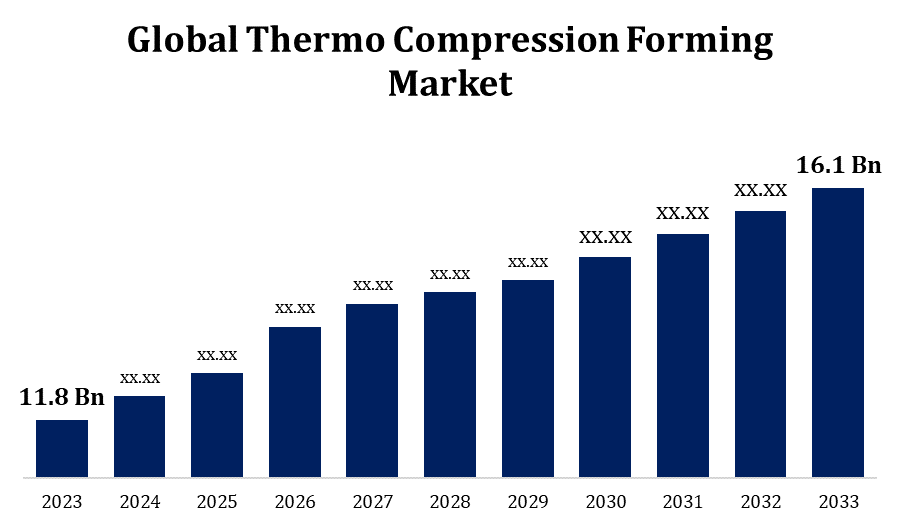

- The Thermo Compression Forming Market Size Was valued at USD 11.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.16% from 2023 to 2033.

- The Worldwide Thermo Compression Forming Market Size is expected to reach USD 16.1 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Thermo Compression Forming Market Size is expected to reach USD 16.1 Billion by 2033, at a CAGR of 3.16% during the forecast period 2023 to 2033.

The thermo compression forming market is witnessing significant growth due to its applications in various industries, including automotive, aerospace, and consumer goods. This process involves heating thermoplastic materials to a pliable state, then compressing them into molds to create intricate shapes and components. The increasing demand for lightweight and high-strength materials is driving the adoption of thermo compression forming, especially in sectors focused on sustainability and energy efficiency. Innovations in material science, coupled with advancements in manufacturing technologies, are further enhancing the capabilities of this process. Additionally, the rise of electric vehicles and renewable energy solutions is expected to propel market expansion, as manufacturers seek efficient production methods to meet growing consumer demands for environmentally friendly products.

Thermo Compression Forming Market Value Chain Analysis

The thermo compression forming market value chain encompasses several key stages, starting from raw material suppliers who provide thermoplastics and additives. These materials are then processed by manufacturers using thermo compression forming techniques to produce finished components. This stage involves careful control of temperature and pressure to ensure optimal material performance. Once produced, the components are distributed to various end-use industries such as automotive, aerospace, and electronics. Value is added at each stage through innovations in material properties and manufacturing efficiency, enhancing product performance and reducing waste. Post-manufacturing, the components undergo quality control and testing before reaching consumers. The collaboration between suppliers, manufacturers, and end-users is crucial for driving advancements in technology and sustainability within the thermo compression forming market.

Thermo Compression Forming Market Opportunity Analysis

The thermo compression forming market presents substantial opportunities driven by increasing demand for lightweight materials across various industries, particularly in automotive and aerospace. As manufacturers prioritize energy efficiency and sustainability, the adoption of advanced thermoplastic composites offers significant weight reduction without compromising strength, enhancing overall performance. Additionally, the growing trend toward electric vehicles creates a need for innovative manufacturing processes to produce high-strength, durable components. The expansion of applications in consumer goods and electronics further amplifies market potential. Emerging technologies, such as automation and advanced molding techniques, are expected to streamline production and reduce costs. Collaborations between material suppliers and manufacturers can lead to the development of new products, positioning companies to capitalize on evolving market trends and meet consumer demands for eco-friendly solutions.

Global Thermo Compression Forming Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 11.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.16% |

| 2033 Value Projection: | USD 16.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Foam Type, End-Use Industry, and By Region. |

| Companies covered:: | BASF SE, Core Molding Technologies, Engineered Plastic Products Inc., FLEXTECH, Formed Solutions, Janco, Inc., Mitsubishi Chemical Group, Present Advanced Composites Inc., Ray Products Company Inc., RCO Engineering, Toray Advanced Composites, and Others |

| Growth Drivers: | Heightened investments in infrastructure development |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Thermo Compression Forming Market Dynamics

Heightened investments in infrastructure development

Heightened investments in infrastructure development are significantly contributing to the growth of the thermo compression forming market. As governments and private entities allocate funds towards improving transportation networks, energy facilities, and urban projects, there is an escalating demand for high-performance materials and components that can withstand rigorous conditions. Thermo compression forming, known for its ability to produce lightweight and durable thermoplastic parts, is increasingly being utilized in construction equipment, transport vehicles, and energy solutions. This trend not only fosters innovation in material science but also encourages collaborations between manufacturers and infrastructure developers. As a result, companies in the thermo compression forming sector are well-positioned to benefit from this growing demand, driving market expansion and enhancing product offerings to meet the evolving needs of infrastructure projects.

Restraints & Challenges

One primary concern is the high initial investment required for advanced machinery and technology, which can deter smaller manufacturers from entering the market. Additionally, the variability in material properties of thermoplastics can lead to inconsistencies in product quality, necessitating stringent quality control measures and additional costs. The need for skilled labor to operate sophisticated equipment and ensure precision during the manufacturing process further complicates production. Moreover, increasing competition from alternative manufacturing methods, such as injection molding and 3D printing, may limit market share. Lastly, fluctuating raw material prices and supply chain disruptions can impact production costs and timelines, creating uncertainty in the market landscape.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Thermo Compression Forming Market from 2023 to 2033. The region's emphasis on lightweight and high-strength materials aligns with the increasing production of electric vehicles, which require advanced components to enhance efficiency and performance. Additionally, favorable government initiatives promoting sustainable manufacturing practices are encouraging investments in thermo compression technology. The presence of established manufacturers and suppliers, coupled with ongoing research and development activities, fosters innovation and competitiveness in the market. Challenges such as fluctuating raw material prices and competition from alternative manufacturing methods must be addressed. Overall, North America's focus on technological advancement and infrastructure development positions it as a key player in the global thermo compression forming market.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The growing popularity of electric vehicles and renewable energy solutions is further propelling the adoption of thermo compression forming techniques, as manufacturers seek efficient production methods. Additionally, government initiatives promoting sustainable practices and investments in advanced manufacturing technologies are enhancing market prospects. However, challenges such as fluctuating raw material costs and the need for skilled labor remain. Overall, the Asia Pacific market is set to play a crucial role in the global thermo compression forming landscape, offering significant opportunities for growth and innovation.

Segmentation Analysis

Insights by Foam Type

The thermoplastic foams segment accounted for the largest market share over the forecast period 2023 to 2033. These foams offer excellent thermal insulation, impact resistance, and cushioning, making them ideal for applications in automotive, aerospace, and consumer goods. As manufacturers increasingly prioritize energy efficiency and sustainability, thermoplastic foams provide an effective solution for reducing the weight of components without compromising performance. The rising demand for energy-efficient vehicles and advanced packaging solutions further fuels this segment's expansion. Innovations in foam technology, including enhanced structural integrity and recyclability, are also contributing to market growth. Additionally, the increasing focus on eco-friendly materials aligns with global sustainability trends, positioning thermoplastic foams as a key player in the evolving thermo compression forming landscape.

Insights by End Use Industry

The construction segment accounted for the largest market share over the forecast period 2023 to 2033. Thermo compression forming allows for the efficient production of complex structural components that enhance energy efficiency and sustainability in construction projects. The growing emphasis on green building practices and regulations promotes the use of advanced thermoplastics, which offer excellent insulation properties and contribute to reduced carbon footprints. Additionally, the integration of thermo compression formed components in prefabricated construction methods is gaining traction, enabling faster project completion and improved quality control. As urbanization continues to escalate, the construction industry's need for innovative materials and techniques positions the thermo compression forming market for significant expansion, catering to evolving architectural demands and sustainable practices.

Recent Market Developments

- On July 2024, FLEXTECH and Sun Path Products, Inc. have collaborated to select and develop materials for the laminated and molded foam components of the Spyn System, which are essential for skydiving equipment.

Competitive Landscape

Major players in the market

- BASF SE

- Core Molding Technologies

- Engineered Plastic Products Inc.

- FLEXTECH

- Formed Solutions

- Janco, Inc.

- Mitsubishi Chemical Group

- Present Advanced Composites Inc.

- Ray Products Company Inc.

- RCO Engineering

- Toray Advanced Composites

- Others

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Thermo Compression Forming Market, Foam Type Analysis

- Thermoplastic Foams

- Needle-Punch Nonwovens

- Lightweight Glass Mat Thermoplastic

Thermo Compression Forming Market, End Use Industry Analysis

- Automotive

- Aerospace

- Medical

- Construction

- Electrical & Electronics

Thermo Compression Forming Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Thermo Compression Forming Market?The global Thermo Compression Forming Market is expected to grow from USD 11.8 billion in 2023 to USD 16.1 billion by 2033, at a CAGR of 3.16% during the forecast period 2023-2033.

-

2. Who are the key market players of the Thermo Compression Forming Market?Some of the key market players of the market are BASF SE, Core Molding Technologies, Engineered Plastic Products Inc., FLEXTECH, Formed Solutions, Janco, Inc., Mitsubishi Chemical Group, Present Advanced Composites Inc., Ray Products Company Inc., RCO Engineering, and Toray Advanced Composites.

-

3. Which segment holds the largest market share?The construction segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Thermo Compression Forming Market?North America dominates the Thermo Compression Forming Market and has the highest market share.

Need help to buy this report?