Global Thin Film Photovoltaics Market Size, Share, and COVID-19 Impact Analysis, By Type (Cadmium Telluride, Copper Indium Gallium Diselenide, and Amorphous Thin-Film Silicon), By Installation (On-Grid and Off-Grid), By End-User (Residential, Commercial, and Industrial and Utility), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2032

Industry: Semiconductors & ElectronicsGlobal Thin Film Photovoltaics Market Insights Forecasts to 2032

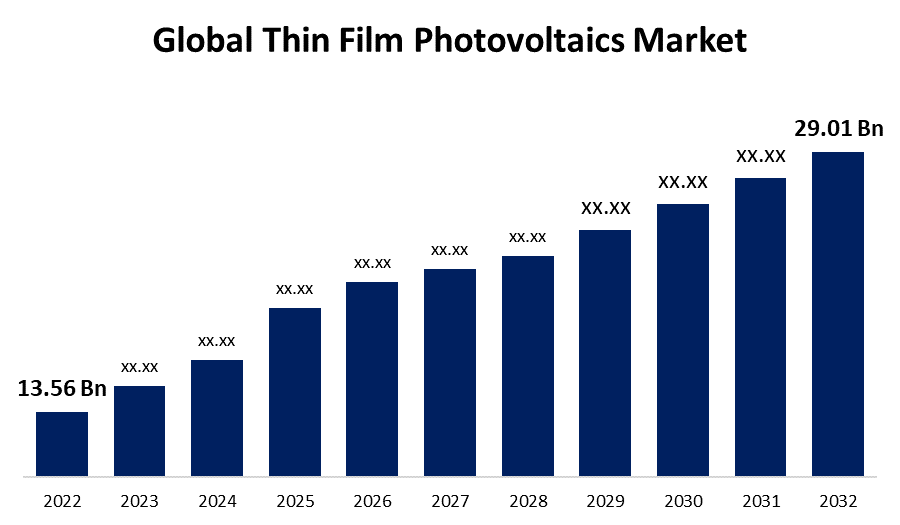

- The Thin Film photovoltaics market was valued at USD 13.56 Billion in 2022.

- The Market is growing at a CAGR of 7.9% from 2023 to 2032

- The Worldwide thin film photovoltaics market is expected to reach USD 29.01 Billion by 2032

- Latin America is expected to grow the fastest during the forecast period

Get more details on this report -

The global thin film photovoltaics market is expected to reach USD 29.01 Billion by 2032, at a CAGR of 7.9% during the forecast period 2023 to 2032.

Market Overview

Thin film photovoltaics (TFPV) are a type of solar technology that offer potential advantages over traditional silicon-based solar cells. TFPV involves depositing a thin layer of semiconductor material, typically 1-2 micrometers thick, onto a substrate that can be flexible or rigid. This allows for a lower cost of production and potentially higher efficiency compared to silicon-based cells. TFPV can be made from a variety of materials such as cadmium telluride, copper indium gallium selenide, and amorphous silicon. They are commonly used in small-scale applications such as portable devices, building-integrated photovoltaics, and in some large-scale solar farms. TFPV technology is still evolving and improving, and researchers continue to explore new materials and fabrication techniques to further improve their efficiency and cost-effectiveness.

Report Coverage

This research report categorizes the market for thin film photovoltaics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the thin film photovoltaics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the thin film photovoltaics market.

Global Thin Film Photovoltaics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 13.56 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.9% |

| 2032 Value Projection: | USD 29.01 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Installation, By End-User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Greatcell, Exeger Operations AB, Fujikura Europe Ltd., G24 Power Ltd., Konica Minolta Sensing Europe B.V., Merck KGaA·,Oxford PV, Peccell Technologies, Inc., Sharp Corporation, Solaronix SA, Sony Corporation, Ricoh, First Solar, SunPower Corporation, Suniva Inc., Tata Power Solar Systems Ltd., Sharp Corporation, ALPS Technology Inc., Solaris Technology Industry, Inc., Green Brilliance Renewable Energy LLP, Trina Solar |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers of the thin film photovoltaics (TFPV) market include a growing demand for renewable energy sources, increasing adoption of solar energy systems, and decreasing costs of TFPV production. The flexibility of TFPV also enables new applications such as building-integrated photovoltaics and portable devices. Additionally, TFPV can potentially offer higher efficiency and better performance in low-light conditions compared to traditional silicon-based solar cells. Government policies and incentives promoting the use of renewable energy, as well as advancements in TFPV technology and materials, are also driving market growth. Furthermore, the increasing need for energy independence and reducing carbon emissions are encouraging the growth of the TFPV market.

Restraining Factors

The restraints of the thin film photovoltaics (TFPV) market include lower efficiency and shorter lifespan compared to traditional silicon-based solar cells, limited availability of raw materials, and the potential environmental impact of TFPV production and disposal. There is also a lack of standardization in TFPV manufacturing processes, which may impact product quality and reliability. In addition, the relatively lower market share of TFPV compared to silicon-based solar cells and the high capital investment required for TFPV production are also potential restraints for the growth of the TFPV market.

Market Segmentation

- In 2022, the cadmium telluride segment accounted for around 35.1% market share

On the basis of type, the global thin film photovoltaics market is segmented into cadmium telluride, copper indium gallium diselenide, and amorphous thin-film silicon. The cadmium telluride segment is dominating with the largest market share in 2022. CdTe has been shown to have high efficiency and low production costs compared to other TFPV materials, making it a popular choice for large-scale solar farms. Additionally, CdTe TFPV has a higher tolerance for high temperatures and low light conditions, which makes it well-suited for use in hot and arid environments. Furthermore, several major TFPV companies have invested in CdTe TFPV production and research, further driving its market dominance.

- In 2022, the on-grid segment dominated the market with more than 57.4% revenue share

Based on the installation, the global thin film photovoltaics market is segmented into on-grid and off-grid. Out of this, the on-grid is dominating the market with the largest market share in 2022, due to its connection to the grid, allowing for excess power to be fed back into the grid, reducing energy costs for users and providing a source of income. On-grid TFPV systems also offer higher efficiency and reliability compared to off-grid systems. Moreover, government policies promoting grid-tied solar energy systems further drive the growth of the on-grid TFPV segment.

Regional Segment Analysis of the Thin Film Photovoltaics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

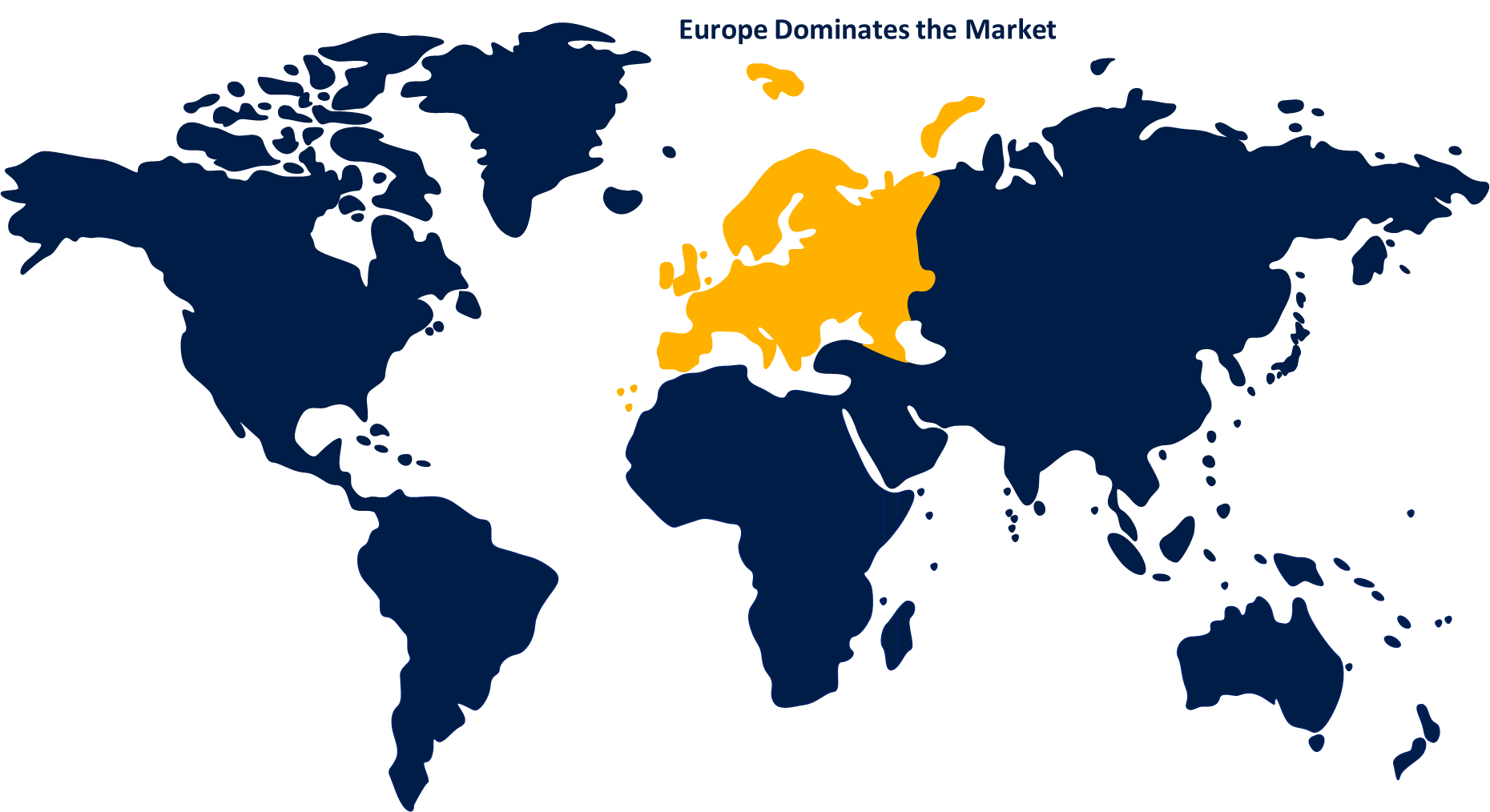

Europe dominated the market with more than 45.6% revenue share in 2022.

Get more details on this report -

Europe has been a dominant player in the thin film photovoltaics market due to several factors. Firstly, European countries have been at the forefront of promoting renewable energy sources, with many government policies and incentives supporting the adoption of solar energy systems. Additionally, Europe has a highly developed infrastructure for solar energy production, with many large-scale TFPV manufacturing facilities located in the region. Europe is also home to several leading TFPV technology and material research institutions. Furthermore, the presence of major TFPV companies in Europe, coupled with a growing demand for renewable energy, has propelled the growth of the TFPV market in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global thin film photovoltaics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- Greatcell

- Exeger Operations AB

- Fujikura Europe Ltd.

- G24 Power Ltd.

- Konica Minolta Sensing Europe B.V.

- Merck KGaA

- Oxford PV

- Peccell Technologies, Inc.

- Sharp Corporation

- Solaronix SA

- Sony Corporation

- Ricoh

- First Solar

- SunPower Corporation

- Suniva Inc.

- Tata Power Solar Systems Ltd.

- Sharp Corporation

- ALPS Technology Inc.

- Solaris Technology Industry, Inc.

- Green Brilliance Renewable Energy LLP

- Trina Solar

- Canadian Solar

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, A US-based innovator renowned for designing and manufacturing lightweight, flexible, and sturdy CIGS thin-film photovoltaic (PV) solutions has completed a deal to acquire the manufacturing assets of Flisom AG, a thin-film solar manufacturer based in Zurich. Despite the acquisition, the company will remain headquartered in Thornton, Colorado, and will promptly begin manufacturing utilizing the newly acquired 15MW roll-to-roll thin-film production assets situated in Zurich, Switzerland.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global thin film photovoltaics market based on the below-mentioned segments:

Thin Film Photovoltaics Market, By Type

- Cadmium Telluride

- Copper Indium Gallium Diselenide

- Amorphous Thin-Film Silicon

Thin Film Photovoltaics Market, By Installation

- On-Grid

- Off-Grid

Thin Film Photovoltaics Market, By End-User

- Residential

- Commercial

- Industrial and Utility

Thin Film Photovoltaics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?