U.S. Contract Glazing Market Size, Share, and COVID-19 Impact Analysis, By Product (Flat Glass, Others), By Application (Building & Construction, Automotive, Others), and U.S. Contract Glazing Market Insights Forecasts to 2032.

Industry: Advanced MaterialsU.S. Contract Glazing Market Insights Forecasts to 2032

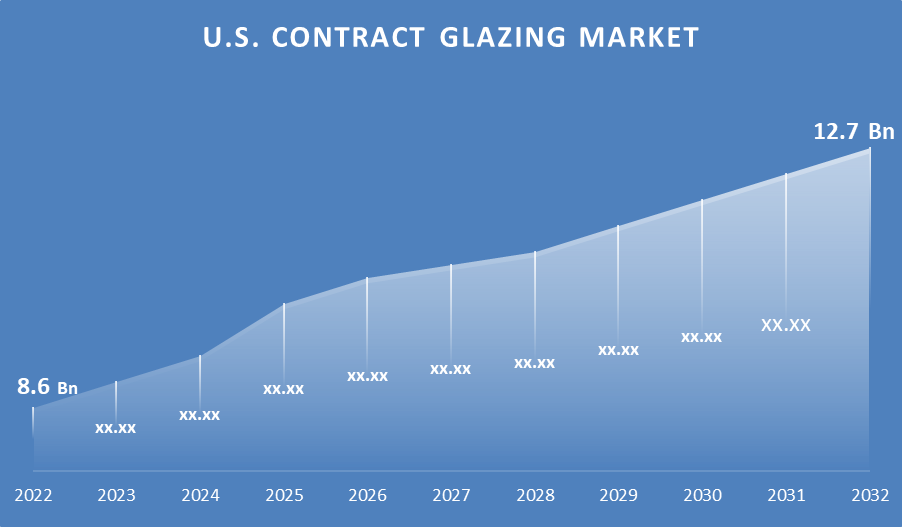

- The U.S. Contract Glazing Market Size was valued at USD 8.6 Billion in 2022.

- The market is growing at a CAGR of 3.9% from 2022 to 2032.

- The U.S. Contract Glazing Market Size is expected to reach USD 12.7 Billion by 2032.

Get more details on this report -

The U.S. Contract Glazing Market Size is expected to reach USD 12.7 Billion by 2032, at a CAGR of 3.9% during the forecast period 2022 to 2032.

Market Overview

Contract glazing is the design, fabrication, and installation of glass in commercial, residential, and institutional structures. This encompasses every detail from skyscraper windows to shops, curtain walls, and interiors made of glass. Contract glaziers collaborate with architects, builders, and owners to develop solutions that not only meet the aesthetic needs of a project but also ensure safety, energy efficiency, and regulatory compliance. Contract glazing is a vital segment of the construction industry in the United States, dedicated to designing, producing, and installing glass in structures ranging from skyscrapers to residential dwellings. Contract glaziers in the United States work closely with architects and builders to ensure that glass installations are aesthetically beautiful, energy-efficient and meet stringent safety regulations and building codes. Many glaziers are focused on sophisticated solutions like low-emissivity coatings and double glass to minimize energy expenses, with an emphasis on sustainability. The sector not only has a huge impact on the country's architectural scene, but it also promotes cutting-edge glass technologies and uses.

Report Coverage

This research report categorizes the market for U.S. Contract Glazing Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. Contract Glazing Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the U.S. Contract Glazing Market.

U.S. Contract Glazing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 8.6 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.9% |

| 2032 Value Projection: | USD 12.7 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Application, and U.S. Contract Glazing Market Insights Forecasts to 2032 |

| Companies covered:: | Benson Industries, Inc., snswanger Glass, Crown Corr, Inc., Enclos Corp., Gamma, Harmon Inc., Massey’s Glass, Permasteelisa S.p.A, W&W Glass, LLC, Walters & Wolf, and Other Key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The contract glazing market in the United States is a significant component of the country's construction industry, focusing on the design, manufacture, and installation of glass in a variety of structures. The contemporary architectural trend of enhanced natural lighting and open spaces is a big driver for this sector. As a result, there is an increased demand for high-quality, energy-efficient glass solutions that can deliver aesthetics without sacrificing insulation or safety. Double glazing, UV-resistant coatings, and low-emissivity glass are increasing in popularity, providing both energy savings and improved building performance. Another important consideration is rigorous respect for safety regulations and construction codes. In the United States, regulations require the use of specified types of safety glasses in specific settings to ensure the safety of people. Furthermore, the automotive industry's demand is predicted to rise in the coming years as the incidence of traffic accidents rises, necessitating the replacement of windshields and windows in automobiles.

Market Segment

- In 2022, the flat glass segment accounted for the largest revenue share of more than 67.8% over the forecast period.

On the basis of product, the U.S. Contract Glazing Market is segmented into flat glass and others. Among these, the flat glass segment is dominating the market with the largest revenue share of 37.8% over the forecast period. Flat glass, also known as sheet glass, is generally manufactured in flat form before being cut, bent, or assembled into various items. It is the backbone of the contract glazing sector in the United States. Flat glass's pervasiveness across a wide range of applications, from architectural to automotive, secures its dominance. Its adaptability, combined with continual developments in the flat glass industry, such as energy-efficient coatings and enhanced manufacturing procedures, strengthens its market leadership.

- In 2022, the building & construction segment accounted for the largest revenue share of more than 74.2% over the forecast period.

On the basis of application, the U.S. Contract Glazing Market is segmented into building & construction, automotive, and others. Among these, the building & construction segment is dominating the market with the largest revenue share of 74.2% over the forecast period. The building and construction industry continues to be a major consumer of contract glazing goods. Glazing not only adds visual appeal to structures but also helps with energy efficiency and safety. The continued rise of the residential and commercial construction sectors, together with the growing emphasis on energy-efficient and green buildings, increases demand for high-quality glazing materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.S. Contract Glazing Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Benson Industries, Inc.

- snswanger Glass

- Crown Corr, Inc.

- Enclos Corp.

- Gamma

- Harmon Inc.

- Massey’s Glass

- Permasteelisa S.p.A

- W&W Glass, LLC

- Walters & Wolf

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- On October 2023, Beacon announced the completion of its acquisition of waterproofing distributor Garvin Construction Products today. Garvin has provided entire building envelope solutions to design professionals, contractors, and owners, including waterproofing, restoration, glass, tinting, and glazing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the U.S. Contract Glazing Market based on the below-mentioned segments:

U.S. Contract Glazing Market, By Product

- Flat Glass

- Others

U.S. Contract Glazing Market, By Application

- Building & Construction

- Automotive

- Others

Need help to buy this report?