Global Transportation Lighting Market Size, Share, and COVID-19 Impact Analysis, By Lighting Technology (LED, HID, Fluorescent, Others), By Installation (Replacement Installation, Retrofit Installation, New Installation), By Application (Train Transportation Lighting, Airport Transportation Lighting, Commercial, Industrial), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Automotive & TransportationGlobal Transportation Lighting Market Insights Forecasts to 2033

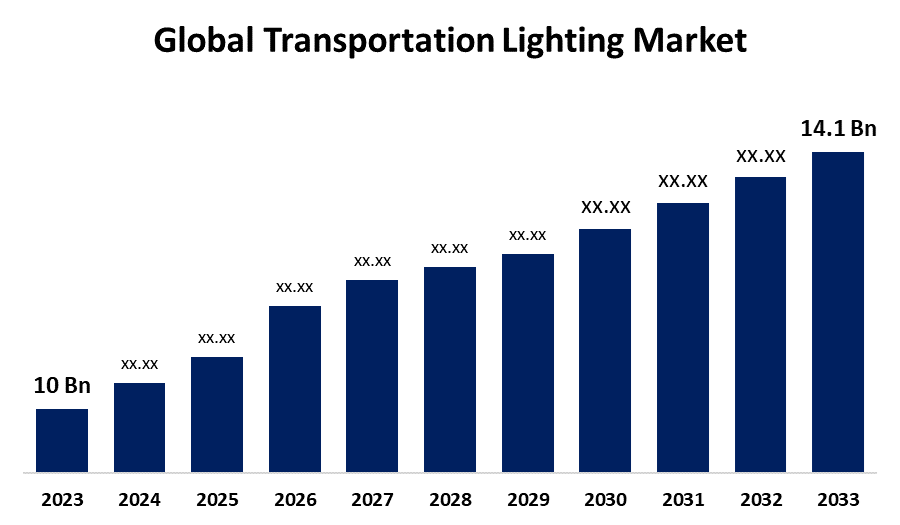

- The Global Transportation Lighting Market Size was Valued at USD 10 Billion in 2023

- The Market Size is Growing at a CAGR of 3.50% from 2023 to 2033

- The Worldwide Transportation Lighting Market Size is Expected to Reach USD 14.1 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Transportation Lighting Market Size is Anticipated to Exceed USD 14.1 Billion by 2033, Growing at a CAGR of 3.50% from 2023 to 2033.

Market Overview

Transportation lighting involves the different lighting systems used in transportation environments to enhance safety, visibility, and aesthetics. This includes roadway lighting, such as streetlights that illuminate driving surfaces, and railway lighting for train stations and tracks. Airport lighting is crucial for guiding aircraft during takeoff and landing, while marine lighting helps ensure safe navigation in ports and on waterways. Furthermore, public transport lighting enhances safety and comfort for passengers in buses and subways. Transportation lighting prioritizes safety, compliance with regulations, energy efficiency, user experience, cost-effectiveness, and aesthetics. Cost-effectiveness balances initial investments with long-term savings.

Transportation lighting is crucial for various modes of transport, including roadways, railways, airports, marine navigation, public transport, pedestrian pathways, tunnels, and parking lots. It enhances visibility, reduces accidents, guides aircraft, aids navigation, and ensures safety, user experience, and efficient operation.

Report Coverage

This research report categorizes the market for transportation lighting based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the transportation lighting market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the transportation lighting market.

Global Transportation Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.50% |

| 2033 Value Projection: | USD 14.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Lighting Technology, By Installation, By Application, By Region and COVID-19 Impact Analysis |

| Companies covered:: | ABB, AGC Lighting, Cree Lighting, Eaton, Intertek Group plc, Kenall Manufacturing, LEDiL, Signify Holding B.V., Transportation Solutions and Lighting, Inc., WSP USA, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The transportation lighting market is propelled by several factors including stringent safety regulations that require improved transportation lighting across various transport modes. Technological advancements, such as LEDs and smart lighting systems, enhance efficiency and adaptability. Growing concerns about energy efficiency and sustainability further propel the adoption of energy-saving solutions. Rapid urbanization increases the demand for effective lighting in cities while rising public transportation demand necessitates better illumination in transit systems to improve user experience. Furthermore, aesthetic considerations encourage the integration of stylish lighting designs, and increased government investments in infrastructure projects contribute to market growth.

Restraining Factors

The transportation lighting market is constrained by several factors including high initial costs for advanced technologies, such as LEDs and smart lighting systems, which can be a barrier for municipalities and organizations with limited budgets. Maintenance challenges, including the need for regular upkeep and replacement, can increase operational costs. The technological complexity of integrating new systems with existing infrastructure might require specialized skills, complicating implementation.

Market Segmentation

The transportation lighting market share is classified into lighting technology, installation, and application.

- The LED segment is estimated to hold the highest market revenue share through the projected period.

Based on the lighting technology, the transportation lighting market is classified into LED, HID, fluorescent, and others. Among these, the LED segment is estimated to hold the highest market revenue share through the projected period. The segment dominance is derived from LEDs' energy efficiency, longevity, and superior brightness, which enhance visibility and safety on the roads. Furthermore, their reduced environmental impact and ongoing technological advancements contribute to their appeal.

- The new installation segment is anticipated to hold the largest market share through the forecast period.

Based on the installation, the transportation lighting market is divided into replacement installation, retrofit installation, and new installation. Among these, the new installation segment is anticipated to hold the largest market share through the forecast period. The segment's prominence is attributed to the increasing demand for advanced lighting solutions in new vehicles, infrastructure projects, and smart city initiatives. New installations allow for the incorporation of the latest technologies, such as LED lighting, which enhances energy efficiency and performance. Furthermore, as urbanization and transportation networks expand, the demand for modern lighting in new developments further contributes to the segment's growth.

- The train transportation lighting segment dominates the market with the largest market share through the forecast period.

Based on the application, the transportation lighting market is categorized into train transportation lighting, airport transportation lighting, commercial, and industrial. Among these, the train transportation lighting segment dominates the market with the largest market share through the forecast period. The train transportation lighting segment dominance is propelled due to an increasing emphasis on safety, comfort, and efficiency in rail systems. Enhanced lighting in trains improves visibility for passengers and crew, while also contributing to operational safety. Furthermore, ongoing investments in rail infrastructure and modernization initiatives are driving demand for advanced lighting solutions in train transportation.

Regional Segment Analysis of the Transportation Lighting Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the transportation lighting market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the transportation lighting market over the predicted timeframe. The region's dominance is due to rapid urbanization, increasing infrastructure development, and a growing emphasis on enhancing transportation safety and efficiency in the region. Major investments in rail networks, airports, and roadways are fueling demand for advanced lighting solutions. Furthermore, the rising adoption of energy-efficient lighting technologies, particularly LEDs, aligns with regional sustainability goals.

North America is expected to grow at the fastest CAGR growth of the transportation lighting market during the forecast period. The region's rapid expansion can be attributed to increasing investments in transportation infrastructure, a strong focus on safety regulations, and the rising adoption of energy-efficient lighting technologies, particularly LEDs. Furthermore, the growing trend toward smart cities and intelligent transportation systems is further fueling innovation and expansion in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the transportation lighting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ABB

- AGC Lighting

- Cree Lighting

- Eaton

- Intertek Group plc

- Kenall Manufacturing

- LEDiL

- Signify Holding B.V.

- Transportation Solutions and Lighting, Inc.

- WSP USA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, OLEDWorks announced that it will showcase the latest OLED lighting technology for the automotive industry and redefine the landscape with the launch of an exciting new brand at CES 2024.

- In September 2023, LEDVANCE is increasing its efforts to make the lighting business greener. The lighting experts announce the new "LEDVANCE LOOP" sub-brand to represent all of their sustainability efforts and strategies across the organization.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the transportation lighting market based on the below-mentioned segments:

Global Transportation Lighting Market, By Lighting Technology

- LED

- HID

- Fluorescent

- Others

Global Transportation Lighting Market, By Installation

- Replacement Installation

- Retrofit Installation

- New Installation

Global Transportation Lighting Market, By Application

- Train Transportation Lighting

- Airport Transportation Lighting

- Commercial

- Industrial

Global Transportation Lighting Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the transportation lighting market over the forecast period?The transportation lighting market is projected to expand at a CAGR of 3.50% during the forecast period.

-

2. What is the market size of the transportation lighting market?The Global Transportation Lighting Market Size is Expected to Grow from USD 10 Billion in 2023 to USD 14.1 Billion by 2033, Growing at a CAGR of 3.50% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the transportation lighting market?Asia Pacific is anticipated to hold the largest share of the transportation lighting market over the predicted timeframe.

Need help to buy this report?