Global Tire Retreading Market Size, Share, and COVID-19 Impact Analysis, By Method (Pre-Cure and Mold-Cure), By Vehicle Type (Commercial Vehicle and Off-highway Vehicle), By Tire Type (Radial, Bias, and Solid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Tire Retreading Market Insights Forecasts to 2033

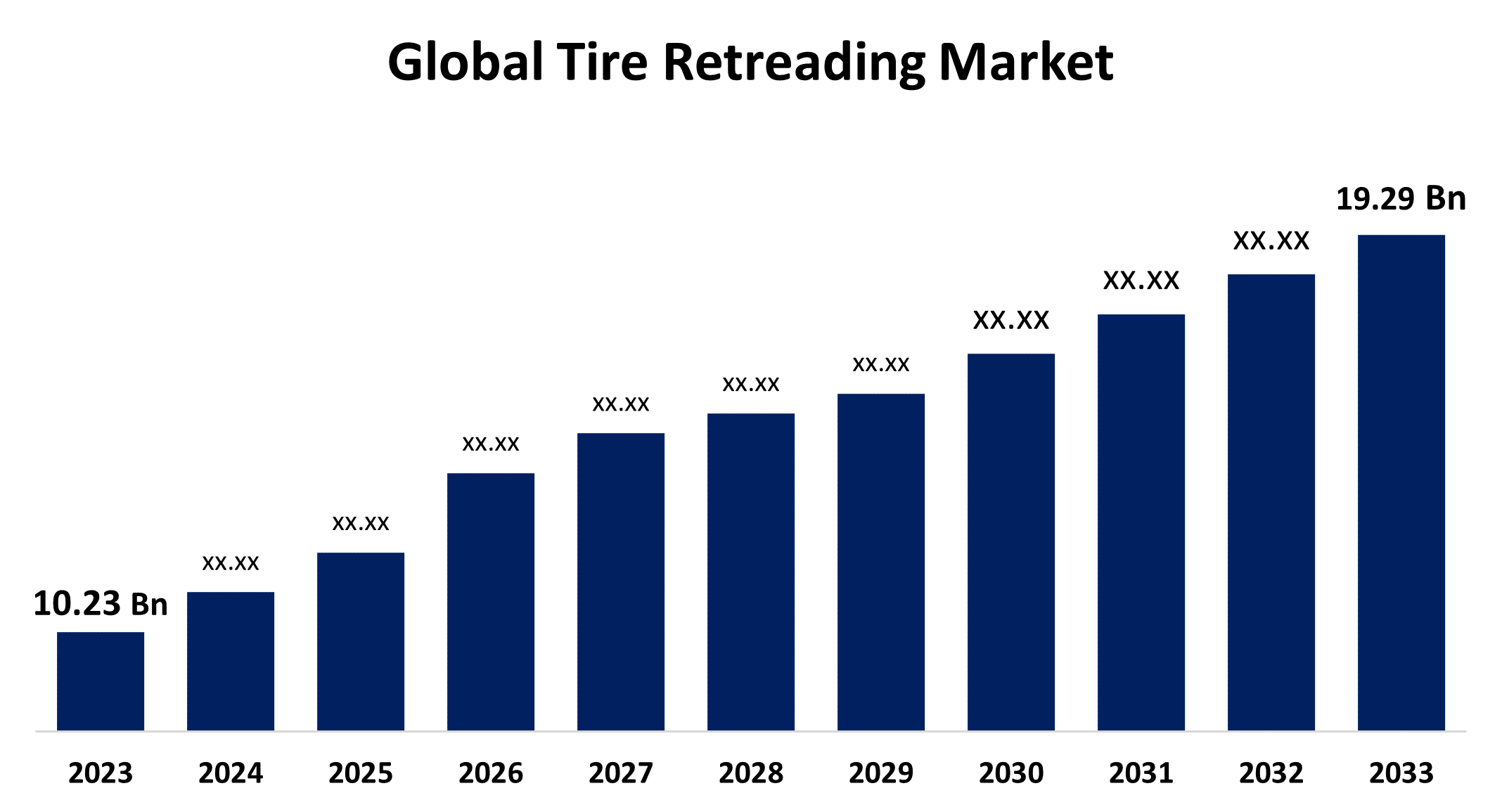

- The Global Tire Retreading Market Size was Valued at USD 10.23 Billion in 2023

- The Market Size is Growing at a CAGR of 6.55% from 2023 to 2033

- The Worldwide Tire Retreading Market Size is Expected to Reach USD 19.29 Billion by 2033

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Tire Retreading Market Size is Anticipated to Exceed USD 19.29 Billion by 2033, Growing at a CAGR of 6.55% from 2023 to 2033.

Market Overview

Retreading, also known as remolding, recycles a worn tire by replacing its treads with new ones while retaining its solid structure. It increases the lifespan of the original tire casing, significantly reducing waste and conserving raw materials. This type of tire is not commonly used by car drivers, as they prefer to replace tires completely. However, it is popular among drivers of larger vehicles like lorries, which require more frequent tire replacements, and retreading is often a more cost-effective option than purchasing new tires.

Retreading offers various advantages, including being budget-friendly and sustainable as it reduces waste production. A tire is made from a durable, petroleum-based rubber compound, and retreading requires significantly less rubber than manufacturing a new tire from scratch. There are several opportunities in the market, like advances in retreading technologies that improve the performance and safety of retreaded tires to standards comparable to new tires. Market trends show a growing adoption among trucking and logistics companies. Moreover, governmental incentives in various regions further encourage the use of retreaded tires.

Report Coverage

This research report categorizes the market for the global tire retreading market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global tire retreading market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global tire retreading market.

Global Tire Retreading Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 10.23 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.55% |

| 2033 Value Projection: | USD 19.29 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Method, By Vehicle Type, By Tire Type, By Region |

| Companies covered:: | Michelin, Kit Loong Commercial Tyre Group, JK TYRES, The Goodyear Tire & Rubber Company, Fortune Tire Tech Limited, Bridgestone, MRF, Tread Wright Tire, Carloni Tire, Rosler Tech Innovators, YOKOHAMA RUBBER COMPANY, Eastern treads, Continental AG, Pilipinas Kai Rubber Corporation, Nokian Tyres Plc., and Others Key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A confluence of economic and environmental factors drives the growth of the global tire retreading market. Among these, a major factor is the substantial cost savings that retreaded tires offer, making them appealing to commercial fleet operators who seek to minimize operational expenses. Environmental sustainability also plays an important role as tire retreading reduces waste and conserves non-degradable resources such as rubber and oil. This aligns with the increasing emphasis on sustainable practices and corporate social responsibility. Furthermore, technological advancements have improved the quality, safety, and durability of retreaded tires, improving their acceptance among previously skeptical consumers. The regulatory environment is another market driver, as many governments provide incentives for retreaded tires. Lastly, the rise in commercial vehicle usage, repair shops, and logistics sectors adds to the demand for cost-effective tire solutions.

Restraining Factors

The global tire retreading market might face some challenges, including the persistent consumer perception that retreaded tires are inferior in quality and safety to new tires. This skepticism can limit market adoption, particularly in regions with low consumer education on retreading benefits. Also, the high initial setup costs associated with establishing retreading facilities can be a major barrier for new entrants in the market. Competition from affordable new tires also poses a challenge, as consumers might opt for them over retreaded options. In some developing regions, limited access to advanced retreading technologies can limit market growth.

Market Segmentation

The global tire retreading market share is classified into the method, vehicle type, and tire type.

- The pre-cure segment is expected to hold the largest share of the global tire retreading market during the forecast period.

Based on the method, the global tire retreading market is divided into pre-cure and mold-cure. Among these, the pre-cure segment is expected to hold the largest share of the global tire retreading market during the forecast period. This method involves applying a pre-vulcanized tread to the tire casing, which is then cured in a chamber. It offers good quality and consistency, as the tread is manufactured separately under controlled conditions. Pre-cure retreading is known for providing a smoother and more uniform tread pattern, which improves performance and safety. The process is also highly versatile, allowing for a wide range of tread designs and patterns that can be tailored to specific applications. Furthermore, its cost-effectiveness and relatively simpler production requirements make it a popular choice among commercial fleet operators, driving its significant market share.

- The commercial vehicle segment is expected to hold the largest share of the global tire retreading market during the forecast period.

Based on vehicle type, the global tire retreading market is divided into commercial vehicles and off-highway vehicles. Among these, the commercial vehicle segment is expected to hold the largest share of the global tire retreading market during the forecast period. Commercial fleets require high operational costs, due to logistics, transportation, and freight services. Retreading offers a cost-effective solution for managing tire expenses, enabling fleet operators to significantly cut down on replacement costs. Additionally, commercial vehicles, due to their extensive mileage and rigorous usage, require frequent tire replacements, making retreading an economically viable option. Environmental considerations also play a role, as fleet operators increasingly adopt sustainable practices to reduce their carbon footprint. The durability and performance of retreaded tires made by advanced retreading technologies fuel their demand in the commercial vehicle sector.

- The radial segment is expected to grow at the fastest CAGR in the global tire retreading market during the forecast period.

Based on tire type, the global tire retreading market is divided into radial, bias, and solid. Among these, the radial segment is expected to grow at the fastest CAGR in the global tire retreading market during the forecast period. Radial tires are known for their performance, including improved fuel efficiency, greater durability, and ride comfort, which make them increasingly popular across various vehicle types. The structural benefits of radial tires, including better heat dissipation and less rolling resistance, contribute to their longer lifespan than bias and solid tires. This longevity translates into fewer replacements and a higher potential for retreading. Furthermore, the adoption of radial tires in commercial and passenger vehicles, driven by technological advancements and customer preference for high-performance tires, boosts the rapid market growth. Increasing regulatory support for sustainable tires also incentivizes the retreading of radial tires.

Regional Segment Analysis of the Global Tire Retreading Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

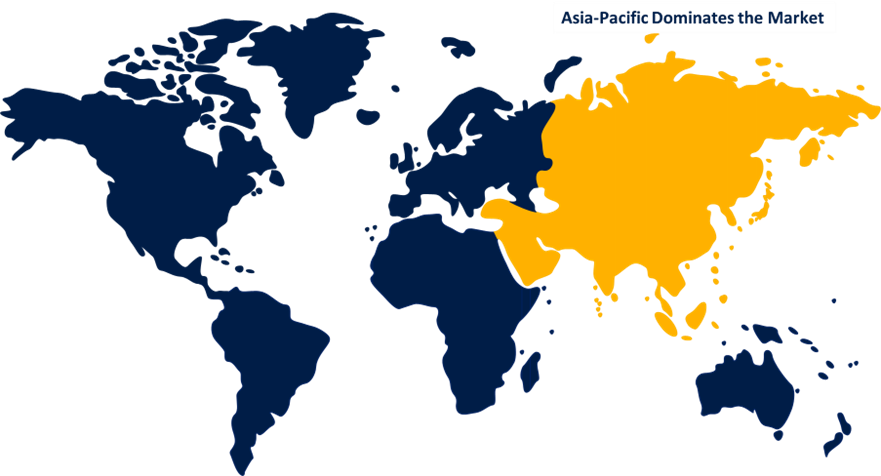

Asia-Pacific is anticipated to hold the largest share of the global tire retreading market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global tire retreading market over the predicted timeframe. This dominance is expected due to several factors, including the expansive and rapidly growing automotive sector in countries like China, India, and Japan. The high volume of commercial vehicles in operation, driven by industrial and logistics activities, creates more demand for cost-efficient tire solutions.

Additionally, the economic benefits of tire retreading resonate strongly in cost-sensitive markets within the region. Technological improvements in retreading processes have further enhanced the quality and reliability of retreaded tires, boosting consumer confidence. Government policies promoting sustainable practices and resource conservation also play a significant role, as retreading helps reduce environmental impact by extending the lifecycle of tires.

Europe is expected to grow at the fastest pace in the global tire retreading market during the forecast period. The growth is expected due to the region's strong emphasis on sustainability and environmental responsibility, which aligns with the benefits of tire retreading. European Union regulations and incentives that promote waste reduction and resource conservation encourage the adoption of retreaded tires. The advanced transportation infrastructure and the high usage rates of commercial vehicles in Europe create a significant demand for cost-effective tire solutions. Technological innovation in the tire manufacturing and retreading industries improves the quality and performance of retreaded tires, further driving the regional market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global tire retreading market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Michelin

- Kit Loong Commercial Tyre Group

- JK TYRES

- The Goodyear Tire & Rubber Company

- Fortune Tire Tech Limited

- Bridgestone

- MRF

- Tread Wright Tire

- Carloni Tire

- Rosler Tech Innovators

- YOKOHAMA RUBBER COMPANY

- Eastern treads

- Continental AG

- Pilipinas Kai Rubber Corporation

- Nokian Tyres Plc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In July 2024, Bridgestone Americas (Bridgestone) introduced the new BDR-AD3 retread, Bandag's premier solution for the demanding challenges of package & delivery and last-mile delivery applications.

- In June 2024, During the 2024 edition of the Brazilian tire retreading exhibition Pneushow, tread rubber manufacturer Tipler announced the launch of its new RT74+ tread.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global tire retreading market based on the below-mentioned segments:

Global Tire Retreading Market, By Method

- Pre-Cure

- Mold-Cure

Global Tire Retreading Market, By Vehicle Type

- Commercial Vehicle

- Off-highway Vehicle

Global Tire Retreading Market, By Tire Type

- Radial

- Bias

- Solid

Global Tire Retreading Market, Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Michelin, Kit Loong Commercial Tyre Group, JK TYRES, The Goodyear Tire & Rubber Company, Fortune Tire Tech Limited, Bridgestone, MRF, Tread Wright Tire, Carloni Tire, Rosler Tech Innovators, YOKOHAMA RUBBER COMPANY, Eastern treads, Continental AG, Pilipinas Kai Rubber Corporation, Nokian Tyres Plc., and others.

-

2. What is the size of the global tire retreading market?The Global Tire Retreading Market is expected to grow from USD 10.23 Billion in 2023 to USD 19.29 Billion by 2033, at a CAGR of 6.55% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?Asia-Pacific is anticipated to hold the largest share of the global tire retreading market over the predicted timeframe.

Need help to buy this report?