Global Transportation Battery Market Size, Share, and COVID-19 Impact Analysis, By Type (NCM/NCA, LCO, LFP, LMO), By Application (HEV, BEV), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Transportation Battery Market Insights Forecasts to 2033

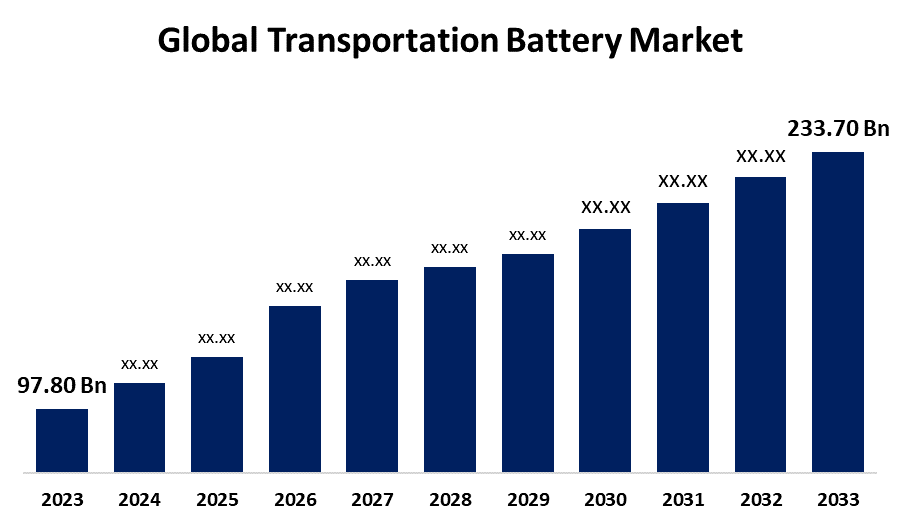

- The Global Transportation Battery Market Size was Valued at USD 97.80 Billion in 2023

- The Market Size is Growing at a CAGR of 9.10% from 2023 to 2033

- The Worldwide Transportation Battery Market Size is Expected to Reach USD 233.70 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Transportation Battery Market Size is Anticipated to Exceed USD 233.70 Billion by 2033, Growing at a CAGR of 9.10% from 2023 to 2033.

Market Overview

A transportation battery is a rechargeable battery that is specifically built to power vehicles such as electric cars (EVs), hybrid electric vehicles (HEVs), and other modes of transportation like buses, trucks, and scooters. These batteries store and supply electrical energy to the car's electric motors, allowing propulsion, energy recovery, and other vehicle systems. Transportation batteries, including lithium-ion, lead-acid, and nickel-metal hydride, are designed for their performance, durability, and safety, ensuring long-range and rapid charging capabilities.

The transportation battery market is expanding due to the increasing adoption of electric vehicles, technological advancements, charging infrastructure expansion, decreasing costs, and a growing focus on sustainability. Investments in research and development further support this growth. Transportation batteries are crucial in electric vehicles, commercial vehicles, urban mobility, public transport, energy storage, and emerging technologies for electric aviation and marine applications. They provide power for propulsion, and onboard systems, and reduce emissions, making them essential for sustainable and efficient mobility.

For Instance, In September 2024, Impact Clean Power Technology unveiled Europe's most advanced, highly automated lithium-ion battery production line. The new line will enable the company to raise its generating capacity from 0.6 to 1.2 GWh in 2024, and eventually to up to 4 GWh.

Report Coverage

This research report categorizes the market for transportation battery based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the transportation battery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the transportation battery market.

Global Transportation Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 97.80 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.10% |

| 2033 Value Projection: | USD 233.70 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Lithium Energy Japan, BYD, Panasonic, OptimumNano, LG Chem, WanXiang, GuoXuan, PEVE, AESC, Samsung, Beijing Pride Power, BAK Battery, Hitachi, ACCUmotive, Boston Power, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The transportation battery market is propelled by several factors including the increasing adoption of electric vehicles (EVs) as consumers and governments seek cleaner transportation solutions. Supportive government policies, such as incentives for EV purchases and investments in charging infrastructure, further stimulate demand. Technological advancements in battery efficiency, along with decreasing production costs, make EVs more appealing and affordable. Furthermore, growing concerns about sustainability and climate change push both consumers and manufacturers towards electric options. The expansion of energy storage systems for renewable energy also plays a crucial role, while the development of charging infrastructure enhances convenience for EV users.

Restraining Factors

The transportation battery market is hindered by several key factors including the high initial costs of electric vehicles and batteries can deter consumers, while concerns about limited driving range and inadequate charging infrastructure further impact adoption. Battery degradation and lifespan issues raise questions about long-term viability, and supply chain challenges related to raw materials like lithium and cobalt can affect production capacity.

Market Segmentation

The transportation battery market share is classified into type and application.

- The LFP segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the transportation battery market is classified into NCM/NCA, LCO, LFP, and LMO. Among these, the LFP segment is estimated to hold the highest market revenue share through the projected period. LFP transportation batteries offer longer range, high-energy density, and rapid charging capabilities, making them a popular choice for various applications due to their durability and safety. Furthermore, LFP batteries are cost-effective and increasingly preferred by manufacturers, especially for applications in commercial vehicles and energy storage. As the demand for reliable and efficient battery solutions grows, the LFP segment is well-positioned to lead the market.

- The HEV segment is anticipated to hold the largest market share through the forecast period.

Based on the application, the transportation battery market is divided into HEV and BEV. Among these, the HEV segment is anticipated to hold the largest market share through the forecast period. The segment prominence is propelled by consumer preferences for the convenience of HEVs, which combine electric and gasoline power, addressing range anxiety. Furthermore, HEVs are generally more cost-effective, benefiting from existing fuel infrastructure that facilitates easy refueling. Furthermore, regulatory support aimed at reducing emissions enhances the appeal of HEVs, contributing to segment growth.

Regional Segment Analysis of the Transportation Battery Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the transportation battery market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the transportation battery market over the predicted timeframe. The region has a rapidly growing electric vehicle (EV) market, driven by increasing government support, investments in EV infrastructure, and rising consumer demand for cleaner transportation options propelled the region's dominance in the transportation battery market. Major countries like China, Japan, and South Korea are leading in battery production and technology innovation, contributing to the region's dominant position in the market.

North America is expected to grow at the fastest CAGR growth of the transportation battery market during the forecast period. The region's rapid expansion is attributed to the increasing adoption of electric vehicles (EVs) fueled by stricter emissions regulations and consumer incentives. Furthermore, significant investments from major automotive manufacturers in battery production and research are solidifying the local supply chain in North America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the transportation battery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lithium Energy Japan

- BYD

- Panasonic

- OptimumNano

- LG Chem

- WanXiang

- GuoXuan

- PEVE

- AESC

- Samsung

- Beijing Pride Power

- BAK Battery

- Hitachi

- ACCUmotive

- Boston Power

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In September 2024, the global leader battery supplier CATL launched a brand new Tectrans LFP battery range, including a specific model for e-coaches.

- In September 2024, XING Mobility introduced the IMMERSIO XM28 battery system at the IAA Transportation 2024 exhibition. It has twice the energy density of normal lithium iron phosphate batteries, which promotes longer driving range and battery lifespan for commercial vehicles.

- In September 2024, ABB Traction Division launched the Pro series traction battery for hybrid and full electric rail applications.

- In September 2024, Contemporary Amperex Technology Co., Limited (CATL), a global pioneer in new energy technology innovation, launched the ground-breaking TECTRANS battery system, which will transform the commercial transportation sector.

- In September 2024, Octillion Power Systems, a global producer of high-density lithium-ion battery packs for electric vehicles, announced the imminent availability of battery systems for the European market at IAA Transportation 2024 in Hannover, Germany.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the transportation battery market based on the below-mentioned segments:

Global Transportation Battery Market, By Type

- NCM/NCA

- LCO

- LFP

- LMO

Global Transportation Battery Market, By Application

- HEV

- BEV

Global Transportation Battery Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the transportation battery market over the forecast period?The transportation battery market is projected to expand at a CAGR of 9.10% during the forecast period.

-

2. What is the market size of the transportation battery market?The Global Transportation Battery Market Size is Expected to Grow from USD 97.80 Billion in 2023 to USD 233.70 Billion by 2033, Growing at a CAGR of 9.10% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the transportation battery market?Asia Pacific is anticipated to hold the largest share of the transportation battery market over the predicted timeframe.

Need help to buy this report?