Global Travel Now Pay Later Market Size, Share, and COVID-19 Impact Analysis, By Type (Leisure, Business, Adventure, Family Travel, Other), By Destination (Domestic, International), By Payment Plan (Installment plan, Deferred Payment Plan, Others), By Distribution Channel (Travel Agencies, Airlines, Hotels, Tour Operators, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Banking & FinancialGlobal Travel Now Pay Later Market Insights Forecasts to 2032

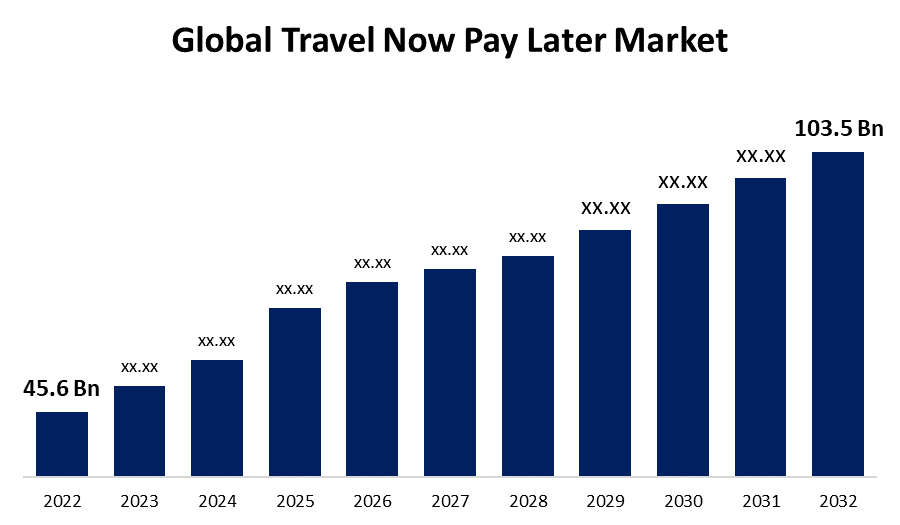

- The Global Travel Now Pay Later Market Size was valued at USD 45.6 Billion in 2022.

- The Market Size is Growing at a CAGR of 8.6% from 2022 to 2032

- The Worldwide Travel Now Pay Later Market Size is expected to reach USD 103.5 Billion by 2032

- Asia Pacific is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Travel Now Pay Later Market Size is expected to reach USD 103.5 Billion by 2032, at a CAGR of 8.6% during the forecast period 2023 to 2032.

Travelers can schedule and pay for their vacations gradually rather than all at once with the help of financing options like travel now pay later. These have grown in popularity recently because they make travel more affordable for folks who might not be able to pay for all expenses at once. Services for travel now pay later are offered from a variety of sources, including airlines, hotels, and third-party companies that specialize in travel financing. Fintech businesses have altered the travel now pay later services market by using technologies to provide customers with cutting-edge financing solutions. These businesses are streamlining the lending process and giving customers individualized financing alternatives by utilizing artificial intelligence, big data analytics, and other technologies.

Global Travel Now Pay Later Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 45.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.6% |

| 2032 Value Projection: | USD 103.5 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Destination, By Payment Plan, By Distribution Channel, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Afterpay, PayPal Holdings, Inc., Splitit, Sezzle, Perpay Inc., Openpay, Quadpay, Inc., LatitudePay, Others, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Travel can be expensive; financing options like travel now and pay later services make it more affordable for many consumers, enabling them to travel more frequently or to more expensive destinations. Consumers now have easier access to financing options for travel purchases because of the expansion of digital payment networks like PayPal and Klarna. Through the provision of innovative finance solutions like travel loans and instalment plans, fintech companies are utilizing technology to their advantage. There is also a growing travel demand now, pay later services as the global middle class continues to grow and more people travel than ever before. Nowadays, a lot of online travel agencies provide “integrated travel, and pay later” services to make it easier for customers to access financing choices while making their travel arrangements. As more businesses work to give clients a simple and convenient booking experience, this trend is anticipated to continue.

Restraining Factors

Travel now pay later services are subject to regulation in several nations, which might restrict their growth. Consumer purchasing may be affected by economic downturns, which can also make it harder for businesses providing these services to draw clients. Additionally, economic unpredictability raises the default risk for these services, resulting in increased default rates and losses for businesses operating in this sector. By the entry of new fintech startups and conventional financial institutions, the market for travel now pay later services is getting increasingly congested. Companies in this sector may see pricing pressure and decreased profit margins as a result of this.

Market Segmentation

By Type Insights

The leisure segment dominates the market with the largest revenue share over the forecast period.

Based on types, the global travel now pay later market is segmented into leisure, business, adventure, family travel, and others. Among these, the leisure segment is dominating the market with the largest revenue share of 38.6% over the forecast period. Vacations, weekend getaways, family vacations, and solo travel are all examples of leisure travel. It may also include niche types of travel, such as adventure travel and cultural travel. Travel for pleasure frequently results from personal interests, hobbies, and preferences and is catered to a range of age groups, lifestyles, and financial constraints. Business travelers typically travel so they can attend conferences, meetings, or training sessions that are linked to their jobs. Additionally, business travelers could be required to travel for sales-related work, negotiations, or other obligations.

By Destination Insights

The international segment is witnessing significant CAGR growth over the forecast period.

Based on destination, the global travel now pay later market is segmented into domestic and international. Among these, the international segment is witnessing significant CAGR growth over the forecast period. The global economy cannot exist without international travel, which has a significant impact on industries including tourism, aviation, and hospitality. Domestic travel is crucial for boosting regional tourism while assisting the local economy.

By Payment plan Insights

The installment plan segment is expected to hold the largest share of the global travel now-pay-later market during the forecast period.

Based on the payment plan, the global travel now pay later market is classified into installment plans, deferred payment plans, and others. Among these, the installment plan segment is expected to hold the largest share of the travel-now-pay-later market during the forecast period. In the travel and tourism industries, installment plans refer to financial agreements that let clients pay their bills in installments over time rather than all at once. By making services and solutions more readily available to a larger range of clients, installment plans can aid travel companies in increasing sales and earnings. Deferred payment programs also typically call for a portion deposit up front and a future date for the balance.

By Distribution channel Insights

The travel agencies segment accounted revenue share of more than 57.2% over the forecast period.

Based on the distribution channel, the global travel now pay later market is segmented into travel agencies, airlines, hotels, tour operators, and others. Among these, the travel agencies segment dominates the market with the largest revenue share over the forecast period. Travel agencies are companies that focus on providing customers with services relating to travel, such as suggestions and recommendations, reservations, insurance, paperwork, and package deals.

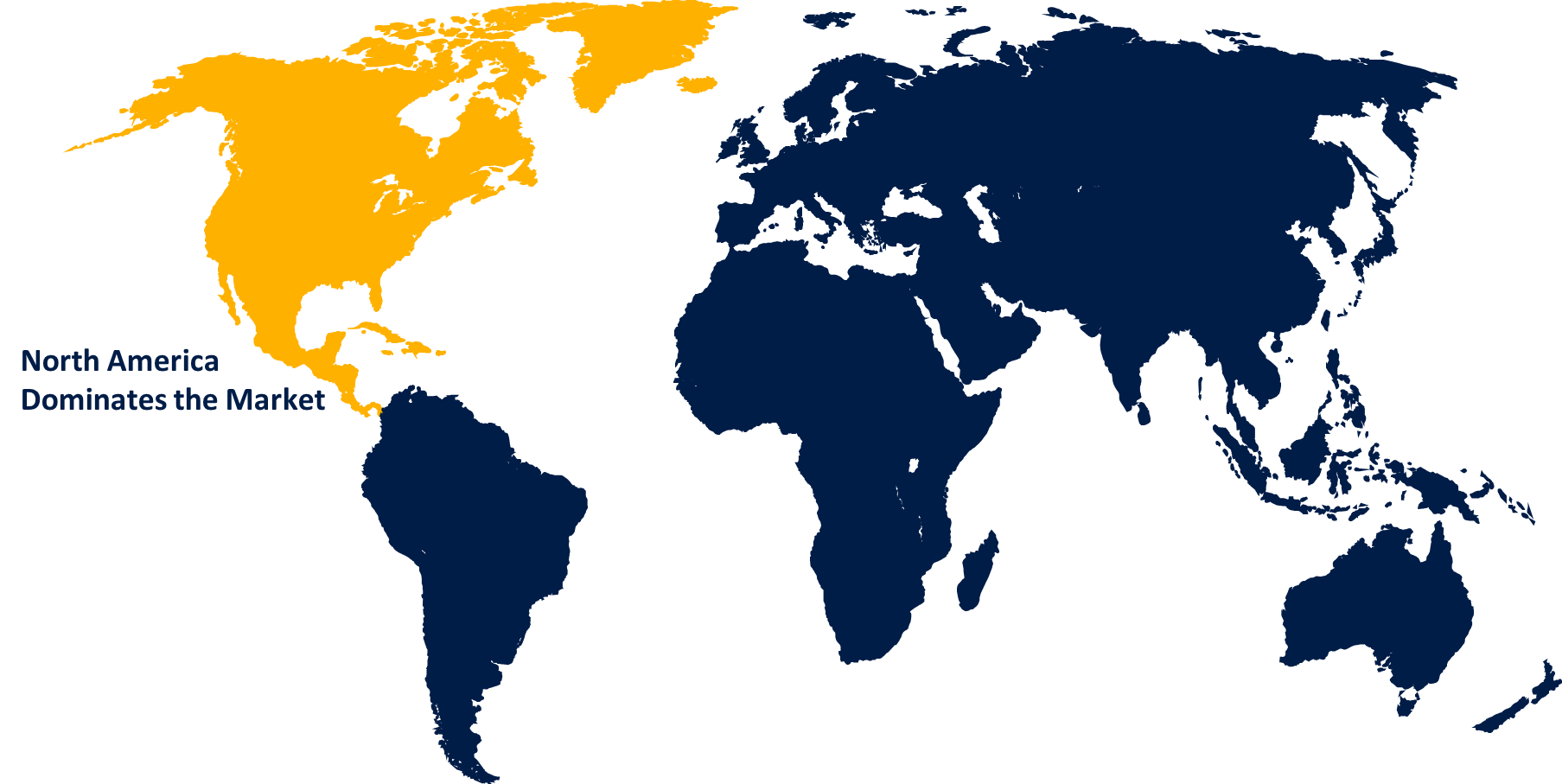

Regional Insights

North America dominates the market with the largest market share over the forecast period.

Get more details on this report -

North America is dominating the market with more than 38.7% market share over the forecast period. Fintech businesses in North America are utilizing technology by providing innovative finance solutions including travel loans and installment plans. This is partially a result of the high disposable income in North America and the accessibility of direct booking choices and online travel agents. As a result, it is projected that the market for travel now pay later services will expand.

Asia Pacific market is expected to register a substantial CAGR growth rate during the forecast period. The region has seen a rise in the usage of digital payments, making it simpler for individuals to use travel now and pay later services. The travel now pay later model is a good fit for this market because the tourism industry in the Asia Pacific region is expanding.

Europe, travel now pay later services are popular in Europe, where several suppliers offer flexible payment options for reservations. This pattern is particularly pervasive in the UK, where deferred payment schemes are frequently used to book flights and vacation packages.

List of Key Market Players

- Afterpay

- PayPal Holdings, Inc.

- Splitit

- Sezzle

- Perpay Inc.

- Openpay

- Quadpay, Inc.

- LatitudePay

- Others

Key Market Developments

- In May 2022, Splitit, a platform for instalments as-a-service with a merchant brand obtained private placement funding to grow into untapped verticals. Their system offers merchant partners an uncompromised merchant-branded experience in addition to simplifying checkout for customers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2032. Spherical Insights has segmented the Global Travel Now Pay Later Market based on the below-mentioned segments:

Travel Now Pay Later Market, Type Analysis

- Leisure

- Business

- Adventure

- Family Travel

- Others

Travel Now Pay Later Market, Destination Analysis

- Domestic

- International

- Others

Travel Now Pay Later Market, Payment Plan Analysis

- Installment plan

- Deferred payment plan

- Others

Travel Now Pay Later Market, Distribution Channel Analysis

- Travel agencies

- Airlines

- Hotels

- Tour operators

- Others

Travel Now Pay Later Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?