Global Transfusion Technology Market Size, Share, and COVID-19 Impact Analysis, By Product (Instruments, Disposables & Consumables), By End-user (Hospitals, Blood Banks, Biotechnology & Pharmaceutical Companies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: HealthcareGlobal Transfusion Technology Market Insights Forecasts to 2033

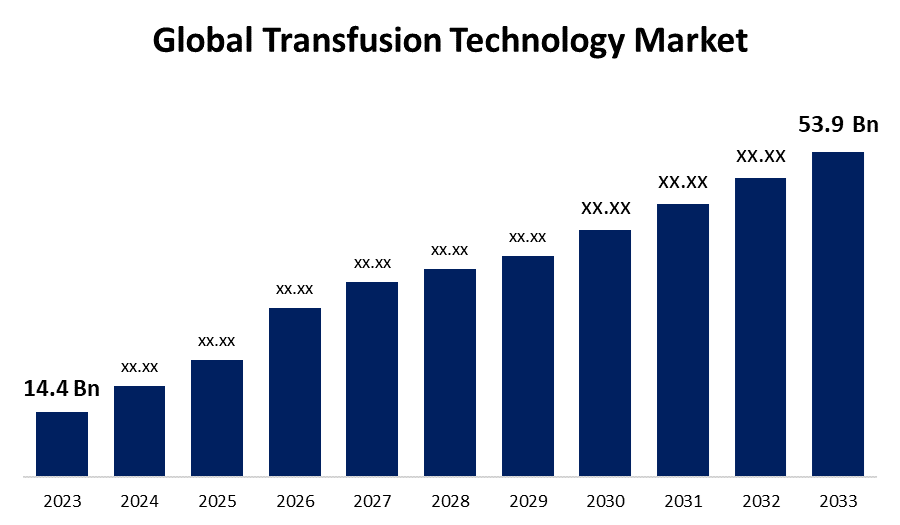

- The Global Transfusion Technology Market Size was Valued at USD 14.4 Billion in 2023

- The Market Size is Growing at a CAGR of 14.11% from 2023 to 2033

- The Worldwide Transfusion Technology Market Size is Expected to Reach USD 53.9 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Transfusion Technology Market Size is Anticipated to Exceed USD 53.9 Billion by 2033, Growing at a CAGR of 14.11% from 2023 to 2033.

Market Overview

Transfusion technology involves the methods and systems used to safely and effectively transfer blood or blood products from one person to another. This technology is crucial in medical situations, particularly for treating patients who have lost blood due to surgery, injury, or disease. The process starts with the collection of blood from donors, which is then carefully tested and processed to ensure it is safe for use. Blood is separated into its components such as red blood cells, plasma, and platelets so that each component can be used for different medical needs. For example, red blood cells can be used for patients with anemia, while plasma might be used for patients with clotting disorders. Advanced transfusion technology includes the use of blood bags, automated blood separators, and computer systems that track and manage blood products to ensure compatibility and prevent errors. Techniques such as blood typing and crossmatching are used to match donor blood with recipients to prevent adverse reactions. The technology also includes innovations in blood storage and transport, which help maintain the quality and safety of blood products until they are needed. Overall, transfusion technology is essential for saving lives and improving patient outcomes in a variety of medical situations.

Report Coverage

This research report categorizes the market for the global transfusion technology market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global transfusion technology market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global transfusion technology market.

Global Transfusion Technology Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.4 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 14.11% |

| 2033 Value Projection: | USD 53.9 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By End-user, By Region |

| Companies covered:: | Haemonetics Corporation, Inc., Medtronic plc, Asahi Kasei Medical Co., Ltd., B. Braun Melsungen AG, Cerus Corporation, Fresenius Kabi AG (Fresenius SE & Co. KGaA), GE Healthcare, Miltenyi Biotec, Terumo BCT, LivaNova PLC., Medtronic plc, Kawasumi Laboratories, Lmb Technologie GmbH, Advancis Surgical, Redax, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, and Analysis |

Get more details on this report -

Driving Factors

The rising volume of surgical procedures

The increasing number of surgical procedures is significantly driving the growth of the transfusion technology market. As more surgical operations are performed, whether for routine procedures or complex surgeries, there is a greater need for blood transfusions to ensure patient safety and successful outcomes. This heightened demand for blood products and related technologies fuels advancements and investments in transfusion technologies, which include blood collection, storage, and transfusion systems. These technologies are essential for managing blood supply efficiently, ensuring compatibility, and improving patient care. Consequently, the surge in surgical activities directly boosts the need for sophisticated transfusion technologies, leading to innovations and expanded market opportunities in this sector.

Restraining Factors

Substantial investments are needed to drive innovation in transfusion technology.

The need for significant investments in developing and advancing transfusion technology can be a constraint for the market. High costs associated with research, development, and implementation might limit the pace of innovation and adoption in this field.

Market Segmentation

The global transfusion technology market share is classified into product and end-user.

- The disposables & consumables segment is expected to hold the largest share of the global transfusion technology market during the forecast period.

Based on the product, the global transfusion technology market is categorized into instruments and disposables & consumables. Among these, the disposables & consumables segment is expected to hold the largest share of the global transfusion technology market during the forecast period. This increase is due to end-users' extensive use of these transfusion technology devices. This is due to the implementation of strict regulations by government agencies to reduce the incidence of transfusion-related illnesses. Apheresis equipment is primarily used for blood donation in health care facilities, as well as government and commercial blood banks. Because of the increased demand for therapeutic apheresis, end users are increasingly selecting apheresis equipment as well as multi-component treatment facilities.

- The blood banks segment is expected to grow at the fastest CAGR during the forecast period.

Based on the end-user, the global transfusion technology market is categorized into hospitals, blood banks, biotechnology & pharmaceutical companies, and others. Among these, the blood banks segment is expected to grow at the fastest CAGR during the forecast period. One of the primary drivers of the market is the rising prevalence of hematological diseases such as rare genetic abnormalities, anemia, and sickle cell disorders caused by blood and plasma organ dysfunction. Furthermore, the number of sports-related injuries caused by poor training techniques, structural abnormalities, and unsafe training conditions is increasing at a rapid pace for packed red blood cells (RBCs) during blood transfusions.

Regional Segment Analysis of the Global Transfusion Technology Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is projected to hold the largest share of the global transfusion technology market over the forecast period.

Get more details on this report -

North America is projected to hold the largest share of the global transfusion technology market over the forecast period. North America represented a significant portion of the global transfusion technology market. This can be attributed to high health care expenditure, high rate of apheresis for treatment of chronic diseases, for example, chronic kidney disease, driven by an increase in the commonness of way of life-related infections, rise in mindfulness about the importance of careful blood, high market penetration of recently created transfusion technology gadgets, favorable reimbursement policies guaranteeing business development for new market competitors, and proximity of real pl.

Asia Pacific is expected to grow at the fastest CAGR growth of the global transfusion technology market during the forecast period. This is due to an increase in the elderly population, an increase in the adoption of transfusion technology gadgets driven by awareness of their benefits, and a surge in the occurrence of transfusion-acquired infections in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global transfusion technology market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Haemonetics Corporation, Inc.

- Medtronic plc

- Asahi Kasei Medical Co., Ltd.

- B. Braun Melsungen AG

- Cerus Corporation

- Fresenius Kabi AG (Fresenius SE & Co. KGaA)

- GE Healthcare

- Miltenyi Biotec

- Terumo BCT

- LivaNova PLC.

- Medtronic plc

- Kawasumi Laboratories

- Lmb Technologie GmbH

- Advancis Surgical

- Redax

- Others

Key Market Developments

- In April 2024, Fresenius Kabi AG, Advances its Biopharma Progress with the U.S. Launch of Subcutaneous Tyenne (tocilizumab-aazg) Formulation. Tyenne is the first tocilizumab biosimilar to receive FDA approval for both intravenous and subcutaneous formulations.

- In February 2024, Terumo India, the Indian arm of Japan-based medtech company Terumo Corporation, recently announced the launch of new medical tools for the treatment of liver cancer. With World Cancer Day approaching, new products are being launched in India to improve cancer prevention, detection, and treatment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global transfusion technology market based on the below-mentioned segments:

Global Transfusion Technology Market, By Product

- Instruments

- Disposables & Consumables

Global Transfusion Technology Market, By End-user

- Hospitals

- Blood Banks

- Biotechnology & Pharmaceutical Companies

- Others

Global Transfusion Technology Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the global transfusion technology market over the forecast period?The Global Transfusion Technology Market Size is Expected to Grow from USD 14.4 Billion in 2023 to USD 53.9 Billion by 2033, at a CAGR of 14.11% during the forecast period 2023-2033.

-

2.Which region is expected to hold the highest share in the global transfusion technology market?North America is projected to hold the largest share of the global transfusion technology market over the forecast period.

-

3.Who are the top key players in the transfusion technology market?The top key players in the global transfusion technology market are Haemonetics Corporation, Inc., Medtronic plc, Asahi Kasei Medical Co., Ltd., B. Braun Melsungen AG, Cerus Corporation, Fresenius Kabi AG (Fresenius SE & Co. KGaA), GE Healthcare, Miltenyi Biotec, Terumo BCT, LivaNova PLC., Medtronic plc, Kawasumi Laboratories, Lmb Technologie GmbH, Advancis Surgical, Redax, Others.

Need help to buy this report?