Global Truck Brake Systems Market Size, Share, and COVID-19 Impact Analysis, By Brake Type (Disc Brakes, Drum Brakes), By Technology (Anti-lock Braking System (ABS), Electronic Stability Control (ESC), Traction Control System (TCS), Automatic Emergency Braking (AEB), Brake-by-Wire), By Vehicle Type (Light Commercial Vehicles (LCVs), Medium Commercial Vehicles (MCVs), and Heavy Commercial Vehicles (HCVs)), By Component (Brake Pads/Shoes, Brake Calipers, Rotors/Drums, Brake Lines, Master Cylinder, Brake Booster, Electronic Control Unit (ECU), Sensors (Speed, Pressure)), By Actuation Method (Hydraulic, Pneumatic, Electromechanical), By Sales Channel (OEM, Aftermarket), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Automotive & TransportationGlobal Truck Brake Systems Market Insights Forecasts to 2033

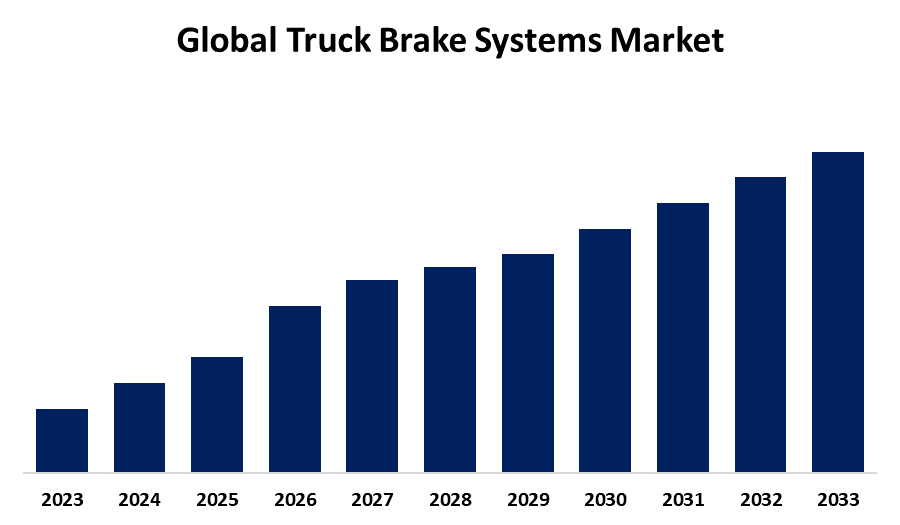

- The Market Size is Growing at a CAGR of 4.40% from 2023 to 2033

- The Worldwide Truck Brake Systems Market Size is Anticipated to Hold a Significant Share by 2033

- Aisa Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Truck Brake Systems Market Size is Anticipated to Hold a Significant Share by 2033, at 4.40% CAGR from 2023 to 2033.

Market Overview

Truck brake systems provide effective stopping power while ensuring safety and reliability under various conditions. Truck brake systems are designed to handle the increased demands of larger, heavier vehicles compared to passenger vehicles and provide reliable performance under heavy loads.

Truck brake systems are essential for safe and efficient vehicle operation, handling primary and emergency braking, as well as managing downhill and heavy-load conditions. They integrate with advanced driver assistance systems (ADAS) for features like collision avoidance and adaptive cruise control. Truck brake systems also include parking brakes, trailer braking, and regenerative braking for electric and hybrid trucks. Auxiliary systems like hydraulic and electromagnetic retarders provide additional braking power. Regular maintenance and performance testing ensure reliability and safety. The truck brake systems market is driven by safety regulations, technological advancements, increased commercial vehicle sales, and economic pressures for cost efficiency.

For Instance, In May 2024, NAPA Truck, a prominent commercial vehicle aftermarket manufacturer, expanded its product portfolio in the United Kingdom with the introduction of a new ABS Sensor Rings series. These components are critical to improving the performance of safety systems like as ABS (Anti-Lock Braking Systems), ESP (Electronic Stability Programs), and ASR.

Report Coverage

This research report categorizes the market for truck brake systems based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the truck brake systems market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the truck brake systems market.

Truck Brake Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.40% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Brake Type, By Technology, By Vehicle Type, By Component, By Actuation Method, By Sales, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, Aisin Seiki Co., Ltd., Wabco Holdings Inc. (ZF Group), Meritor, Inc., Knorr-Bremse AG, Haldex AB, Brembo S.p.A., Nissin Kogyo Co., Ltd., BPW Bergische Achsen KG, Phillips Industries, JJUAN, S.A., MGM Brakes, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The truck brake systems market is primarily driven by stringent safety regulations and technological advancements. Increasing regulations demand advanced braking technologies like ABS and ADAS for enhanced vehicle safety and performance. Technological innovations, including air disc brakes and regenerative braking systems, further fuel market growth. The expansion of the commercial vehicle sector and fleet upgrades boost demand, while economic factors such as rising fuel prices and the need for cost-effective operations also play a role. Environmental concerns and the rise of electric and hybrid trucks necessitate specialized brake systems. Additionally, competitive market dynamics and consumer preferences for improved safety and driving experience contribute to the ongoing evolution of truck brake systems.

Restraining Factors

The truck brake systems market faces several restraining factors that impact its growth including high costs associated with advanced technologies, such as air disc brakes and electronic systems, and the higher maintenance and replacement costs can deter adoption. The complexity of integrating these systems with existing vehicle setups, along with varying regulatory requirements and certification challenges, further complicates the market. Economic downturns and fluctuating material costs restrain the market growth worldwide.

Market Segmentation

The truck brake systems market share is classified into brake type, technology, vehicle type, component, actuation method, and sales channel.

- The disc brakes segment is estimated to hold the highest market revenue share through the projected period.

Based on the brake type, the truck brake systems market is classified into disc brakes and drum brakes. Among these, the disc brakes segment is estimated to hold the highest market revenue share through the projected period. This dominance is due to disc brakes' superior performance in terms of stopping power, heat dissipation, and overall safety, making them increasingly preferred for modern commercial vehicles. The growth towards advanced braking systems, driven by regulatory requirements and technological advancements, further reinforces the dominance of disc brakes in the market.

- The anti-lock braking system (ABS) segment is anticipated to hold the largest market share through the forecast period.

Based on the technology, the truck brake systems market is divided into anti-lock braking system (ABS), electronic stability control (ESC), traction control system (TCS), automatic emergency braking (AEB), and brake-by-wire. Among these, the anti-lock braking system (ABS) segment is anticipated to hold the largest market share through the forecast period. ABS's dominance is attributed to its long-standing integration into commercial vehicles, regulatory requirements mandating its use for enhanced safety, and its effectiveness in preventing wheel lock-up during braking, which improves vehicle stability and control. Its widespread adoption and proven performance ensure its leading position in the market.

- The heavy commercial vehicles (HCVs) segment dominates the market with the largest market share through the forecast period.

Based on the vehicle type, the truck brake systems market is categorized into light commercial vehicles (LCVs), medium commercial vehicles (MCVs), and heavy commercial vehicles (HCVs). Among these, the heavy commercial vehicles (HCVs) segment dominates the market with the largest market share through the forecast period. This dominance is attributed to the higher demand for advanced braking solutions required for HCVs due to their larger size, heavier loads, and rigorous operational demands. HCVs also face stricter safety regulations, necessitating sophisticated braking technologies like air disc brakes and ABS. Additionally, the frequent maintenance and replacement needs for these vehicles further bolster the HCV segment's leading position in the market.

- The electronic control unit (ECU) segment is anticipated to grow at the fastest CAGR growth through the forecast period.

Based on the component, the truck brake systems market is categorized into brake pads/shoes, brake calipers, rotors/drums, brake lines, master cylinder, brake booster, electronic control unit (ECU), sensors (speed, pressure, etc.). Among these, the electronic control unit (ECU) segment is anticipated to grow at the fastest CAGR growth through the forecast period. This growth is driven by the increasing integration of advanced braking technologies such as ABS, ESC, and ADAS, which rely heavily on sophisticated ECUs for managing and optimizing performance. The rising demand for enhanced safety features, the push towards vehicle electrification, and stringent regulatory requirements further contribute to the rapid expansion of the ECU segment, reflecting the growth towards more intelligent and automated braking systems in modern trucks.

- The pneumatic segment dominated the market with the largest revenue share over the forecast period.

Based on the actuation method, the truck brake systems market is categorized into hydraulic, pneumatic, and electromechanical. Among these, the pneumatic segment dominated the market with the largest revenue share over the forecast period. This dominance is due to pneumatic brakes' suitability for heavy-duty trucks, their effective handling of large braking loads, and their ability to offer robust safety and control. Pneumatic systems are favored for their reliability under high demands and regulatory compliance, which often mandates their use in commercial vehicles.

- The OEM segment is projected to hold a significant market share through the forecast period.

Based on the sales channel, the truck brake systems market is categorized into OEM and aftermarket. Among these, the OEM segment is projected to hold a significant market share through the forecast period. This dominance is largely due to the continuous demand for new trucks, which requires the initial installation of brake systems. OEMs are preferred for their ability to provide brake systems that are specifically designed for new vehicles, ensuring optimal integration and performance. Additionally, OEM brake systems often come with warranties and are favored for their reliability and compliance with vehicle design specifications.

Regional Segment Analysis of the Truck Brake Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the truck brake systems market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the truck brake systems market over the predicted timeframe. North America region is driven due to stringent safety regulations, high demand for commercial vehicles, and significant technological advancements. The region's robust transportation and logistics sector, along with the presence of major brake system manufacturers, supports the widespread adoption of advanced braking technologies. Additionally, ongoing fleet upgrades and replacements further contribute to North America's dominance in the market. Top of Form

Asia Pacific is expected to grow at the fastest CAGR growth of the truck brake systems market during the forecast period. This rapid growth is driven by several factors, including increasing industrialization and urbanization, which boost demand for commercial vehicles. The region's expanding logistics and transportation sectors, coupled with rising investments in infrastructure and vehicle safety standards, also contribute to the growth. Additionally, the presence of major automotive manufacturers and a growing focus on technological advancements and regulatory compliance further propel the market expansion in Asia Pacific.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the truck brake systems market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Continental AG

- Aisin Seiki Co., Ltd.

- Wabco Holdings Inc. (ZF Group)

- Meritor, Inc.

- Knorr-Bremse AG

- Haldex AB

- Brembo S.p.A.

- Nissin Kogyo Co., Ltd.

- BPW Bergische Achsen KG

- Phillips Industries

- JJUAN, S.A.

- MGM Brakes

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In December 2023, TMD Friction UK, a leading braking specialist, expanded its Mintex product line to further service the passenger car and light commercial vehicle industries.

- In November 2023, Toyota has launched the all-new 2024 Tacoma, which will establish new standards in the mid-size pickup truck sector. Tacoma boasts substantial upgrades in braking systems and safety technologies, making it an excellent choice for both off-road enthusiasts and safety-conscious drivers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the truck brake systems market based on the below-mentioned segments:

Global Truck Brake Systems Market, By Brake Type

- Disc Brakes

- Drum Brakes

Global Truck Brake Systems Market, By Technology

- Anti-lock Braking System (ABS)

- Electronic Stability Control (ESC)

- Traction Control System (TCS)

- Automatic Emergency Braking (AEB)

- Brake-by-Wire

Global Truck Brake Systems Market, By Vehicle Type

- Light Commercial Vehicles (LCVs)

- Medium Commercial Vehicles (MCVs)

- Heavy Commercial Vehicles (HCVs)

Global Truck Brake Systems Market, By Component

- Brake Pads/Shoes

- Brake Calipers

- Rotors/Drums

- Brake Lines

- Master Cylinder

- Brake Booster

- Electronic Control Unit (ECU)

- Sensors (Speed, Pressure, etc.)

Global Truck Brake Systems Market, By Actuation Method

- Hydraulic

- Pneumatic

- Electromechanical

Global Truck Brake Systems Market, By Sales Channel

- OEM

- Aftermarket

Global Truck Brake Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the truck brake systems market over the forecast period?The truck brake systems market is projected to expand at a CAGR of 4.40% during the forecast period.

-

2. What is the market size of the truck brake systems market?The Global Truck Brake Systems Market Size is Anticipated to Hold a Significant Share by 2033, at 4.40% CAGR from 2023 to 2033.

-

3. Which region holds the largest share of the truck brake systems market?North America is anticipated to hold the largest share of the truck brake systems market over the predicted timeframe.

Need help to buy this report?