Global Travel Medical Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-Trip Travel Insurance, Multi-Trip Travel Insurance, Student travel insurance, Others), By Distribution Channel (Insurance Companies, Insurance Brokers, Banks, Travel Agencies, Others), By Application (International Travel, Domestic Travel, High-Risk Travel, Business Travel), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Travel Medical Insurance Market Insights Forecasts to 2033

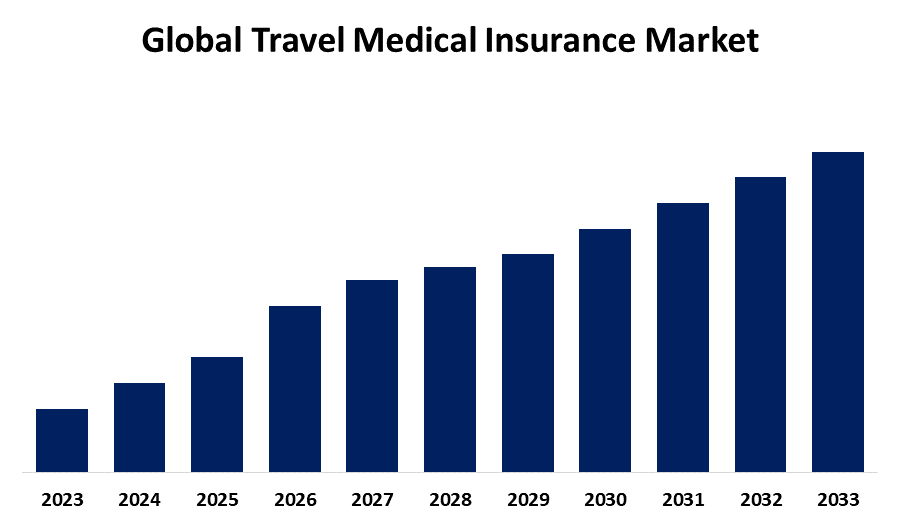

- The Market Size is Growing at a CAGR of 12.6% from 2023 to 2033

- The Worldwide Travel Medical Insurance Market Size is Anticipated to Hold a Significant Share by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Travel Medical Insurance Market Size is Anticipated to Hold a Significant Share by 2033, at 12.6% CAGR from 2023 to 2033.

Market Overview

Travel medical insurance is a specialized insurance plan that provides coverage for medical expenses and health-related issues encountered while traveling. Travel medical insurance typically includes benefits for emergency medical treatment, hospitalization, and sometimes additional services such as emergency evacuation and repatriation. Travel medical insurance is designed to protect travelers from unexpected health risks and financial burdens associated with medical emergencies that occur during their trip, ensuring they have access to necessary medical care and support while traveling internationally or domestically.

For Instance, In June 2024, Trawick International, a global travel insurance expert, announced the launch of a new portfolio of international student insurance plans, that aims to improve the health coverage alternatives for students studying abroad.

Report Coverage

This research report categorizes the market for travel medical insurance based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the travel medical insurance market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the travel medical insurance market.

Global Travel Medical Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.6% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Distribution Channel, By Application, and By Region |

| Companies covered:: | Care Insurance, AwayCare, Bajaj Allianz Travel Insurance, Gerry’s Visa, TME TRAVEL INSURANCE, Razi Insurance Company, INF, Easy Insurance India, Just Travel Cover, National Insurance Travel Insurance, BSI Insurance Broker Ltd., New India Assurance Travel Insurance, Medical Travel Compared Limited, Europ Assistance South Africa, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The travel medical insurance market is driven by a range of factors including the increasing volume of global travel, rising healthcare costs, and heightened awareness of medical risks associated with traveling. Events like global health crises and evolving travel trends, such as longer and more adventurous trips, further boost demand. Regulatory requirements, technological advancements, and the growing preference for customizable insurance plans also contribute to market growth. Additionally, economic conditions and consumer priorities play significant roles in shaping the market.

Restraining Factors

The travel medical insurance market faces several challenges that can restrain its growth including high premiums and complex policy details that might deter potential buyers, especially those with budget concerns. Limited awareness of the benefits and existing coverage through credit cards or other insurance plans can also reduce demand. Economic uncertainty might lead travelers to cut back on insurance expenses that constrain the market growth worldwide.

Market Segmentation

The travel medical insurance market share is classified into type, distribution channel, and application.

- The single-trip travel insurance segment is estimated to hold the highest market revenue share through the projected period.

Based on the type, the travel medical insurance market is classified into single-trip travel insurance, multi-trip travel insurance, student travel insurance, and others. Among these, the single-trip travel insurance segment is estimated to hold the highest market revenue share through the projected period. This dominance is attributed to its appeal among travelers who prefer coverage for specific, one-off journeys rather than committing to multi-trip plans. Single-trip insurance is simple and tailored for individual trips, making it a popular choice for occasional travelers, whether for leisure or business. The convenience of purchase and usage, combined with a broad range of coverage options, contribute to its market leadership.

The insurance companies segment is anticipated to hold the largest market share through the forecast period.

Based on the distribution channel, the travel medical insurance market is divided into insurance companies, insurance brokers, banks, travel agencies, and others. Among these, the insurance companies segment is anticipated to hold the largest market share through the forecast period. The insurance companies segment is attributed because insurance companies are the primary entities responsible for underwriting, managing, and providing travel medical insurance policies. They have the infrastructure to offer a wide range of insurance plans, process claims, and provide customer support, making them crucial to the market.

- The international travel segment dominates the market with the largest market share through the forecast period.

Based on the application, the travel medical insurance market is categorized into international travel, domestic travel, high-risk travel, and business travel. Among these, the international travel segment dominates the market with the largest market share through the forecast period. This segment is driven by the higher medical costs and risks associated with traveling abroad, which necessitate comprehensive insurance coverage. The increasing volume of international travel, regulatory requirements for proof of insurance, and the complexities of accessing healthcare in foreign countries contribute to its prominence. As worldwide travel thrives, there is increasing demand for international trip insurance, cementing the international travel segment's market leadership.Top of FormBottom of Form

Regional Segment Analysis of the Travel Medical Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the travel medical insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the travel medical insurance market over the predicted timeframe. The region's high volume of international and domestic travel, combined with its substantial healthcare costs, drives demand for travel medical insurance. Additionally, a strong awareness of the benefits of travel insurance and high disposable incomes contribute to its significant market share. The presence of well-established insurance providers and favorable regulatory environments further bolster the region's position in the market.Top of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the travel medical insurance market during the forecast period. The region's rapid economic development, increasing middle-class population, and rising disposable incomes contribute to a surge in both domestic and international travel driving demand for travel medical insurance. Growing awareness about the importance of travel medical insurance and expanding travel infrastructure further support market growth. Additionally, the rise in regional tourism, both for leisure and business purposes and an improving insurance penetration rate is expected to drive the market's rapid expansion in the Asia Pacific region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the travel medical insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Care Insurance

- AwayCare

- Bajaj Allianz Travel Insurance

- Gerry's Visa

- TME TRAVEL INSURANCE

- Razi Insurance Company

- INF

- Easy Insurance India

- Just Travel Cover

- National Insurance Travel Insurance

- BSI Insurance Broker Ltd.

- New India Assurance Travel Insurance

- Medical Travel Compared Limited

- Europ Assistance South Africa

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In August 2024, The Life Insurance Corporation of India (LIC) announced the launch of new insurance products for providing term insurance and a safety net against loan repayments, both available offline and online.

- In July 2024, World Nomads, a global travel insurance company, announced the launch of its new Annual Multi-Trip (AMT) package in the United Kingdom and Ireland.

- In March 2024, TATA AIG General Insurance Company Limited, a prominent general insurance provider, launched "Travel Guard Plus", a comprehensive travel insurance product that redefines complete coverage for travelers with an array of package plans.

- In January 2024, Allianz Partners announced the launch of the Allyz mobile app, a digital platform providing travelers with trusted advice and expertise as well as access to the full suite of insurance benefits available to customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the travel medical insurance market based on the below-mentioned segments:

Global Travel Medical Insurance Market, By Type

- Single-Trip Travel Insurance

- Multi-Trip Travel Insurance

- Student travel insurance

- Others

Global Travel Medical Insurance Market, By Distribution Channel

- Insurance Companies

- Insurance Brokers

- Banks

- Travel Agencies

- Others

Global Travel Medical Insurance Market, By Application

- International Travel

- Domestic Travel

- High-Risk Travel

- Business Travel

Global Travel Medical Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the travel medical insurance market over the forecast period?The travel medical insurance market is projected to expand at a CAGR of 12.6% during the forecast period.

-

2. What is the market size of the travel medical insurance market?The Global Travel Medical Insurance Market Size is Expected to Hold a Significant Share by 2033, at 12.6% CAGR from 2023 to 2033.

-

3. Which region holds the largest share of the travel medical insurance market?North America is anticipated to hold the largest share of the travel medical insurance market over the predicted timeframe.

Need help to buy this report?