Global Thermoplastic Polyurethane Market Size, Share, and COVID-19 Impact Analysis, By Type (Polyester, Polyether, Polycaprolactone, and Others), By Application (Automotive, Construction, Engineering, Footwear, Hose & Tubing, Wire & Cable, Medical, Synthetic Leather, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Thermoplastic Polyurethane Market Insights Forecasts to 2033

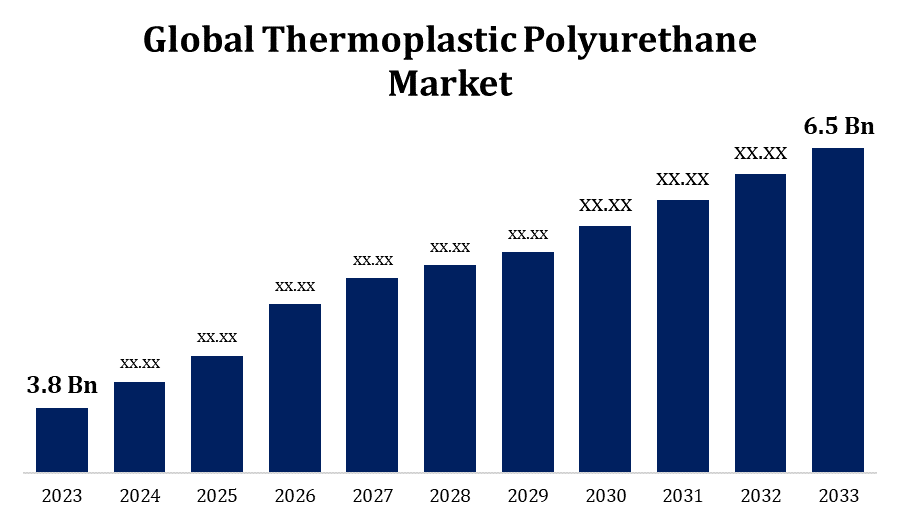

- The Thermoplastic Polyurethane Market Size was valued at USD 3.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 5.51% from 2023 to 2033.

- The Global Thermoplastic Polyurethane Market Size is expected to reach USD 6.5 Billion by 2033.

- Asia Pacific is expected to Grow the fastest during the Forecast period.

Get more details on this report -

The Global Thermoplastic Polyurethane Market Size is expected to reach USD 6.5 Billion by 2033, at a CAGR of 5.51% during the Forecast period 2023 to 2033.

The Thermoplastic Polyurethane (TPU) market is experiencing robust growth due to its versatility and wide range of applications. TPU, known for its elasticity, durability, and resistance to abrasions, is increasingly utilized in industries such as automotive, construction, footwear, and electronics. The rise in demand for lightweight, recyclable materials in automotive and the growing adoption of TPU in sustainable practices further propel market expansion. Innovations in TPU-based medical devices and wearables also enhance its market appeal. However, fluctuations in raw material prices pose challenges. Regionally, Asia-Pacific dominates the TPU market, driven by rapid industrialization and booming automotive and construction sectors. North America and Europe are also significant contributors due to technological advancements and stringent regulatory standards promoting eco-friendly materials.

Thermoplastic Polyurethane Market Value Chain Analysis

The Thermoplastic Polyurethane (TPU) market value chain comprises raw material suppliers, manufacturers, distributors, and end-users. Key raw materials include diisocyanates, polyols, and chain extenders, sourced from petrochemical and chemical producers. TPU manufacturers blend these components through polymerization to create resins with specific properties like flexibility and abrasion resistance. These resins are processed into films, sheets, or granules for downstream industries. Distributors and suppliers act as intermediaries, ensuring efficient delivery to end-use industries such as automotive, footwear, electronics, and construction. The end-users convert TPU into final products like seals, cables, adhesives, and medical devices. Technological advancements, eco-friendly production methods, and recycling initiatives are reshaping the value chain, enhancing efficiency, and catering to evolving consumer and regulatory demands.

Thermoplastic Polyurethane Market Opportunity Analysis

The Thermoplastic Polyurethane (TPU) market presents significant growth opportunities driven by advancements in material science and rising demand for versatile polymers. Growing applications in automotive lightweighting, fueled by the global shift toward electric vehicles (EVs), are creating substantial opportunities. In the footwear industry, TPU's durability and design flexibility continue to attract interest, especially in sportswear and sustainable shoe production. The rise of wearable medical devices and TPU-based films in healthcare offers another avenue for expansion. Increasing awareness of recyclability and eco-friendly practices further promotes TPU usage in sustainable solutions. Emerging markets in Asia-Pacific, supported by rapid industrialization and urbanization, are expected to drive demand. Additionally, advancements in bio-based TPU production create pathways to meet environmental regulations and enhance market competitiveness.

Global Thermoplastic Polyurethane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.8 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.51% |

| 2033 Value Projection: | USD 6.5 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), Avient Corporation (US), and other key companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Thermoplastic Polyurethane Market Dynamics

The growing demand for lightweight and high-performance materials in the sports industry

The Thermoplastic Polyurethane (TPU) market is significantly benefiting from the rising demand for lightweight and high-performance materials in the sports industry. TPU's unique properties, such as flexibility, abrasion resistance, and excellent tensile strength, make it an ideal choice for sports equipment and apparel. It is widely used in the production of athletic footwear, protective gear, and inflatable products, enhancing durability and comfort. Additionally, the material's lightweight nature aids in improving athletic performance by reducing strain and increasing agility. Innovations in design and material science further enable the creation of customizable, high-performance sports products. As sustainability becomes a priority, TPU's recyclability and potential for bio-based production offer eco-friendly solutions, aligning with the industry's focus on reducing its environmental footprint.

Restraints & Challenges

The Thermoplastic Polyurethane (TPU) market faces several challenges despite its growing demand. Fluctuations in raw material prices, particularly diisocyanates and polyols derived from petrochemicals, significantly impact production costs and profit margins. Environmental concerns over petrochemical-based TPUs and the need for sustainable alternatives pose another hurdle, pressuring manufacturers to innovate with bio-based options. The complex manufacturing process of TPU, requiring precision and expertise, adds to operational challenges. Market competition is intensifying as new players and alternative materials enter the space, offering cost-effective or specialized solutions. Furthermore, stringent environmental regulations in regions like Europe demand compliance, increasing operational costs. Economic volatility and geopolitical tensions also disrupt supply chains, affecting the availability of raw materials and global trade flows, further complicating market dynamics.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Thermoplastic Polyurethane Market from 2023 to 2033. The region's focus on lightweight, durable, and eco-friendly materials supports the increasing adoption of TPU. In the automotive sector, TPU is widely used for interior components, cable sheathing, and lightweight parts to enhance fuel efficiency and performance. The booming construction industry leverages TPU for applications like roofing membranes and sealants. The rising popularity of athletic footwear and sports equipment further bolsters demand. Additionally, innovation in TPU-based medical devices and wearables contributes to market expansion. However, challenges such as fluctuating raw material prices and competition from alternative materials persist. Overall, North America's robust industrial base and regulatory focus on sustainability drive the TPU market forward.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. The region's booming automotive industry, especially in countries like China, India, and Japan, is a significant contributor, with TPU being used in lightweight components and interior applications to improve fuel efficiency. The construction sector also fuels demand for TPU in applications such as waterproof membranes and adhesives. Additionally, Asia-Pacific's thriving footwear and apparel industries capitalize on TPU's flexibility and durability for high-performance and trendy products. Innovations in consumer electronics further boost TPU usage in protective cases and cables. However, environmental concerns and fluctuating raw material costs present challenges. Despite this, Asia-Pacific's expanding middle class and focus on sustainability ensure strong growth opportunities.

Segmentation Analysis

Insights by Type

The polyester segment accounted for the largest market share over the forecast period 2023 to 2033. Polyester-based TPU is valued for its excellent chemical resistance, high tensile strength, and superior wear performance, making it ideal for demanding industries such as automotive, industrial machinery, and consumer goods. Its durability in harsh environments, including exposure to oils, fuels, and solvents, enhances its utility in applications like conveyor belts, hoses, and seals. The segment's growth is further fueled by rising demand for durable yet lightweight materials in footwear and sporting goods. Advancements in production technologies and the development of bio-based polyester TPU variants align with sustainability trends, boosting adoption. Increasing industrial activities, particularly in emerging markets, further amplify growth prospects for the polyester TPU segment.

Insights by Application

The footwear segment accounted for the largest market share over the forecast period 2023 to 2033. TPU is widely used in athletic, casual, and safety footwear for midsoles, outsoles, and uppers, offering superior comfort, shock absorption, and abrasion resistance. The rising demand for high-performance sports shoes and stylish yet functional casual footwear accelerates its adoption. Moreover, TPU enables innovative designs through 3D printing and customization, appealing to evolving consumer preferences. Sustainability trends also boost the use of recyclable and bio-based TPU in eco-friendly footwear. Growing consumer awareness of health and fitness, coupled with the increasing popularity of premium and technologically advanced shoes, positions the footwear segment as a key contributor to the TPU market’s expansion.

Recent Market Developments

- On February 2023, Covestro AG has announced plans to build its largest thermoplastic polyurethane manufacturing plant in Zhuhai, located in South China.

Competitive Landscape

Major players in the market

- BASF SE (Germany)

- The Lubrizol Corporation (US)

- Covestro AG (Germany)

- Huntsman Corporation (US)

- Wanhua Chemical Group Co. Ltd. (China)

- American Polyfilm, Inc. (US)

- Epaflex Polyurethanes SpA (Italy)

- COIM Group (Italy)

- Mitsui Chemicals, Inc. (Japan)

- Avient Corporation (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Thermoplastic Polyurethane Market, Type Analysis

- Polyester

- Polyether

- Polycaprolactone

- Others

Thermoplastic Polyurethane Market, Application Analysis

- Automotive

- Construction

- Engineering

- Footwear

- Hose & Tubing

- Wire & Cable

- Medical

- Synthetic Leather

- Others

Thermoplastic Polyurethane Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Thermoplastic Polyurethane Market?The global Thermoplastic Polyurethane Market is expected to grow from USD 3.8 billion in 2023 to USD 6.5 billion by 2033, at a CAGR of 5.51% during the forecast period 2023-2033.

-

2. Who are the key market players of the Thermoplastic Polyurethane Market?Some of the key market players of the market are BASF SE (Germany), The Lubrizol Corporation (US), Covestro AG (Germany), Huntsman Corporation (US), Wanhua Chemical Group Co. Ltd. (China), American Polyfilm, Inc. (US), Epaflex Polyurethanes SpA (Italy), COIM Group (Italy), Mitsui Chemicals, Inc. (Japan), and Avient Corporation (US).

-

3. Which segment holds the largest market share?The footwear segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Thermoplastic Polyurethane Market?North America dominates the Thermoplastic Polyurethane Market and has the highest market share.

Need help to buy this report?