Global Transfection Technologies Market Size, Share, and COVID-19 Impact Analysis, By Product (Kits & Reagents, and Equipment), By Method (Physical Transfection, Biochemical-Based Transfection, Viral-Vector Based Transfection, Cotransfection), By Application (Therapeutic Delivery, Biomedical Research, Protein Production, Cell-Based Microarrays), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Transfection Technologies Market Insights Forecasts to 2033

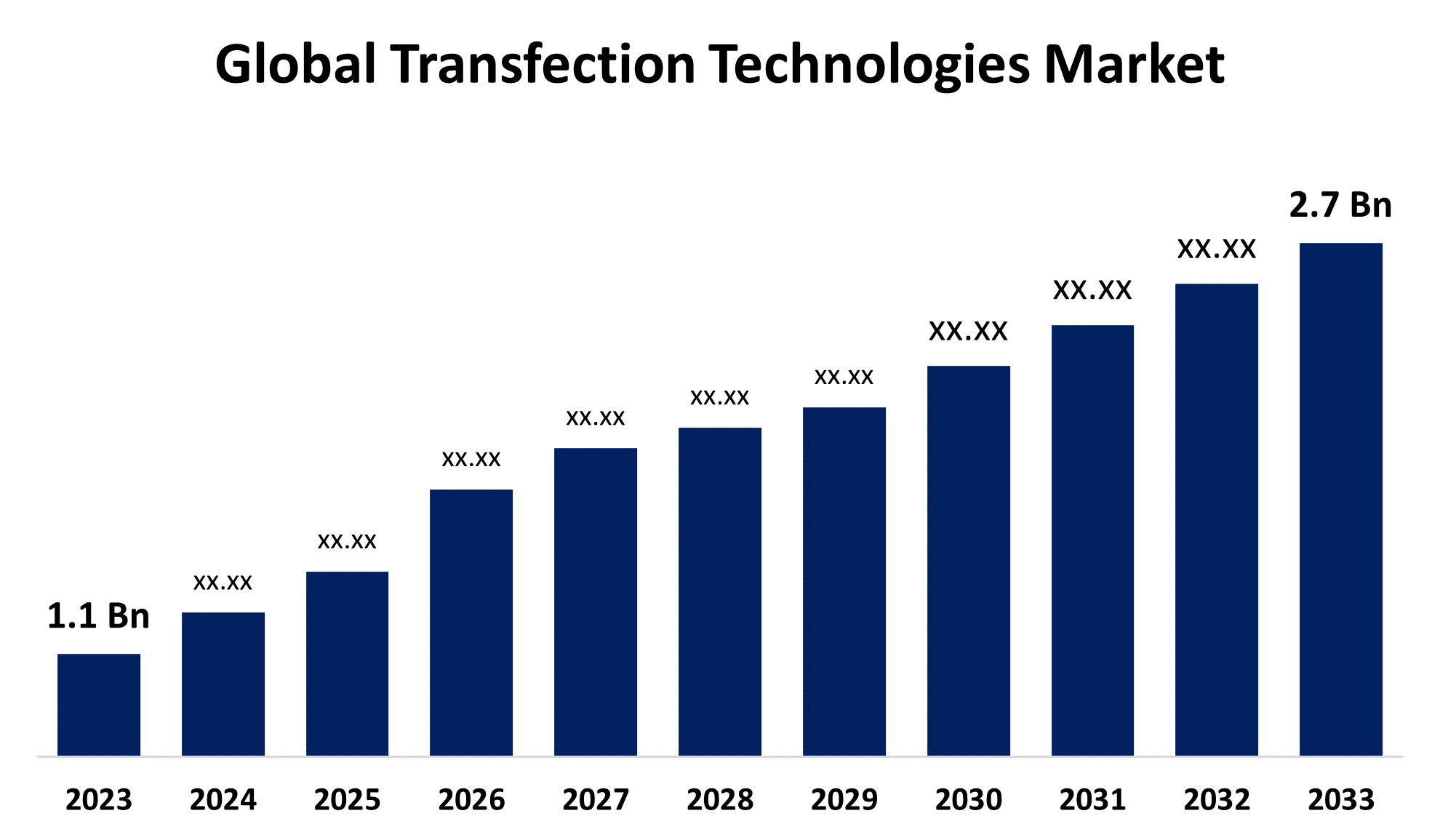

- The Global Transfection Technologies Market Size was Valued at USD 1.1 Billion in 2023

- The Market Size is Growing at a CAGR of 9.39% from 2023 to 2033

- The Worldwide Transfection Technologies Market Size is Expected to Reach USD 2.7 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Transfection Technologies Market Size is Anticipated to Exceed USD 2.7 Billion by 2033, Growing at a CAGR of 9.39% from 2023 to 2033.

Market Overview

Transfection technologies include a range of methods designed to introduce foreign genetic material, such as DNA or RNA, into cells, enabling scientists to delve deeply into gene function, protein production, and the development of novel treatments for a myriad of diseases. This intricate process is pivotal in advancing genetic research and drug development, as it allows for the manipulation of gene expression and the study of gene behavior in a controlled environment. Various transfection techniques chemical, physical, and biological are tailored to suit different cell types and experimental requirements. Chemical methods often involve the use of lipid-based compounds or polymers to facilitate the uptake of genetic material, while physical methods might include electroporation or microinjection to directly deliver genes into cells. Biological methods, such as viral vectors, use modified viruses to carry and insert genetic material into host cells. These technologies are not only instrumental in producing genetically modified organisms but also play a critical role in the creation of therapeutic proteins and the development of gene therapies. As such, transfection technologies are indispensable tools in modern medical and biological sciences, driving innovation and offering new avenues for treating complex genetic disorders and other health conditions.

Report Coverage

This research report categorizes the market for the global transfection technologies market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global transfection technologies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global transfection technologies market.

Global Transfection Technologies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.1 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.39% |

| 2033 Value Projection: | USD 2.7 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product, By Method, By Application, By Region |

| Companies covered:: | Thermo Fisher Scientific, Inc., Promega Corporation, F. Hoffmann-La Roche Ltd, QIAGEN N.V., Polyplus-transfection, Bio-Rad Laboratories, Inc., Lonza Group, Sigma-Aldrich Corporation, Mirus Bio, MaxCyte, Inc., Sartorius AG, Revvity, Inc., Danaher Corporation, Agilent Technologies, Inc., Biontex Laboratories GmbH, and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing demand for cell and gene therapy

Cell and gene therapies are advanced treatments for a variety of diseases including cancer, cystic fibrosis, heart disease, and genetic disorders. Cell therapy is a treatment in which viable cells are injected or implanted into the patient's body to achieve therapeutic effects. Gene therapy, on the other hand, is a medical technology that uses gene expression manipulation to produce therapeutic effects. Thus, cell and gene therapies are commonly used to treat genetic and rare diseases. The use of cell and gene therapies has increased in recent years, and this trend is expected to continue in the future due to the high and rising incidence of cancer and other rare diseases.

Restraining Factors

Transfection technologies limited efficiency

Transfection technologies often face challenges like decreased efficiency and cell viability due to factors such as low DNA concentration and contamination, potentially hindering market growth.

Market Segmentation

The global transfection technologies market share is classified into product, method, and application.

- The kits & reagents segment is expected to hold the largest share of the global transfection technologies market during the forecast period.

Based on the product, the global transfection technologies market is categorized into kits & reagents, and equipment. Among these, the kits & reagents segment is expected to hold the largest share of the global transfection technologies market during the forecast period. Kits and reagents for transfection technologies provide researchers with ready-to-use solutions that simplify the entire process, from preparation to optimization, saving time and resources. These commercial products include pre-optimized formulations of transfection reagents, buffers, and other essential components, ensuring experiments are conducted under standardized conditions. Available for various applications such as DNA, RNA, and protein transfection, as well as specialized techniques like CRISPR/Cas9 genome editing, these kits and reagents are driving the growth of the transfection technology segment.

- The physical transfection segment is expected to grow at the fastest CAGR during the forecast period.

Based on the method, the global transfection technologies market is categorized into physical transfection, biochemical-based transfection, viral-vector-based transfection, and cotransfection. Among these, the physical transfection segment is expected to grow at the fastest CAGR during the forecast period. Physical transfection methods, like electroporation and particle bombardment, often achieve higher transfection efficiency than chemical-based methods. This is especially useful for challenging cell types or when high gene expression is needed. These methods can be applied to a wide range of cell types, including adherent and suspension cells, primary cells, and even tissues or organs, making them versatile for various biological systems. This versatility supports diverse applications in basic research, drug discovery, and gene therapy. Physical transfection methods deliver nucleic acids directly into cells using electric pulses (electroporation) or microprojectiles (gene guns), bypassing the need for cellular uptake mechanisms, which can lead to faster and more efficient gene expression.

- The therapeutic delivery segment is expected to grow at the fastest CAGR during the forecast period.

Based on the application, the global transfection technologies market is categorized into therapeutic delivery, biomedical research, protein production, and cell-based microarrays. Among these, the therapeutic delivery segment is expected to grow at the fastest CAGR during the forecast period. Transfection methods can be designed to deliver therapeutic nucleic acids like siRNA, mRNA, or CRISPR-Cas9 constructs directly to target cells or tissues, reducing off-target effects and enhancing therapeutic efficacy. This precision allows for personalized treatments tailored to an individual's genetic profile or disease, improving effectiveness and minimizing side effects. Additionally, some methods, such as lipid nanoparticles or viral vectors, enable non-invasive delivery of these therapies either systemically or locally, enhancing patient comfort and compliance while reducing risks associated with invasive procedures.

Regional Segment Analysis of the Global Transfection Technologies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global transfection technologies market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global transfection technologies market over the forecast period. The dominance of the North America region is fueled by its strong biotechnology and pharmaceutical industries, advanced healthcare infrastructure, and significant research and development investments. Strategic partnerships and collaborations between academic institutions, biotech companies, and pharmaceutical firms promote innovation and the adoption of transfection technologies. Additionally, the region's early adoption of new technologies boosts the use of advanced transfection methods in research labs and biopharmaceutical companies.

Asia Pacific is expected to grow at the fastest CAGR growth of the global transfection technologies market during the forecast period. The growth of the Asia Pacific region is driven by expanding biopharmaceutical research, a booming biotechnology and life sciences sector, and increasing demand for personalized medicine. Government backing, investments, and the rise of contract research organizations are also boosting the market. The rapid development of healthcare infrastructure, including research institutes and specialized facilities, creates more opportunities for adopting transfection technologies. Countries like China, India, Japan, and South Korea are experiencing a surge in investments, research partnerships, and supportive regulatory policies, further accelerating market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global transfection technologies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Thermo Fisher Scientific, Inc.

- Promega Corporation

- F. Hoffmann-La Roche Ltd

- QIAGEN N.V.

- Polyplus-transfection

- Bio-Rad Laboratories, Inc.

- Lonza Group

- Sigma-Aldrich Corporation

- Mirus Bio

- MaxCyte, Inc.

- Sartorius AG

- Revvity, Inc.

- Danaher Corporation

- Agilent Technologies, Inc.

- Biontex Laboratories GmbH

- Others

Key Market Developments

- In March 2023, Thermo Fisher Scientific Inc. launched the Neon NxT Electroporation system, which is designed to improve genome editing. The system is suitable for transfecting challenging cell lines.

- In February 2022, Polyplus acquired e-Zyvec, which provides DNA design and production services for custom DNA vectors. The acquisition aims to broaden the portfolio of DNA vector engineering.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global transfection technologies market based on the below-mentioned segments:

Global Transfection Technologies Market, By Product

- Kits & Reagents

- Equipment

Global Transfection Technologies Market, By Method

- Physical Transfection

- Biochemical-Based Transfection

- Viral-Vector Based Transfection

- Cotransfection

Global Transfection Technologies Market, By Application

- Therapeutic Delivery

- Biomedical Research

- Protein Production

- Cell-Based Microarrays

Global Transfection Technologies Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global transfection technologies market over the forecast period?The Global Transfection Technologies Market Size is Expected to Grow from USD 1.1 Billion in 2023 to USD 2.7 Billion by 2033, at a CAGR of 9.39% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global transfection technologies market?North America is projected to hold the largest share of the global transfection technologies market over the forecast period.

-

3.Who are the top key players in the transfection technologies market?The top key players in the global transfection technologies market are Thermo Fisher Scientific, Inc., Promega Corporation, F. Hoffmann-La Roche Ltd, QIAGEN N.V., Polyplus-transfection, Bio-Rad Laboratories, Inc., Lonza Group, Sigma-Aldrich Corporation, Mirus Bio, MaxCyte, Inc., Sartorius AG,Revvity, Inc., Danaher Corporation, Agilent Technologies, Inc., Biontex Laboratories GmbH, Others.

Need help to buy this report?