Global Turbine Motor Market Size, Share, Growth, and Industry Analysis, By Phase (Single Phase, and Three Phase), By Application (Hydro Turbine, Wind Turbine, and Nuclear Turbine), and Regional Insights and Forecast to 2033

Industry: Energy & PowerGlobal Turbine Motor Market Insights Forecasts to 2033

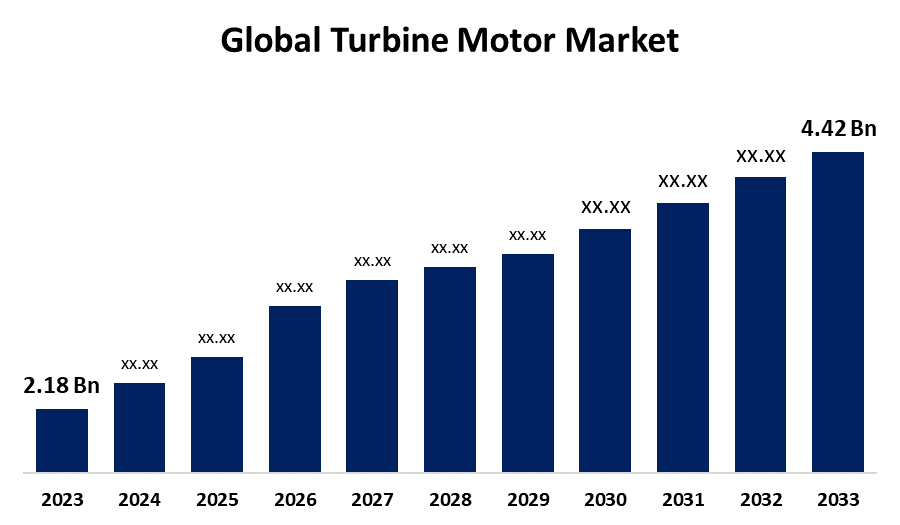

- The Global Turbine Motor Market Size was Valued at USD 2.18 Billion in 2023

- The Market Size is Growing at a CAGR of c from 2023 to 2033

- The Worldwide Turbine Motor Market Size is Expected to Reach USD 4.42 Billion by 2033

- The Middle East and Africa are Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Turbine Motor Market Size is Anticipated to Exceed USD 4.42 Billion by 2033, Growing at a CAGR of 7.32% from 2023 to 2033. The increased usage of renewable energy by industry participants, as well as significant investments in medium and large hydropower projects, have a beneficial impact on the turbine power market's growth.

TURBINE MOTOR MARKET REPORT OVERVIEW

A turbine is a rotational mechanical device that turns the energy of a fluid flow into productive work. There are four types of turbine motors that exist on the market: wind turbine, water turbine, steam turbine, and gas turbine. The shift in preference from fossil fuels to alternative green energy resources, as well as the spike in demand for sustainable energy sources, are important drivers driving the growth of the global turbine motor market. Turbine motors are presently used in a variety of end-use industries, including petrochemicals, oil and gas, and electricity production. Hydropower is more effective than traditional fossil fuels (coal, natural gas, and oil). In addition, hydro turbines use no natural resources and create no direct emissions. These factors have contributed significantly to the growth of the turbine motors market over the predicted period.

The need for renewable energy, particularly wind power, is increasing as a result of the global shift toward greener and more sustainable energy sources to battle climate change and reduce greenhouse gas emissions. Businesses, consumers, and governments are increasingly supporting wind energy adoption since it is seen as a crucial component of the sustainable energy transition. The governments around the world have put in place incentives and rules to encourage the development and use of wind energy. Feed-in tariffs, tax credits, subsidies, and renewable energy mandates are just a few of the incentives that developers and investors use to make wind energy projects more profitable. These factors are expected to drive wind turbine generator market expansion over the forecast period.

Inox Wind has teamed up with Germany-based Wind to Energy to launch a new line of wind turbine generators in India. The 4.X MW series WTGs are suited for low-wind conditions and can be improved with boosters. Inox Wind, India's top wind energy solutions provider, would target the installation of these generators across several sites in the country.

Report Coverage

This research report categorizes the market for the global turbine motor market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global turbine motor market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global turbine motor market.

Global Turbine Motor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 2.18 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.32% |

| 2033 Value Projection: | USD 4.42 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 219 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Phase, By Application |

| Companies covered:: | Toshiba Hydroelectric Power, Vestas Wind Systems, Canyon Industries, Voith GmbH & Co. Kgaa, Kirloskar Brothers Ltd., Arani Power, Turbocam, Gilbert Gilkes & Gordon Ltd., Andritz AG, General Electric, Mitsubishi Hitachi Power Systems, Siemens Gamesa, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

DRIVING FACTORS:

The growing demand for wind turbines can stimulate the growth of the market.

The rising worldwide need for power, combined with rising government attempts to produce clean energy to reach zero carbon emissions, is driving the installation of many wind turbines around the world. According to the United States Bureau of Labor Statistics, the wind business in the United States employs approximately 125,000 people in all 50 states, and this figure is growing. In 2022, wind turbines in all 50 states produced more than 10% of the country's total energy. In the meantime, expenditures in new wind projects injected $20 billion into the US economy. Wind energy generation works effectively in agricultural and multi-use work environments. Wind energy is easily integrated into rural or distant regions, such as farms and ranches, as well as coastal and island towns, which frequently have high-quality wind resources.

RESTRAINING FACTORS

The high cost of technology could restrict the market growth.

The price of these motors is unreasonably high, restricting the number of consumers. These motor units are quite expensive, hence large-scale users have received financial assistance. The installation of such components requires a significant investment in each application, as solar installation costs are comparable to the construction of portable refrigerators, inhibiting market expansion.

Market Segmentation

The turbine motor market share is classified into product type and application.

The three phase segment having the highest share of the market during the forecast period.

Based on phase, the turbine motor market is classified into single phase, and three phase. The market demand for three-phase motors is expanding because they are widely employed in a variety of turbines, including wind turbines, steam turbines, and gas turbines. This motor is more compact and less expensive than the single-phase motor. This is projected to drive three-phase motor segment growth throughout the forecast period. Three-phase turbine motors are ideal for wind energy and even hydropower generation. When used as generators, induction machines have a fixed stator and a spinning rotor, just like synchronous generators. The single-phase sector is expected to increase in the market throughout the forecast period. It requires less maintenance and repairs. However, these motors are prone to overheating and run slowly.

The growing accessibility of wind turbines for electricity generation can fuel the market growth.

Based on application, the turbine motor market is classified into hydro turbine, wind turbine, and nuclear turbine. Wind turbines are installed in regions with favorable wind and weather patterns. They turn the kinetic energy of moving air into electricity. Wind turbines can be built individually, but they are typically installed in groups to form 'wind farms' or wind power plants. Wind energy can also be used to manufacture hydrogen, which can then be used to generate electricity or as a fuel for transportation. It is a renewable energy source; therefore, we can generate energy as long as the wind blows. Turbine improvements make them more efficient, delivering clean and reliable energy to the grid, homeowners, and communities even in less windy areas. Wind energy is also a form of clean energy, which implies that wind turbines do not emit greenhouse gases such as carbon dioxide, resulting in less pollution in the air, oceans, and environment, which can cause health problems or harm the environment. Wind energy can be used in a variety of settings, including isolated or distant locales, such as islands, that cannot access the utility grid for power. A wind farm often has numerous turbines spread across a vast region. As of the end of 2022, the Highlands Wind Project in Iowa had the most wind turbines (462), with a total output producing capacity of roughly 502 megawatts

Regional Segment Analysis of the Global Turbine Motor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia-Pacific will have the biggest share of the turbine motor market throughout the forecast period.

Get more details on this report -

Asia-Pacific is home to a number of coal and nuclear power stations. In 2022, China has 46 nuclear reactors and approximately 53 coal-fired facilities. Furthermore, the country has the most hydroelectric and wind power installations, with the highest installed capacity. India is a notable country that, unlike China, generates the majority of its electricity from coal-fired power plants. As part of an environmental agenda, India has a total operational capacity of roughly 80 gigawatts (wind and hydro energy), with the installed wind energy capacity expected to triple by 2022. The turbine market in the area is expected to grow significantly throughout the forecast period. Coal-powered facilities are expected to maintain a significant market position in the power-generating industry, which includes steam turbines as a power-producing unit.

The Middle East and Africa are the fastest-growing regions during the projected timeframe.

The Middle East and Africa are expected to experience significant growth over the forecast period. The demand for uninterrupted power is expanding, as are investments in the power sector. Power plants are boosting their capacity, which fuels market growth. As the region's electricity consumption grows, so does the number of turbines being installed. The installation of the new turbine increases the capacity of the current power plants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global turbine motor market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toshiba Hydroelectric Power

- Vestas Wind Systems

- Canyon Industries

- Voith GmbH & Co. Kgaa

- Kirloskar Brothers Ltd.

- Arani Power

- Turbocam

- Gilbert Gilkes & Gordon Ltd.

- Andritz AG

- General Electric

- Mitsubishi Hitachi Power Systems

- Siemens Gamesa

- Others

Key Market Developments

- In August 2023, Suzlon Group obtained a contract to sell 64 wind turbine generators (WTGs) to Teq Green Power XI, a subsidiary of O2 Power, with a total capacity of 201.6 MW. The turbines will have a Hybrid Lattice Tubular (HLT) tower design with a rated capacity of 3.15MW.

- In April 2022, Envision Energy signed a contract for 2000 MW of wind turbines in India. Envision's manufacturing operation in India is expected to supply and commission all 596 turbines by the end of 2023.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the global turbine motor market based on the below-mentioned segments:

Global Turbine Motor Market, By Phase

- Single Phase

- Three Phase

Global Turbine Motor Market, By Application

- Hydro Turbine

- Wind Turbine

- Nuclear Turbine

Global Turbine motor Market, By Regional

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the global turbine motor market over the forecast period?The global turbine motor market size is expected to grow from USD 2.18 Billion in 2023 to USD 4.42 Billion by 2033, at a CAGR of 7.32% during the forecast period 2023-2033.

-

2. Which region is expected to hold the highest share in the global turbine motor market?Asia-Pacific is projected to hold the largest share of the global turbine motor market over the forecast period.

-

3. Who are the top key players in the turbine motor market?Toshiba Hydroelectric Power, Vestas Wind Systems, Canyon Industries, Voith GmbH & Co. Kgaa, Kirloskar Brothers Ltd., Arani Power, Turbocam, Gilbert Gilkes & Gordon Ltd, Andritz AG, General Electric, Mitsubishi Hitachi Power Systems, Siemens Gamesa, and Others.

Need help to buy this report?