Global Transplant Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Technology (Molecular Assays and Non-Molecular Assays), By Product (Instrument, Reagent, Services & Software), By Application (Pre-Transplantation Testing and Post-Transplantation Monitoring), By End Users (Hospitals & Transplant Centers, Research Laboratories, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Industry: HealthcareGlobal Transplant Diagnostics Market Insights Forecasts to 2032

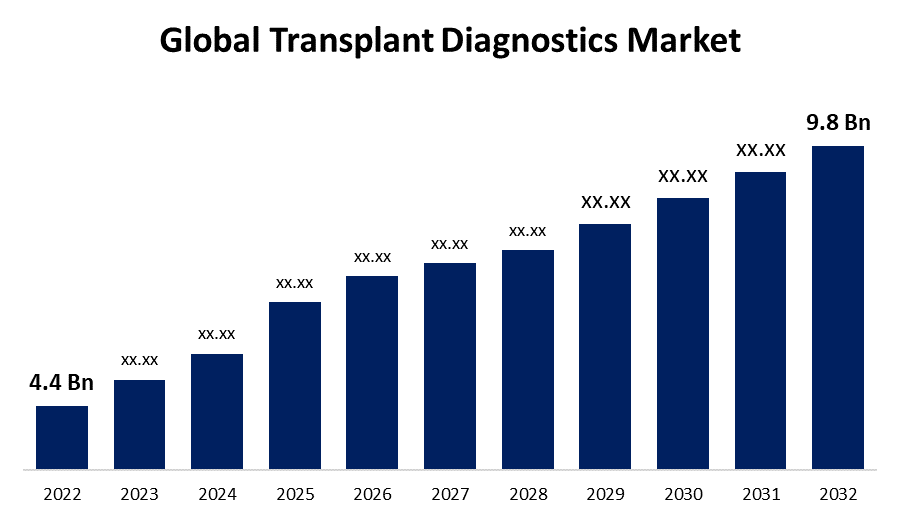

- The Global Transplant Diagnostics Market Size was valued at USD 4.4 Billion in 2022.

- The Market is growing at a CAGR of 8.3% from 2022 to 2032.

- The worldwide Transplant Diagnostics Market size is expected to reach USD 9.8 Billion by 2032.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Transplant Diagnostics Market Size is expected to reach USD 9.8 Billion by 2032, at a CAGR of 8.3% during the forecast period 2022 to 2032.

Market Overview

Transplant diagnostics is a diagnostic test that is often performed before and after transplantation. It aids in the analysis of the patient's medical issues. If not avoided, the individual with decreased immunity stands the danger of contracting HAIs or worse, which might be deadly. The technique is recognized to be a harmonic partnership between healthcare practitioners and laboratory experts, resulting in improved patient results. Organ transplantation is the necessity to move organs to address organ failures such as the liver, pancreas, lungs, kidney, and heart. Human leukocyte antigens are antigens present on the surface of cells that govern body identification and reject foreign tissue transplants. With the rising frequency of chronic illnesses that might lead to organ failure, the use of transplant diagnostics (including both pre-and post-transplant screening) is predicted to increase. The market has captured the interest of healthcare professionals due to the numerous advantages given by these tests to determine the feasibility of organ transplant operations.

Report Coverage

This research report categorizes the global transplant diagnostics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global transplant diagnostics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global transplant diagnostics market. Technological innovation and advancement will further optimize the performance of the product, enabling it to acquire a wider range of applications in the downstream market.

Global Transplant Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 4.4 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.3% |

| 2032 Value Projection: | USD 9.8 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Technology, By Product, By Application, By End Users, By Region, and COVID-19 Impact Analysis |

| Companies covered:: | Abbott Laboratories, Becton, Dickinson and Company, Biomérieux SA, Bio-Rad Laboratories Inc., CareDx, F Hoffman-La Roche AG, Hologic Inc., Illumina Inc., Qiagen NV, Thermo Fisher Scientific Inc., Immucor, Inc., Omixon Ltd., GenDx, and BioGenuix |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

With the increasing acceptance of various technologies and screening procedures, such as genetic profiling and cross-matching, transplants are becoming an appropriate means of providing life or rebirth to an individual. The growing number of transplant surgeries in key nations might be contributed to the transplant market's increasing CAGR. For example, in the United States, 41,354 organ transplants will be performed in 2021, whereas France will do 5,273 organ transplants in 2021. Diseases such as tuberculosis, end-stage renal failure, and liver cirrhosis are widespread among the elderly, making transplant surgery imperative. Furthermore, a rising number of patients suffering from chronic conditions that usually lead to organ failure is boosting demand for transplant treatments.

Restraining Factors

Transplant diagnostic techniques like Histocompatibility testing, blood profiling, and genomic profiling are carried out using specialized molecular diagnostic platforms that incorporate several modern technologies. Because these technologies are combined with traditional PCR/NGS equipment, the cost of these sophisticated goods is on the high side.

Market Segmentation

- In 2022the molecular assays segment is dominating the market with the largest market share over the forecast period.

Based on the technology, the global transplant diagnostics market is segmented into molecular assays and non-molecular assays. Among these segments, the molecular assay segment is dominating the market with the largest revenue share during the forecast period. In transplant diagnostic techniques, molecular assays are utilized to determine donor-recipient compatibility. The increased demand for molecular tests during transplant diagnostic procedures is mostly due to the technical advantages these assays offer over non-molecular assays, such as high procedural effectiveness, multiple sample analysis, and real-time analysis.

- In 2022, the services & software segment is influencing the largest market share over the forecast period.

Based on the product, the global transplant diagnostics market is classified into instruments, reagents, & services & software. Among these segments, the services & software segment is dominating the market. This segment's growth can be attributable to the increased introduction of complex equipment, which has raised the demand for training sessions to educate technical personnel on handling and usage. Furthermore, factors such as regular software upgrades and better services supplied by market participants to remain competent are boosting segment expansion.

- In 2022, the post-transplantation monitoring segment is influencing the largest market share over the forecast period.

Based on the application, the global transplant diagnostics market is classified into pre-transplantation testing and post-transplantation monitoring. Among these segments, the post-transplantation monitoring segment is dominating the market. Transplant diagnostics play an important part in post-transplantation monitoring by giving several advantages. By monitoring certain biomarkers and immunological responses, diagnostic diagnostics can detect signals of rejection before they emerge clinically. This enables quick intervention and modification of immunosuppressive medication to prevent additional organ damage.

- In 2022, the hospitals & transplant centers segment is dominating the largest market share over the forecast period.

On the basis of end users, the global transplant diagnostics market is classified into hospitals & transplant centers, research laboratories, and others. Among these segments, the hospitals & transplant centers segment is dominating the market. Hospitals and transplant facilities, as well as transplant diagnostic procedures, are all necessary steps in the organ transplantation process. Hospitals are critical players in organ transplantation. They offer the infrastructure, medical skills, and facilities required to conduct transplant surgery.

Regional Segment Analysis of the neurovascular devices market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America dominated the market with the largest market revenue during the forecast period

Get more details on this report -

North America is dominating the significant market growth during the forecast period due to its advanced healthcare infrastructure and high demand for organ transplants, it has a leading market share. Factors such as an aging population, an increase in the frequency of chronic illnesses, breakthroughs in transplantation methods, and more knowledge about the advantages of organ transplantation have all contributed to the market's rise.

Asia Pacific is expected to experience high revenue market growth during the forecast period, due to China and India will have the fastest growth rates in the worldwide transplant diagnostics sector over the next five years in the Asia Pacific area.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the global transplant diagnostics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Becton, Dickinson and Company

- Biomérieux SA

- Bio-Rad Laboratories Inc.

- CareDx

- F Hoffman-La Roche AG

- Hologic Inc.

- Illumina Inc.

- Qiagen NV

- Thermo Fisher Scientific Inc.

- Immucor, Inc.

- Omixon Ltd.

- GenDx

- BioGenuix

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On February 2023, BD received authorization from the FDA for their BD Onclarity HPV assay in the serology testing category.

- On March 2023, BioRad's iQ-Check kits have been approved by AQAC International and AFNOR.

- In January 2022, Hoffmann-La Roche Ltd. introduced Cobas Infinity Edge, a cloud-based point-of-care platform that is accessible from anywhere. Because of advances in technology, healthcare practitioners may handle patient data. This has helped the company broaden its product offering.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the Global Transplant Diagnostics Market based on the below-mentioned segments:

Global Transplant Diagnostics Market, By Technology

- Molecular Assays

- Non-Molecular Assays

Global Transplant Diagnostics Market, By Product

- Instrument

- Reagent

- Software

Global Transplant Diagnostics Market, By Application

- pre-transplantation testing

- post-transplantation monitoring

Global Transplant Diagnostics Market, By End Users

- Hospitals & Transplant Centers

- Research Laboratories

- Others

Transplant Diagnostics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?