Global Torque Vectoring Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Passenger cars, Commercial Vehicles), Propulsion Type (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive (AWD)/Four Wheel Drive (4WD)), Technology Type (Active Torque Vectoring, Passive Torque Vectoring), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Torque Vectoring Market Insights Forecasts to 2033

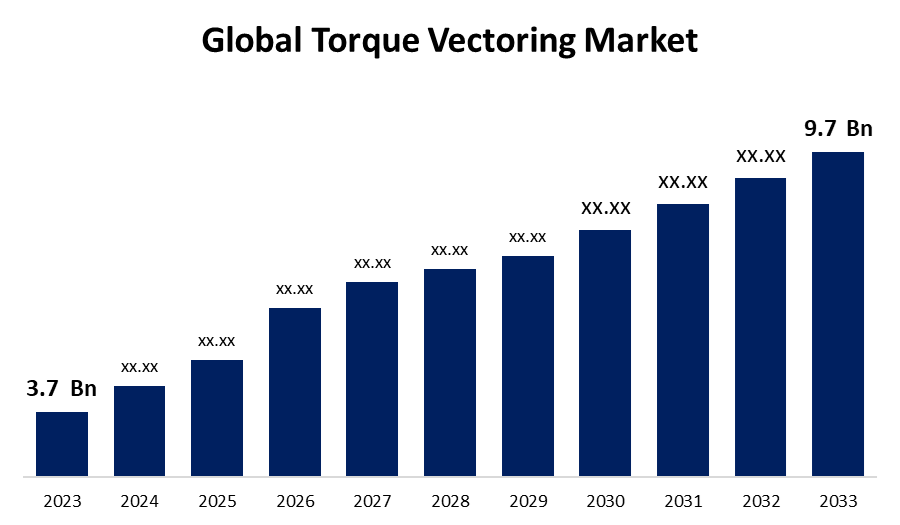

- The Torque Vectoring Market Size was valued At USD 3.7 Billion in 2023.

- The Market Size is Growing At a CAGR of 10.12% from 2023 to 2033.

- The Worldwide Torque Vectoring Market Size is Expected to reach USD 9.7 Billion by 2033.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Torque Vectoring Market Size is Expected To reach USD 9.7 Billion by 2033, at a CAGR of 10.12% during the forecast period 2023 to 2033.

The torque vectoring market Size is experiencing steady growth, driven by increasing demand for enhanced vehicle safety, performance, and handling across both luxury and high-performance vehicles. This technology optimizes power distribution to individual wheels, improving traction, cornering, and overall driving dynamics. The rise in electric and hybrid vehicles further fuels adoption, as torque vectoring plays a crucial role in managing electric motor outputs for smoother and more efficient driving. Automakers are investing heavily in advanced drivetrain systems to differentiate their offerings, particularly in the premium and sports segments. Additionally, growing consumer expectations for improved vehicle stability and control, along with tightening regulations on vehicle safety, are prompting manufacturers to integrate torque vectoring systems. As a result, the market is set to expand across both OEM and aftermarket applications globally.

Torque Vectoring Market Value Chain Analysis

The torque vectoring market value chain comprises multiple interconnected stages, starting with raw material suppliers providing essential components like sensors, actuators, electronic control units, and drivetrain parts. These materials are then utilized by component manufacturers who design and develop torque vectoring modules tailored to various vehicle platforms. System integrators and Tier 1 suppliers assemble these components into complete systems and collaborate closely with automotive OEMs for integration into vehicles. OEMs conduct testing, validation, and customization based on model-specific requirements. Post-manufacturing, vehicles are distributed through dealer networks, while aftermarket service providers handle maintenance, upgrades, and part replacements. R&D institutions and technology partners also contribute by driving innovation in software and control algorithms. Throughout the chain, regulatory bodies ensure safety and performance compliance, influencing product development and market direction.

Torque Vectoring Market Opportunity Analysis

The torque vectoring market presents significant opportunities driven by evolving automotive trends and technological advancements. As the industry shifts towards electrification, torque vectoring systems become integral in enhancing vehicle performance, safety, and energy efficiency. Electric powertrains facilitate precise torque distribution, improving traction and handling. The growing demand for high-performance and luxury vehicles further propels the adoption of torque vectoring technology, offering manufacturers a means to differentiate their offerings. Additionally, the rise of autonomous and connected vehicles opens avenues for integrating torque vectoring with advanced driver-assistance systems, enhancing vehicle control and stability. Emerging markets, particularly in Asia-Pacific, are witnessing increased adoption due to rising consumer expectations and supportive regulatory frameworks.

Global Torque Vectoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.7 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 10.12% |

| 2033 Value Projection: | USD 9.7 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Vehicle Type, Propulsion Type, Technology Type and By Region |

| Companies covered:: | Delphi Technologies, Honda Motor Co, Nissan Motor Corporation, Trelleborg AB, Continental AG, Magna International, RenaultNissanMitsubishi Alliance, ZF Friedrichshafen, Aisin Seiki, Toyota Motor Corporation, Voith GmbH, Hyundai Mobis, Daimler AG, GKN Automotive, and BorgWarner |

| Growth Drivers: | Growing Demand for Improved Vehicle Performance |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Torque Vectoring Market Dynamics

Growing Demand for Improved Vehicle Performance

The torque vectoring market is witnessing significant growth, driven by the growing demand for improved vehicle performance. As consumers and manufacturers prioritize enhanced handling, stability, and safety, the adoption of torque vectoring systems has surged across various vehicle segments. These systems play a crucial role in distributing power effectively between wheels, resulting in better traction and cornering capabilities. Automakers are increasingly integrating advanced torque vectoring technologies to meet the expectations of modern drivers who seek a dynamic and responsive driving experience. The rise in electric and hybrid vehicles has further fueled this demand, as these platforms benefit greatly from precise power distribution. Additionally, advancements in automotive electronics and control systems are enabling more efficient and adaptable torque vectoring solutions, supporting the market's ongoing expansion.

Restraints & Challenges

One of the primary obstacles is the high cost of implementation, especially in high-performance and luxury vehicles. The integration of advanced torque vectoring systems requires sophisticated hardware and software, which increases manufacturing costs and, in turn, vehicle prices. Additionally, the complexity of these systems can result in higher maintenance and repair expenses, making them less appealing for certain consumer segments. Another challenge is the lack of standardization in torque vectoring technologies, which can create compatibility issues across different vehicle platforms. Furthermore, the market is hindered by the relatively slow adoption of electric vehicles in some regions, as these vehicles benefit significantly from torque vectoring. Lastly, the technology's reliance on precise sensors and control systems may limit its efficiency in adverse weather conditions or rough terrain.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Torque Vectoring Market from 2023 to 2033. Consumers' increasing desire for superior handling and dynamic driving experiences has led automakers to integrate torque vectoring systems into various vehicle types, including sports cars and SUVs. The emphasis on driving performance, coupled with regulatory safety mandates, further drives the adoption of these systems. Opportunities lie in the integration of torque vectoring in electric and hybrid vehicles, as well as in the aftermarket sector. The U.S. leads the market, with Canada and Mexico also experiencing notable growth in adopting torque vectoring technologies.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. This growth is primarily driven by the increasing adoption of electric vehicles (EVs), particularly battery electric vehicles (BEVs), which benefit significantly from torque vectoring systems that enhance performance and efficiency. Countries like China, Japan, and India are leading this trend, with China achieving notable milestones in EV adoption ahead of set targets. The market is also bolstered by supportive government policies promoting EV adoption and technological advancements in torque vectoring systems.

Segmentation Analysis

Insights by Vehicle Type

The passenger car segment accounted for the largest market share over the forecast period 2023 to 2033. As consumers seek vehicles with superior handling, stability, and safety, automakers are increasingly incorporating torque vectoring systems into passenger cars. These systems offer improved traction, better cornering ability, and enhanced overall vehicle dynamics, which are especially valued in high-performance and luxury models. The growing trend toward electric and hybrid vehicles also boosts the adoption of torque vectoring in passenger cars, as these vehicles benefit from precise power distribution. As consumer expectations continue to evolve, automakers are investing more in advanced technologies to cater to the demand for vehicles that deliver both performance and safety, further accelerating the market's growth.

Insights by Propulsion Type

The All-Wheel Drive (AWD) and Four-Wheel Drive (4WD) segment accounted for the largest market share over the forecast period 2023 to 2033. These systems enhance vehicle handling, stability, and traction by distributing torque between individual wheels, especially under varying driving conditions. The increasing demand for SUVs, off-road vehicles, and electric vehicles (EVs) is driving the adoption of AWD/4WD systems, as they offer improved performance and safety features. Technological advancements in torque vectoring systems, such as electronic clutch actuation and integration with advanced driver assistance systems (ADAS), are further boosting their appeal. As consumer preferences shift towards vehicles that provide superior driving dynamics and safety, the AWD/4WD segment is poised for continued expansion in the torque vectoring market.

Insights by Technology Type

The passive torque vectoring segment accounted for the largest market share over the forecast period 2023 to 2033. PTVS utilizes mechanical components, such as limited-slip differentials and braking systems, to distribute torque between wheels, enhancing vehicle stability and handling without the complexity of electronic controls. This simplicity makes PTVS an attractive option for automakers aiming to improve vehicle performance while keeping costs manageable. Despite the growing preference for active torque vectoring systems in high-performance and electric vehicles, PTVS maintains its relevance due to its cost-effectiveness and reliability. As the automotive industry continues to prioritize affordability and efficiency, the passive torque vectoring segment is expected to sustain its presence, especially in vehicle segments where advanced electronic systems are less prevalent.

Recent Market Developments

- In August 2023, Lamborghini revealed the Lamborghini Lanzador, a two-door crossover concept powered entirely by electricity, marking the brand's first electric vehicle.

Competitive Landscape

Major players in the market

- Delphi Technologies

- Honda Motor Co

- Nissan Motor Corporation

- Trelleborg AB

- Continental AG

- Magna International

- RenaultNissanMitsubishi Alliance

- ZF Friedrichshafen

- Aisin Seiki

- Toyota Motor Corporation

- Voith GmbH

- Hyundai Mobis

- Daimler AG

- GKN Automotive

- BorgWarner

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Torque Vectoring Market, Vehicle Type Analysis

- Passenger cars

- Commercial Vehicles

Torque Vectoring Market, Propulsion Type Analysis

- Front Wheel Drive

- Rear Wheel Drive

- All Wheel Drive (AWD)/Four Wheel Drive (4WD)

Torque Vectoring Market, Technology Type Analysis

- Active Torque Vectoring

- Passive Torque Vectoring

Torque Vectoring Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Torque Vectoring Market?The global Torque Vectoring Market is expected to grow from USD 3.7 billion in 2023 to USD 9.7 billion by 2033, at a CAGR of 10.12% during the forecast period 2023-2033.

-

2. Who are the key market players of the Torque Vectoring Market?Some of the key market players of the market are Delphi Technologies, Honda Motor Co, Nissan Motor Corporation, Trelleborg AB, Continental AG, Magna International, RenaultNissanMitsubishi Alliance, ZF Friedrichshafen, Aisin Seiki, Toyota Motor Corporation, Voith GmbH, Hyundai Mobis, Daimler AG, GKN Automotive, BorgWarner.

-

3. Which segment holds the largest market share?The passenger cars segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?