Global Third-party Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service (Dedicated Contract Carriage/Freight forwarding, Domestic Transportation Management, International Transportation Management, Warehousing &Distribution, and Value Added Logistics Services), By Transport (Roadways, Railways, Waterways, and Airways), By End-Use (Manufacturing, Retail, Healthcare, Automotive, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2032.

Industry: Automotive & TransportationGlobal Third-party Logistics Market Insights Forecasts to 2032

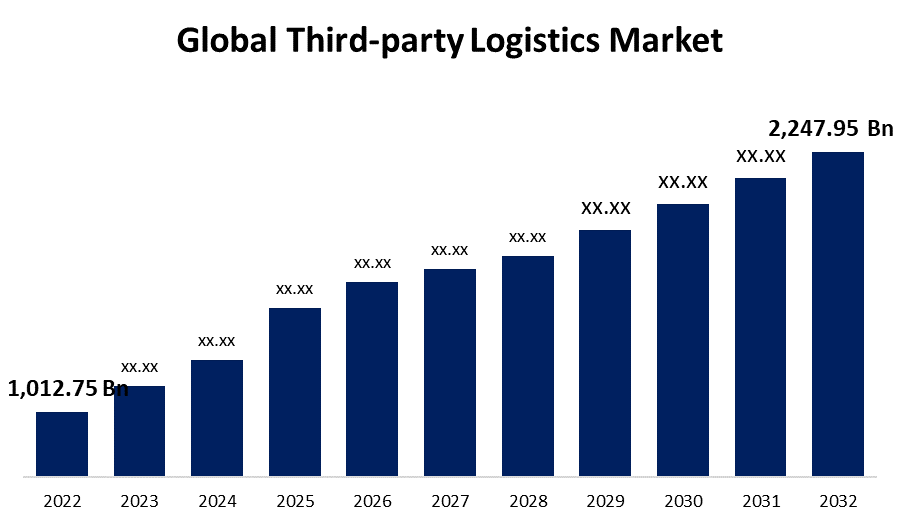

- The Third-Party Logistics Market was valued at USD 1,012.75 Billion in 2022.

- The Market is Growing at a CAGR of 8.3% from 2023 to 2032

- The Worldwide Third-Party Logistics Market is expected to reach USD 2,247.95 Billion by 2032

- Asia-Pacific is expected to Grow fastest during the forecast period

Get more details on this report -

The Global Third-Party Logistics Market is expected to reach USD 2,247.95 Billion by 2032, at a CAGR of 8.3% during the forecast period 2023 to 2032.

Market Overview

Third-party Logistics (3PL) refers to a strategic business arrangement where companies outsource their logistics and supply chain management functions to specialized third-party providers. This arrangement allows businesses to focus on their core competencies while leveraging the expertise and resources of 3PL providers to streamline and optimize their logistics operations. 3PL providers offer a wide range of services, including transportation, warehousing, inventory management, order fulfillment, and distribution, tailored to meet the unique needs of their clients. By partnering with 3PL providers, companies can reduce costs, improve efficiency, and enhance their overall supply chain performance. The 3PL industry has evolved to offer advanced technologies, real-time visibility, and global reach, making it an indispensable component of modern supply chain strategies across various industries.

Report Coverage

This research report categorizes the market for the third-party logistics market based on various segments and regions and forecasts revenue Growth and analyzes trends in each submarket. The report analyses the key Growth drivers, opportunities, and challenges influencing the third-party logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the third-party logistics market.

Global Third-party Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | 2,247.95 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.3% |

| 2032 Value Projection: | USD 1,012.75 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By Transport, By End-Use, By Region and COVID-19 Impact |

| Companies covered:: | BDP International, Burris Logistics, C.H. Robinson Worldwide, Inc., CEVA Logistics, DB Schenker Logistics, FedEx, J.B. Hunt Transport, Inc., Kuehne + Nagel, Nippon Express, United Parcel Service of America, Inc., XPO Logistics, Inc., Yusen Logistics Co. Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth & Analysis. |

Get more details on this report -

Driving Factors

The Third-party Logistics (3PL) market is influenced by a multitude of drivers that collectively shape its Growth and evolution. The globalization plays a pivotal role as businesses expand their operations across international borders, creating a heightened demand for complex supply chain solutions. This leads to a need for 3PL providers with expertise in managing cross-border logistics, customs compliance, and navigating international regulations. The rise of e-commerce and the digital economy has revolutionized consumer expectations, requiring faster and more flexible delivery options. As a result, companies are turning to 3PL providers to optimize last-mile delivery, warehousing, and inventory management to meet these evolving customer demands efficiently. Increasing focus on cost optimization and efficiency in supply chain management. 3PL providers offer economies of scale and expertise in supply chain optimization, enabling companies to reduce costs, improve resource allocation, and achieve greater operational efficiency. Technological advancements are transforming the 3PL landscape. Innovations like IoT (Internet of Things) sensors, RFID (Radio-Frequency Identification), and blockchain are enhancing visibility and traceability within the supply chain. This not only reduces the risk of disruptions but also enables data-driven decision-making, which is crucial for supply chain efficiency and customer satisfaction. Furthermore, sustainability and environmental concerns are driving the adoption of 3PL services. Many companies are seeking eco-friendly solutions in their supply chain operations, and 3PL providers can help implement greener practices such as optimized transportation routes, eco-friendly packaging, and efficient energy management. The complexity of regulatory compliance is increasing, particularly in industries like pharmaceuticals and food. 3PL providers offer specialized expertise in navigating these intricate regulations, ensuring that products are transported and stored in accordance with legal requirements. The COVID-19 pandemic exposed vulnerabilities in supply chains, prompting companies to re-evaluate their risk management strategies.

Restraining Factors

The Third-party Logistics (3PL) market faces several restraints that can hinder its Growth. One significant challenge is the potential loss of control over critical aspects of the supply chain when outsourcing to 3PL providers, which can lead to concerns regarding quality, visibility, and communication. Additionally, the cost of 3PL services can be a restraint for some companies, particularly smaller businesses with limited budgets. Complex and changing regulations and customs procedures in international trade can also pose challenges, as can the risk of over-dependence on a single 3PL provider. Technological and cybersecurity risks, as well as the potential for data breaches, are additional concerns that need to be addressed within the 3PL market.

Market Segmentation

- In 2022, the domestic transportation management segment accounted for around 30.4% market share

On the basis of the service, the global third-party logistics market is segmented into dedicated contract carriage/freight forwarding, domestic transportation management, international transportation management, warehousing & distribution, and value-added logistics services. The Domestic Transportation Management (DTM) segment has secured the largest market share in the third-party logistics (3PL) industry due to its pivotal role in managing the movement of goods within a single country. DTM providers offer expertise in optimizing trucking, rail, and other domestic transportation modes, enabling businesses to enhance supply chain efficiency and cost-effectiveness. This segment's prominence is driven by the increasing need for reliable and streamlined domestic logistics solutions, particularly in regions with robust industrial and commercial activities, such as North America, Europe, and Asia.

- The roadways segment held the largest market with more than 57.5% revenue share in 2022

Based on transport, the global third-party logistics market is segmented into roadways, railways, waterways, and airways. The dominance of the roadways segment in the third-party logistics (3PL) market can be attributed to several factors. Road transportation offers flexibility, accessibility, and cost-effectiveness, making it a preferred choice for domestic and regional logistics. Additionally, the extensive road networks in many regions, coupled with the last-mile delivery demands of e-commerce, have propelled the significance of roadways in the 3PL sector. Road transportation is well-suited for handling various types of cargo, making it versatile and adaptable to diverse supply chain needs, solidifying its dominance in the market.

- The manufacturing segment held the largest market with more than 25.3% revenue share in 2022

Based on the end-use, the global third-party logistics market is segmented into manufacturing, retail, healthcare, automotive, and others. The manufacturing segment has secured the largest revenue share in the third-party logistics (3PL) market due to its critical role in optimizing supply chains for production and distribution. Manufacturers increasingly rely on 3PL providers to streamline their logistics, reduce costs, and enhance operational efficiency. This is particularly crucial in an era of globalized supply chains and just-in-time production. The manufacturing sector's demand for services such as inventory management, warehousing, and transportation solutions has contributed significantly to its dominance in the 3PL market, as manufacturers seek to remain competitive and agile in a rapidly changing business environment.

Regional Segment Analysis of the Third-party Logistics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with more than 32.5% revenue share in 2022.

Get more details on this report -

Based on region, North America boasts the largest market share in the Third-party Logistics (3PL) industry for several compelling reasons. The region benefits from a highly developed and sophisticated logistics infrastructure, with extensive transportation networks and advanced technology adoption. Moreover, a robust e-commerce ecosystem and the presence of numerous large retail and manufacturing companies create substantial demand for 3PL services. North America's focus on supply chain optimization, stringent quality standards, and regulatory compliance also contribute to its dominant market position. Additionally, its geographical proximity to major global markets fosters efficient international trade, further solidifying its leadership in the 3PL sector.

Asia Pacific is anticipated to become the fastest-Growing region in the Third-party Logistics (3PL) market over the forecast period due to economic Growth, the burgeoning e-commerce sector, and expanding manufacturing industries are driving increased demand for efficient and scalable supply chain solutions. Additionally, the region's vast consumer base and the need for streamlined logistics to meet evolving customer expectations are propelling the Growth of 3PL services.

Recent Developments

- In December 2022, SEKO Logistics formed its first robotics relationship with GreyOrange's Ranger Assist Bots, with aims to "scale up" warehouse operations. During the initial part of the initiative, SEKO will install 15 bots in one of its Milton Keynes, UK, offices. Another 35 robots will be placed in the early part of next year. The logistics business plans to expand the bot effort beyond the United Kingdom next year, with the Netherlands serving as the initial stop.

- In September 2022, AI LOGISTIX, a startup that identifies and resolves logistics and supply chain challenges, has collaborated with SUN Mobility, a supplier of battery-swapping services and energy infrastructure for electric vehicles (EVs), to become India's last-mile delivery partner. The Bengaluru-based start-up leverages SUN Mobility's energy services as a customer of Alchemy Mobility LLP, a green mobility service provider for last-mile delivery providers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global third-party logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Companies:

- BDP International

- Burris Logistics

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- DB Schenker Logistics

- FedEx

- J.B. Hunt Transport, Inc.

- Kuehne + Nagel

- Nippon Express

- United Parcel Service of America, Inc.

- XPO Logistics, Inc.

- Yusen Logistics Co. Ltd.

Key Target Audience

- Market Players

- Investors

- End-Users

- Government Authorities

- Consulting and Research Firm

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global third-party logistics market based on the below-mentioned segments:

Third-party Logistics Market, By Service

- Dedicated Contract Carriage/Freight forwarding

- Domestic Transportation Management

- International Transportation Management

- Warehousing &Distribution

- Value Added Logistics Services

Third-party Logistics Market, By Transport

- Roadways

- Railways

- Waterways

- Airways

Third-party Logistics Market, By End-Use

- Manufacturing

- Retail

- Healthcare

- Automotive

- Others

Third-party Logistics Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Need help to buy this report?