Global Turpentine Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fat Turpentine, Sulphate Turpentine, Wood Turpentine, Gum Turpentine, Others), By Grade (Pharmaceutical, Technical, Chemical, Other), By Purity (Below 95%, 95%, Above 95%), By Application (Cosmetics, Fragrance, Paints and Coatings, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Chemicals & MaterialsGlobal Turpentine Market Insights Forecasts to 2033

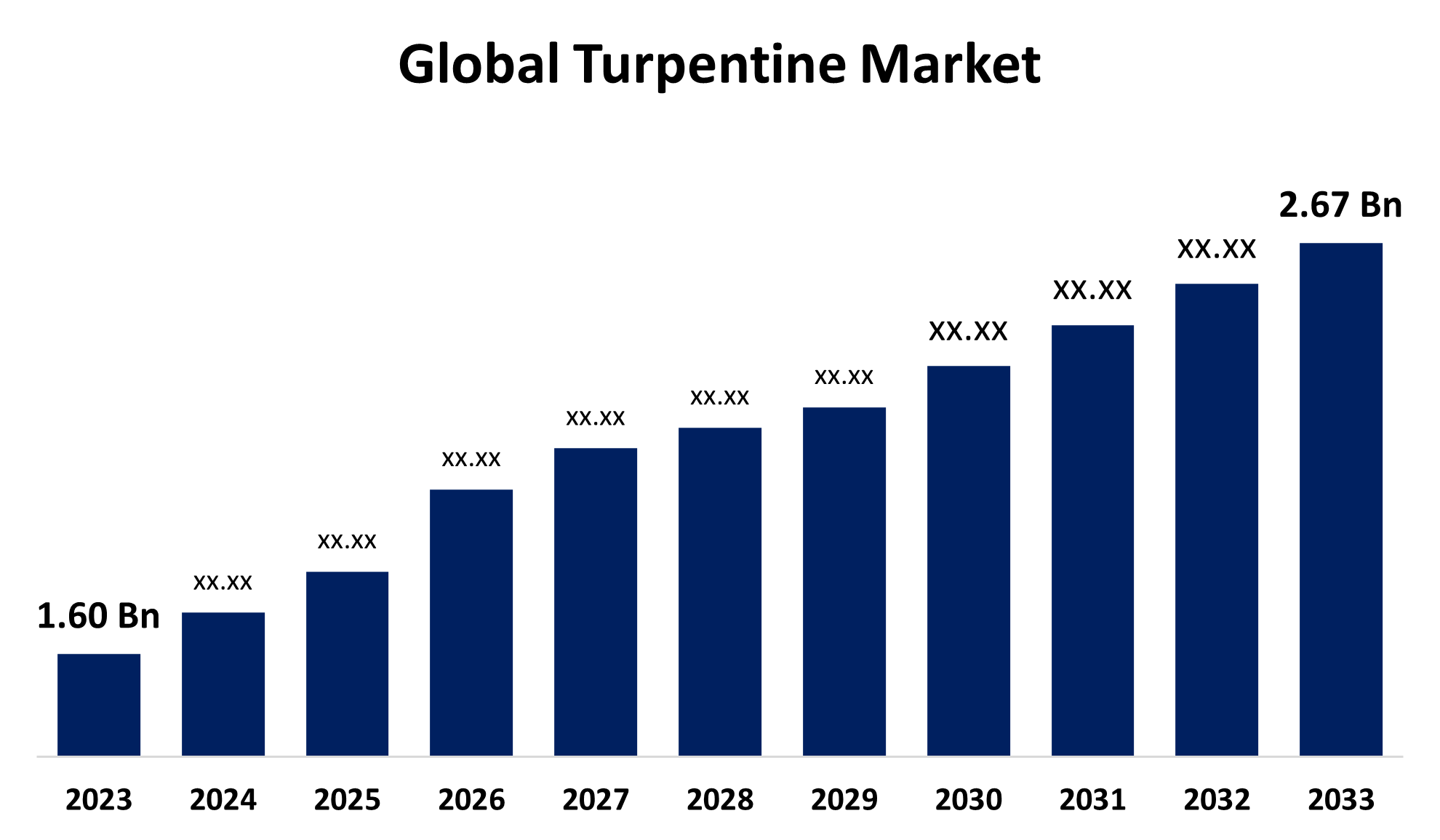

- The Global Turpentine Market Size Was Estimated at USD 1.60 Billion in 2023

- The Market Size is expected to grow at a CAGR of around 5.23% from 2023 to 2033

- The Worldwide Turpentine Market Size is Expected to Reach USD 2.67 Billion by 2033

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The global turpentine market size was estimated at USD 1.60 billion in 2023 and is expected to reach USD 2.67 billion by 2033, growing at a CAGR of 5.23% from 2023 to 2033. The global market of turpentine is propelled due to the rising requirements for improving the quality and longevity of paints and coating solvents and materials can be met through the use of turpentine solutions. Additionally, the adhesive and sealants sub-segment closely trails, reaping the benefits of growth in the construction sector. Moreover, many industries and manufacturers invest their funds to develop more efficient, durable, and environmentally friendly turpentine products and their manufacturing techniques.

Market Overview

The turpentine industry is the business of extracting and selling turpentine, an oil derived from pine trees. Its function extends beyond conventional uses because of its efficiency as an organic solvent and its ability to generate synthetic organic compounds. Turpentine serves various purposes, such as a solvent, in paint, food production, construction, and within the pharmaceutical sector.

The rising urbanization from migration leads to a surge in the construction sector and improved infrastructure in relation to their geographical environment. Consequently, rising requirements for improving the quality and longevity of paints and coating solvents and materials can be met through the use of turpentine solutions. Additionally, the adhesive and sealants sub-segment closely trails, reaping the benefits of growth in the construction sector. According to Volza's data, from March 2023 to February 2024, the world imported 274 shipments of Turpentine Oil from India, supplied by 105 exporters to 141 buyers. This marked a 48% growth from the previous year. In February 2024, 26 shipments indicated an 8% year-on-year and 13% sequential growth. This trend is expected to grow due to the increasing construction sector and the contribution of other major applications due to the global population growth and their needs.

Moreover, many industries and manufacturer invest their fund to develop more efficient, durable, and environmentally friendly turpentine products and their manufacturing techniques. Such innovations contribute to improving the purity and effectiveness of turpentine and strengthen its competitiveness against synthetic substitutes. The continuous advancement and refinement of turpentine extraction and processing represent a proactive reaction to the rising need for more environmentally friendly solvents.

Report Coverage

This research report categorizes the global turpentine market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global turpentine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global turpentine market.

Global Turpentine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.60 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.23% |

| 2033 Value Projection: | USD 2.67 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Grade, By Purity, By Application, By Region |

| Companies covered:: | Foreverest Resources Ltd., Kraton Corporation, Eastman Chemical Company, Wuzhou Pine Chemicals Ltd., Arakawa Chemical Industries, Ltd., Mentha & Allied Products Pvt. Ltd., PT. Naval Overseas, Harima Chemicals Group, Inc., Lawter Inc., DRT, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The increasing uses of turpentine in the chemical industry are expanding considerably as a solvent and a material for organic synthesis. It plays an important role in creating aromatic substances and transforming chemicals into different products. there are many terpenes such as alpha-pinene and beta-pinene, myrcene, limonene, and Δ3 carene, limonene and dipentene. some of these are used in paints as thinners, and sourced from turpentine playing a vital role in fragrance manufacturing. Moreover, turpentine oils have become a crucial factor in the production of numerous chemicals and resins. The growing chemical industry and significant need for chemical products across various sectors are fueling the demand for turpentine. According to Akzo Nobel India, the paints and coatings sector in India is expected to grow to US$ 12.22 billion in five years, increasing from the existing US$ 7.57 billion. This increase, fueled by the architectural sector's 69% volume share and the low cost of raw materials, is greatly enhancing the demand for turpentine and the growth of the industry. The rising need for turpentine highlights its essential function as a raw material in industrial development.

Increasing need for Turpentine oil due to its widespread uses in the cosmetic sector. Turpentine is an important fragrance ingredient in cosmetic products such as soaps, shampoos, and perfumes because of its delightful aroma. Also, it is popular for its advantages for hair, aiding in maintaining it smooth, strong, and shiny. Furthermore, it is included in skincare items, but it must be applied carefully since it can lead to skin irritation in individuals with sensitive skin. In general, the versatility and positive attributes of turpentine oil render it a significant component in numerous cosmetic products.

Restraints and challenges:

A major fluctuation in the supply and prices of raw materials in the turpentine industry leads to the industry’s downstream flow. Actually, the production of turpentine depends on the availability of its raw materials such as pine resin and chips, which directly interact with the condition and management of pine forests. So, it can be disrupted by environmental stressors such as climate change, pest infestations, and forest fires that affect the production of turpentine directly. Also, the global trade regulations and duties on forest resources and products can lead to increased costs for turpentine producers and hamper market growth.

Market Segmentation

The global turpentine market share is classified into product type, grade, purity, and application.

- The sulfate turpentine segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the product type, the global turpentine market is classified into fat turpentine, sulphate turpentine, wood turpentine, gum turpentine, and others. Among these, the sulphate turpentine segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. this dominance is because of its nature, Sulphate turpentine, a byproduct of the pulp and paper industry, is valued for its cost-effectiveness and abundance. So, it’s getting traction in the chemical industry for synthesizing various compounds, including synthetic resins and adhesives. The increasing demand for these chemicals in industrial applications and the push for sustainable feedstocks are driving its growth. The popularity of its consistent quality and widespread availability is extensively used in high-purity chemical synthesis, making it essential in industries like fragrances and other chemical manufacturing.

- The technical segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period.

Based on the grade, the global turpentine market is divided into pharmaceutical, technical, chemical, and other. Among these, the technical segment accounted for the highest share in 2023 and is anticipated to grow at a prominent CAGR during the forecast period. This segmental growth is driven by their major utilization in industrial applications such as the manufacturing of paints, varnishes, and various coatings where strong solvent capability is crucial. Its ability to dissolve oils and resins renders it essential in these industries. Additionally, technical grade is quietly useful in the construction industry by performing an important role in the manufacturing of certain adhesives and sealants, which contribute to the durability and longevity of construction materials.

- The above 95% segment secured a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the purity, the global turpentine market is separated into below 95%, 95%, and above 95%. Among these, the above 95% segment secured a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. This significance is attributed to, the demand for high purity, which is preferred in fields requiring strict quality criteria, like pharmaceuticals, food flavorings, and premium chemical synthesis, where contaminants could compromise product integrity and safety. Its exceptional quality guarantees peak performance in these essential applications, positioning it as the favored option for manufacturers who value precision and dependability.

- The paints and coatings segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the application, the global turpentine market is categorized into cosmetics, fragrances, paints and coatings, and others. Among these, the paints and coatings segment secured a dominant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance is due to the crucial role of turpentine as an important solvent in the paints and coatings sector, improving product effectiveness and durability. The demand for sustainable paints is driven by the construction and automotive industries, further enhancing this segment. Moreover, the emphasis on environmental sustainability encourages manufacturers to substitute synthetic solvents with natural options such as turpentine. Its ability to dissolve resins, oils, and varnishes makes it essential for achieving high-quality finishes in both industrial and residential projects.

Regional Segment Analysis of the Global Turpentine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

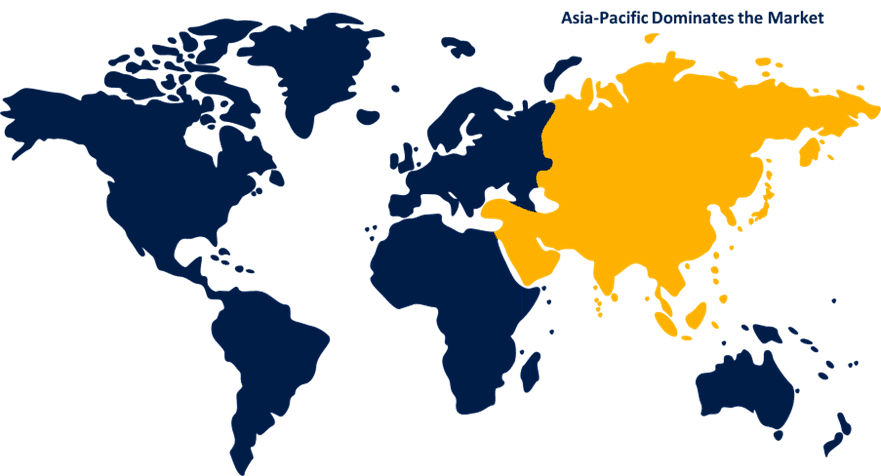

Asia-Pacific is expected to hold the dominant share of the global turpentine market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is expected to hold the dominant share of the global turpentine market over the predicted timeframe. This regional dominance is attributed to major population and continuous migration to urban areas, propelled growth in industrialization, developing residential areas, and increasing demands for sustainable turpentine-based products in their applications. growing spending power of customers on the basic needs and traction towards change in living standard demands for the long-lasting and durable paints in the building construction in both residential and industrial areas.

Moreover, the Increasing awareness and availability of international brands like Revlon, Avon, and Calvin Klein are driving demand for pure and efficient cosmetic products. As consumers seek natural ingredients, turpentine's role in enhancing fragrances and skincare efficacy is gaining recognition, significantly boosting its popularity and demand in the cosmetic industry. Additionally, the growth in construction activities in the APAC is propelling the demand for turpentine for coatings, paints, lubrication, and others. According to the World Bank, in 2024, the value added by the construction sector in China accounted for approximately 36.5% of the GDP. This contribution is expected to increase with ongoing construction projects across the region.

The North America turpentine market is expected to grow with the fastest CAGR during the forecasting period. This regional growth is significantly influenced by strict environmental regulations and the rising use of bio-based products. The construction and automotive sectors in these areas are significant users of turpentine, as they emphasize sustainability and environmentally friendly options. The increasing consumer knowledge regarding the advantages of natural products is boosting demand in these areas. Also, the operating industry key players in the region are investing in research and development for the innovation in turpentine products and boosting their applications. These kinds of innovations and investments are expected to contribute the market growth across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global turpentine market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Foreverest Resources Ltd.

- Kraton Corporation

- Eastman Chemical Company

- Wuzhou Pine Chemicals Ltd.

- Arakawa Chemical Industries, Ltd.

- Mentha & Allied Products Pvt. Ltd.

- PT. Naval Overseas

- Harima Chemicals Group, Inc.

- Lawter Inc.

- DRT

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, Harima built its first myrcene facility in Kakogawa, utilizing turpentine-derived pinene for aroma oils and fragrances. The plant emphasizes sustainability by using renewable energy and carbon-neutral fuel. Harima aims to meet the demand for plant-based resources in flavors and fragrances, enhancing product traceability and human rights protection.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global turpentine market based on the below-mentioned segments:

Global Turpentine Market, By Product Type

- Fat Turpentine

- Sulphate Turpentine

- Wood Turpentine

- Gum Turpentine

- Others

Global Turpentine Market, By Grade

- Pharmaceutical

- Technical

- Chemical

- Other

Global Turpentine Market, By Purity

- Below 95%

- 95%

- Above 95%

Global Turpentine Market, By Application

- Cosmetics

- Fragrance

- Paints and Coatings

- Others

Global Turpentine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the global turpentine market over the forecast period?The global turpentine market size was valued at USD 1.60 billion in 2023 and is expected to reach USD 2.67 billion by 2033, growing at a CAGR of 5.23% from 2023 to 2033.

-

Which region holds the largest share of the global turpentine market?Asia-Pacific is estimated to hold the largest share of the global turpentine market over the predicted timeframe.

-

Who are the top key players in the global turpentine market?Foreverest Resources Ltd., Kraton Corporation, Eastman Chemical Company, Wuzhou Pine Chemicals Ltd., Arakawa Chemical Industries, Ltd., Mentha & Allied Products Pvt. Ltd., PT. Naval Overseas, Harima Chemicals Group, Inc., Lawter Inc., DRT, and Others.

Need help to buy this report?