Global Trade Finance Market Size, Share, and COVID-19 Impact Analysis, By Finance Type (Structured Trade Finance, Supply Chain Finance, and Traditional Trade Finance), By Service Provider (Banks, Financial Institutions, Trading Houses, and Others), By Product Type (Letters of Credit, Export Factoring, Insurance, Bill of Lading, Guarantees, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Banking & FinancialGlobal Trade Finance Market Insights Forecasts to 2033

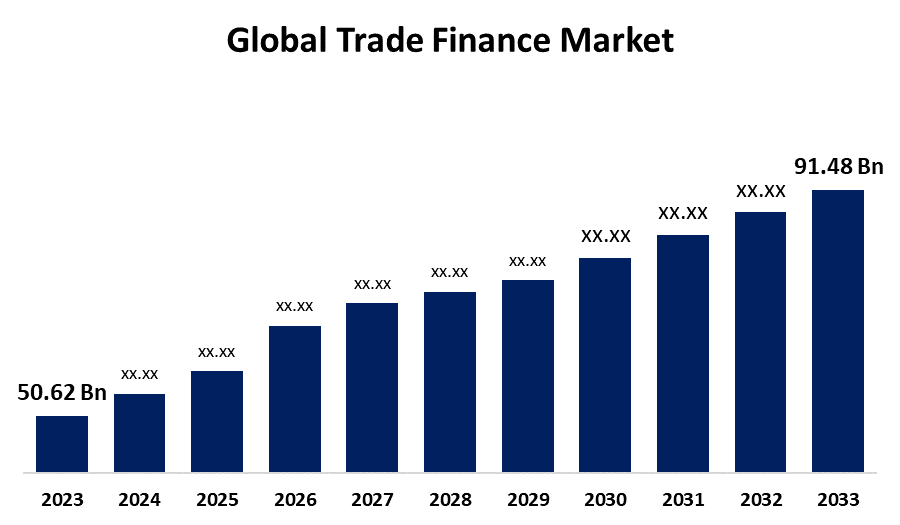

- The Global Trade Finance Market Size was Valued at USD 50.62 Billion in 2023

- The Market Size is Growing at a CAGR of 6.10% from 2023 to 2033

- The Worldwide Trade Finance Market Size is Expected to Reach USD 91.48 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Trade Finance Market Size is Anticipated to Exceed USD 91.48 Billion by 2033, Growing at a CAGR of 6.10% from 2023 to 2033.

Market Overview

The financial tools and products used by businesses to promote global trade and commerce are referred to as trade finance. The ability and convenience of trade financing allow importers and exporters to conduct business through commerce. A trade is any successful transaction involving the purchasing or selling of a good. Trade can be either worldwide, involving states, or domestic, involving market participants inside their borders. Commerce financing makes it easier for parties to conduct profitable commerce. It serves as a funding source for both internal and foreign trade. Trade financing guarantees smooth transactions, and successful delivery of goods and payments, and lowers the risks associated with purchasing and selling items. Buyers, sellers, lenders, insurance companies, and other pertinent parties are the parties involved in trade finance. Trade finance makes it possible for buyers and sellers to offer favorable conditions. By reducing late payments throughout the trading cycle. Market expansion is projected to be driven by factors such as rising volumes of international trade, continuous digital transformation, and the emergence of emerging economies as major players in global trade. Globalization is a major factor driving the expansion of the trade finance market as more companies look to expand internationally. Through the market, businesses can reduce the risks of doing business internationally, including currency volatility, instability in politics, and payment defaults. Additionally, trade finance ensures efficient and seamless trade flows by bridging the funding gap that exists between buyers and sellers.

Report Coverage

This research report categorizes the market for the global trade finance market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global trade finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global trade finance market.

Global Trade Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 50.62 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.10% |

| 2033 Value Projection: | USD 91.48 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Finance Type, By Service Provider, By Product Type, By Region |

| Companies covered:: | Citigroup Inc., BNP Paribas SA, HSBC Holdings plc, Mitsubishi UFJ Financial Group Inc., JPMorgan Chase & Co., UniCredit S.p.A., Credit Agricole Group, Santander Group, Bank of America Corporation, Standard Chartered Bank, Commerzbank AG, Sumitomo Mitsui Financial Group Inc., Deutsche Ban, and Other key companies. has context menu |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding owing to rapid globalization and an increase in the volume of international trade. To facilitate cross-border transactions, businesses are investing in safe finance trade solutions as they expand into new international markets. This is further strengthened by the growing reliance on e-commerce platforms due to their simplicity in facilitating international trade for businesses of all kinds. Additionally, the increasing significance of small and medium-sized businesses in international trade has brought attention to their limited access to acceptable trade financing options. Millions of people are employed by small and medium-sized businesses, which also help to develop national economies around the globe. They serve as the foundations of the world economy and drive progress and expansion on a global scale.

Restraining Factors

The continued use of outdated, paper-based procedures, which can result in delays, inefficiencies, and higher expenses, is a significant market constraint. These outdated techniques increase the danger of fraud and manual mistakes, which can impede the efficient operation of trade finance.

Market Segmentation

The global trade finance market share is segmented into finance type, service provider, and product type.

- The supply chain finance segment dominates the market with the largest market share through the forecast period.

Based on the finance types, the global trade finance market is segmented into structured trade finance, supply chain finance, and traditional trade finance. Among these, the supply chain finance segment dominates the market with the largest market share through the forecast period. Supply chain financing is necessary for supply chain management (SCF). Supply chain finance connects buyers and suppliers with a financial institution to reduce risks, improve cash flow efficiency, and save financing costs. To put it briefly, it is useful for supply chain management, adaptable, and efficient. By channeling the lowest price of capital to the parts of the supply chain where it is most needed, supply chain financing can assist supply networks in becoming more stable and flexible. This enables them to turn their focus from just getting by to increasing productivity, creating new goods, and inventing. Longer payment terms and a faster cash conversion cycle are provided. Supply chain financing helps businesses grow by reducing supply chain risk and building stronger supplier relationships.

- The financial institutions segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the service provider, the global trade finance market is segmented into banks, financial institutions, trading houses, and others. Among these, the financial institutions segment is anticipated to grow at the fastest CAGR growth through the forecast period. The ability of financial institutions to meet unique needs and provide specialized services is causing them to grow rapidly in the market. When it comes to customized and flexible solutions, financial institutions frequently outperform traditional banks. They use technology to expedite procedures, cut down on paperwork, and provide quicker funding access. Their flexibility enables them to cater to a wider range of companies, including small and medium-sized ones that conventional banks might have overlooked.

- The letters of credit segment accounted for the largest revenue share through the forecast period.

Based on the product type, the global trade finance market is segmented into letters of credit, export factoring, insurance, bill of lading, guarantees, and others. Among these, the letters of credit segment accounted for the largest revenue share through the forecast period. An official document that acts as a guarantee for payments made by one bank to another. A letter of credit is an agreement between a beneficiary, a bank, and the bank's customer. The beneficiary has the assurance that payment will be made once the conditions of the letter of credit have been met by the letter of credit, which is regularly provided by the importer's bank. Risk is reduced when using letters of credit. The risk of clients defaulting is reduced. A bank's letter of credit, under certain circumstances, guarantees that a seller will receive payment. It helps buyers demonstrate their financial soundness. It assists vendors with managing their cash flow and ensures the security of payments.

Regional Segment Analysis of the Global Trade Finance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global trade finance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global trade finance market over the predicted timeframe. Global banks and financial institutions, which offer a variety of trade financing products and services, are a major force in the region's economy. With a sizable portion of the trade finance market's overall revenue coming from trade, the United States leads the market in North America. Furthermore, there has been a notable movement in the trade finance sector of the region towards digitalization, as an increasing number of financial institutions are providing digital trade finance solutions.

Asia-Pacific is expected to grow at the fastest CAGR growth of the global trade finance market during the forecast period. The region's solid economic growth and expanding trade operations, notably in China and India, fuel demand for trade financing solutions. Governments and financial institutions are actively pushing trade finance through programs such as the Belt and Road Initiative. The use of digital platforms and innovative fintech solutions is increasing the efficiency of trade finance operations. Supply chain finance offers crucial working cash to businesses, enabling them to expand their operations and trade. These combined circumstances place Asia Pacific as a dominating role in the global trade finance scene.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global trade finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Citigroup Inc.

- BNP Paribas SA

- HSBC Holdings plc

- Mitsubishi UFJ Financial Group Inc.

- JPMorgan Chase & Co.

- UniCredit S.p.A.

- Credit Agricole Group

- Santander Group

- Bank of America Corporation

- Standard Chartered Bank

- Commerzbank AG

- Sumitomo Mitsui Financial Group Inc.

- Deutsche Ban

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In April 2023, Credit Suisse and blockchain startup ConsenSys collaborated to create a blockchain-based platform meant to digitize trade finance processes.

- In March 2023, Barclays declared that it would extend its trade finance capabilities by acquiring TradeIX, a trade finance platform.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global trade finance market based on the below-mentioned segments:

Global Trade Finance Market, By Finance Type

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Global Trade Finance Market, By Service Provider

- Banks

- Financial Institutions

- Trading Houses

- Others

Global Trade Finance Market, By Product Type

- Letters of Credit

- Export Factoring

- Insurance

- Bill of Lading

- Guarantees

- Others

Global Trade Finance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which are the key companies that are currently operating within the market?Citigroup Inc., BNP Paribas SA, HSBC Holdings plc, Mitsubishi UFJ Financial Group Inc., JPMorgan Chase & Co., UniCredit S.p.A., Credit Agricole Group, Santander Group, Bank of America Corporation, Standard Chartered Bank, Commerzbank AG, Sumitomo Mitsui Financial Group Inc., Deutsche Bank, and Others

-

2. What is the size of the global trade finance market?The Global Trade Finance Market Size is Expected to Grow from USD 50.62 Billion in 2023 to USD 91.48 Billion by 2033, at a CAGR of 6.10% during the forecast period 2023-2033.

-

3. Which region is holding the largest share of the market?North America is anticipated to hold the largest share of the global trade finance market over the predicted timeframe.

Need help to buy this report?