Global Thermoplastic Polyolefin Market Size By Type (In-situ TPO, Compounded TPO), By Application (Automotive, Building and Construction), By Region, And Segment Forecasts, By Geographic Scope And Forecast 2022 – 2032

Industry: Chemicals & MaterialsGlobal Thermoplastic Polyolefin Market Insights Forecasts to 2032

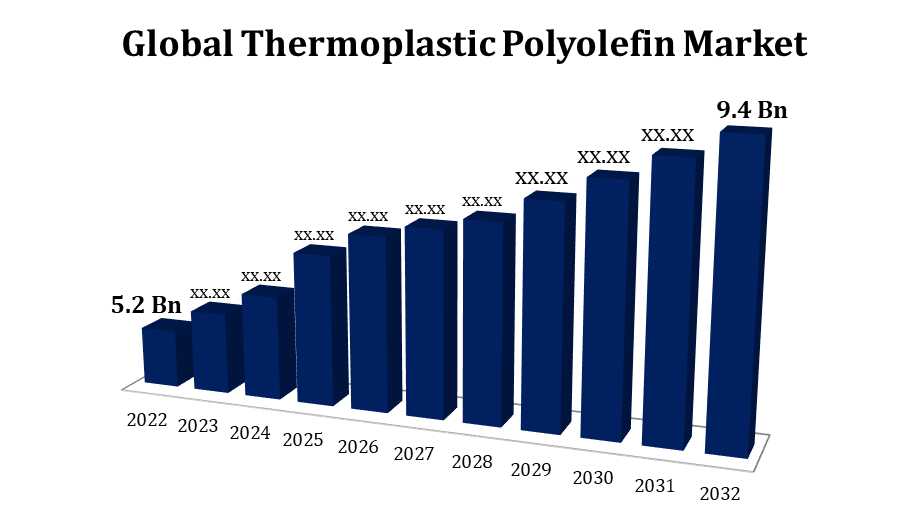

- The Thermoplastic Polyolefin Market Size was valued at USD 5.2 Billion in 2022.

- The Market Size is Growing at a CAGR of 7.2% from 2022 to 2032

- The Worldwide Thermoplastic Polyolefin Market Size is expected to reach USD 9.4 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Thermoplastic Polyolefin Market Size is expected to reach USD 9.4 Billion by 2032, at a CAGR of 7.2% during the forecast period 2022 to 2032.

The TPO market is largely driven by the automobile sector. Because TPOs are durable and lightweight, they are frequently employed in automotive applications, such as exterior and interior components. TPOs are used in roofing membranes in the construction sector. TPO membranes are being used more frequently in both commercial and residential construction because to the growing need for energy-efficient roofing solutions. TPOs are appropriate for a variety of applications due to their adaptability and versatility. This covers not just the building and automotive industries, but other industries like consumer products, packaging, and healthcare. The automotive industry uses TPOs extensively for the production of bumpers, interior pieces, and exterior body parts. TPOs are perfect for these applications since they are strong and lightweight.

Thermoplastic Polyolefin Market Value Chain Analysis

The manufacture of raw ingredients, principally ethylene and polypropylene, is where the value chain starts. These components serve as the foundation for TPOs. The base TPO polymer is formed via polymerization procedures involving raw ingredients. The process of polymerization has a crucial role in defining the final TPO product's attributes. The TPO polymer is blended with several additives, including as fillers, stabilisers, and reinforcing agents, during the compounding process. This process improves particular qualities including strength, flexibility, and resistance to UV rays. Following compounding, extrusion or other shaping techniques are used to transform the TPO into sheets or films. These sheets or films are the foundation for many different applications, such as packing materials, automobile parts, and roofing membranes. TPO products are used in many different industries, such as consumer goods, packaging, construction, and automotive. End customers employ TPO materials for medical equipment, roofing, automobile components, and other products.

Thermoplastic Polyolefin Market Opportunity Analysis

TPOs can benefit from the tendency in the automotive sector towards lightweighting for fuel efficiency. They are desirable for automotive applications because of their lightweight nature and capacity to substitute conventional materials, which helps with fuel economy. There is a chance that the need for TPOs would rise as emerging markets see growth in their industrial and infrastructure sectors. These areas frequently look for affordable, adaptable materials for industry and building. TPOs in the automotive industry have an opportunity due to the growing popularity of electric vehicles. TPOs can help make electric vehicles lighter by being used in their components. TPO materials' weatherability and resilience in challenging conditions open up possibilities for sectors like marine, where UV and saltwater resistance are essential.

Global Thermoplastic Polyolefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 5.2 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.2% |

| 2032 Value Projection: | USD 9.4 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Exxon Mobil Corporation, S&E Specialty Polymers, SABIC, INEOS Olefins & Polymers, Johns Manville, A Berkshire Hathaway Company, Arkema SA, The Hexpol group of companies, LyondellBasell, Sumitomo Chemical Co., Ltd., RTP Company, Noble Polymers, and Other Key Vendors. |

| Growth Drivers: | Growing need for TPOs in the healthcare and pharmaceutical industries |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Thermoplastic Polyolefin Market Dynamics

Growing need for TPOs in the healthcare and pharmaceutical industries

TPOs are suited for the production of a range of medical devices due to their combination of flexibility, durability, and chemical resistance. These could consist of parts for surgical instruments, diagnostic equipment, and disposable medical devices. TPOs can be employed in the manufacturing of medical equipment and furnishings. Because of these qualities, they can be utilised for furniture in healthcare institutions, including hospital beds and medical carts. TPOs can be used in the manufacturing of pharmaceutical product packaging materials. TPOs are helpful in developing packaging solutions that guarantee the integrity and safety of pharmaceutical items because of their flexibility and sealing capabilities. Cleanrooms are essential in facilities for the production of pharmaceuticals and medical equipment. TPOs' resistance to impurities and simplicity of cleaning make them suitable for use in the construction of cleanroom equipment and components.

Restraints & Challenges

Thermosetting polymers, other thermoplastics, and well-known materials like polyvinyl chloride (PVC) compete with TPOs. It can be difficult to persuade industries to switch from conventional materials to TPOs. Polypropylene and ethylene are two raw materials that are necessary for TPO synthesis, and changes in their prices can have an effect on the total cost of TPO manufacture. Price fluctuation can make cost management difficult for producers. TPO processing can be difficult, particularly when it comes to getting uniform qualities and looks in the finished product. To guarantee quality and consistency, process control and optimisation are essential. TPOs work well at moderate temperatures, however they might not be the best choice for applications requiring resistance to extremely high temperatures.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Thermoplastic Polyolefin market from 2023 to 2032. The TPO market in North America is largely driven by the automobile industry. TPOs are lightweight, strong, and reasonably priced, which makes them popular for usage in bumpers, interior elements, and exterior parts for automobiles. TPO roofing membranes are well-liked in the building sector due to their energy-saving qualities. TPO membrane use in commercial and residential construction projects has expanded as a result of the focus on energy-efficient roofing solutions and sustainable building practises. TPOs are used in the manufacturing of packaging and consumer goods. Their adaptability and capacity to assume diverse forms render them appropriate for usage in products including toys, home goods, and packaging.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. The Asia-Pacific region is rapidly becoming more urbanised and industrialised. The need for TPOs in construction applications, such as roofing membranes for residential and commercial structures, is driven by this increase. Asia-Pacific's automobile sector is expanding significantly, especially in nations like China and India. TPOs are frequently utilised in the automotive industry to produce lightweight parts that increase fuel economy. Asia-Pacific's packaging market is growing as a result of rising e-commerce and consumer population. TPOs are becoming more and more in demand due to their adaptability and suitability for packaging applications. In the Asia-Pacific area, consumer products production is expanding. Appliances, home goods, and toys are just a few of the consumer goods that are made with TPOs.

Segmentation Analysis

Insights by Type

The compounded TPO segment accounted for the largest market share over the forecast period 2023 to 2032. Compound TPOs are extensively utilised in the automotive sector for the production of external body parts, interior elements, and other automotive applications. TPO formulations' adaptability is one of the factors that makes them so popular in this industry. In the building sector, compounded TPO roofing membranes are in high demand. Weatherability, durability, and other qualities that are important for roofing applications in both commercial and residential structures are improved by the inclusion of additives. Applications for compounded TPOs include packaging and consumer goods manufacturing. Manufacturers can address special needs for these applications by customising TPO compositions. Compound thermoplastic polymers (TPOs) are in greater demand as sectors, particularly the automotive sector, concentrate on lightweighting for fuel efficiency. TPOs can offer durable solutions that are lightweight.

Insights by Application

Automotive segment is witnessing the fastest market growth over the forecast period 2023 to 2032. Lightweighting is becoming more and more important to the automotive industry as a way to meet stricter emission regulations and increase fuel efficiency. Due to their low weight and excellent strength-to-weight ratio, thermoplastic polymers (TPOs) are replacing conventional materials in a variety of automobile components. When considering some traditional materials, such as metal and thermosetting polymers, TPOs are more affordable. Their adoption for large-scale vehicle production is largely due to this cost advantage. TPOs are becoming more significant in terms of lightweighting EV components as the market for electric vehicles grows. Their application in the production of electric vehicles enhances the vehicles' overall efficiency and sustainability. The need for TPOs in the automobile manufacturing sector is rising as a result of the global automotive industry's expansion, which places a strong emphasis on emerging markets.

Recent Market Developments

- In December 2020, 100% of the shares are owned by the joint venture "Gemini HDPE" between Sasol Chemicals and the Ineos Group. The company produces polyethylene with a high density at LA Porte, Texas.

Competitive Landscape

Major players in the market

- Exxon Mobil Corporation

- S&E Specialty Polymers

- SABIC

- INEOS Olefins & Polymers

- Johns Manville

- A Berkshire Hathaway Company

- Arkema SA

- The Hexpol group of companies

- LyondellBasell

- Sumitomo Chemical Co., Ltd.

- RTP Company

- Noble Polymers

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

Thermoplastic Polyolefin Market, Type Analysis

- In-situ TPO

- Compounded TPO

Thermoplastic Polyolefin Market, Application Analysis

- Automotive

- Building and Construction

Thermoplastic Polyolefin Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Thermoplastic Polyolefin Market?The global Thermoplastic Polyolefin Market is expected to grow from USD 5.2 Billion in 2023 to USD 9.4 Billion by 2032, at a CAGR of 7.2% during the forecast period 2023-2032.

-

2. Who are the key market players of the Thermoplastic Polyolefin Market?Some of the key market players of market are Exxon Mobil Corporation, S&E Specialty Polymers, SABIC, INEOS Olefins & Polymers, Johns Manville, A Berkshire Hathaway Company, Arkema SA, The Hexpol group of companies, LyondellBasell, Sumitomo Chemical Co., Ltd., RTP Company, and Noble Polymers.

-

3. Which segment holds the largest market share?Automotive segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Thermoplastic Polyolefin Market?North America is dominating the Thermoplastic Polyolefin Market with the highest market share.

Need help to buy this report?