Global Transgenic Seeds Market Size, Share, and COVID-19 Impact Analysis, By Crop Type (Soybean, Corn, Cotton, Canola, and Others), By Trait (Insecticide Resistance, Herbicide Tolerance, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: AgricultureGlobal Transgenic Seeds Market Insights Forecasts to 2033

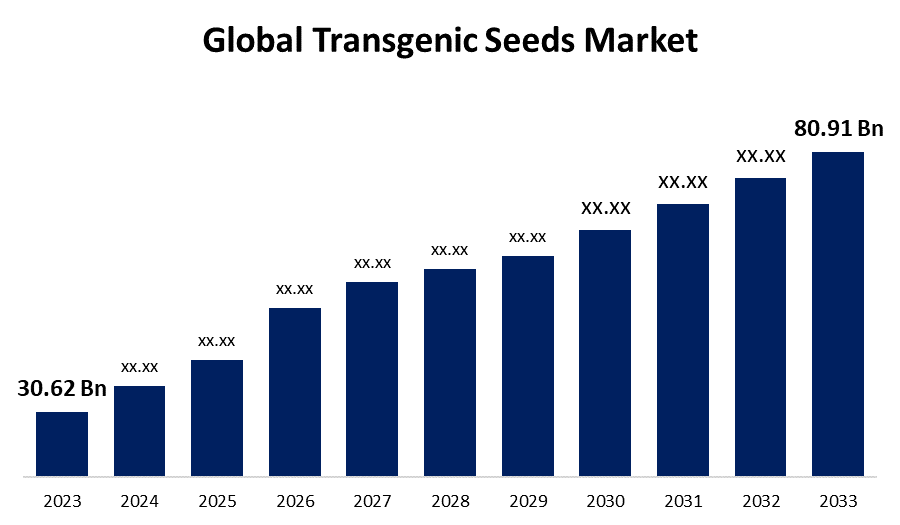

- The Global Transgenic Seeds Market Size was Valued at USD 30.62 Billion in 2023

- The Market Size is Growing at a CAGR of 10.20% from 2023 to 2033

- The Worldwide Transgenic Seeds Market Size is Expected to Reach USD 80.91 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Transgenic Seeds Market Size is Anticipated to Exceed USD 80.91 Billion by 2033, Growing at a CAGR of 10.20% from 2023 to 2033.

Market Overview

Genetic engineering (GE) techniques are used to modify DNA, the basic genetic material, to create transgenic seeds. This is an application of modern biotechnology. These can also be called transgenic seeds/crops, GE plants, or genetically modified crops. All living things have certain traits that are shaped by their genetic composition and interactions with their surroundings. An organism's genome, which is composed of DNA in all plants and animals, is its genetic composition. Genes are sections of DNA found in the genome that often include the instructions needed to make proteins. The traits of the plant are derived from these proteins.

For Instance, in April 2024, for commercialization, 14 new biotechnology or genetically modified organism (GMO) seeds were certified by Ghana's National Biosafety Authority (NBA). Eight corn and six soybean events make up the permitted crops. Pest-resistant soybeans, herbicide-resistant soybeans, drought-tolerant soybeans, glyphosate-tolerant soybeans, pest-resistant maize, and soybeans with higher levels of oleic acid and lower levels of fatty acid are some of them.

The rising demand for transgenic seeds across the globe has led to significant expansion in the transgenic seeds industry. The global transgenic seed market is expanding due to several factors, including improved agricultural productivity, resistance to pests and diseases, tolerance to harsh environmental conditions, higher nutritional value, weed control, technological advancements, government backing, and others.

Report Coverage

This research report categorizes the market for the transgenic seeds market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the transgenic seeds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the transgenic seeds market.

Global Transgenic Seeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 30.62 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 10.20% |

| 023 – 2033 Value Projection: | USD 80.91 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Crop Type, By Trait, By Region |

| Companies covered:: | Monsanto, Syngenta, DowDuPont, BASF SE, Bayer AG, Groupe Limagrain, Land O’Lakes, KWS SAAT SE, Sakata Seed Corporation, UPL Limited, Suntory Holdings Ltd, Vilmorin & Cie SA, Maharashtra Hybrid Seed Company, Monsanto, Syngenta AG, JK Agri Genetics Ltd, J.R. Simplot Co, Others |

| Pitfalls & Challenges: | Covid-19 Impact, Challenge, Future,Growth and Analysis |

Get more details on this report -

Driving Factors

The driving factors including increased crop yields, lower costs for food or drug production, less need for pesticides, improved nutrient composition and food quality, resistance to pests and disease, increased food security, and medical benefits for the world's expanding population are some advantages of genetic engineering in agriculture. Additionally, progress has been made in creating crops that mature more quickly and can withstand environmental stressors like drought, cold, boron, salt, and drought. This allows plants to grow in environments where they could not normally thrive. The creation of non-protein (bioplastic) or non-industrial (ornamental plant) products are examples of additional uses. In certain situations, transgenic seeds/crops can decrease the need for chemical insecticides while also significantly increasing crop yields per acre. For instance, the need for broad-spectrum insecticides decreased in many regions where crops like corn, cotton, and potatoes were genetically modified to produce Bt toxin, a naturally occurring insecticide, by the bacterium Bacillus thuringiensis.

Restraining Factors

The regulatory approval procedures for transgenic seeds can be challenging and time-consuming. Every nation or area has its own set of laws governing the production and distribution of genetically modified crops. Protracted and costly regulatory procedures can make it more difficult to release transgenic seeds on schedule. Acceptance and adoption of transgenic seeds might be influenced by sociocultural variables. The use of genetically modified crops might be discouraged in particular areas or communities by customs, cultural norms, and beliefs about naturalness and organic farming. It is essential to overcome these barriers through transparent communication, responsible stewardship practices, scientific research, and efficient regulatory frameworks to guarantee the safe and sustainable use of transgenic seeds.

Market Segmentation

The transgenic seeds market share is classified into crop type and trait.

- The corn segment is estimated to hold the highest market revenue share through the projected period.

Based on the crop type, the transgenic seeds market is classified into soybean, corn, cotton, canola, and others. Among these, the corn segment is estimated to hold the highest market revenue share through the projected period. One of the most extensively farmed crops in the world, corn has undergone substantial genetic modification to provide a variety of traits. Many regions' farmers have approved transgenic maize seeds with traits like resistance to herbicides, resistance to insects, and higher yield. For instance, GE varieties are being used in the production of over 90% of the corn grown in the United States. The three main categories of genetically engineered crops (GE) products are herbicide-tolerant (HT), insect-resistant (Bt), and stacking varieties, which combine both HT and Bt components. HT and Bt traits are the most commonly utilized in U.S. crop production, despite the development of other GE traits (such as resistance to viruses and fungi, resilience to drought, and higher protein, oil, or vitamin content).

For instance, in March 2023, the commercial launch of VorceedTM Enlist corn products was announced by Corteva Agriscience. Under the exclusive Corteva Horizon Network, American farmers in Corn Belt regions with elevated corn rootworm (CRW) pressure will have access to Vorceed Enlist corn technology across Pioneer, Dairyland Seed, and Brevant seeds.

- The herbicide tolerance segment is anticipated to hold the largest market share through the forecast period.

Based on the trait, the transgenic seeds market is divided into insecticide resistance, herbicide tolerance, and others. Among these, the herbicide tolerance segment is anticipated to hold the largest market share through the forecast period. Herbicide-tolerant (HT) seeds provide farmers with an essential tool for controlling weeds and work well with no-till farming practices, which protect topsoil. They provide farmers with the freedom to use herbicides with desired environmental qualities, to regulate the overall amount of herbicide input, and to apply herbicides only when necessary. These herbicides target important enzymes in the plant's metabolic pathway, which causes disruptions and ultimately results in the death of the plant. For instance, By inhibiting the EPSPS enzyme, which is necessary for the production of several secondary plant metabolites, vitamins, and aromatic amino acids, glyphosate herbicide causes plant death. Crops can be altered in several ways to make them glyphosate-tolerant. Including a gene from a soil bacteria that generates an EPSPS strain that is tolerant to glyphosate is one tactic. Adding a separate gene from a soil bacterium that generates an enzyme that breaks down glyphosate is one additional method.

Regional Segment Analysis of the Transgenic Seeds Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the transgenic seeds market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the transgenic seeds market over the predicted timeframe. Top of Form Geographically, transgenic seeds have historically found a significant market share in North America. The agricultural industry in the region is well-established, and genetically modified crops are widely used. The three most significant crops for the transgenic seed industry in North America are corn, soybeans, and cotton. For instance, with an area under cultivation 6.6 times larger than Canada, the USA is the country with the most GM cropland in North America. Maize is the most important genetically modified crop in North America, and the USA is usually the world's top exporter of harvested maize. With 33.3 million hectares of GM maize in 2022, the USA holds the record for the greatest GM maize acreage in the world, accounting for 50.4% of the global GM maize area. Since the US began planting genetically modified maize types in 1996, the country's acceptance rates have rapidly increased. Additionally, at 33.6 million hectares in 2022, the US will be the second-largest global producer of genetically modified soybeans, behind Brazil. Currently, 34.0% of the world's GM soybean acreage is made up of GM soybeans planted in the US.

Bottom of Form

Asia Asia Pacific is expected to grow at the fastest CAGR growth of the transgenic seeds market during the forecast period. In developing nations like China and India, agricultural biotechnology is expanding quickly and increasing crop yields despite shifting environmental factors like salt and drought. For instance, China has authorized the production of genetically modified maize and soybeans in recent years; the first GM maize crops are scheduled for 2023. China is predicted to plant 267,000 hectares of genetically modified maize this year; this amount is anticipated to increase to encompass most of the nation's approximately 43 million hectares of maize. After peak adoption is reached, China will probably plant the most genetically modified maize in the world. Additionally, at 12.4 million hectares, India will grow the most genetically modified cotton in the world in 2022 a 4.8% increase from the year before. In 2022, the first genetically modified cotton cultivars went on sale. These varieties were primarily Bollgard-based.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the transgenic seeds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Monsanto

- Syngenta

- DowDuPont

- BASF SE

- Bayer AG

- Groupe Limagrain

- Land O’Lakes

- KWS SAAT SE

- Sakata Seed Corporation

- UPL Limited

- Suntory Holdings Ltd

- Vilmorin & Cie SA

- Maharashtra Hybrid Seed Company

- Monsanto

- Syngenta AG

- JK Agri Genetics Ltd

- J.R. Simplot Co

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In February 2023, according to business executives, the plant genetics company GDM applied for the registration of 13 soy plant types in South Africa following the country's approval of the use of a new genetically modified seed technology. Although GDM is established in Argentina, the majority of its revenue comes from Brazil, a neighbor. Three of the 13 materials are anticipated to be pre-launched this year, with the firm aiming to strengthen its operations in South Africa and get ready for regional invasions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the transgenic seeds market based on the below-mentioned segments:

Global Transgenic Seeds Market, By Crop Type

- Soybean

- Corn

- Cotton

- Canola

- Others

Global Transgenic Seeds Market, By Trait

- Insecticide Resistance

- Herbicide Tolerance

- Others

Global Transgenic Seeds Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the transgenic seeds market over the forecast period?The transgenic seeds market is projected to expand at a CAGR of 10.20% during the forecast period.

-

2. What is the market size of the transgenic seeds market?The Global Transgenic Seeds Market Size is Expected to Grow from USD 30.62 Billion in 2023 to USD 80.91 Billion by 2033, at a CAGR of 10.20% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the transgenic seeds market?North America is anticipated to hold the largest share of the transgenic seeds market over the predicted timeframe.

Need help to buy this report?